Filling out official documents can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online repository of formal documents, you can trust the blanks available, as they all adhere to federal and state regulations and are verified by our experts.

Acquiring your Arizona Part 1A from our collection is as simple as 1-2-3. Existing users with an active subscription just need to sign in and click the Download button after finding the right template. Subsequently, if necessary, users can retrieve the same document from the My documents section of their account. However, even if you are new to our service, registering with a valid subscription will only require a few moments. Here’s a quick guide for you.

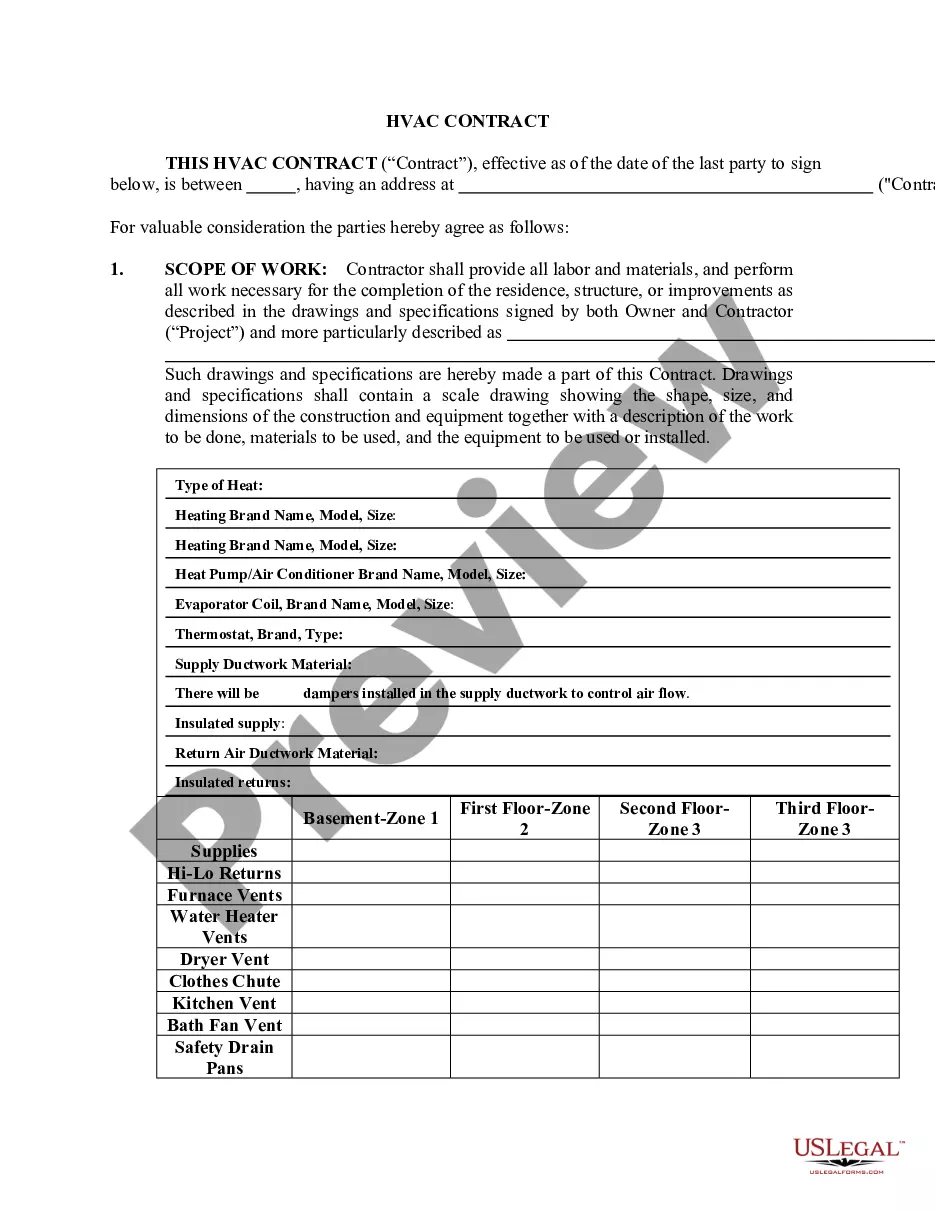

Template retrieval and further utilization. Choose the file format for your Arizona Part 1A and click Download to store it on your device. Print it to complete your documents by hand, or utilize a feature-rich online editor to prepare an electronic version more swiftly and effectively. Have you not yet tried US Legal Forms? Register for our service now to quickly and effortlessly acquire any official document whenever necessary, and keep your paperwork organized!

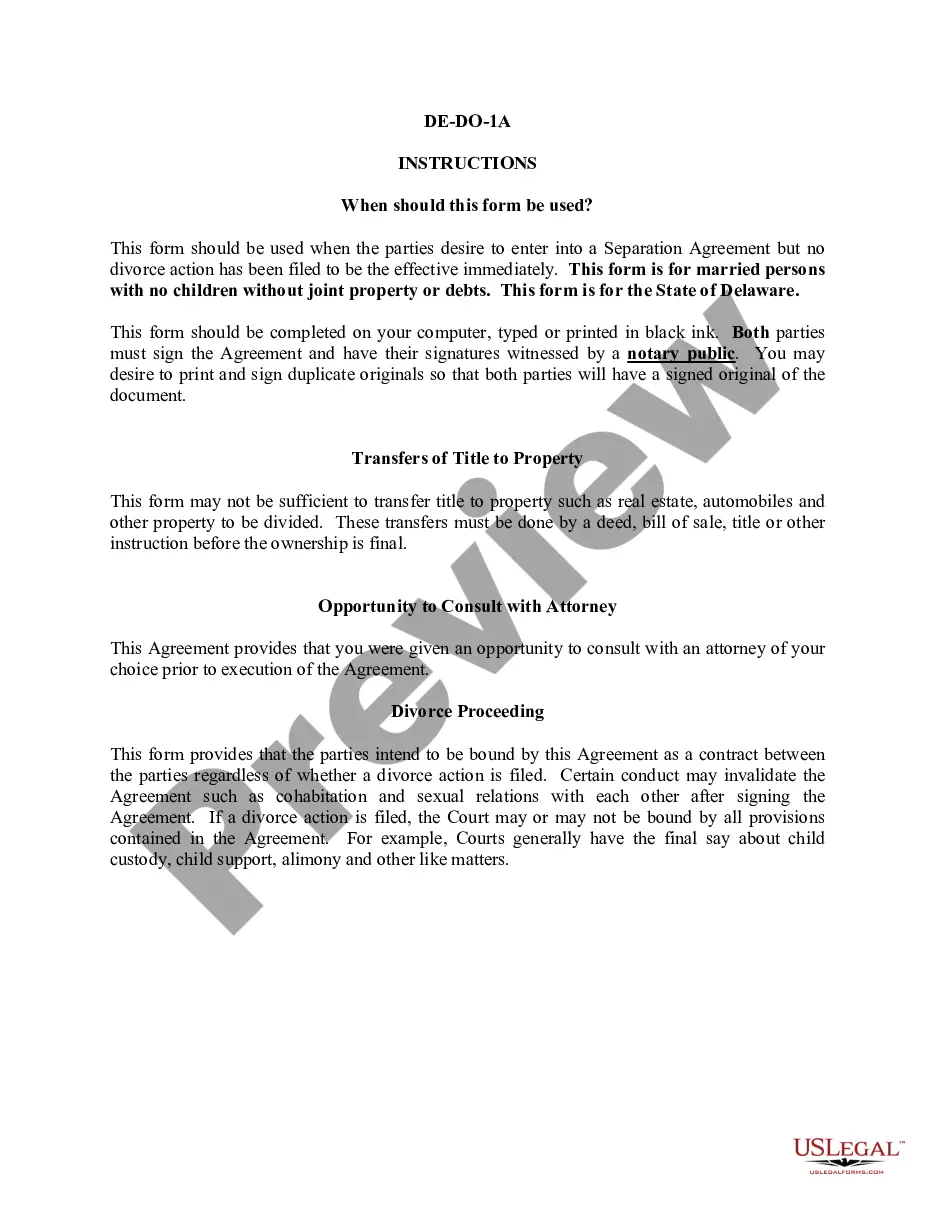

- Document validity review. You should thoroughly assess the form's content that you wish to use and ensure that it meets your requirements and conforms to your state law regulations. Reviewing your document and examining its overview will assist you in doing so.

- Alternative search (optional). If you find any discrepancies, navigate through the library using the Search tab at the top of the page until you discover a suitable template, and click Buy Now upon finding the one you need.

- Account registration and document purchase. Create an account with US Legal Forms. Post account confirmation, Log In/">Log In and choose your preferred subscription option. Make a payment to continue (PayPal and credit card methods are offered).

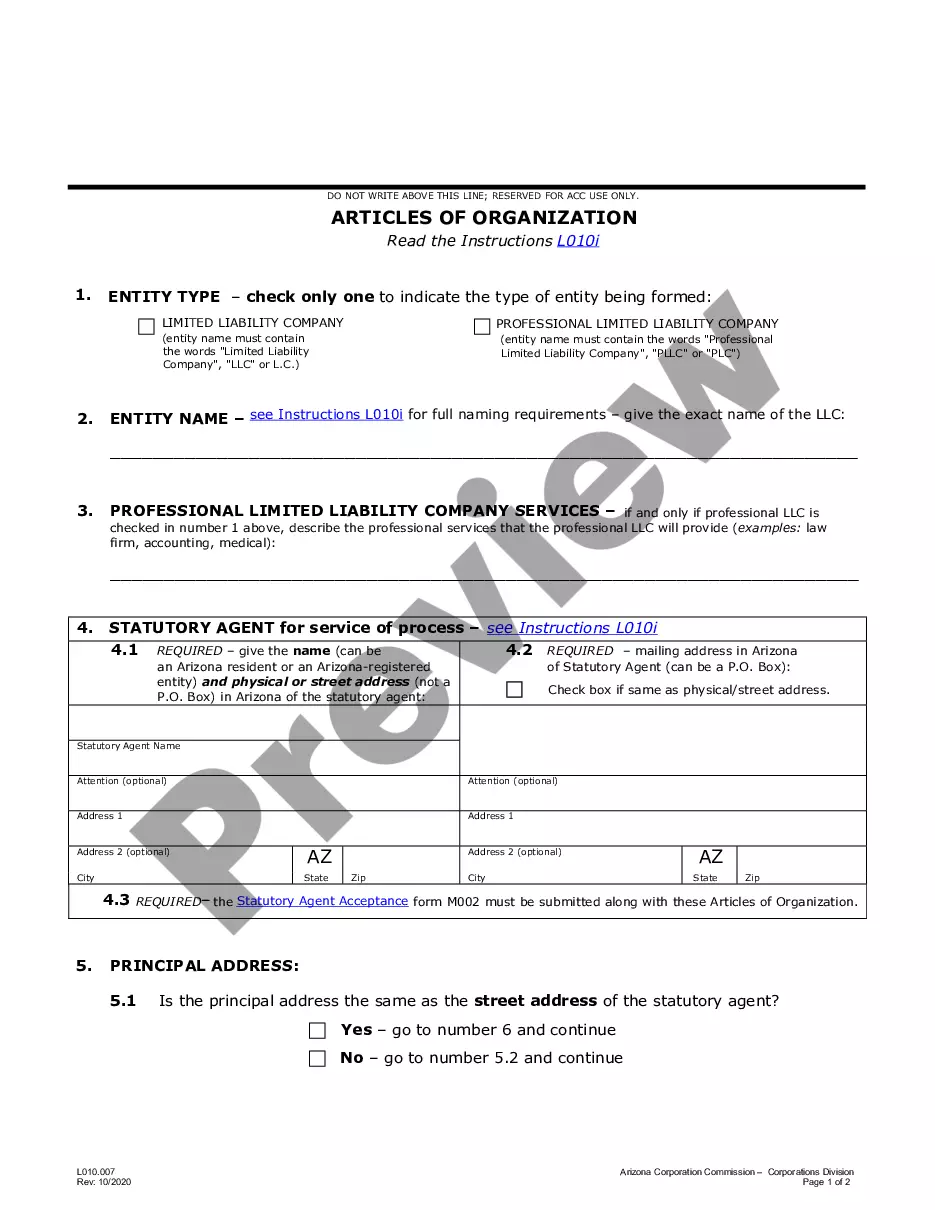

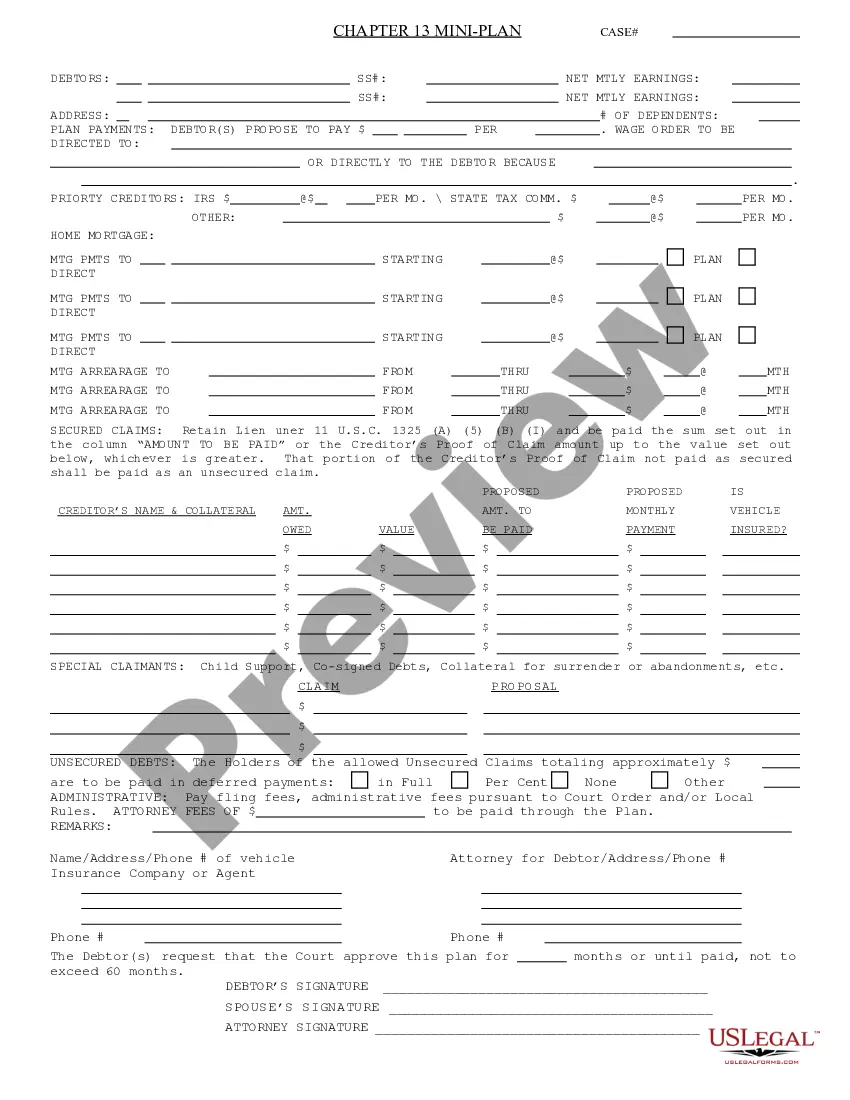

These instructions explain how to complete certain items in Part 1A of Form ADV. 1. Item 1: Identifying Information.Exempt reporting advisers that are registering with any state securities authority must complete all of Form ADV. The form enables the SEC to register investment advisers and to obtain information from and about exempt reporting advisers. You will need Form 1095-A from the Marketplace. 2. Part IV, the organization determines which schedules are required. Your employees must complete and sign Section 1 of Form I9 no later than their first day of employment. You must complete the first 2 pages of the form (Parts A and B). • You will need to provide your employer's Federal Employer Identification Number on Part B. After the interview process,. Part 1 provides details that will help the lead agency understand the location, size, type, and characteristics of the proposed project.