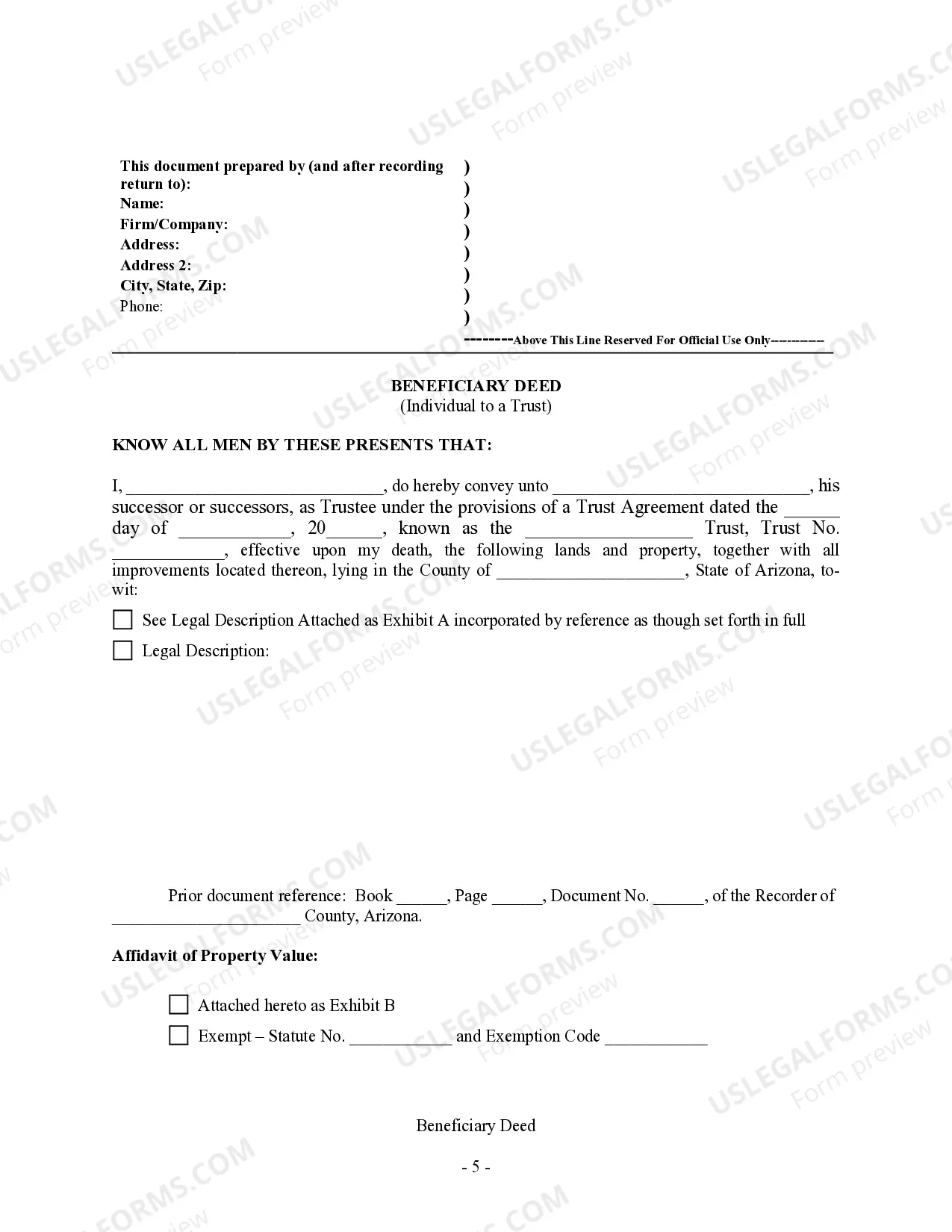

This form is a Beneficiary or Transfer on Death Deed where the grantor is an individual and the grantee is a trustee acting on behalf of the trust. This transfer is revocable until grantor's death and effective only upon the death of the grantor. This deed complies with all state statutory laws.

Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To A Trust?

If you're looking for precise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust web templates, US Legal Forms is exactly what you require; obtain documents created and validated by state-accredited legal professionals.

Using US Legal Forms not only spares you from hassles related to legal documents; moreover, you conserve time, effort, and money! Downloading, printing, and filling out a professional form is considerably less expensive than hiring an attorney to draft it for you.

And there you have it. In just a few simple clicks, you receive an editable Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust. Once you create your account, all future purchases will be even more straightforward. With a US Legal Forms subscription, simply Log In to your account and then click the Download button you will find on the form’s page. Then, whenever you need to access this blank again, you will always be able to locate it in the My documents section. Do not waste your time and energy searching through multiple forms on different websites. Acquire accurate documents from one reliable source!

- To start, complete your registration process by providing your email and setting a secure password.

- Follow the instructions below to create an account and acquire the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust template to address your needs.

- Use the Preview feature or review the file description (if available) to ensure that the template is what you require.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Choose a suitable pricing plan.

- Create an account and make the payment via your credit card or PayPal.

- Select a preferred file format and save the document.

Form popularity

FAQ

To transfer property to a trust in Arizona, you need to execute a deed that clearly states the trust as the new owner. After preparing the appropriate paperwork, ensure it is signed in front of a notary public. Finally, record the deed with the county recorder's office to make it official. This process is critical for maintaining clear ownership and ensuring that your trust operates as intended.

Certain assets, such as retirement accounts with specific beneficiaries designated, life insurance policies, and some government benefits, cannot be placed in a trust. Additionally, assets that have a joint ownership agreement may also be excluded. Understanding these limitations is crucial for effective estate planning. Consulting uslegalforms can help clarify which assets can and cannot be placed in your trust.

Transferring property into a trust in Arizona involves executing a new deed that transfers ownership from you to the trust. This usually means drafting a deed that specifies the trust as the new owner, and you must sign it before a notary. After signing, you should file this deed with the county recorder's office. This action ensures that the property is managed according to your trust's terms and can simplify matters for your beneficiaries.

One common mistake is failing to properly fund the trust. Many parents think that simply creating a trust is enough, but they often forget to transfer their assets into the trust. Without this vital step, assets remain outside the trust, and you may not achieve your estate planning goals. Utilizing a resource like uslegalforms can guide you through the essentials of setting up a trust correctly.

To file a transfer on death deed in Arizona, you need to complete the proper form that designates a beneficiary for your property. After filling out the Arizona Transfer on Death Deed, you must sign it in the presence of a notary public. Once signed, file the deed with the county recorder's office where the property is located. This process is straightforward and ensures that your property goes directly to your beneficiary without going through probate.

Yes, Arizona is a deed of trust state, which means that mortgages are typically secured using a deed of trust rather than a mortgage. This allows for a more straightforward foreclosure process, involving a trustee to sell the property if necessary. Understanding how this works can be beneficial, especially when navigating options like the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust, which can help secure your estate planning goals.

Transferring a deed to a trust in Arizona involves creating a new deed that names the trust as the new owner of the property. This deed must clearly describe the property and be signed by the current owner. Once completed, the deed needs to be recorded with the local county recorder. The Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust can further facilitate this transfer, keeping the process efficient and effective.

Yes, a Transfer on Death (TOD) account can designate a trust as its beneficiary in Arizona. This allows the assets in the account to directly transfer to the trust upon the account holder's death, streamlining the process for your heirs. This arrangement can be particularly beneficial when utilizing the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust to ensure that all your assets are managed according to your intentions.

Transferring items into a trust requires formally assigning ownership of the assets to the trust. You will typically need to prepare and execute transfer documents, which may vary based on the type of asset, whether real estate, bank accounts, or investments. Consulting with a legal professional can help ensure all necessary documents are properly completed and compliant with Arizona laws, particularly when using the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust.

A trust is a legal arrangement where assets are managed by a trustee for the benefit of beneficiaries, while a beneficiary deed allows you to designate someone to receive your property upon your death. The Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust functions similarly, but without the need for probate. Understanding these differences is essential to ensuring your assets are distributed according to your wishes.