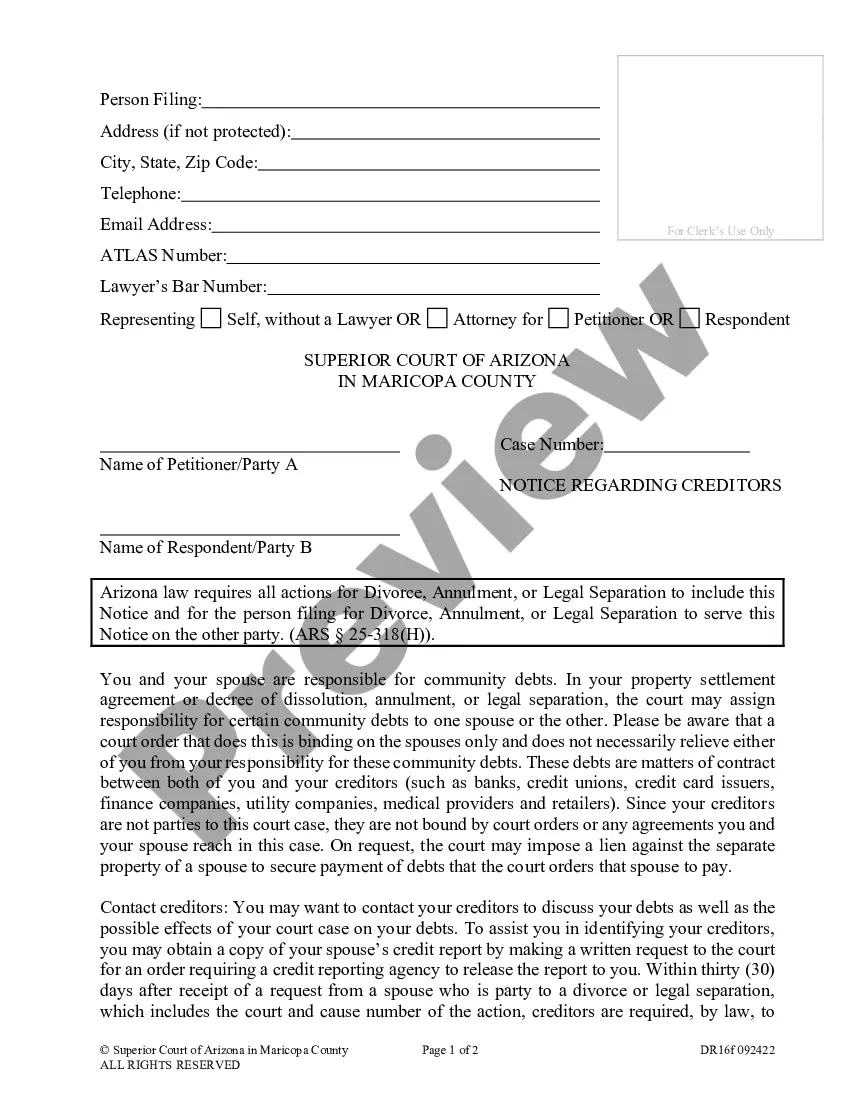

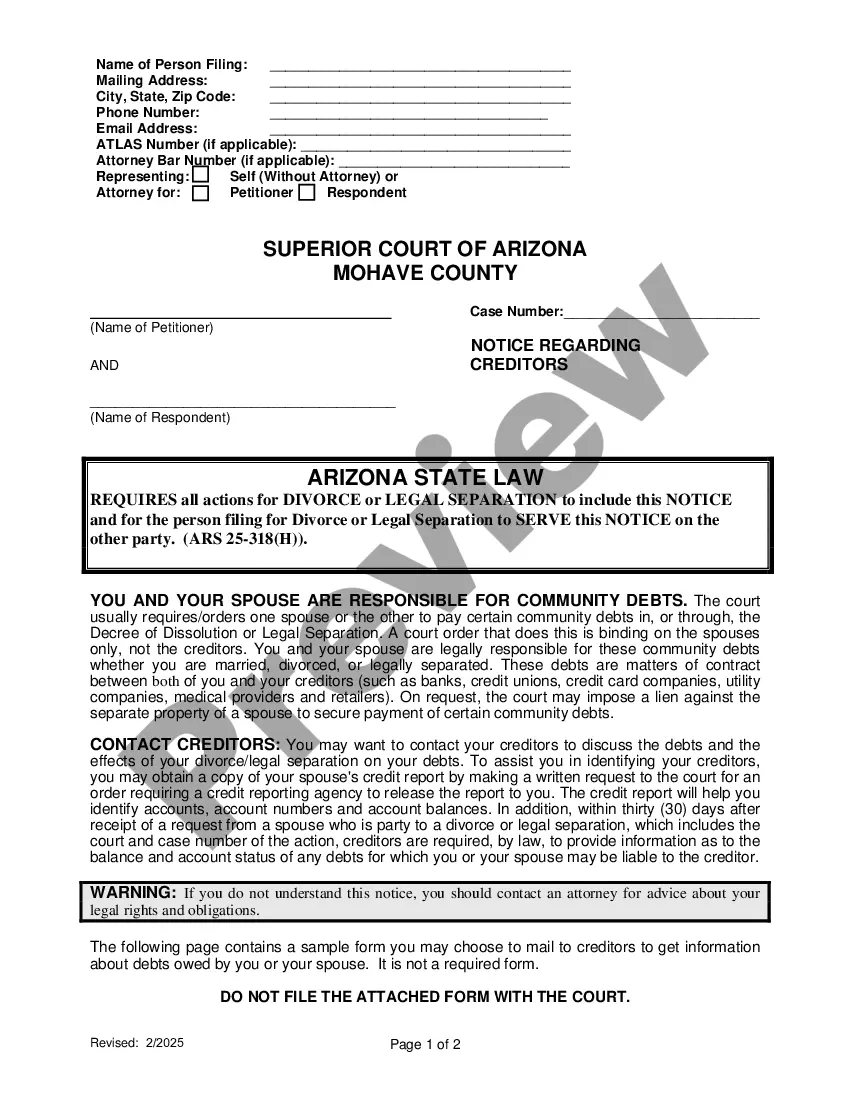

Notice Regarding Creditors: You are required by law to file this form and serve it on your spouse. It contains information about you and your spouses joint debts.

Arizona Notice Regarding Creditors

Description

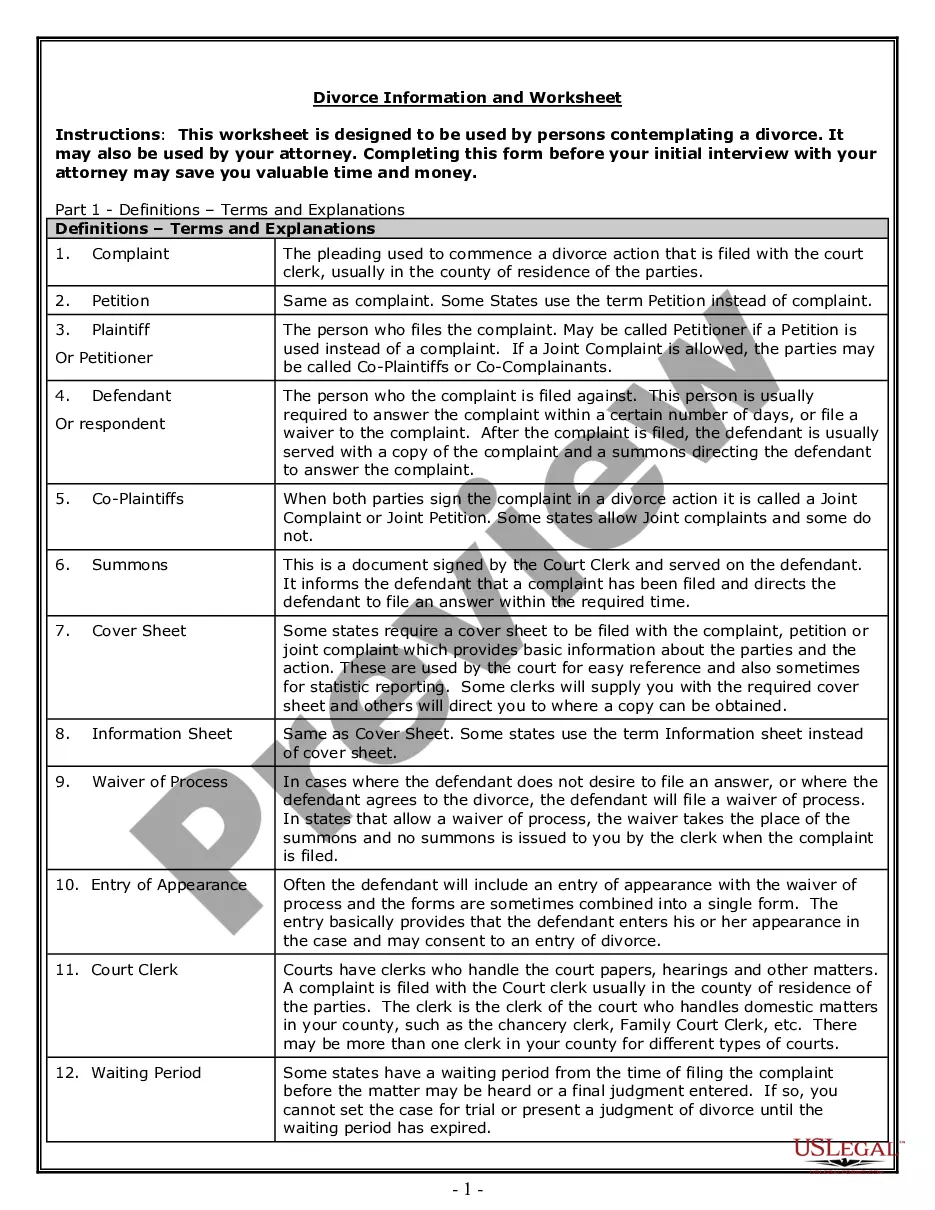

How to fill out Arizona Notice Regarding Creditors?

If you're looking for accurate Arizona Notice Regarding Creditors templates, US Legal Forms is precisely what you require; obtain documents crafted and reviewed by state-certified attorneys.

Using US Legal Forms not only alleviates concerns about legal paperwork; you also conserve time, effort, and funds! Downloading, printing, and completing a professional document is much more economical than hiring a lawyer to do it for you.

And that's all there is to it. In just a few simple steps, you have an editable Arizona Notice Regarding Creditors. Once you establish your account, all subsequent purchases will be processed even more smoothly. If you have a US Legal Forms subscription, just Log In to your profile and click the Download button you see on the form's page. Then, when you need to use this template again, you'll always be able to locate it in the My documents section. Don't waste your time and energy searching through countless forms across various platforms. Obtain accurate copies from one reliable service!

- Start by completing your registration process with your email and creating a password.

- Follow the instructions below to set up an account and acquire the Arizona Notice Regarding Creditors sample to fulfill your requirements.

- Utilize the Preview feature or examine the document details (if available) to ensure that the template suits your needs.

- Verify its legitimacy in your state.

- Click Buy Now to finalize your order.

- Select a preferred pricing option.

- Establish an account and pay with your credit card or PayPal.

Form popularity

FAQ

In Arizona, debt collectors can attempt to collect debts for up to six years, depending on the type of debt. After this period, they lose the legal right to sue you. Understanding the Arizona Notice Regarding Creditors can provide valuable insights into your situation. For assistance in managing debts and understanding your rights, US Legal Forms offers essential resources.

Yes, a collection agency can sue you in Arizona to recover unpaid debts. However, they must follow the laws and procedures in place for debt collection. Familiarizing yourself with the Arizona Notice Regarding Creditors can help you understand the process and your rights. If you are facing such legal action, seeking guidance from US Legal Forms may help you respond effectively.

Arizona follows specific collection rules to protect consumers from unfair practices. Creditors must provide proper notice to debtors before taking collections action. The Arizona Notice Regarding Creditors is a key element in understanding your rights and responsibilities. To navigate these rules effectively, you may benefit from resources offered by US Legal Forms.

In Arizona, a creditor can garnish up to 25% of your disposable earnings. This garnishment applies to wages that exceed a certain amount per week. It is crucial to understand the Arizona Notice Regarding Creditors as it outlines your rights and protections during the garnishment process. If you find yourself facing wage garnishment, consider exploring options and resources available through US Legal Forms.

In Arizona, the timeline to settle an estate can vary but generally should be completed within one year from the date of the decedent's death. Various factors can influence this timeframe, including the complexity of the estate and any outstanding claims. Timely administration ensures compliance with Arizona laws regarding the notice regarding creditors.

A notice to creditors is a formal declaration that informs potential claimants about the death of an individual and their opportunity to submit claims against the deceased's estate. In Arizona, this notice typically must be published in a local newspaper. This process seeks to streamline debt resolution and guard the interests of the estate's beneficiaries.

Creditors in Arizona must file their claims against an estate generally within four months following the notice to creditors. This timeframe allows for proper estate administration, and failing to adhere to it can result in claims being barred. Therefore, it's essential for estate executors to ensure that all necessary notices are sent timely.

In Arizona, creditors can pursue actions that may lead to a lien on your house, but they generally cannot take your house without going through legal processes. This usually involves a court judgment and a foreclosure process. Understanding how these laws apply to your situation can help you protect your assets effectively.

Yes, in Arizona, a lien can be placed on a home for a spouse's debt, especially if both spouses are co-owners of the property. Creditors may pursue claims against marital assets to recover unpaid debts. If you have concerns about this, it may be wise to seek guidance from a knowledgeable legal professional.

In Arizona, the statute of limitations for contesting a will is generally one year from the date the will is admitted to probate. This time frame emphasizes the importance of prompt action for anyone considering a legal challenge. Since delays can complicate matters, it's crucial to seek advice as soon as possible.