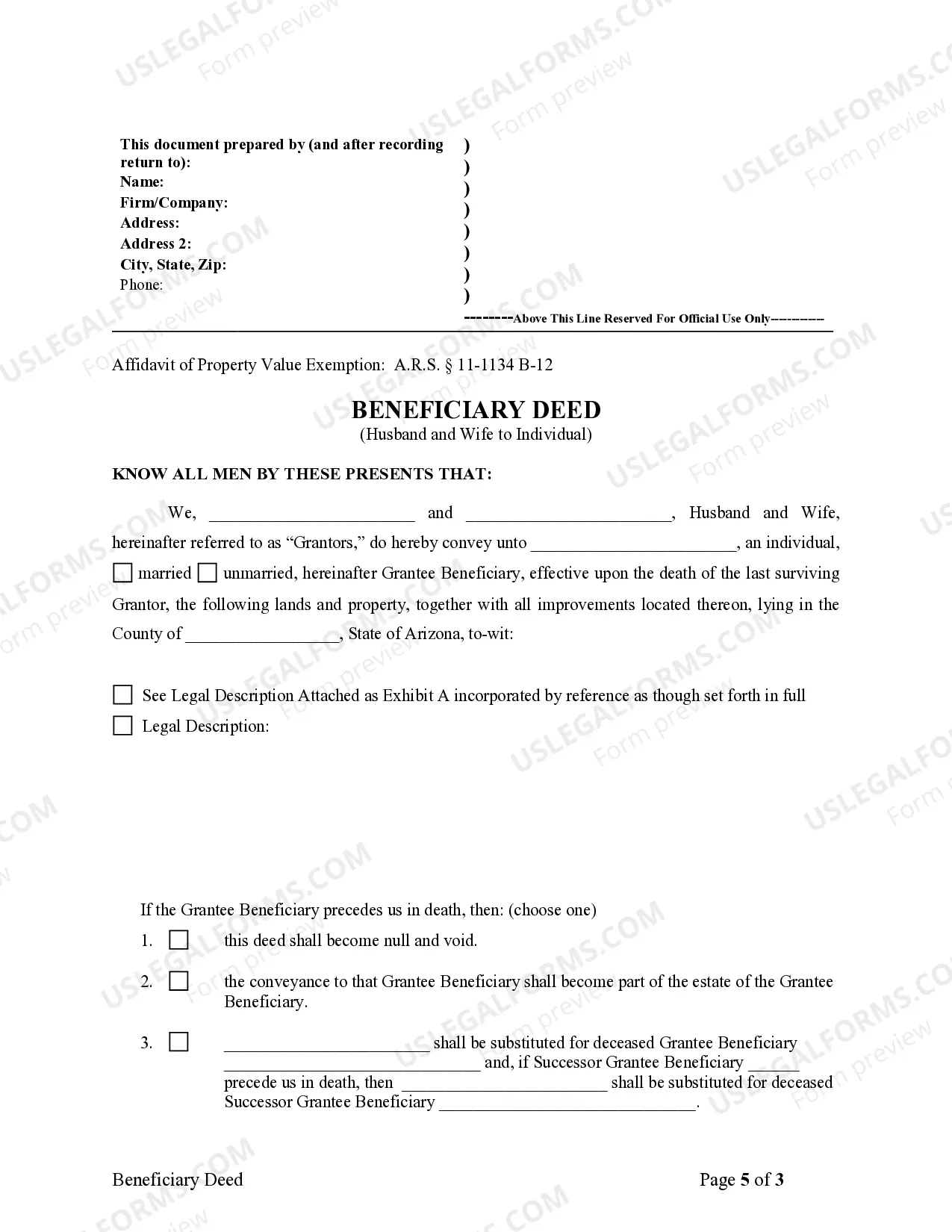

Transfer on Death Deed - Arizona - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual

Description Az Transfer Beneficiary Individual Fill

How to fill out Az Death Individual Document?

If you are looking for precise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual web templates, US Legal Forms is precisely what you require; obtain documents prepared and verified by state-certified legal experts.

Utilizing US Legal Forms not only alleviates concerns regarding legal paperwork; it also saves you time, effort, and money! Acquiring, printing, and submitting a professional form is significantly less expensive than hiring an attorney to draft it for you.

And that’s all there is to it. In just a few effortless clicks, you have an editable Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual. Once you create an account, all future purchases will be processed even more seamlessly. After obtaining a US Legal Forms membership, simply Log In to your account and then click the Download button located on the form’s page. Subsequently, whenever you require this document again, you will always find it in the My documents section. Do not waste your valuable time comparing multiple forms across different websites. Obtain accurate documents from a single reliable service!

- To start, complete your registration by entering your email and creating a secure password.

- Follow the instructions below to set up an account and find the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual template to manage your situation.

- Utilize the Preview feature or review the document details (if accessible) to confirm that the template is suitable for your needs.

- Verify its relevance in your residing state.

- Click Buy Now to place your order.

- Choose an acceptable pricing option.

- Register and make payment using a credit card or PayPal.

- Select a convenient format and save the documents.

Arizona Beneficiary Individual Blank Form popularity

Arizona Beneficiary Individual Other Form Names

Transfer Deed Beneficiary FAQ

To transfer a property deed from a deceased relative in Arizona, begin by obtaining a copy of the death certificate. Next, file an Affidavit of Death along with the property deed with the county recorder's office. If applicable, make sure to check if a Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual was executed, as this can greatly simplify the transfer process.

When a spouse dies in Arizona, the surviving spouse typically inherits the house if they were joint owners. In cases where a Transfer on Death Deed exists, the designated beneficiary will receive the property directly. Therefore, it's essential to consider an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual to ensure your wishes are clearly stated.

Yes, Arizona does allow for Transfer on Death Deeds, making it simple to pass property to your beneficiaries without going through probate. This type of deed is particularly beneficial for couples, as it streamlines the transition of ownership. Utilizing an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual can provide peace of mind knowing your property will transfer as intended.

To remove a deceased spouse from a deed in Arizona, you need to file an Affidavit of Death with the county recorder's office. This document provides proof of death and allows you to update the property records. It is advisable to consult with an attorney for guidance on completing this process, ensuring that your Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual is correctly amended.

A TOD deed and a beneficiary deed serve similar purposes, but there are distinct differences. An Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual transfers property automatically upon death to the named beneficiary, avoiding probate. In contrast, a traditional beneficiary deed may allow for more complex distributions, possibly requiring additional legal considerations depending on the specific terms.

One significant disadvantage of an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual is that it may not provide the same level of control as a will. If the owner of the property changes their mind or wants to change beneficiaries, they must execute a new deed. Additionally, creditors can still pursue the property after death, which may not prevent financial issues.

Yes, an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual must be recorded to be effective. Recording the deed ensures that it is legally recognized and informs others about the intended inheritance. Without recording, the beneficiary deed may not be valid upon the death of the property owner. Using a reliable platform like uslegalforms can simplify the process and ensure that your deed is properly executed and recorded.

To change the deed on a house after the death of a spouse in Arizona, you may need to execute a new deed that reflects the change in ownership. If your spouse left a Transfer on Death Deed, the property automatically transfers to you, making this a straightforward process. However, if not, engaging with resources like uslegalforms can assist you in completing the necessary steps efficiently.

Transferring a property deed in Arizona involves preparing a new deed that clearly states the transfer details. This deed must be signed, notarized, and recorded with the county assessor’s office. For spouses wishing to ensure smooth transitions, a Transfer on Death Deed is ideal, as it simplifies the transfer process.

If you inherit property in Arizona via a Beneficiary Deed, you may not have to go through probate. The property generally transfers directly to you upon the deceased’s passing. However, it's essential to review the deed's terms to understand any specific conditions or requirements that may apply.