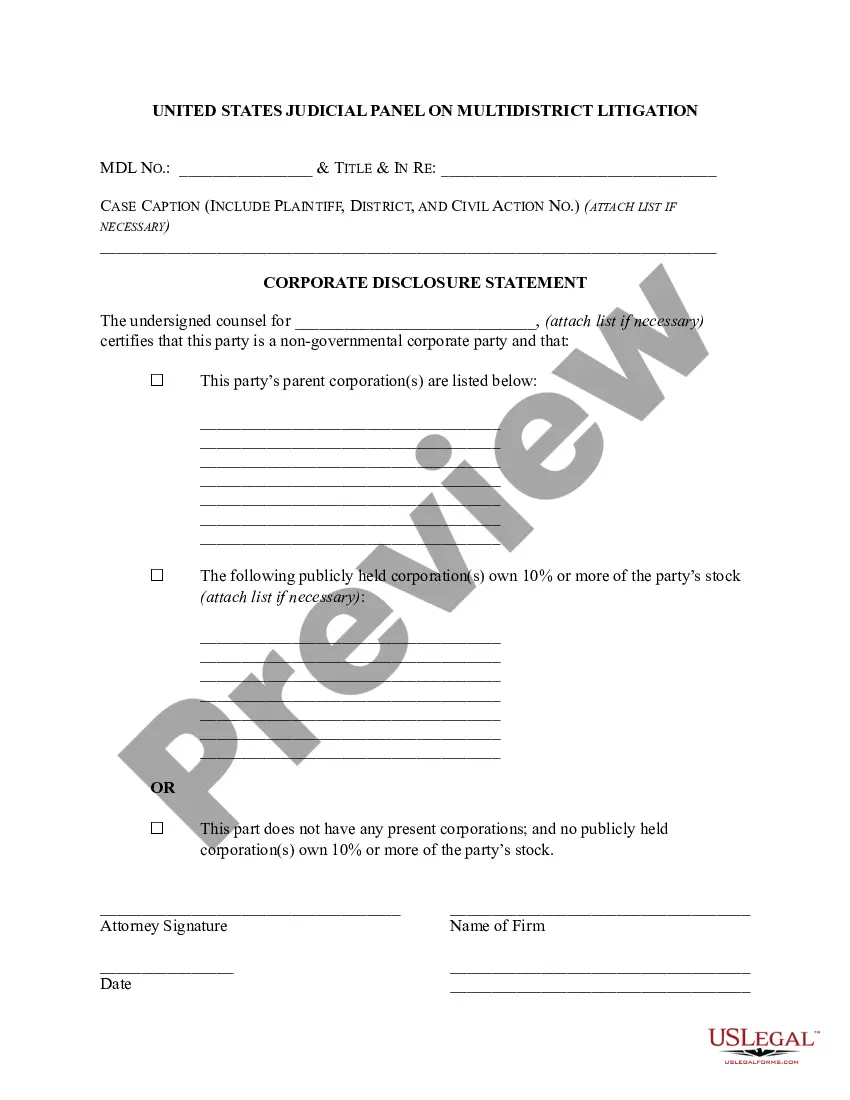

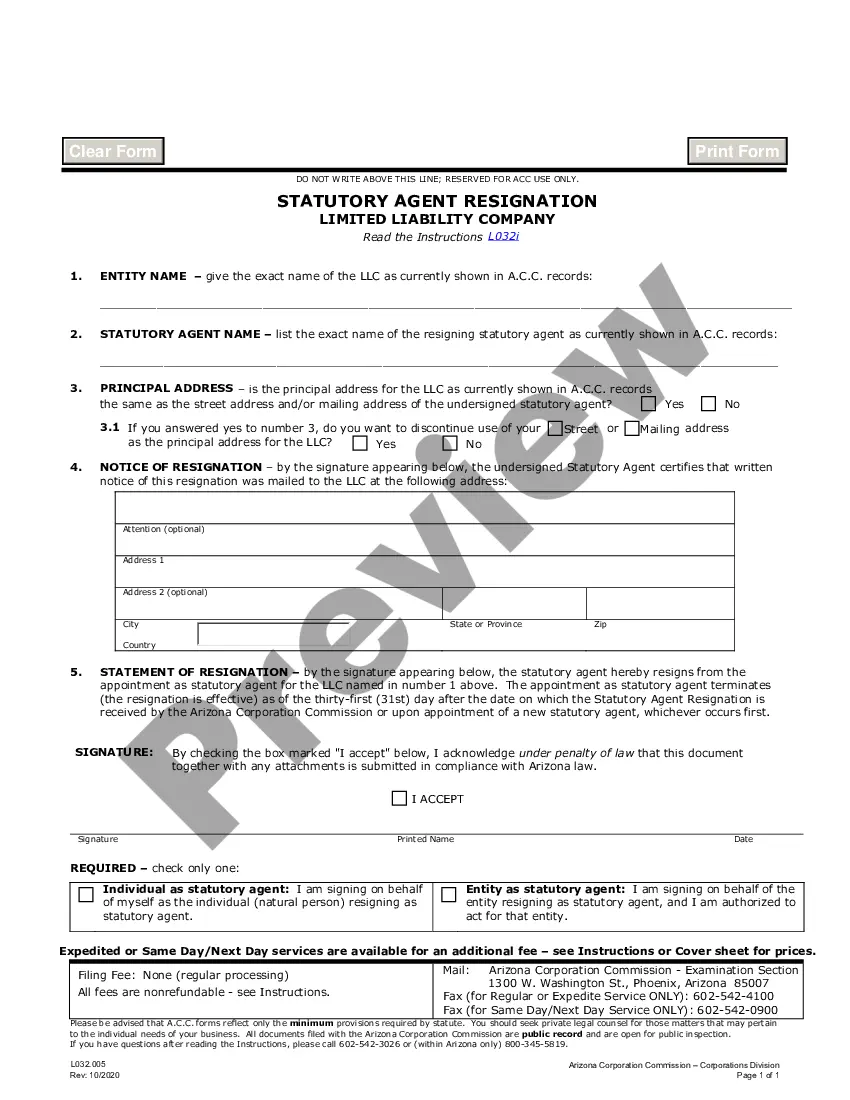

The Arizona Corporate Disclosure Statement is a document that must be filed with the Arizona Corporation Commission when registering a business as a corporation, limited liability company, limited partnership, or nonprofit corporation. This document is also required when making certain amendments to the Articles of Incorporation or when making a name change. It contains important information about the business, such as the name, address, and directors or officers of the company. The different types of Arizona Corporate Disclosure Statements include: Initial statement, Annual statement, Amended statement, and Name change statement. The Initial statement must be filed when registering a business as a corporation, limited liability company, limited partnership, or nonprofit corporation. The Annual statement must be filed annually on or before the anniversary of the initial filing. The Amended statement must be filed when making changes to the Articles of Incorporation or the name of the business. The Name change statement must be filed when changing the name of the business.

Arizona Corporate Disclosure Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Corporate Disclosure Statement?

US Legal Forms is the easiest and most affordable method to locate appropriate legal templates.

It boasts the largest online collection of business and personal legal paperwork created and verified by lawyers.

Here, you can discover printable and fillable documents that adhere to national and local regulations - just like your Arizona Corporate Disclosure Statement.

Review the form description or preview the document to confirm you've identified the one that suits your needs, or search for another using the search tab above.

Click Buy now when you are certain of its alignment with all requirements, and select the subscription plan that suits you best.

- Acquiring your template involves just a few uncomplicated steps.

- Users with an existing account and an active subscription only need to sign in to the online platform and download the document to their device.

- Afterward, they can find it in their profile under the My documents section.

- If you are utilizing US Legal Forms for the first time, here’s how to obtain a professionally prepared Arizona Corporate Disclosure Statement.

Form popularity

FAQ

To create a disclosure statement, start by gathering your business's relevant information, including its structure and operations. Organize this data logically and draft a draft, focusing on clarity and accuracy. Utilizing resources from US Legal Forms can simplify this process, providing valuable templates and guidance for your Arizona Corporate Disclosure Statement.

An example of a disclosure statement would include sections detailing the corporation's name, purpose, and ownership structure, along with financial summaries. If you are drafting your own Arizona Corporate Disclosure Statement, referring to examples can be insightful. These templates help you understand what information is vital and how to organize it effectively.

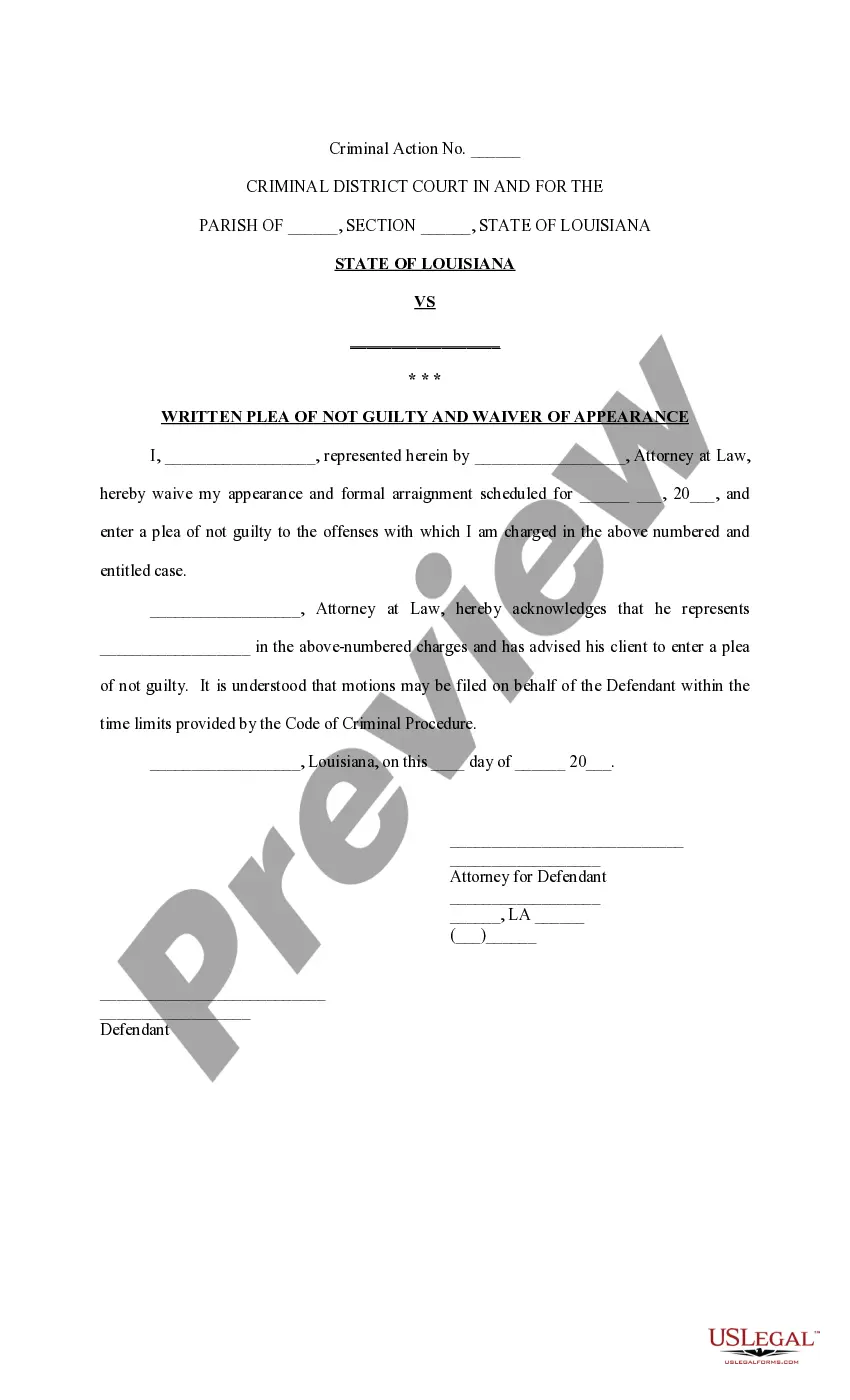

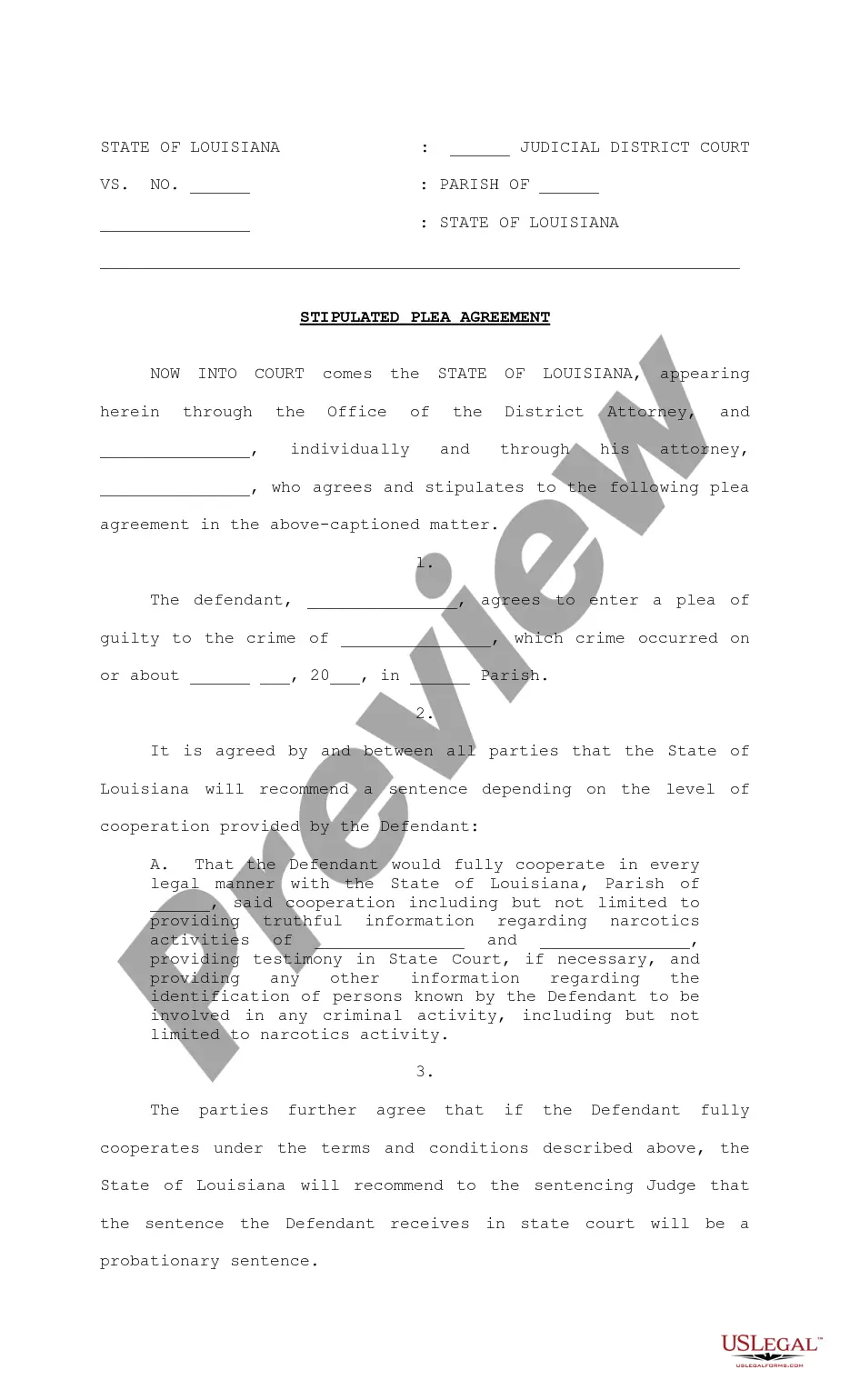

The Rule 26.1 disclosure statement in Arizona requires parties in legal proceedings to disclose certain information to promote transparency. This includes details about witnesses, expert testimonies, and relevant documents. Understanding this rule helps ensure compliance during legal processes, strengthening your Arizona Corporate Disclosure Statement.

Writing a disclosure statement involves laying out your basic information clearly and concisely. Begin with an introduction of your corporate entity, followed by a summary of its operations and financials. Ensure that your Arizona Corporate Disclosure Statement is formatted properly, and revise it for clarity before finalizing.

An effective Arizona Corporate Disclosure Statement should include the business name, address, and contact information. It should also detail the ownership structure, any financial data, and any conflicts of interest. Including this information provides transparency and assures stakeholders of your business integrity.

To write a professional Arizona Corporate Disclosure Statement, start by clearly stating your identity and purpose. Include essential details such as the nature of your business, its structure, and financial information. Ensure clarity and accuracy, as this builds trust and credibility. Additionally, consider using templates available on platforms like US Legal Forms.

Yes, Arizona LLCs must file an annual report, but the state does not require a formal annual report like other states. Instead, you need to submit your updated information during the biennial filing cycle. This ensures that your Arizona Corporate Disclosure Statement stays current and reflects any changes in your LLC's structure or management. Utilizing platforms like uslegalforms can help simplify the filing process.

To file an S Corp in Arizona, you first need to establish your corporation by filing Articles of Incorporation with the Arizona Corporation Commission. After receiving your approval, submit Form 2553 to the IRS to elect S Corporation status. This election allows your corporation to enjoy tax benefits, provided you meet specific criteria. Remember, understanding the Arizona Corporate Disclosure Statement is crucial for ongoing compliance.

To file an Arizona Corporation annual report, you must submit the report to the Arizona Corporation Commission. Ensure you provide accurate details about your corporation, including your registered agent and business status. You can file online through the Commission's website for convenience. This process is essential to maintain your compliance and keep your Arizona Corporate Disclosure Statement up to date.

The corporate disclosure statement is governed by federal rules under the Securities Exchange Act. This rule demands transparency from public companies, requiring them to disclose certain financial and operational details to investors. Understanding this rule can enhance your knowledge of what needs to be included in the Arizona Corporate Disclosure Statement.