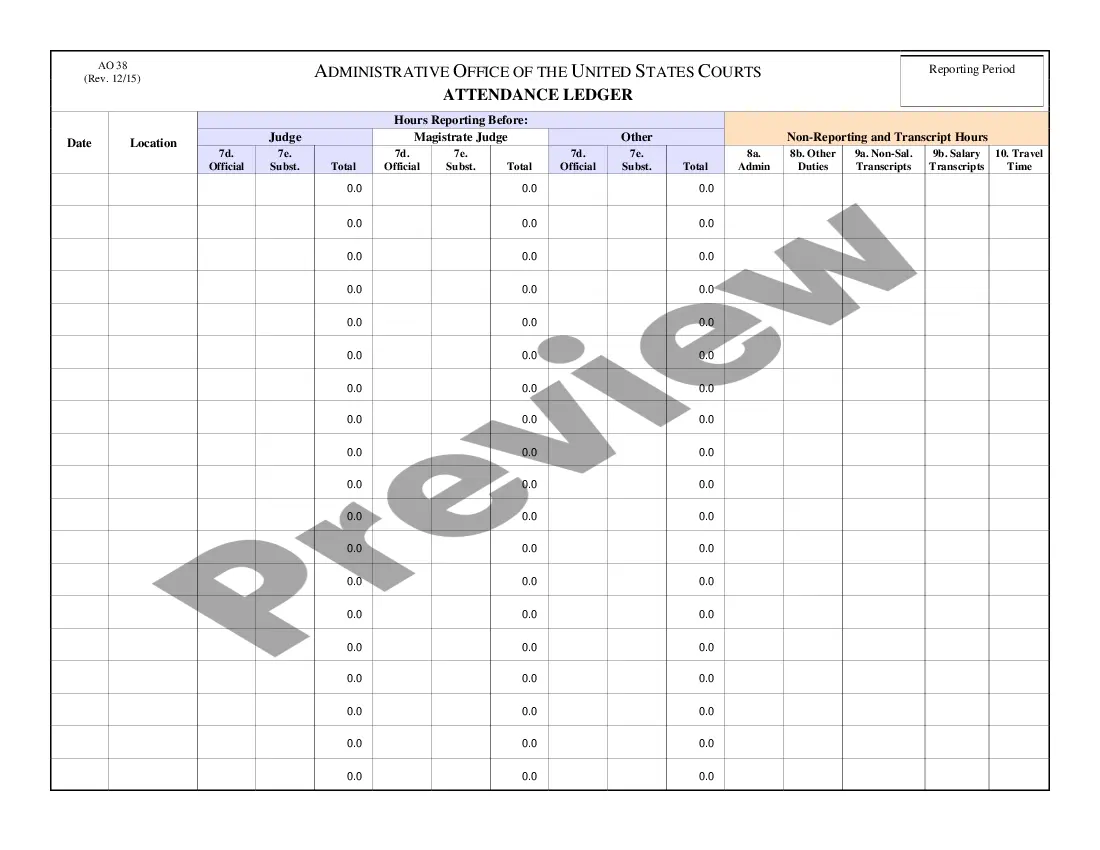

Arizona Expense Ledger is an accounting tool designed to help individuals and businesses track financial expenses in the state of Arizona. The ledger can be used to capture, store and analyze expenses related to income, taxes, and other financial transactions. The ledger can be used to calculate taxes, prepare financial statements, and monitor spending. There are three different types of Arizona Expense Ledger: the Basic Ledger, the Standard Ledger, and the Advanced Ledger. The Basic Ledger is the most basic version of the ledger and is suitable for individuals and small businesses who need to track basic expenses. The Standard Ledger is designed for businesses and larger organizations that need more advanced features, such as the ability to track multiple accounts and generate reports. The Advanced Ledger is the most comprehensive version and includes features such as tracking of multiple accounts, budgeting, and automated billing.

Arizona Expense Ledger

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Expense Ledger?

If you’re looking for a method to suitably prepare the Arizona Expense Ledger without the need for a lawyer, you have come to the right spot.

US Legal Forms has established itself as the largest and most reputable repository of formal templates for every personal and business scenario.

Another fantastic feature of US Legal Forms is that you will never lose the documents you downloaded - you can access any of your downloaded templates in the My documents tab of your profile whenever you need.

- Ensure the document displayed on the page aligns with your legal circumstances and state laws by reviewing its text description or exploring the Preview mode.

- Type the form name into the Search tab at the top of the page and choose your state from the list to find an alternate template in case of any discrepancies.

- Conduct the content verification process again and click Buy now once you are satisfied with the document's adherence to all the requirements.

- Log In to your account and hit Download. Sign up for the service and choose a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format in which you wish to save your Arizona Expense Ledger and download it by clicking the relevant button.

- Upload your template to an online editor for quick filling and signing or print it to prepare a physical copy manually.

Form popularity

FAQ

An example of an expense report might include travel expenses, such as airfare, hotel costs, and meal expenses incurred during a business trip. Each entry would have the date, amount, and purpose clearly outlined. This document serves as a comprehensive summary of expenditures for reimbursement. The Arizona Expense Ledger can provide templates to help you create a professional and accurate expense report.

In accounting, writing expenses involves recording each transaction in a systematic manner, often through a ledger. Ensure that you indicate the date, the purpose of each expense, and the corresponding amount. This helps in tracking operational costs effectively and provides a clear audit trail. The Arizona Expense Ledger can assist you in maintaining accurate accounting records.

Filling out an expense form requires you to enter the date of each expense, a description of what it was for, and the amount spent. Make sure to categorize expenses according to your company’s guidelines, as this will aid in reimbursement and record-keeping. Double-check for accuracy before submission to avoid delays. With the Arizona Expense Ledger, you can easily input this information and keep track of everything.

When formatting an expense report, include essential sections such as the date, description, amount, and category of each expense. Ensure each section is clearly labeled and easy to read. You might consider using templates or software tools that automatically lay out the data correctly. The Arizona Expense Ledger is a user-friendly option that helps you format your report efficiently.

To document your expenses effectively, start by keeping all receipts in one location, whether physical or digital. You should also note the date, purpose, and amount for each expense. Regularly updating your records will keep your documentation organized and allow you to refer back easily. Utilizing the Arizona Expense Ledger can further simplify this documentation process.

To complete an expense report, gather all your receipts and documents related to business expenses. Next, categorize them according to the sections on the report, such as travel, meals, or office supplies. Finally, total each category and ensure that the expenses align with your company's policies. Using the Arizona Expense Ledger can streamline this process, making it easier for you to track and report your expenses.

You enter your deductions on your tax return forms. For federal taxes, this is typically on Schedule A for itemized deductions. When using the Arizona Expense Ledger, you can keep your deductible expenses well-organized, making it easier to transfer the information onto your state and federal tax forms accurately.

Entering itemized deductions in Arizona involves filling out your federal Schedule A first and then transferring relevant amounts to your Arizona state tax return. You will generally report these amounts on the corresponding lines of the state form. Utilizing the Arizona Expense Ledger can streamline this task by keeping all your financial records in one place, ready for quick reference.

Yes, you can deduct medical expenses in Arizona if they exceed a certain percentage of your adjusted gross income. This deduction includes out-of-pocket expenses for medical care, prescriptions, and health insurance premiums. Keeping an updated Arizona Expense Ledger helps you track these costs, making it easier to claim any eligible deductions come tax season.

To report itemized deductions in Arizona, first complete federal Schedule A to determine your itemized deductions. Then, transfer the applicable amounts to the Arizona state return. Leveraging the Arizona Expense Ledger can simplify this process by ensuring you have a comprehensive record of all eligible deductions ready to report.