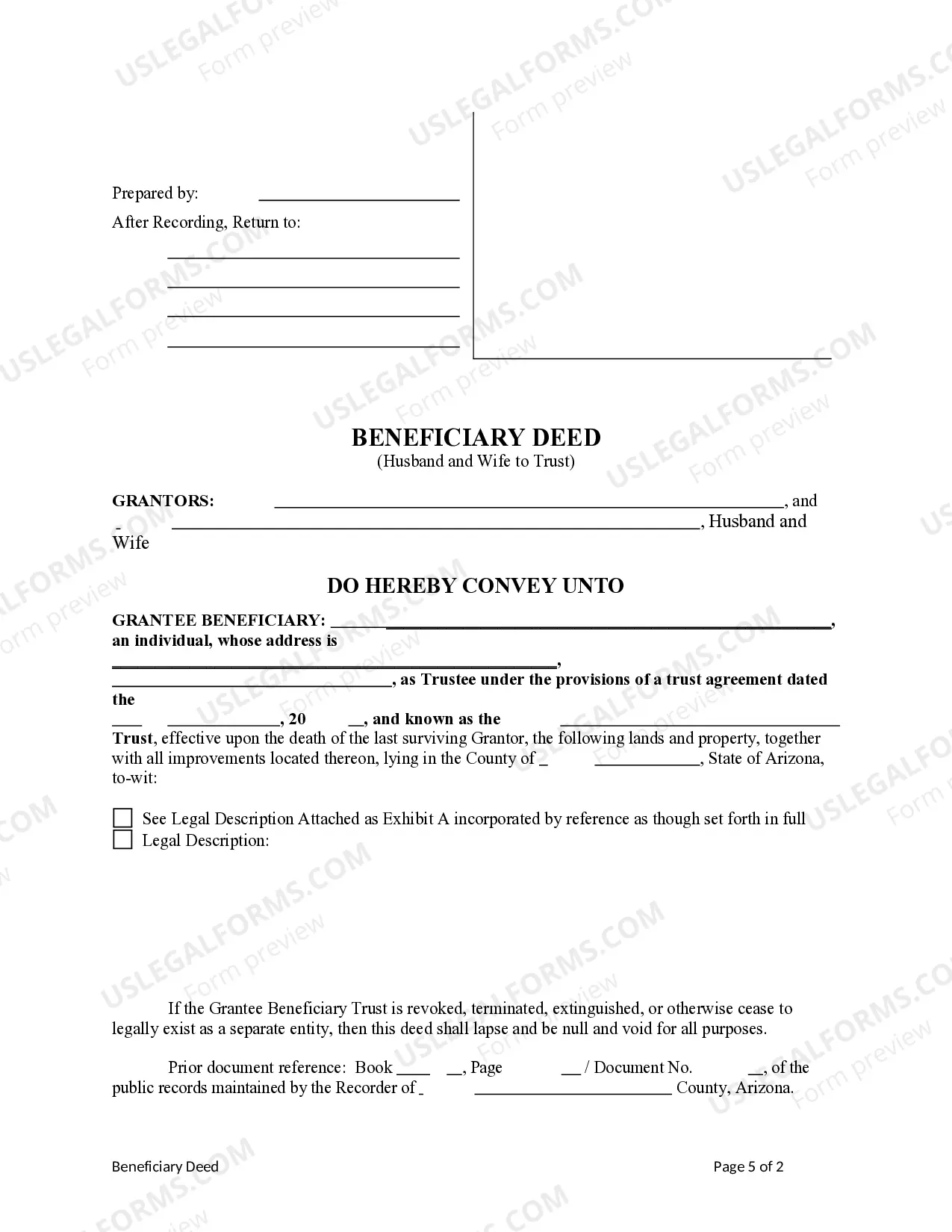

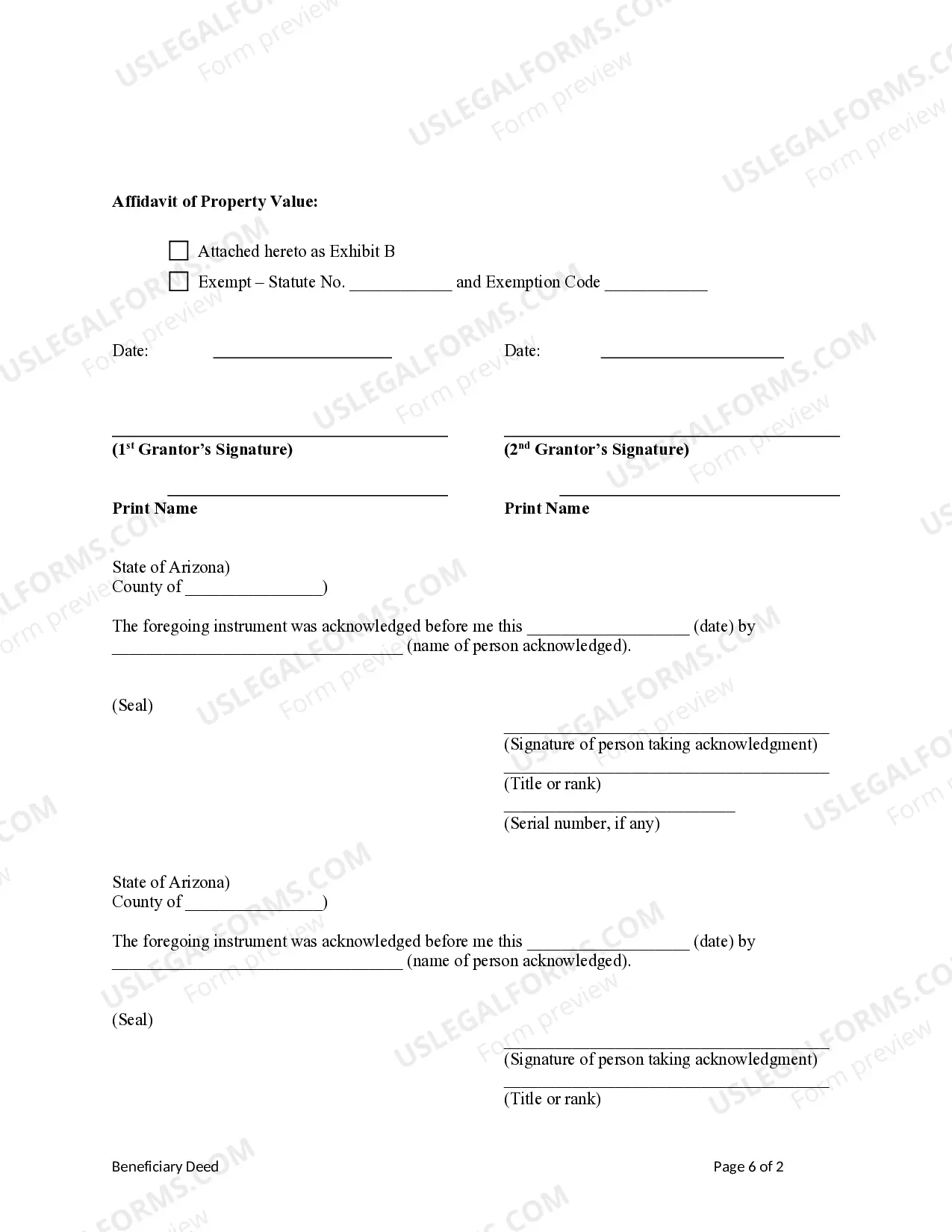

This form is a Beneficiary or Transfer on Death Deed where the Grantors are husband and wife and the Grantee Beneficiary is a Trust. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The deed is not effective unless recorded before the death of the last surviving Grantor. This deed complies with all state statutory laws.

Arizona Beneficiary Deed from Husband and Wife to Trust

Description

How to fill out Arizona Beneficiary Deed From Husband And Wife To Trust?

If you're seeking suitable Arizona Beneficiary Deed examples from Husband and Wife to Trust, US Legal Forms is precisely what you require; find documents created and verified by state-certified legal professionals.

Using US Legal Forms not only alleviates your concerns about legal documents; you also conserve time and effort, as well as money! Downloading, printing, and filling out a professional template is significantly cheaper than hiring a lawyer to do it for you.

And that's it. With a few simple steps, you now possess an editable Arizona Beneficiary Deed from Husband and Wife to Trust. Once your account is set up, subsequent requests will be handled even more easily. When you have a US Legal Forms subscription, just Log In to your profile and click the Download button you see on the form's page. Then, whenever you need to access this template again, you'll always be able to find it in the My documents section. Do not waste your time searching through numerous forms on different websites. Order accurate documents from a single secure platform!

- To get started, complete your registration process by providing your email and creating a secure password.

- Follow the steps outlined below to set up your account and locate the Arizona Beneficiary Deed from Husband and Wife to Trust template to meet your requirements.

- Use the Preview option or review the document description (if available) to ensure that the template is what you need.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose an appropriate format and save the form.

Form popularity

FAQ

After the death of a spouse in Arizona, changing the deed on the house generally involves presenting the death certificate and any existing beneficiary deeds. If you have an Arizona beneficiary deed from husband and wife to trust, this can simplify the process, allowing you to transfer ownership directly to the trust. It's advisable to consult with a legal expert to ensure all requirements are met.

To transfer a deed to a trust in Arizona, you will need to prepare a new deed transferring ownership to the trust. The Arizona beneficiary deed from husband and wife to trust is an effective method for this purpose. Make sure to file the new deed with the county recorder's office to complete the transfer.

Transferring items into a trust often involves changing the titles or deeds of those items. For instance, if you wish to transfer real estate, you may use an Arizona beneficiary deed from husband and wife to trust. Consult legal resources or professionals to make sure all transfers comply with state laws.

To transfer a property deed from a deceased relative in Arizona, you'll typically require the death certificate and relevant documentation proving your relationship. If a beneficiary deed was in place, it can simplify the process, allowing for direct transfer into the trust. Consider reaching out to professionals for assistance with any complex situations.

While you can create an Arizona beneficiary deed from husband and wife to trust without a lawyer, seeking professional advice is wise. A lawyer can help ensure all legal requirements are met and that the deed is properly drafted. This additional guidance can prevent complications in the future.

Using an Arizona beneficiary deed from husband and wife to trust is often the best approach for transferring property between families. This method allows for straightforward transitions while avoiding probate. You can also consult with legal professionals to explore other options that suit your family's unique situation.

While an Arizona beneficiary deed from husband and wife to trust does not have to be recorded to be legally binding, doing so is important for practical reasons. Recording the deed ensures that the trust receives the property seamlessly upon the owners' passing. It also protects the interests of all parties involved.

Yes, Arizona is a deed of trust state. This means the state allows for property purchases to be secured with a deed of trust instead of a mortgage. Understanding this can be beneficial when considering options like an Arizona beneficiary deed from husband and wife to trust.

In Arizona, while a beneficiary deed from husband and wife to trust doesn't need to be recorded to be valid, recording it is highly recommended. Recording provides public notice of the transfer, ensuring clarity about property ownership. This step can help avoid potential disputes in the future.

To record an Arizona beneficiary deed from husband and wife to trust, you need to complete the deed form correctly. After filling it out, you must take the signed document to the county recorder's office where the property is located. Once recorded, the deed will become part of public records and ensure the trust receives the property upon death.