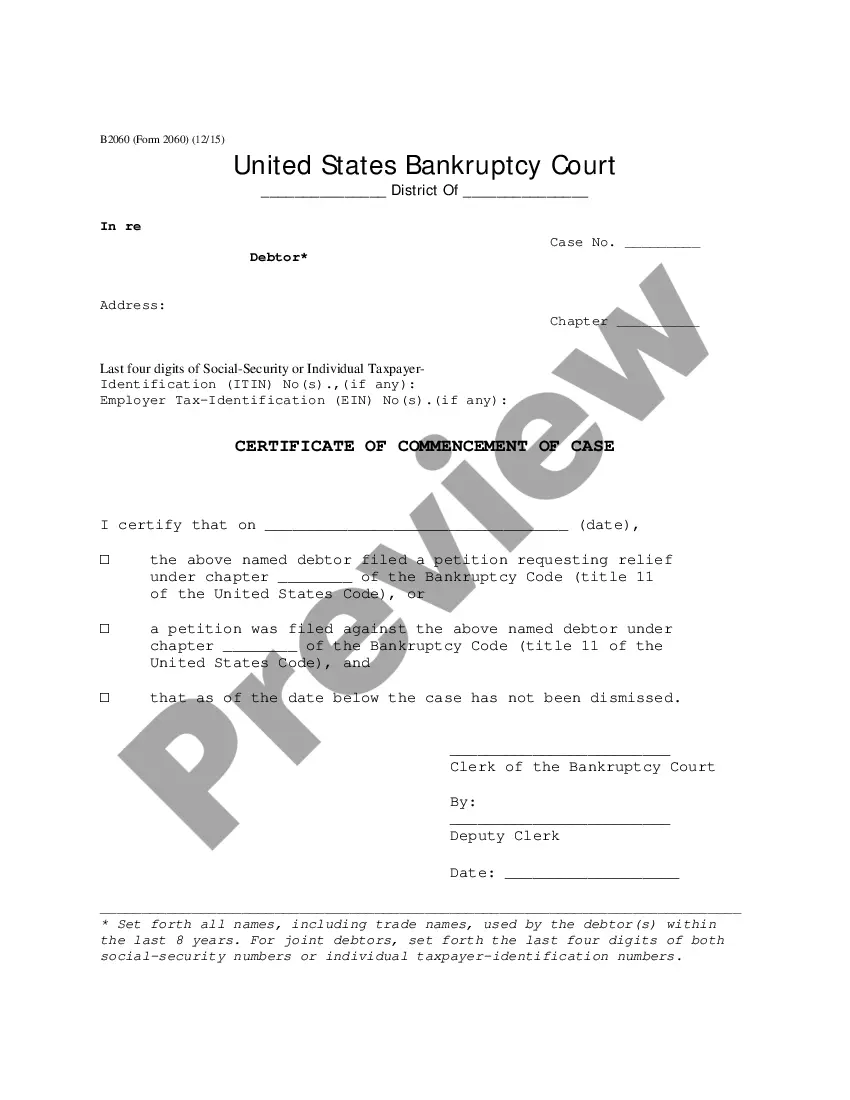

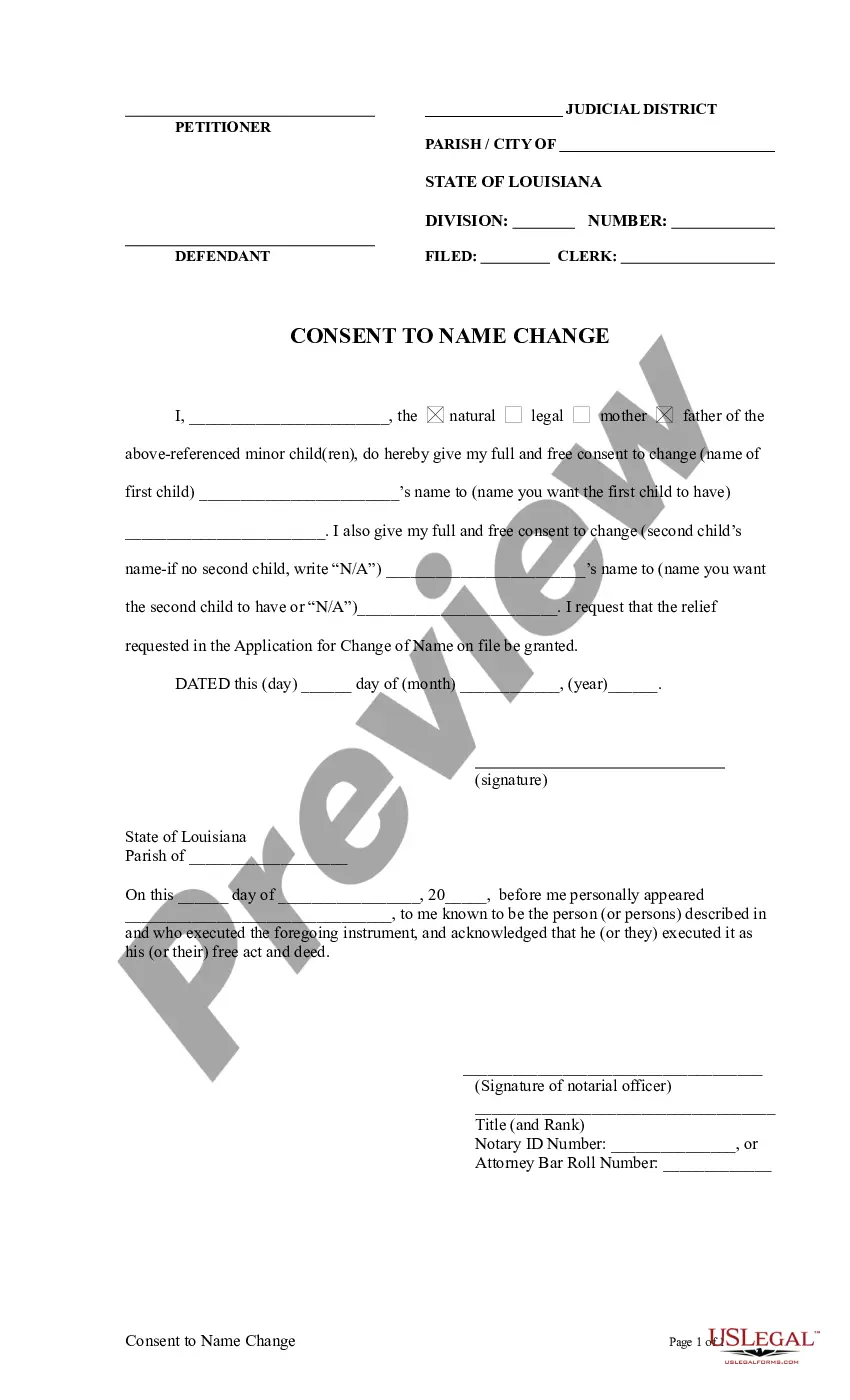

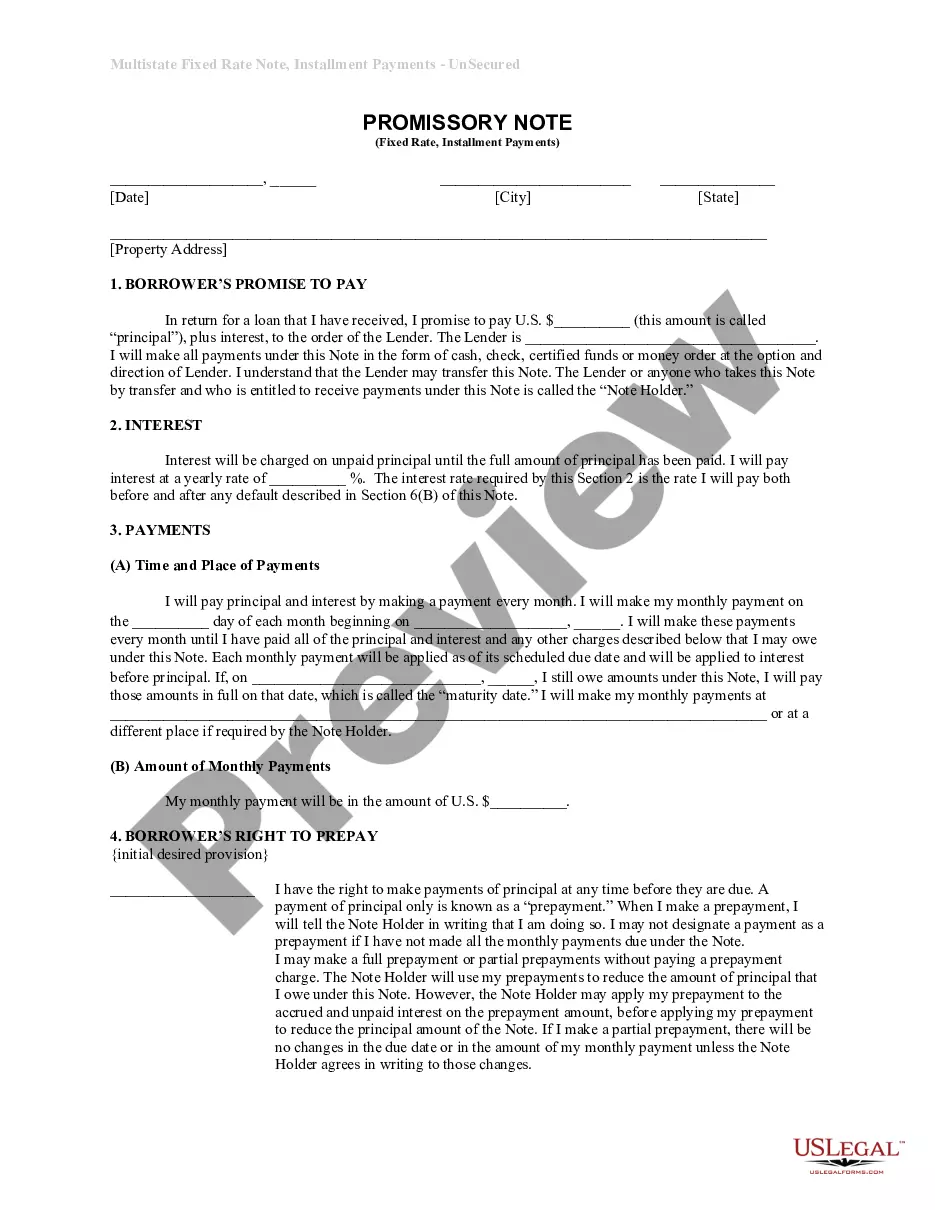

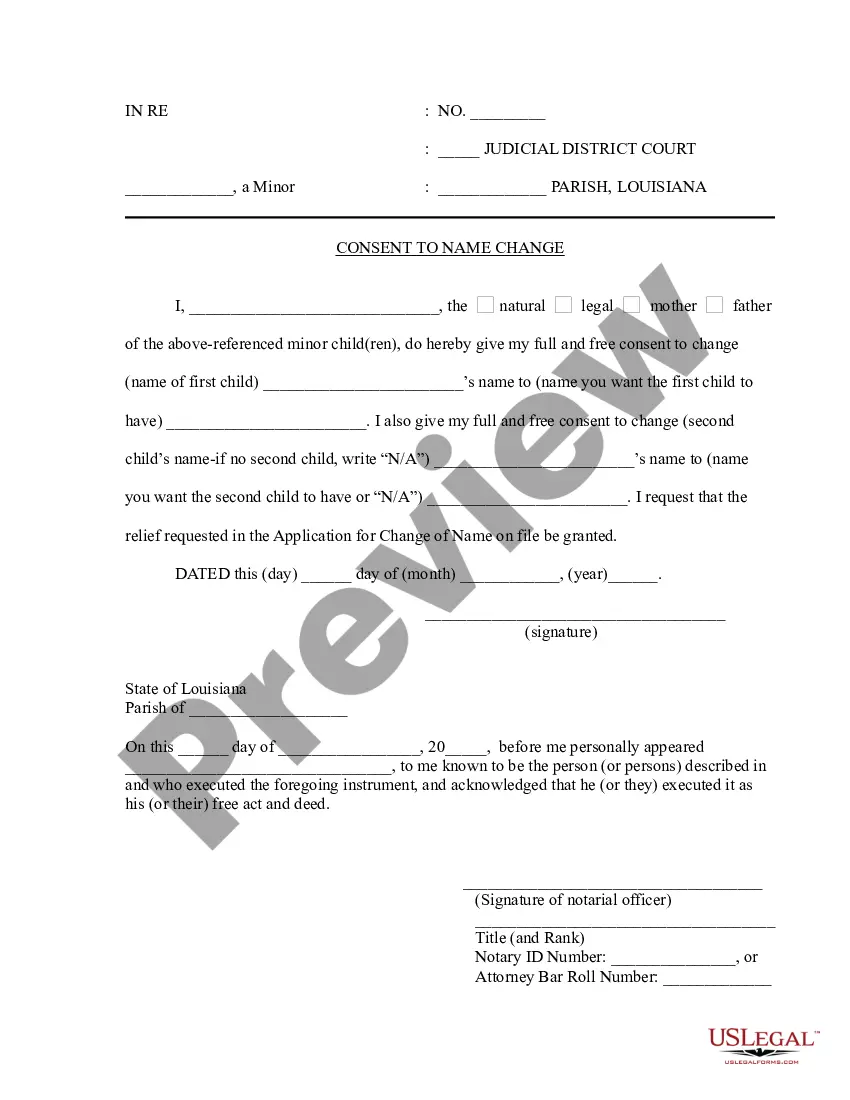

An Arizona Certificate of Compliance With Rule 8015(a)(7)(B) or 8016(d)(2) is a form issued by the Arizona Department of Revenue to taxpayers that verifies that the taxpayer has complied with the requirements of Arizona Revised Statutes (AS) 8015(a)(7)(B) or 8016(d)(2). AS 8015(a)(7)(B) requires taxpayers to submit to the Department a detailed written explanation of their business activities, including the type of business activities, the sources of income, the amount of income, and the expenses associated with the business. AS 8016(d)(2) requires taxpayers to file an Arizona Income Tax Return in accordance with the requirements of AS 43-101. The two types of Arizona Certificate of Compliance With Rule 8015(a)(7)(B) or 8016(d)(2) are the Arizona Certificate of Compliance With Rule 8015(a)(7)(B) and the Arizona Certificate of Compliance With Rule 8016(d)(2). Both forms must be completed and signed by the taxpayer and submitted to the Arizona Department of Revenue along with the required documentation. The certificates must be renewed annually.

Arizona Certificate of Compliance With Rule 8015(a)(7)(B) or 8016(d)(2)

State:

Arizona

Control #:

AZ-DC-185

Format:

PDF

Instant download

Public form

Description

Certificate of Compliance With Rule 8015(a)(7)(B) or 8016(d)(2)

How to fill out Arizona Certificate Of Compliance With Rule 8015(a)(7)(B) Or 8016(d)(2)?

US Legal Forms is the easiest and most budget-friendly method to find appropriate formal templates.

It is the most comprehensive online repository of business and personal legal documents prepared and validated by legal experts.

Here, you can discover printable and fillable templates that adhere to national and local statutes - just like your Arizona Certificate of Compliance With Rule 8015(a)(7)(B) or 8016(d)(2).

Examine the form description or preview the document to ensure you’ve located one that satisfies your needs, or find another one using the search tab above.

Click Buy now when you’re certain of its suitability with all the requirements, and select the subscription plan you prefer most.

- Acquiring your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the site and download the form onto their device.

- Subsequently, they can find it in their profile under the My documents section.

- And here’s how you can obtain a professionally crafted Arizona Certificate of Compliance With Rule 8015(a)(7)(B) or 8016(d)(2) if you are using US Legal Forms for the first time.