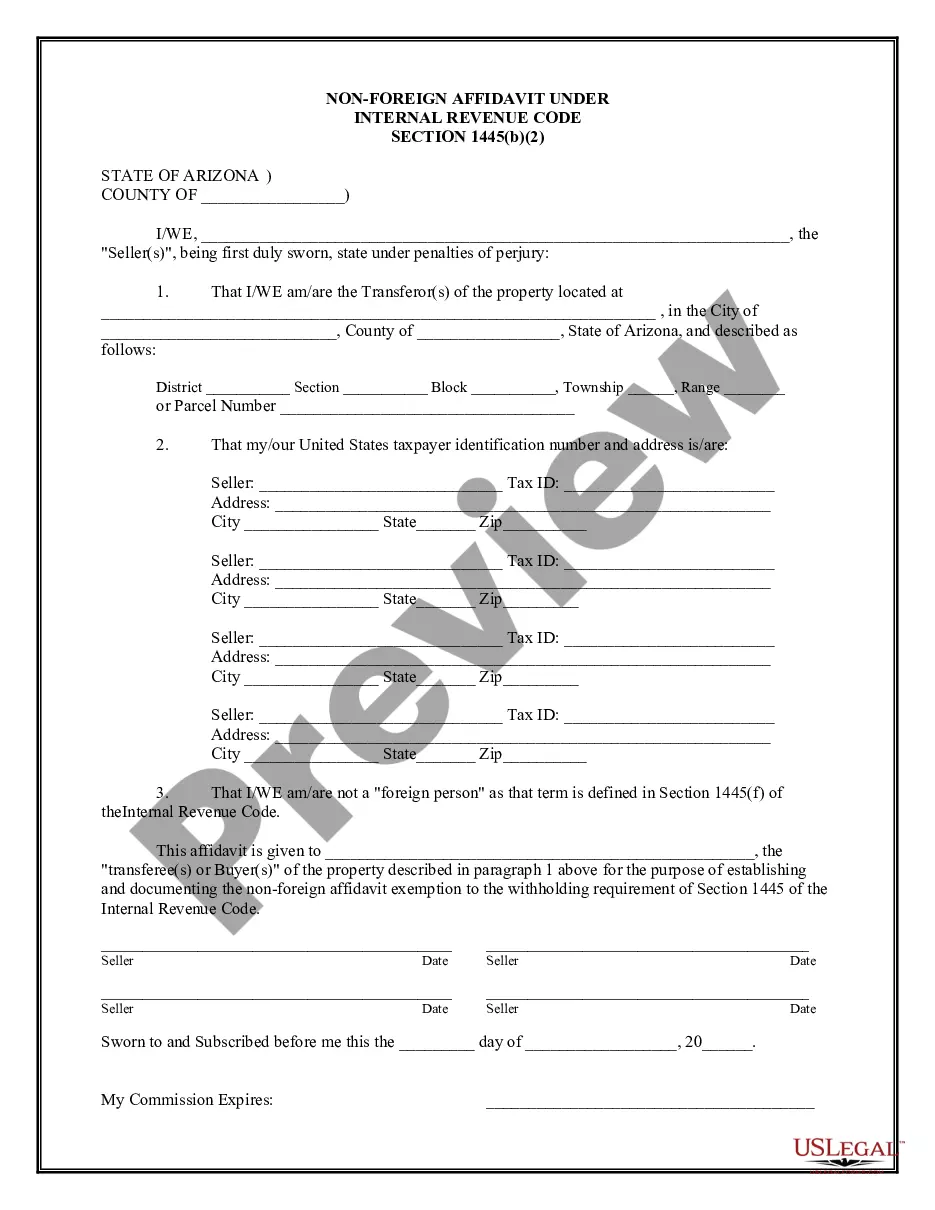

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Arizona Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Arizona Non-Foreign Affidavit Under IRC 1445?

If you are looking for precise Arizona Non-Foreign Affidavit Under IRC 1445 templates, US Legal Forms is exactly what you require; discover documents offered and verified by state-authorized legal professionals.

Utilizing US Legal Forms not only protects you from hassles associated with legal documents; it also conserves your time and effort, as well as money! Downloading, printing, and completing a professional document is definitely more economical than hiring an attorney to handle it for you.

And there you go! In just a few straightforward steps, you obtain an editable Arizona Non-Foreign Affidavit Under IRC 1445. Once you establish an account, all subsequent transactions will be processed even more seamlessly. With a US Legal Forms subscription, just Log In to your profile and click the Download button you see on the form's page. Then, when you wish to access this template again, you will always be able to locate it in the My documents section. Don’t waste your time sifting through countless forms on various websites. Obtain accurate documents from a single reliable source!

- To begin, finish your registration process by providing your email address and creating a password.

- Follow the instructions below to establish your account and locate the Arizona Non-Foreign Affidavit Under IRC 1445 template to address your concerns.

- Utilize the Preview feature or review the document details (if available) to ensure that the template meets your requirements.

- Verify its suitability in your residing state.

- Hit Buy Now to place your order.

- Choose a recommended pricing plan.

- Create your account and pay using a credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

Section 1221 of the Internal Revenue Code defines what constitutes capital assets for tax purposes. This section outlines which assets are subject to capital gains tax or ordinary income tax, impacting how profits from sales are reported. Understanding this section aids taxpayers in making informed financial decisions. For foreign sellers of real estate, the Arizona Non-Foreign Affidavit Under IRC 1445 can help navigate the complexities surrounding these assets.

The amount a transferor realizes on the transfer of U.S. real property interest can be zero in certain circumstances, such as a gift or a significant reduction in property value. In these scenarios, the seller may not receive immediate compensation for their interest. It is crucial to understand how these transactions impact tax implications. For clarity and compliance, the Arizona Non-Foreign Affidavit Under IRC 1445 plays an important role.

A seller is classified as a foreign person based on their citizenship status and residency. If they are not a U.S. citizen or do not meet specific residency requirements, they fall into this category. Recognizing a seller's classification is essential for tax withholding purposes. Utilizing the Arizona Non-Foreign Affidavit Under IRC 1445 can help clarify a seller's status and facilitate the transaction.

The Internal Revenue Code (IRC) is a comprehensive set of tax laws in the United States, established and enforced by the Internal Revenue Service (IRS). It includes various sections that cover different tax principles, including income tax, property tax, and employment tax. Section 1445 specifically addresses the withholding tax for foreign sellers of U.S. real estate. Utilizing the Arizona Non-Foreign Affidavit Under IRC 1445 can simplify compliance with these regulations.

FIRPTA withholding is required to be submitted to the IRS within 20 days of the closing together with IRS Form 8288, U.S. Withholding Tax Return for Disposition by Foreign Persons of U.S. Real Property Interests, and Form 8288-A, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The transferee is the withholding agent.If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.

The address of the property being transferred (or sold) The seller or transferor's information: Full name. Telephone number. Address. Social Security Number, Federal Employer Identification Number, or California Corporation Number.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.