Arizona Form ADV-H is a form required by the Arizona Corporation Commission (ACC) for certain investment advisers to register in the state. It is part of the Uniform Application for Investment Adviser Registration, which the SEC and North American Securities Administrators Association (NASA) have adopted. There are three different types of Arizona Form ADV-H: the ADV-H1, ADV-H2, and ADV-H3. The ADV-H1 form is used by federally-registered investment advisers to register in Arizona, while the ADV-H2 and ADV-H3 forms are used by state-registered investment advisers to register in Arizona. The form requires the investment adviser to provide information about their business, including their business name, address, contact information, and the type of services they offer. Additionally, the form requires information about the firm’s owners, officers, and employees, as well as its financial history and other related information.

Arizona Form ADV-H

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Form ADV-H?

US Legal Forms is the easiest and most affordable method to find appropriate formal templates.

It’s the largest online collection of business and personal legal documents prepared and validated by attorneys.

Here, you can discover printable and fillable forms that adhere to federal and local guidelines - just like your Arizona Form ADV-H.

Examine the form description or preview the document to ensure you’ve located the one that meets your needs, or find another using the search feature above.

Click Buy now when you’re confident of its suitability with all the specifications, and select the subscription plan that suits you best.

- Acquiring your template requires just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the form onto their device.

- Later, they can find it in their account under the My documents section.

- And here’s how you can obtain a correctly drafted Arizona Form ADV-H if you're utilizing US Legal Forms for the first time.

Form popularity

FAQ

When completing your ADV, it is crucial to disclose essential information such as your business structure, services offered, and any conflicts of interest. Additionally, financial details and client-related practices must be included. For accurate guidance and access to the right forms for your Arizona Form ADV-H, consider using US Legal Forms, which offers a comprehensive toolkit for compliance.

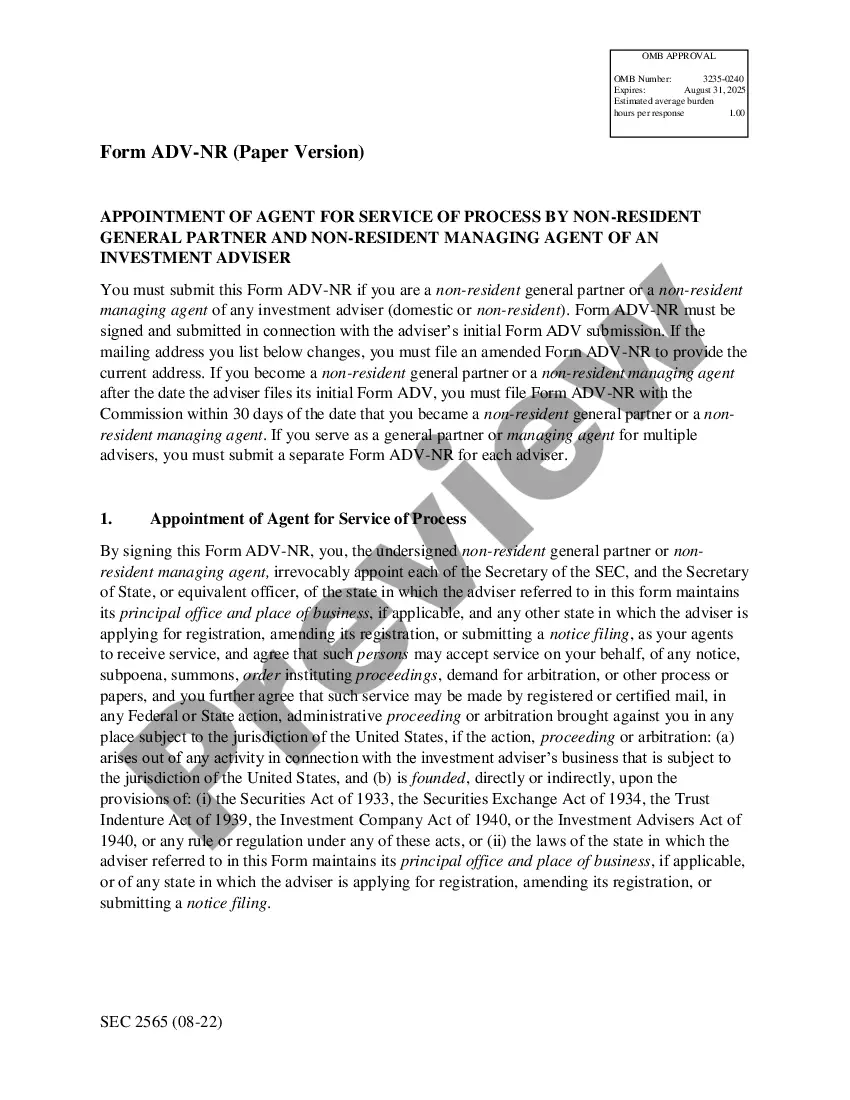

When submitting your ADV electronically, you must follow specific requirements outlined by the SEC and state regulators. This process often includes using electronic signatures, ensuring that your document meets formatting standards, and adhering to submission timelines. Relying on platforms like US Legal Forms can streamline your compliance with these electronic delivery requirements in relation to the Arizona Form ADV-H.

To submit your ADV, you need to complete the form accurately and follow the submission procedures set by the SEC or your state authority. You can submit it electronically or through a mail service, depending on the regulations in Arizona. Platforms like US Legal Forms can help you navigate these requirements by offering step-by-step guides specifically for the Arizona Form ADV-H.

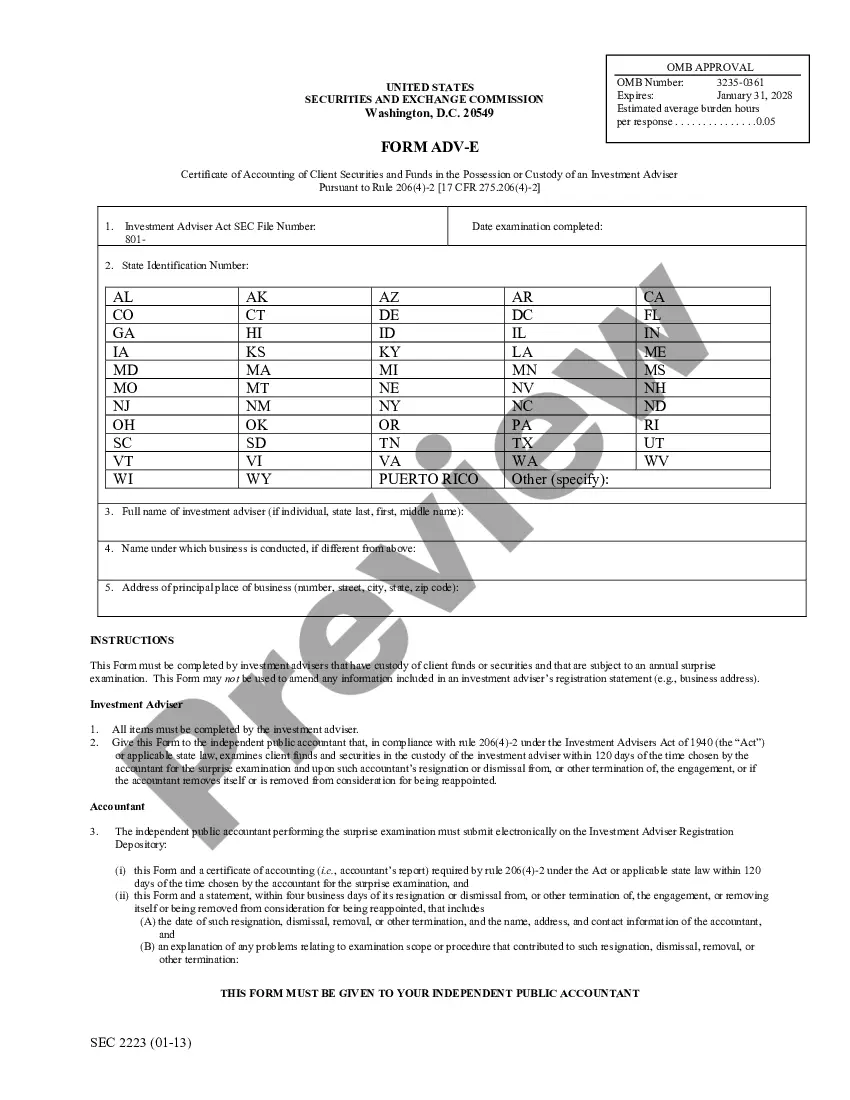

Form ADV-E is submitted by investment advisers that require a compliance review by an independent auditor. This form is an important part of the regulatory process, and it ensures transparency. If you are part of a firm that requires submission, consider using our services to access and file your Arizona Form ADV-H accurately and efficiently.

Form ADV is filed electronically with the Securities and Exchange Commission (SEC) or the appropriate state regulatory agency. In the case of Arizona, ensure you submit it to the Arizona Corporation Commission. Using the US Legal Forms platform can simplify this process, as it provides easy access to the necessary forms and filing guidelines for your Arizona Form ADV-H.

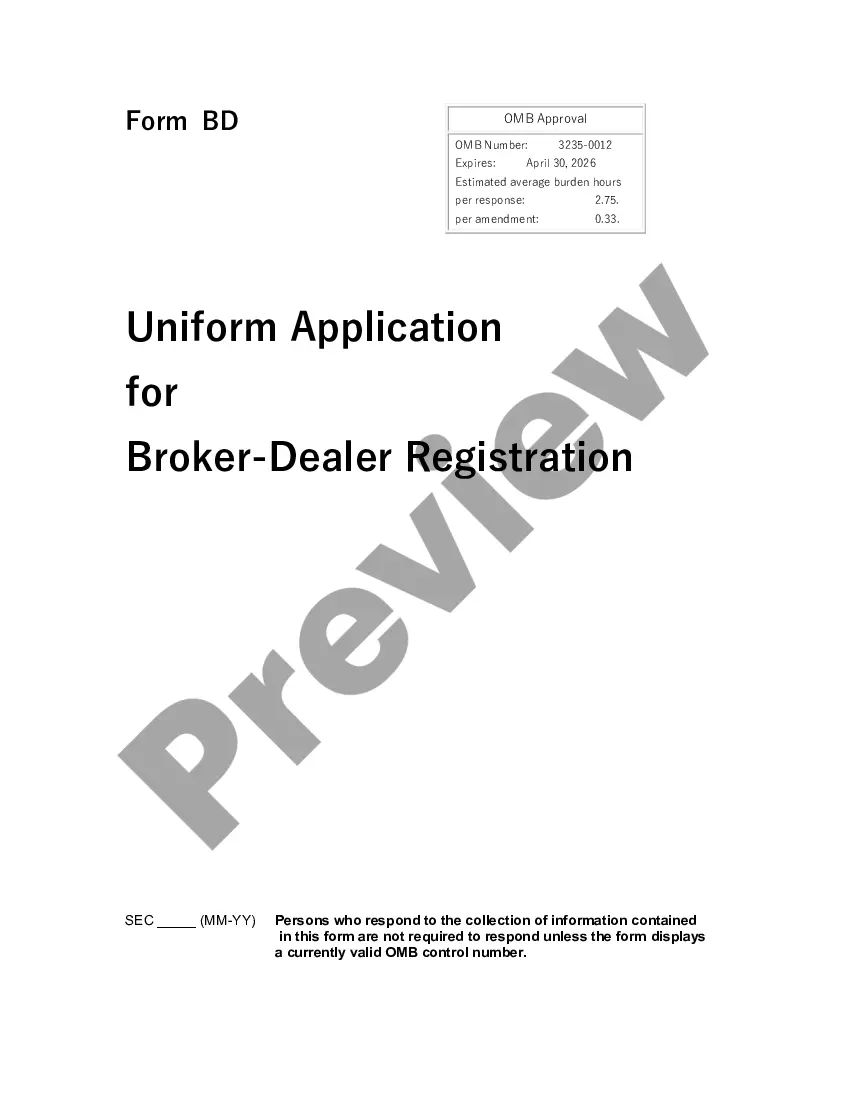

Broker-dealers do not file the Arizona Form ADV-H; instead, they file a different form called the Form BD. However, investment advisers who manage client assets must file the ADV to register and comply with regulations. Understanding the distinction between these filings is crucial for compliance in the financial sector. If you're navigating these requirements, uslegalforms offers valuable tools to help you manage your documentation effectively.

You can file the Arizona Form ADV-H through the Investment Adviser Registration Depository, commonly known as IARD. This online system makes it simple to submit your filings directly to the appropriate regulatory authorities. Doing so ensures that your information is accessible to clients and regulators alike. If you need assistance, uslegalforms can provide comprehensive resources to guide you through the filing process.

The Arizona Form ADV-H needs to be filed annually, along with any other updates that occur throughout the year. It's essential to keep your record current, as these updates may include changes to business practices or contact information. This ensures that your clients have the most accurate information about your services. Regular filing helps maintain compliance and build trust with your clients.

Form ADV is designed to be used by investment advisers to register with federal and state regulators, disclose their business information, and provide necessary client relationships. Using the Arizona Form ADV-H helps advisers fulfill these requirements clearly and accurately.

The purpose of Form ADV is to ensure transparency and accountability in the investment advisory profession. By completing the Arizona Form ADV-H, advisers can effectively communicate their business practices, which helps clients make informed decisions.