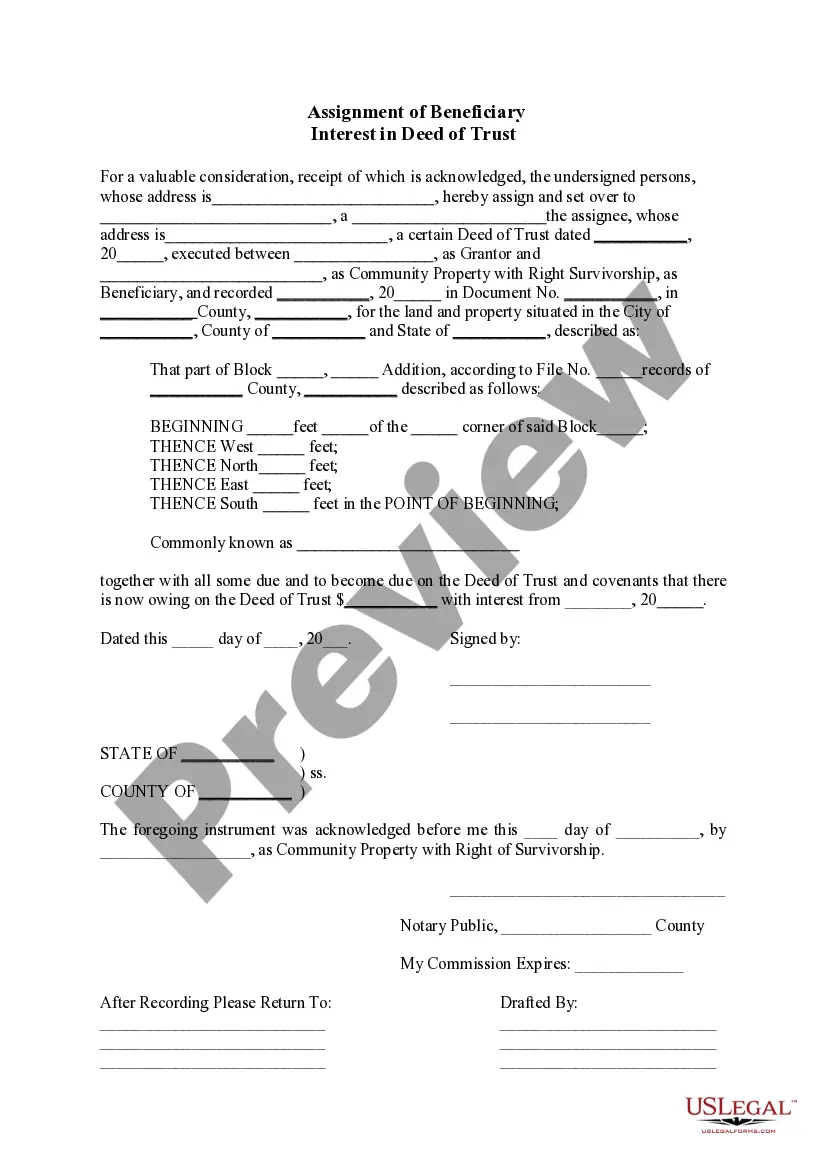

Arizona Assignment of Beneficiary Interest In Deed of Trust

Description

How to fill out Arizona Assignment Of Beneficiary Interest In Deed Of Trust?

If you are looking for accurate Arizona Assignment of Beneficiary Interest In Deed of Trust online templates, US Legal Forms is exactly what you require; obtain documents produced and verified by state-certified legal experts.

Using US Legal Forms not only shields you from complications related to official forms; it also saves you time, effort, and money! Downloading, printing, and filling out a professional template is significantly less expensive than hiring a lawyer to do it for you.

And that's it. In a few simple steps, you have an editable Arizona Assignment of Beneficiary Interest In Deed of Trust. Once you create an account, all future purchases will be even easier to handle. If you have a US Legal Forms subscription, just Log In/">Log In to your profile and click the Download button you see on the form's page. Then, whenever you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time and energy sifting through countless forms on various sites. Purchase accurate templates from a single trusted source!

- To get started, complete your registration process by providing your email and creating a password.

- Follow the instructions outlined below to set up your account and obtain the Arizona Assignment of Beneficiary Interest In Deed of Trust template to address your situation.

- Utilize the Preview option or review the document details (if accessible) to ensure that the form is the correct one for your needs.

- Verify its validity in your residing state.

- Click Buy Now to place an order.

- Select a preferred pricing package.

- Create your account and pay using your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

To transfer property to a trust in Arizona, you need to execute a new deed that names the trust as the new property owner. First, identify the type of trust you are using and prepare the deed accordingly, often as a quitclaim deed. Next, sign the deed in front of a notary public, and then record it with the county recorder's office. This process ensures the Arizona Assignment of Beneficiary Interest In Deed of Trust is properly allocated, providing clarity in property ownership and beneficiary rights.

The Arizona Assignment of Beneficiary Interest In Deed of Trust refers to a legal process where a current beneficiary transfers their interest in a deed of trust to another party. This transfer can occur for various reasons, such as selling the property or adjusting financial agreements. It is crucial for all parties involved to understand their rights and responsibilities during this process. For guidance, consider using the US Legal Forms platform, which offers comprehensive resources and templates to help you navigate this procedure smoothly.

To record a beneficiary deed in Arizona, you must complete the deed form and submit it to the county recorder's office where the property is located. It's vital to ensure all information is accurate and the document is properly signed to avoid issues. Utilizing resources, such as UsLegalForms, can help streamline the process for the Arizona Assignment of Beneficiary Interest In Deed of Trust.

In Arizona, laws governing beneficiaries focus on rights, responsibilities, and the procedures for transferring interests in property. The statutes dictate how beneficiary deeds function and outline the legal framework for the Arizona Assignment of Beneficiary Interest In Deed of Trust. Familiarizing yourself with these laws can empower you in estate planning.

Yes, a properly executed beneficiary deed can help avoid probate in Arizona. By designating a recipient of your property upon death, the beneficiary deed allows for direct transfer without court involvement. This aspect can significantly simplify the process and emphasizes the importance of the Arizona Assignment of Beneficiary Interest In Deed of Trust.

The Assignment of a deed of trust in Arizona refers to the process of transferring the rights and responsibilities of a lender or beneficiary to another party. This assignment facilitates smooth transitions in ownership and financing. If you're considering the Arizona Assignment of Beneficiary Interest In Deed of Trust, clearly understanding this process is essential.

Yes, a beneficiary deed must be recorded in Arizona to be effective. Failing to record the deed can result in legal challenges or disputes regarding ownership. When you engage in the Arizona Assignment of Beneficiary Interest In Deed of Trust, recording the beneficiary deed is a critical step to ensure that your intentions are honored.

A beneficiary interest in a trust refers to the rights that a beneficiary holds to the assets and benefits of the trust. This interest allows the beneficiary to receive distributions from the trust according to its terms. Understanding your beneficiary interest is vital when dealing with the Arizona Assignment of Beneficiary Interest In Deed of Trust.

If a deed is not recorded in Arizona, it may lead to complications regarding ownership and rights. Without recording, third parties might not be aware of the transfer, potentially affecting property claims. It's essential to ensure proper recording to protect your interests, especially concerning the Arizona Assignment of Beneficiary Interest In Deed of Trust.

A deed of Assignment for beneficial interest is a legal document that transfers a person's beneficial interest in a trust to another individual. In Arizona, this deed allows the new beneficiary to receive benefits from the trust, such as income or property. Understanding the intricacies of this deed is crucial when navigating the Arizona Assignment of Beneficiary Interest In Deed of Trust.