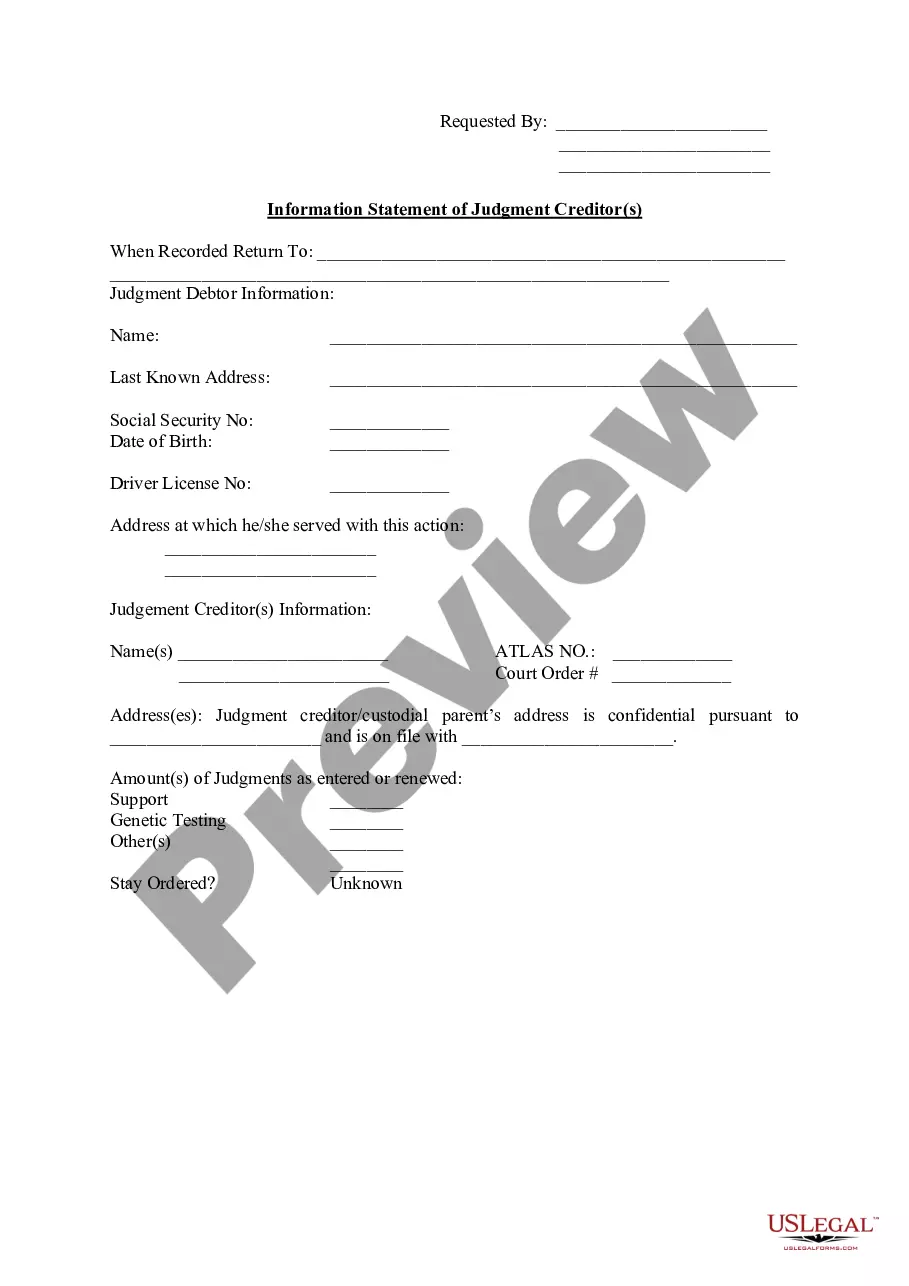

Arizona Information Statement of Judgment Creditor(s)

Description Creditors Statement

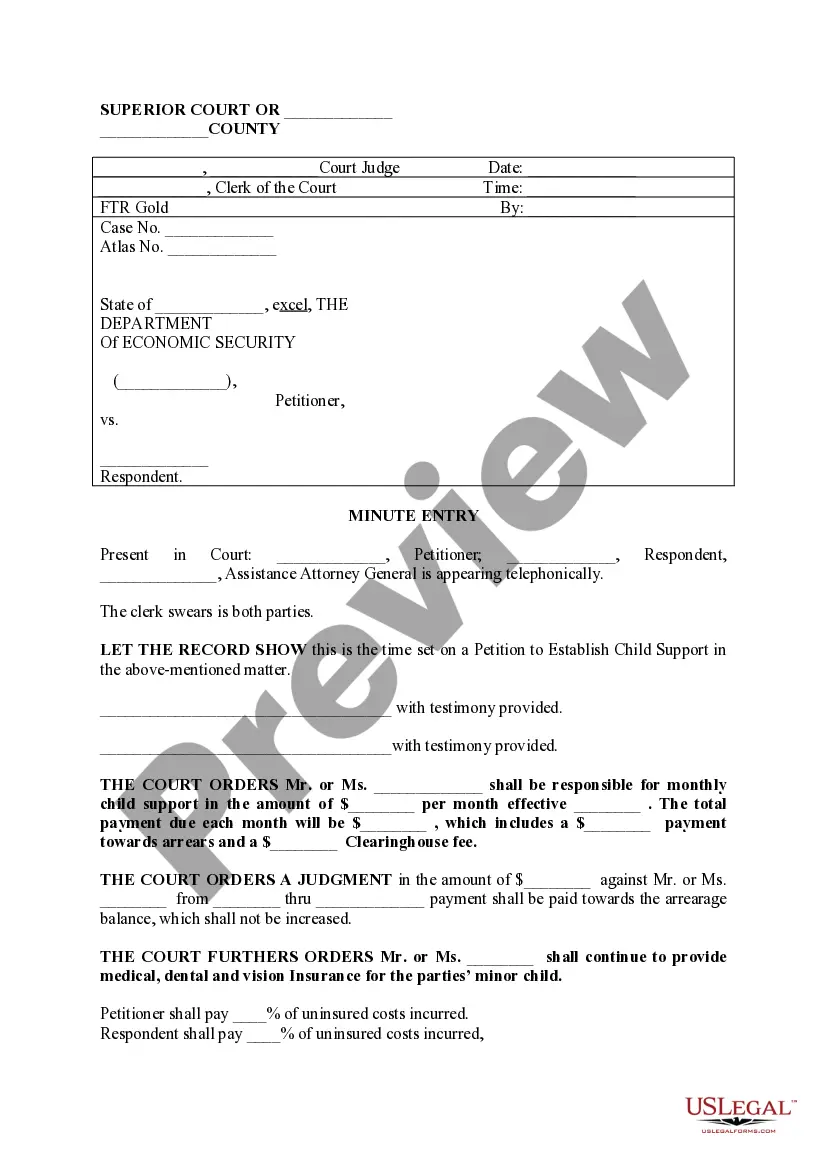

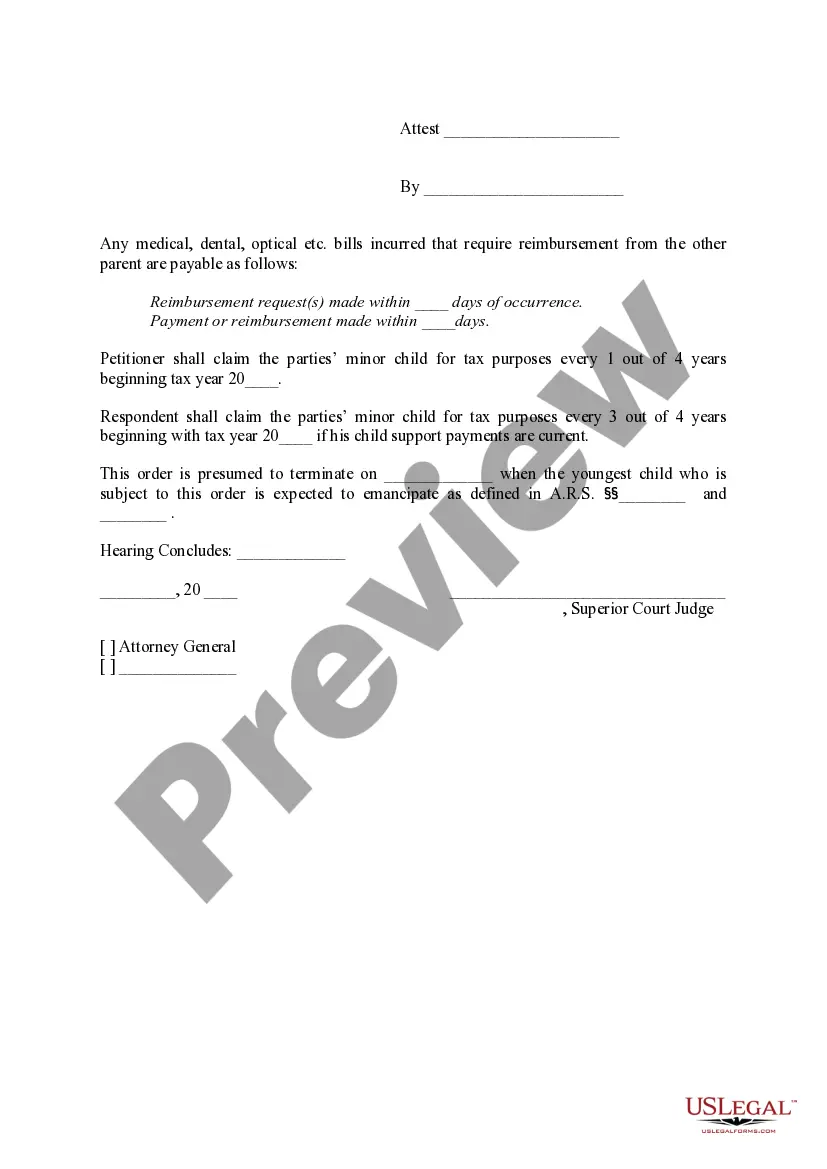

child support payments

How to fill out Arizona Information Statement Of Judgment Creditor(s)?

If you are looking for accurate Arizona Information Statement of Judgment Creditor(s) web templates, US Legal Forms is precisely what you require; discover documents offered and validated by state-authorized legal experts.

Utilizing US Legal Forms not only spares you from issues related to legal documents; it also saves you time, effort, and money! Downloading, printing, and completing a professional form is significantly less expensive than hiring a lawyer to draft it for you.

And that's all there is to it. In just a few simple clicks, you have an editable Arizona Information Statement of Judgment Creditor(s). Once you create an account, all future orders will be processed even more smoothly. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form's page. Then, whenever you need to use this template again, you will always be able to locate it in the My documents section. Don't waste your time and effort searching through countless forms on various platforms. Obtain precise templates from just one reliable service!

- To begin, finalize your registration process by entering your email and creating a password.

- Follow the instructions below to establish your account and locate the Arizona Information Statement of Judgment Creditor(s) web template to meet your requirements.

- Utilize the Preview option or review the document description (if available) to ensure that the template is the one you desire.

- Verify its suitability in the state where you reside.

- Click Buy Now to place your order.

- Choose a preferred pricing plan.

- Set up your account and pay using your credit card or PayPal.

- Select a convenient format and download the form.

Foreclosure Case Information Statement Form popularity

FAQ

To file a judgment lien in Arizona, you must first obtain a certified copy of your judgment from the court. Then, visit the county recorder's office where the property is located to file the lien. Be sure to include necessary details such as the judgment amount and the property's information. For more guidance throughout this process, the Arizona Information Statement of Judgment Creditor(s) offers valuable resources that simplify filing and managing lien-related documents.

Judgments in Arizona are valid for five years from the date they are entered. After this period, the judgment can be renewed, allowing the creditor to continue pursuing collection. Maintaining accurate records is crucial to prevent lapsing in the pursuit of a judgment. The Arizona Information Statement of Judgment Creditor(s) can guide you on how to manage and renew your judgments effectively.

To answer a summons without an attorney in Arizona, you should carefully read the summons and complaint. Prepare your written response, ensuring you include your name, the date, and a statement denying or admitting the claims. You must file your answer with the court and serve it to the opposing party. Utilizing resources like the Arizona Information Statement of Judgment Creditor(s) can help clarify what details you need to include.

In Arizona, a judgment can be collected for up to five years from the date it is entered. However, if you file for a renewal, you can extend this collection period for another five years. It is essential to keep track of the judgment’s status and remain proactive in your collection efforts. Understanding the Arizona Information Statement of Judgment Creditor(s) will provide better insights into potentially renewing your judgment.

In Arizona, the time limit for collecting a debt generally spans six years from the date of the last payment or activity on the account. After this period, creditors can no longer legally enforce collection actions. Knowing this timeframe can help you manage your financial responsibilities better. If you need assistance, using platforms like USLegal can guide you through understanding your rights related to the Arizona Information Statement of Judgment Creditor(s).

Arizona has specific rules regarding debt collection practices. Creditors must follow fair practices when attempting to collect debts, including providing the necessary Arizona Information Statement of Judgment Creditor(s). Additionally, they cannot harass or threaten you. Familiarizing yourself with these regulations can empower you to defend your rights effectively.

Yes, a creditor can put a lien on your house in Arizona if they obtain a judgment against you. This process usually involves filing an Arizona Information Statement of Judgment Creditor(s) after winning a court case. Once the lien is in place, it secures the debt against your property. Understanding this process can help you take proactive measures to protect your assets.

The default judgment rule in Arizona allows a creditor to obtain a judgment if the debtor fails to respond to the complaint within a specified time frame. This means if a debtor does not take action, the court may grant the creditor's request without a hearing. This process helps streamline collections for Arizona Information Statement of Judgment Creditor(s). Therefore, it’s crucial for debtors to respond promptly to avoid default judgments.

In Arizona, judgments are governed by specific rules that ensure fair and transparent processes. Creditors must follow proper procedures, including providing notice to the debtor and filing necessary documentation. When a creditor obtains a judgment, they can collect on it using various methods, including garnishment or liens. Understanding these rules is essential for navigating the Arizona Information Statement of Judgment Creditor(s) process.

Several assets cannot be seized in Arizona under state law, including retirement accounts, Social Security benefits, and certain types of insurance. These protections are in place to ensure that individuals maintain their basic needs and financial security. Understanding these regulations is vital for anyone facing collection actions. The Arizona Information Statement of Judgment Creditor(s) can provide more detailed information on which assets are safe.