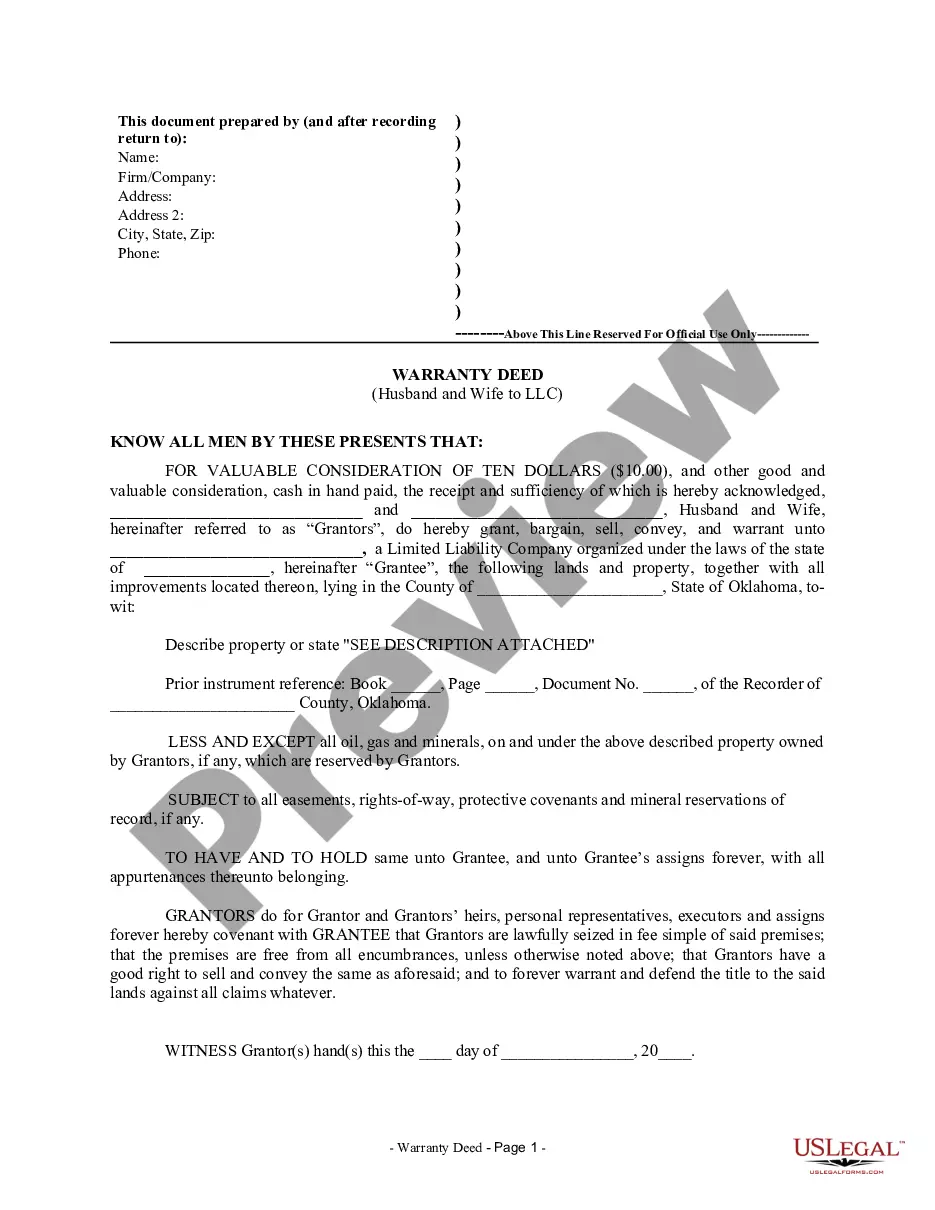

This form is a Transfer on Death Deed where the grantors are husband and wife and the grantees are three individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common . This deed complies with all state statutory laws.

Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals

Description Az Beneficiary Deed Form

How to fill out Tod Az?

If you’re looking for precise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Three Individuals samples, US Legal Forms is exactly what you need; find documents supplied and verified by state-approved legal experts.

Using US Legal Forms not only saves you from frustrations related to legal documentation; you also save time, effort, and money! Downloading, printing, and completing a professional document is significantly less expensive than hiring an attorney to do it for you.

And that’s all. In just a few easy clicks, you obtain an editable Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Three Individuals. After you establish an account, all future orders will be processed even more easily. Once you have a US Legal Forms subscription, just Log In/">Log In to your account and click the Download button found on the form’s page. Then, when you need to access this template again, you will always be able to find it in the My documents menu. Don’t waste your time and energy comparing numerous forms on multiple websites. Purchase professional copies from just one reliable service!

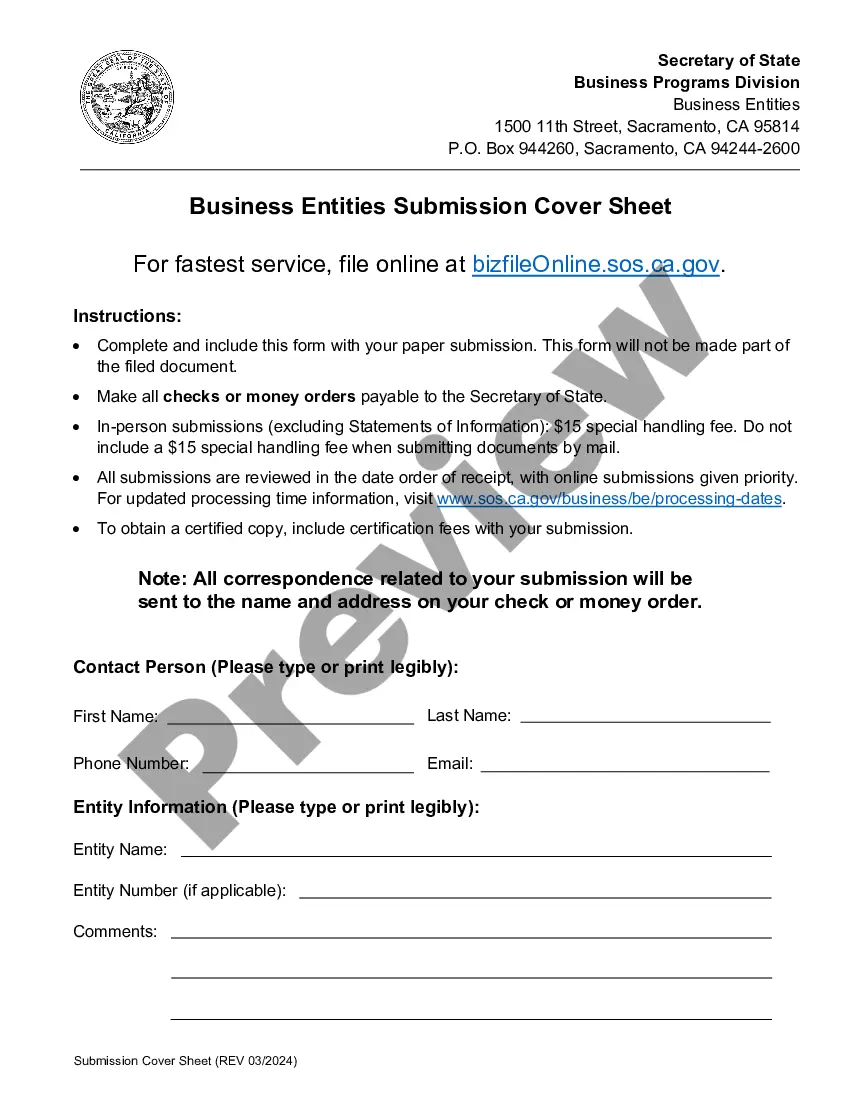

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the instructions below to set up your account and obtain the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Three Individuals template to address your situation.

- Utilize the Preview feature or review the document description (if available) to ensure that the template is the one you require.

- Verify its validity in the state you reside in.

- Click on Buy Now to place an order.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a suitable format and save the form.

What Is A Tod Form Form popularity

Arizona Maricopa County Beneficiary Deed Form Other Form Names

Arizona Beneficiary Form FAQ

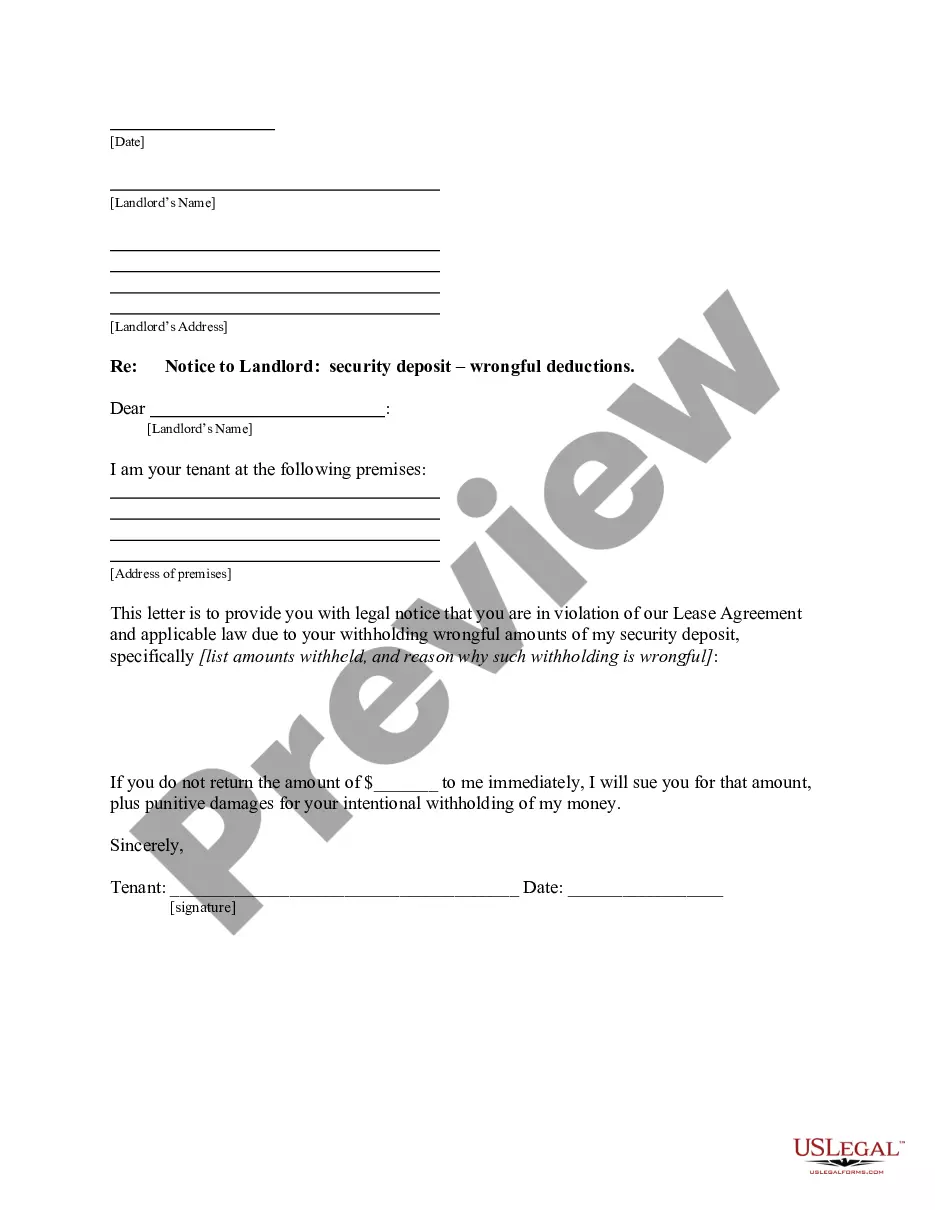

To file a beneficiary deed in Arizona, first, you need to complete the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals form. Ensure that you include accurate details, such as the names of the beneficiaries and a legal description of the property. After completing the form, sign it in front of a notary public. Finally, record the signed and notarized deed with your county recorder's office to make it legally binding.

To transfer a deed after death in Arizona, you will typically need to record the transfer on death deed that the deceased had executed beforehand. This process usually involves providing the death certificate and completing the necessary documentation with the county recorder's office. Utilizing an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals ensures a straightforward and legally sound transfer of property to beneficiaries.

Yes, a beneficiary deed in Arizona needs to be notarized to ensure its validity. It is important that the deed is signed in the presence of a notary public, which adds an extra layer of authenticity. Using resources like uslegalforms can help you understand the requirements and complete your Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals properly.

Filing a transfer on death deed in Arizona involves preparing the document properly, ensuring it includes all required details such as the property description and beneficiary names. Once completed, you need to file the deed with the county recorder’s office in the area where the property is located. Platforms like uslegalforms can assist you in navigating these steps efficiently when dealing with an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals.

Transfer on death (TOD) refers to a legal method for transferring ownership of property to designated individuals upon the owner's death without probate. This designation allows for a smooth transition of assets, while the original owner retains full control and ownership during their lifetime. By using an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals, you can plan seamlessly for the future.

The key difference lies in the legal execution of asset transfer. A beneficiary refers to an individual receiving assets or benefits from a will or other financial documents, while a transfer on death (TOD) allows property to be automatically transferred upon the owner's death without going through probate. Utilizing an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals ensures a more straightforward transition of your assets to your chosen beneficiaries.

Beneficiaries and transfer on death designations are related concepts, but they are not identical. A beneficiary is generally a person designated to inherit or receive assets, while a transfer on death deed creates a specific legal mechanism for transferring property upon death directly. Knowing the difference can help clarify your estate planning intentions for an Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals.

While a transfer on death deed (TOD) offers many benefits, there are some disadvantages to consider. One primary concern is that it does not provide any tax benefits and may still be subject to creditors' claims after death. Additionally, a TOD may not consider family dynamics and could complicate relationships if expectations are not clearly communicated among the beneficiaries.

To create a beneficiary deed in Arizona, you need to prepare a written document that specifies the property you wish to transfer upon your death. This document should clearly state the names of the individuals who will receive the property, ensuring that it's properly witnessed and signed. You can simplify this process using platforms like uslegalforms, which provide templates and guidance to help you through the creation of your Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals.

To transfer a title upon death in Arizona, you can utilize a Transfer on Death Deed, which allows seamless transfer to designated beneficiaries. This method avoids the complexities of probate, making the process simpler for your loved ones. If you are uncertain about the process, consider using USLegalForms to access the required forms and get guidance tailored to the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Three Individuals.