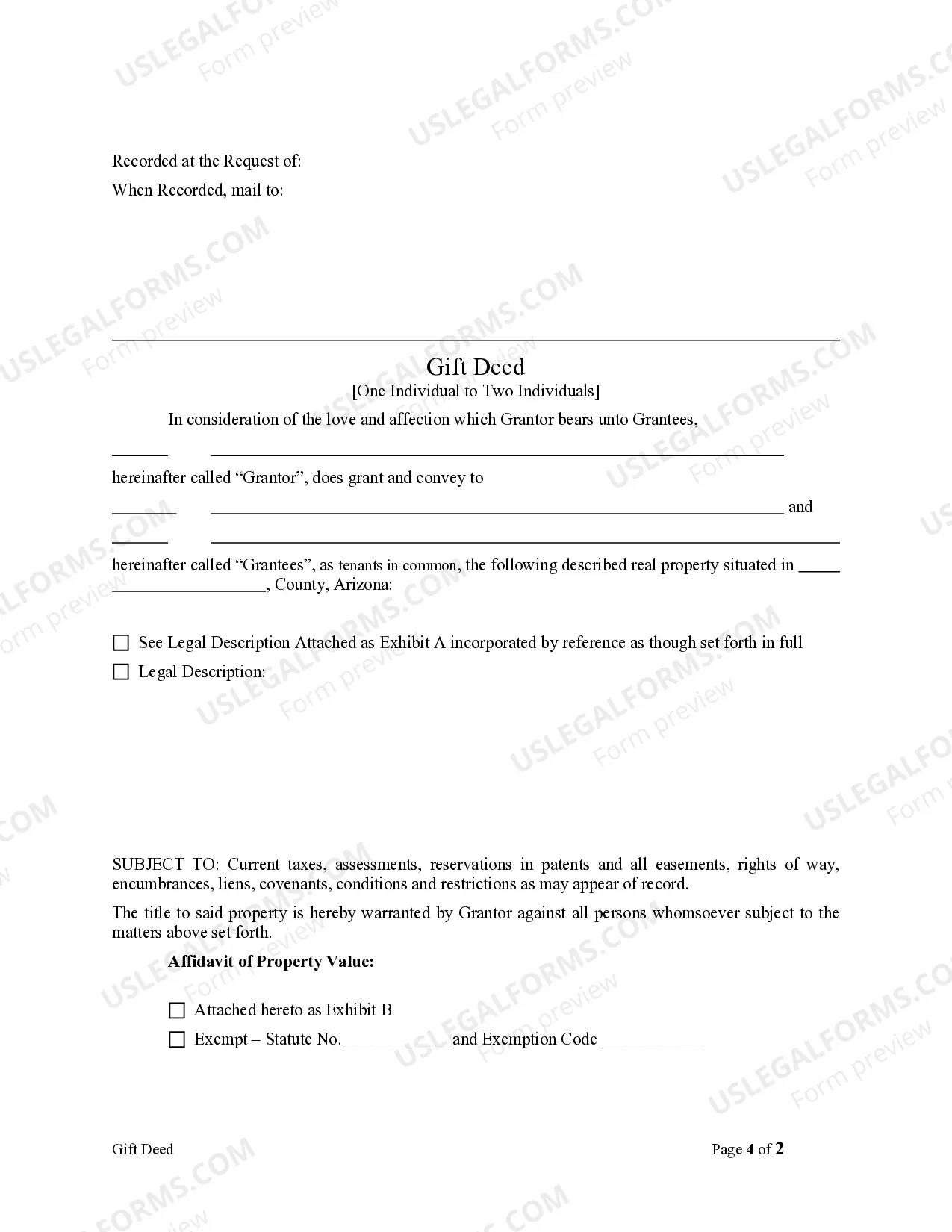

This form is a Gift Deed where the grantor is an individual and the grantees are two individuals. Grantor conveys and warrants the described property to the grantees. Grantees take the property as joint tenants with the right of survivorship or as tenants in common. This deed complies with all state statutory laws.

Arizona Gift Deed - One Individual to Two Individuals

Description

Key Concepts & Definitions

Gift Deed: A legal document used to transfer ownership of property from one individual to one or more individuals without consideration, typically among family members or close friends. Stamp Duty: A tax that must be paid when certain documents, like a gift deed, are executed to make the document legally valid. Real Estate: Refers to property consisting of land and the buildings on it, along with its natural resources. Intellectual Property: Consists of creations of the mind, such as inventions, literary and artistic works, designs, symbols, names, and images used in commerce.

Step-by-Step Guide

- Consult a Lawyer: Obtain legal consultation to understand the implications of transferring property through a gift deed.

- Prepare the Gift Deed: Draft the deed specifying details of the property and the parties involved, particularly noting the transfer from one to two individuals.

- Sign Before Witnesses: The gift deed must be signed by the donor and attested by two witnesses as per the state laws.

- Pay Stamp Duty: Check the local state laws for the exact stamp duty payable on gift deeds regarding real estate or intellectual property. This process can vary significantly between different locations.

- Register the Deed: Record the deed at the local county or registrar's office to make the transfer official and binding.

Risk Analysis

Executing a gift deed involves several risks including improper execution leading to legal disputes, potential tax implications, and misunderstandings about the division of property. Also, if not properly documented and witnessed, the deed might be contested or deemed invalid.

Pros & Cons

- Pros:

- Can be a tax-efficient way to transfer property.

- Strengthens relationships by formalizing the intent of a gift.

- Avoids the complexities and costs of other transfer mechanisms.

- Cons:

- Requires careful legal consultation to prevent future disputes.

- Liability for stamp duty and potential other taxes.

- May be complex to divide a property evenly between two recipients.

Best Practices

Ensure the clarity and completeness of the gift deed, especially when involving multiple recipients. Always verify compliance with local state laws regarding property transfers and stamp duty. Involve a lawyer in drafting and reviewing the deed to safeguard against legal pitfalls.

Common Mistakes & How to Avoid Them

- Lacking Legal Clarity: Always consult with a legal expert instead of using standard templates.

- Ignoring Tax Implications: Consult a tax advisor to understand potential estate and gift tax liabilities.

- Failure to Properly Record the Deed: Ensure the deed is officially registered to prevent future disputes.

FAQ

- What is stamp duty on a gift deed? Stamp duty varies by state but generally involves a percentage of the property's market value or a nominal fee.

- Can intellectual property be transferred via a gift deed? Yes, intellectual property rights can be gifted through a deed, subject to appropriate legal procedures.

- Is a gift deed revocable? Once executed and delivered, a gift deed is generally irrevocable unless specific revocation terms are included in the deed itself.

How to fill out Arizona Gift Deed - One Individual To Two Individuals?

If you're looking for the correct Arizona Gift Deed - One Individual to Two Individuals copies, US Legal Forms is precisely what you require; access documents offered and verified by state-certified attorneys.

Utilizing US Legal Forms not only saves you from issues relating to legal documentation; additionally, you save time, effort, and money! Downloading, printing, and completing a professional template is significantly more cost-effective than hiring a lawyer to draft it for you.

And that's it. In a few straightforward clicks, you have an editable Arizona Gift Deed - One Individual to Two Individuals. After creating your account, all future requests will be handled even more smoothly. Once you hold a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form's page. Then, when you wish to utilize this template again, you'll always find it in the My documents section. Don't waste your time comparing numerous forms on multiple websites. Obtain precise templates from a single reliable platform!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the instructions below to establish your account and locate the Arizona Gift Deed - One Individual to Two Individuals template to meet your requirements.

- Use the Preview feature or review the document description (if available) to confirm that this is the form you need.

- Verify its legality in your jurisdiction.

- Click Buy Now to place your order.

- Select a suggested payment plan.

- Set up your account and pay with a credit card or PayPal.

- Choose a suitable file format and download the document.

Form popularity

FAQ

Adding someone to your home's deed in Arizona can be effectively done through an Arizona Gift Deed - One Individual to Two Individuals. Start by drafting the deed, clearly listing both parties' names, and then sign it in front of a notary. Finally, you need to record the deed with the county recorder's office to officially update ownership and protect your interests.

To efficiently add someone to your deed, you may consider using an Arizona Gift Deed - One Individual to Two Individuals. This method allows you to transfer ownership easily, ensuring both parties have a clear understanding of the shared property rights. Always consult with a legal professional to ensure the deed complies with Arizona laws and fulfills your specific needs.

Yes, the right of survivorship is automatic in Arizona for properties held under joint tenancy. This ensures that when one owner dies, their share of the property goes directly to the surviving owner(s) without going through probate. This aspect is often a motivating factor for individuals considering an Arizona Gift Deed - One Individual to Two Individuals, as it simplifies inheritance matters.

Creating a joint tenancy requires four key elements: unity of possession, unity of interest, unity of time, and unity of title. This means that all tenants must hold equal shares in the property, acquire their interest simultaneously, and hold the same legal document. Recognizing these elements is crucial when establishing ownership through tools like an Arizona Gift Deed - One Individual to Two Individuals, ensuring all parties understand their rights.

Breaking joint tenancy in Arizona requires a clear legal process, such as filing a partition action in court or creating a new deed that explicitly dissolves the joint tenancy. This may involve agreements between the parties or the sale of the property, depending on specific circumstances. It’s wise to consult resources like USLegalForms for insights and documentation needed to navigate this process regarding an Arizona Gift Deed - One Individual to Two Individuals.

To add someone to a deed in Arizona, you must create a new deed that transfers ownership to both the current owner and the new individual. This involves naming the parties, including a description of the property, and designating the type of ownership—joint tenancy or other forms. Moreover, utilizing services from USLegalForms can provide the necessary guidance to ensure the transaction is valid and complies with state laws regarding an Arizona Gift Deed - One Individual to Two Individuals.

To fill out a joint tenancy deed in Arizona, you need to include the names of all parties involved, the legal description of the property, and a clear statement that the owners are taking the property as joint tenants. It’s essential to ensure that the deed is executed properly in front of a notary and filed with the county recorder's office. Using tools available on platforms like USLegalForms can simplify this process, especially for creating an Arizona Gift Deed - One Individual to Two Individuals.

The statute of joint tenancy in Arizona allows two or more individuals to hold property together with equal rights. This type of ownership includes the right of survivorship, meaning that if one owner passes away, their share automatically transfers to the surviving owner or owners. Understanding this can be important when considering an Arizona Gift Deed - One Individual to Two Individuals, as it impacts how property will be distributed in the event of death.

In Arizona, there is no official limit on the number of names that can appear on a home title. Multiple names can be listed as co-owners, which is common in various arrangements such as family properties or partnerships. When you opt for an Arizona Gift Deed - One Individual to Two Individuals, you can easily designate two individuals as co-owners, ensuring that ownership is clearly defined.

In Arizona, the legal requirements for recording a deed include the accurate preparation of the deed itself, notarization, and submission to the county recorder's office. Furthermore, you should ensure that the deed includes a legal description of the property. Using an Arizona Gift Deed - One Individual to Two Individuals will simplify this process, as it is designed to meet specific state requirements for property transfer.