Arizona Form ADV-E, also known as ADV-E Guidance, is a form used by Arizona-based investment advisers who are registered with the Securities and Exchange Commission (SEC). The form is used to provide guidance to Arizona-based investment advisers on filing their Form ADV Part 2A and 2B. This document outlines the requirements for reporting information about the advisory business, the advisory services provided, and the fees charged by the investment adviser. It also provides guidance on the necessary disclosures and other information that must be included in the Form ADV Part 2A and 2B. There are two types of Arizona Form ADV-E: the General Instructions and the Individual Instructions. The General Instructions provide general information on the filing process and the requirements for disclosure of the various items included in the Form ADV Part 2A and 2B. The Individual Instructions provide specific guidance on disclosure items, such as the specific types of assets under management and the types of services offered.

Arizona Form ADV-E(ADV-E Guidance)

Description

How to fill out Arizona Form ADV-E(ADV-E Guidance)?

Completing official documentation can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the fields you encounter, as all of them align with federal and state regulations and are reviewed by our experts.

Acquiring your Arizona Form ADV-E(ADV-E Guidance) from our collection is as easy as 1-2-3. Previously registered users with an active subscription merely need to Log In and hit the Download button after finding the appropriate template.

Alternative search (optional). If you notice any discrepancies, search the library using the Search tab above until you find the suitable blank, and click Buy Now once you identify the one you seek.

- Afterwards, if necessary, users can access the same document from the My documents section of their account.

- However, even if you are a newcomer to our service, registering with a valid subscription will only take a few moments.

- Here’s a quick guide for you.

- Document compliance verification. You should carefully examine the content of the form you desire and ensure it meets your needs and complies with your state's legal requirements.

Form popularity

FAQ

Yes, Arizona Form ADV and its components are publicly accessible, allowing potential clients to review an advisor's qualifications and business practices. Regulatory bodies maintain these records as part of their commitment to transparency and consumer protection. By reviewing these forms, clients can make educated choices regarding their financial advisors, ensuring their investments are in capable hands.

Investment advisors must provide clients with Arizona Form ADV Part 3, also known as the Client Relationship Summary, annually or whenever a material change occurs in the firm's operations. This ensures that clients are kept informed about the advisor's services and any updates that may affect their investment decisions. Keeping clients informed fosters trust and enhances transparency in the advisor-client relationship.

Arizona Form ADV-E is available through multiple channels, including the Securities and Exchange Commission (SEC) website and various financial regulatory authorities. For convenience, you could use uslegalforms, which provides downloadable forms along with valuable instructions. This ensures you can easily access and complete the necessary documentation.

You can obtain Arizona Form ADV-E through the SEC's Investment Adviser Registration Depository (IARD) or from authorized state regulatory agencies. Additionally, platforms like uslegalforms offer easy access to these forms, along with guidance on how to complete them. This ensures that you have the necessary resources whether you are filing for the first time or updating existing information.

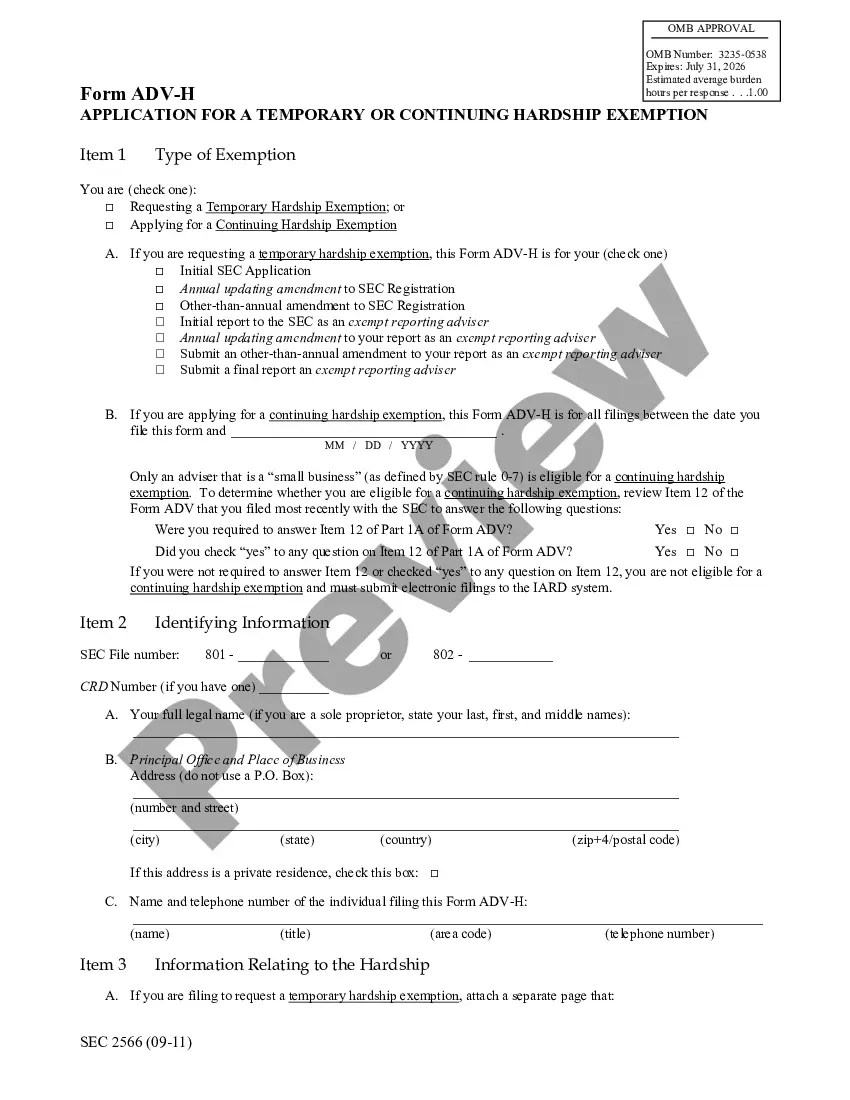

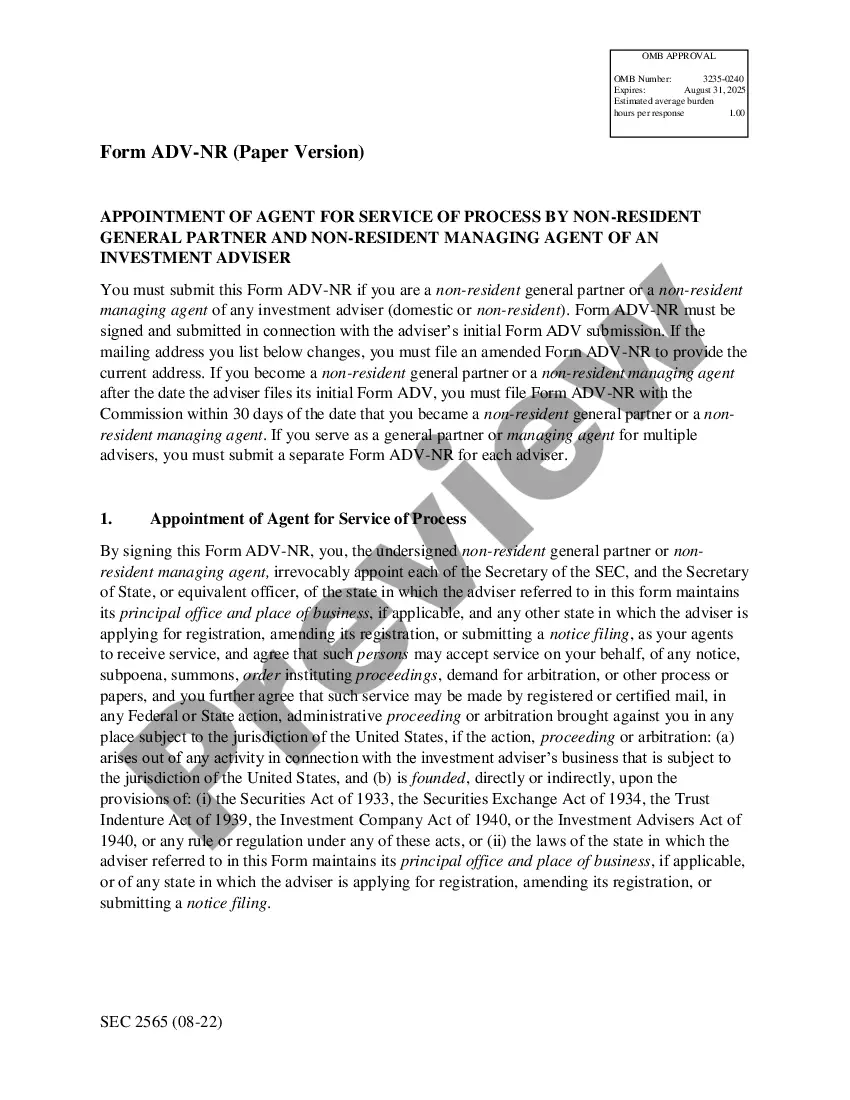

ADV documents consist of Form ADV Part 1, Part 2, and Form ADV-E, which investment advisors must file to register with the SEC or state authorities. These documents provide valuable insights into an advisor's business practices, fees, and potential conflicts of interest. Understanding these forms is crucial for making informed decisions about investment services, making Arizona Form ADV-E an important component of this documentation.

Arizona Form ADV-E is designed for investment advisors who are submitting a final report upon their withdrawal from SEC registration. It provides essential information about the advisor's operations and ensures compliance with federal regulations. By completing this form, advisors fulfill their obligation to report their status accurately, allowing for transparency within the financial industry.

The Arizona Form ADV-E must be filed through the IARD system, which is managed by the Financial Industry Regulatory Authority (FINRA). It is critical to submit your form electronically to ensure proper processing and compliance with state regulations. Filing through the IARD allows for centralized tracking and updates of your submission. For assistance, uslegalforms offers resources to help you navigate the filing process effectively.

The Arizona Form ADV-E features a structured layout that includes several key sections detailing your advisory firm's business and regulatory information. It typically contains both narrative and checklist formats to present your information clearly. Each section is designed to help prospective clients understand your services better. Reviewing a sample of the Arizona Form ADV-E (ADV-E Guidance) can prepare you for filling it out.

To submit the Arizona Form ADV-E, you must file it electronically through the Investment Adviser Registration Depository (IARD) system. This process is straightforward and facilitates an efficient submission for your advisory firm. Make sure to prepare all necessary information before starting the submission to avoid delays. Using uslegalforms can provide templates and tools to ease your filing process.

To meet the adviser brochure requirements, you can use specific sections of the Arizona Form ADV-E. These sections typically include detailed information about your business, services, and fees. By using the appropriate parts, you ensure compliance and provide clear insights for your clients. Utilizing the Arizona Form ADV-E (ADV-E Guidance) helps streamline this process.