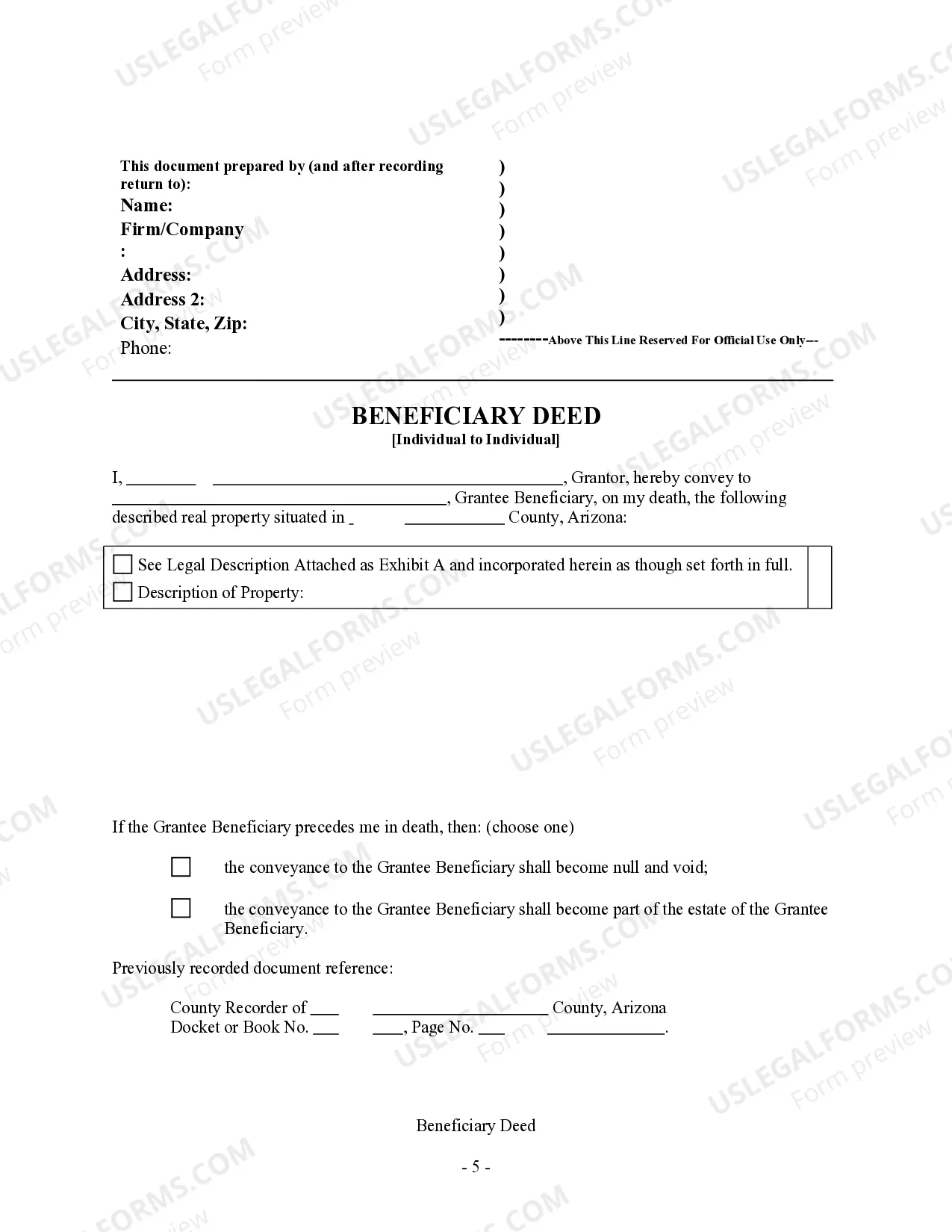

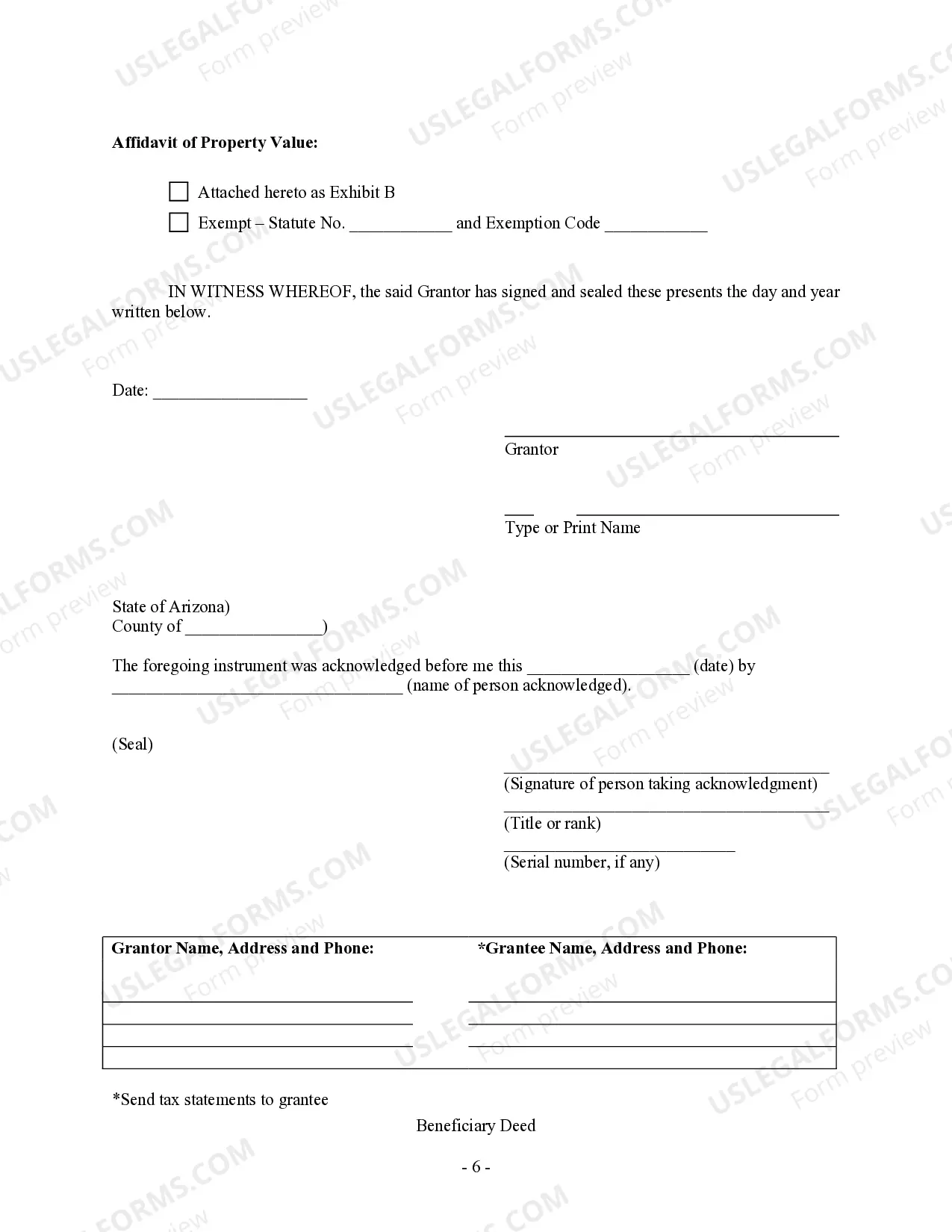

This form is a Beneficiary or Transfer on Death Deed where the grantor is an Individual and the Grantee is an Individual. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

If you're looking for appropriate Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual forms, US Legal Forms is precisely what you require; access documents offered and verified by state-certified legal experts.

Utilizing US Legal Forms not only protects you from complications related to legal documents; furthermore, you save time, effort, and money! Downloading, printing, and completing a professional document is significantly more economical than hiring an attorney to do it for you.

And there you have it. With just a few simple clicks, you now possess an editable Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. Once you have created your account, all future orders will be processed even more seamlessly. If you have a US Legal Forms subscription, simply Log In and click the Download button found on the forms page. Then, whenever you need to use this sample again, you'll always be able to find it in the My documents section. Don't waste your time comparing numerous forms across different websites. Order accurate templates from a single reliable service!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the instructions below to establish your account and locate the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual template to resolve your situation.

- Utilize the Preview feature or review the document information (if available) to confirm that the template is the one you need.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

To transfer a property deed from a deceased relative in Arizona, you need to provide the original beneficiary deed, if applicable, along with the death certificate. This ensures a straightforward transfer without probate, as the property will automatically go to the named beneficiaries. For assistance with the process, consider using ulegalforms, which offers valuable resources and documents.

Yes, Arizona does allow a Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. This law enables residents to assign beneficiaries for their property, facilitating a swift transfer upon the owner's death. It simplifies estate planning and helps avoid probate.

A beneficiary deed in Arizona allows property owners to designate individuals who will inherit their property upon their death without going through probate. When the owner passes away, the named beneficiaries automatically gain ownership. This process requires careful completion of the deed to ensure clarity and legality.

Yes, a beneficiary deed can be contested in Arizona. Disputes may arise if there are claims of undue influence or if the document does not meet legal standards. However, establishing a clear and valid Transfer on Death Deed - Beneficiary Deed for Individual to Individual reduces the likelihood of challenges.

Utilizing a beneficiary deed, or a Transfer on Death Deed, offers several advantages in Arizona. It allows for a seamless transfer of property upon death, avoiding the lengthy probate process. Additionally, it helps maintain privacy since the property does not enter the public record until the owner's passing.

In Arizona, beneficiaries who are named in a Transfer on Death Deed, or TOD - Beneficiary Deed for Individual to Individual, gain certain rights without needing to go through probate. These beneficiaries can receive the property directly upon the owner's death. However, they have no rights to the property while the owner is alive, ensuring the owner's control until that time.

A life estate deed is not commonly used in Arizona compared to other types of deeds, such as the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. Although life estate deeds provide benefits, they can complicate the property ownership upon the death of the life tenant. Many residents prefer the straightforward transfer mechanisms of beneficiary deeds for their simplicity and effectiveness. It's wise to choose the deed type that best meets your needs.

Yes, Arizona is a deed state, which means that property ownership is conveyed through deeds. The Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual plays a significant role in this process as it allows individuals to transfer property upon death without probate. Understanding the different types of deeds is vital to navigate property transfers. Utilizing the right deed streamlines the ownership transition.

An unrecorded deed may not be valid in Arizona when it comes to the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. In general, to protect your interest, it's vital to record the deed with the county recorder's office. Unrecorded deeds can lead to disputes and complications, making your ownership harder to prove. Always ensure your deed is recorded to establish clear title.

To transfer property in Arizona after your parent passes away, you can use the Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. First, ensure that the deed is properly executed and recorded before your parent's death. If your parent included you as a beneficiary, you can claim the property directly. This process simplifies the transfer, avoiding probate expenses and delays.