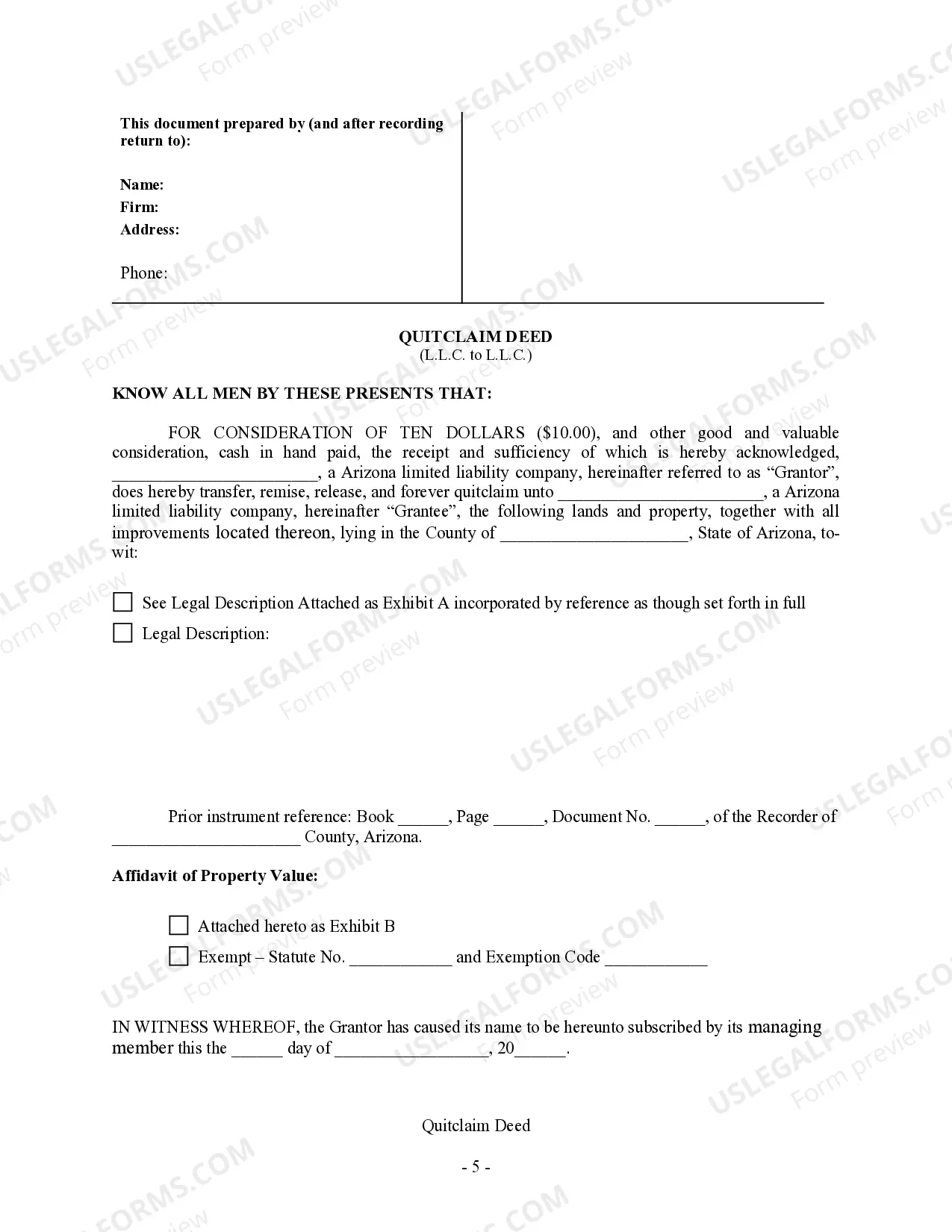

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is an LLC. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company

Description

How to fill out Arizona Quitclaim Deed - Limited Liability Company To Limited Liability Company?

If you're searching for appropriate Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company forms, US Legal Forms is precisely what you require; find documents crafted and authenticated by state-recognized legal professionals.

Utilizing US Legal Forms not only alleviates your concerns about legal documentation; additionally, you save time and effort, as well as money! Acquiring, printing, and completing a competent template is far less expensive than hiring an attorney to prepare it for you.

And that's it. In just a few simple steps, you possess an editable Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company. Once you create your account, all subsequent orders will be processed even more smoothly. After obtaining a US Legal Forms subscription, simply Log In to your account and then click the Download button visible on the form’s page. Thus, when you need to use this template again, you will always be able to find it in the My documents section. Don't waste your time and energy sifting through countless forms on different websites. Purchase accurate documents from a single reliable platform!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the steps below to set up an account and obtain the Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company template to address your needs.

- Use the Preview option or review the document description (if available) to ensure that the sample is what you require.

- Verify its relevance in your state.

- Click Buy Now to place your order.

- Select a recommended pricing plan.

- Create your account and pay with your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

To transfer property into a trust in Arizona, start by drafting the trust documents outlining the property and its beneficiaries. Next, utilize an Arizona Quitclaim Deed to legally transfer the property title into the trust. Ensure that you record the deed with the county recorder’s office to make the trust the official owner. Consulting with a legal expert can help ensure this process is compliant with local laws and effectively structured.

Filling out a quitclaim deed in Arizona involves entering pertinent details like the names of the grantor and grantee, the property's legal description, and the county where the property is located. You can find templates online, but ensure you choose the Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company for the best fit. Once completed, remember to have the document notarized before filing it with your county recorder.

To transfer property to an LLC in Arizona, you need to complete an Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company. Be sure to include relevant property descriptions and the LLC’s details in the deed. After signing the deed in front of a notary, file it with the county recorder's office. This ensures the transfer is documented and legally recognized.

Individuals who benefit the most from a quitclaim deed are often family members or business partners who wish to transfer property quickly and without complications. This deed allows the transfer of property rights without guaranteeing that the title is clear. Therefore, it’s most beneficial in situations where trust exists between the parties, such as in family cases or joint ventures.

The best way to transfer property between families is often through a quitclaim deed, such as the Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company. This type of deed allows the transfer of ownership without a lengthy process, making it suitable for family transactions. Always consider consulting a legal professional to ensure that the transfer meets all legal requirements and protects everyone involved.

Yes, Arizona is considered a good state to form an LLC due to its favorable tax laws and business-friendly environment. The state has straightforward regulations that simplify the formation and operation of an LLC. Additionally, forming an LLC in Arizona can provide asset protection and limit personal liability, making it a smart choice for business owners.

To transfer a property deed in Arizona, you will need to complete a deed form, such as the Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company. You will then sign the deed in front of a notary public. Afterward, file the deed with the county recorder's office where the property is located. This process ensures that the transfer is legally binding and recognized.

Yes, an LLC can buy a house in Texas, allowing for flexibility in property ownership. This process often involves using an Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company to facilitate the transfer. Ensure that the LLC is properly formed and compliant with state regulations. This option can provide benefits such as asset protection and tax advantages.

Transferring property to an LLC in California can have tax implications, such as reassessment of property taxes. Utilizing an Arizona Quitclaim Deed - Limited Liability Company to Limited Liability Company may help mitigate some issues. It's essential to consult with a tax professional to understand specific tax consequences based on your situation. By understanding these factors, you can make informed decisions about your property ownership.

Yes, you can transfer property from your LLC to yourself using a quitclaim deed. The process involves filling out an Arizona Quitclaim Deed form that specifies the transfer from the LLC to you as an individual. When doing this, provide accurate property details and ensure proper notarization before filing. This transfer maintains clear ownership records and simplifies any future transactions.