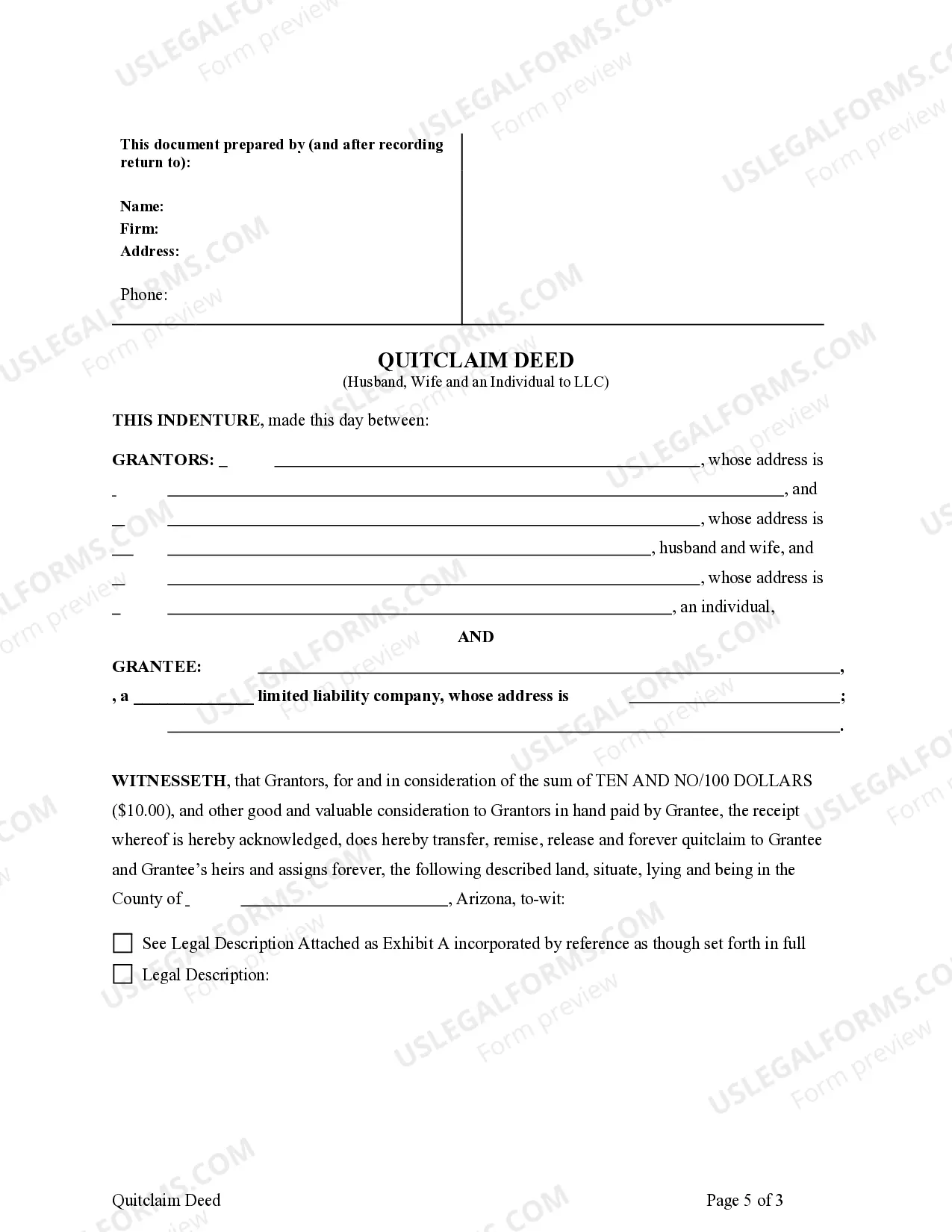

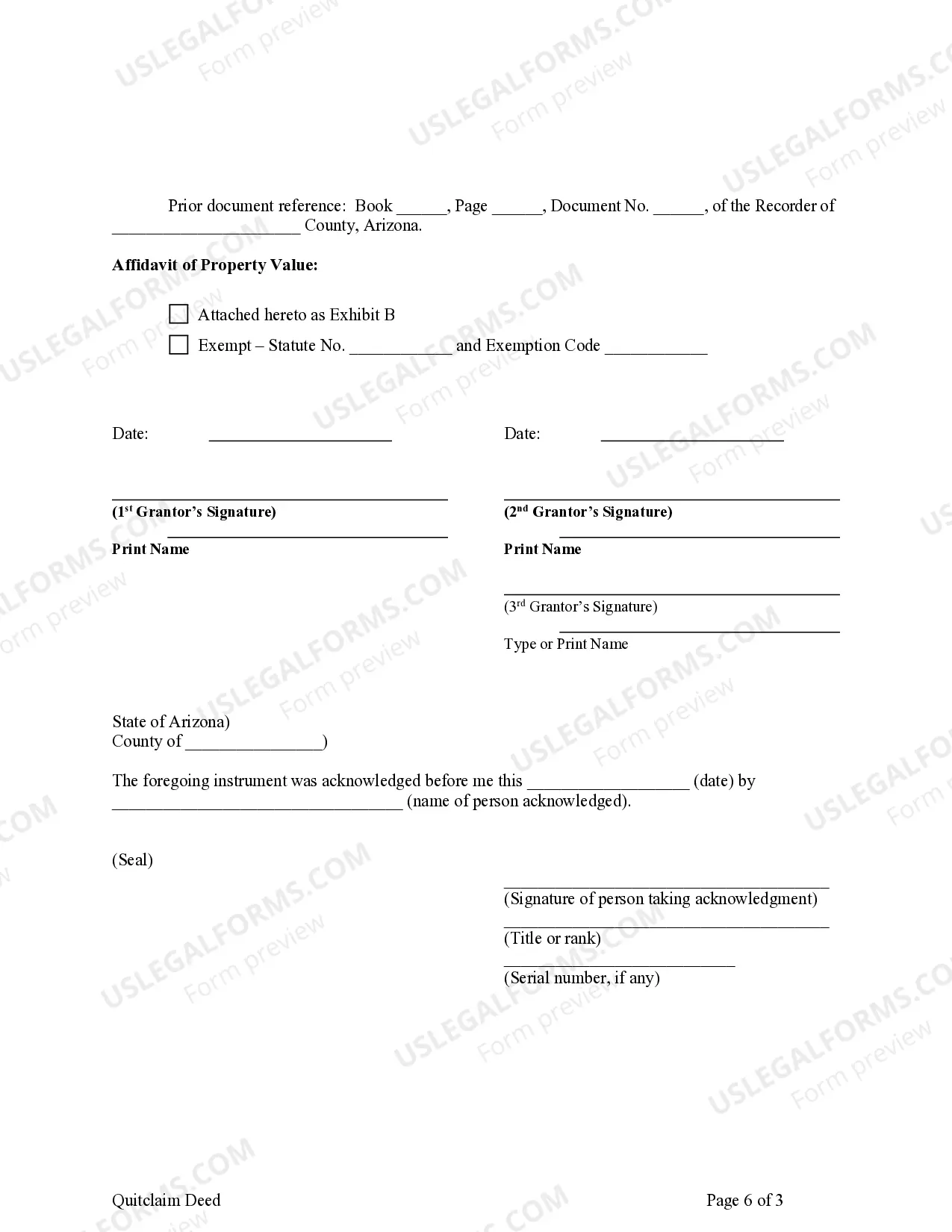

Arizona Quitclaim Deeds from Husband, Wife and an Individual to an LLC are documents used to transfer ownership of real estate from individuals to a Limited Liability Company (LLC). The deed is commonly used when individuals wish to transfer ownership of their real estate to an LLC for business or investment purposes. There are two types of Arizona Quitclaim Deeds from Husband, Wife and an Individual to an LLC: a single granter deed, which is used when only one individual is transferring the property, and a joint granter deed, which is used when all three parties (husband, wife, and individual) are transferring the property to the LLC. In addition to the names of the parties involved and the property description, the deed must also include the signatures of all parties involved as well as the acknowledgment of a notary public. The deed must also be filed with the county recorder's office in the county where the property is located. Once the deed is filed, it will become a public record. Arizona Quitclaim Deeds from Husband, Wife and an Individual to an LLC are an important document required in order to transfer ownership of real estate from individuals to an LLC. The deed is a legal document that must be written and completed correctly to ensure the transfer of ownership is valid.

Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC

Description

How to fill out Arizona Quitclaim Deed From Husband, Wife And An Individual To A LLC?

How much time and resources do you frequently utilize for creating official documents.

There’s a superior choice to obtain such forms rather than employing legal professionals or spending countless hours searching the internet for an appropriate template.

Another advantage of our service is that you can access previously obtained documents that you securely store in your profile in the My documents tab. Retrieve them any time and re-complete your paperwork as often as necessary.

Conserve time and energy preparing legal documents with US Legal Forms, one of the most reliable online solutions. Join us today!

- Review the form content to ensure it fulfills your state criteria. To accomplish this, examine the form description or utilize the Preview option.

- If your legal template does not satisfy your requirements, find another one using the search bar positioned at the top of the page.

- If you are already subscribed to our service, Log In and download the Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC. Otherwise, follow the subsequent steps.

- Click Buy now when you identify the appropriate document. Select the subscription plan that best fits your needs to access the complete advantages of our library.

- Establish an account and pay for your subscription. You can complete the transaction using your credit card or via PayPal - our service is entirely secure for such transactions.

- Download your Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC onto your device and complete it either on a printed hard copy or electronically.

Form popularity

FAQ

To transfer property using an Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC, you will first need to prepare the deed document. It's advisable to consult with a legal professional to ensure all necessary details are included. Regarding tax implications, while there may be no immediate income tax consequences, transferring real estate can trigger property tax reassessments. You can consult resources on uslegalforms to simplify the deed preparation process and understand any potential tax implications thoroughly.

Transferring property title to a family member in Arizona can be accomplished through a quitclaim deed. This document allows the current owner to convey their interest in the property directly and efficiently. It is important to include precise legal descriptions and both parties' signatures for the deed to be valid. If you're pursuing an Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC, seeking assistance from estate planning professionals can ensure that your transfer aligns with legal guidelines.

For a quitclaim deed to be effective in Arizona, it must include essential elements like the names of those involved, the property description, and be signed before a notary. You must also ensure that the grantee is clearly identified and that the deed is filed with the county recorder for public notice. If you're exploring an Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC, understanding these requirements is crucial for a successful transfer. Leveraging tools from uslegalforms can streamline the process.

When looking to remove a spouse or set up an LLC, a quitclaim deed serves as a valuable tool. It allows for the quick transfer of property rights, making it easier to manage ownership changes. If you aim for an Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC, consider the implications on taxes and legal obligations. Reputable services like JustAnswer can provide answers tailored to your specific needs.

In Arizona, a valid quitclaim deed must include the names of the grantor and grantee, a legal description of the property, and the signatures of the parties involved. The deed should also be notarized to ensure its legality. If you are considering executing an Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC, understanding the exact requirements can facilitate a smoother transaction. Utilize platforms like uslegalforms for additional guidance and templates.

In California, once a spouse signs a quitclaim deed, they generally forfeit their rights to the property listed on that deed. This means they can no longer make claims on the property after it has been transferred. However, it is important to consider the specific terms outlined in the deed and any marital agreements in place. When dealing with an Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC, consulting a legal professional can help clarify any potential consequences.

A quitclaim deed is most beneficial for the individual who receives the property, such as an LLC, as it allows for a smooth transfer of ownership without warranty of title. This type of deed is often used in situations involving divorce or transferring property between family members. For those executing a quitclaim deed, understanding the implications of an Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC can provide clarity and peace of mind. Always consider your legal options for a smooth transition.

In Texas, if a spouse signs a quitclaim deed, they effectively relinquish any claim to the property. However, the specific rights can depend on the circumstances of the property ownership and any agreements made between the spouses. It is crucial to understand that signing a quitclaim deed can impact future claims, especially concerning the Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC. Consulting with a legal expert is advisable.

To transfer your property to an LLC in Arizona, you can utilize a quitclaim deed. This deed allows you to transfer your interest in the property directly to the LLC. It is essential to complete the Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC accurately and file it with the county recorder’s office to ensure the transfer is legally recognized.

Changing the ownership of an LLC in Arizona typically involves updating the Articles of Organization and possibly creating an Operating Agreement that reflects the new ownership structure. If property is involved, using the Arizona Quitclaim Deed from Husband, Wife and an Individual to a LLC can facilitate the transfer of property into the LLC's name.