The dissolution of a corporation package contains all forms to dissolve a corporation in Arizona, step by step instructions, addresses, transmittal letters, and other information.

Arizona Dissolution Package to Dissolve Corporation

Description Dissolution Of Corporation Arizona

How to fill out Arizona Dissolution Form?

If you are looking for accurate Arizona Dissolution Package to Dissolve Corporation duplicates, US Legal Forms is your solution; obtain documents created and validated by state-certified legal experts.

Utilizing US Legal Forms not only alleviates the stress related to legal documentation; additionally, you conserve time, effort, and money! Downloading, printing, and filling out a professional template is significantly less expensive than hiring an attorney to do it for you.

And that’s it. With just a few simple clicks, you receive an editable Arizona Dissolution Package to Dissolve Corporation. After establishing your account, all subsequent orders will be processed even more easily. When you have a US Legal Forms subscription, simply Log In/">Log In to your account and then click the Download option available on the form’s page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Do not waste your time and energy comparing numerous forms across various web sources. Order professional copies from one secure service!

- To commence, complete your registration process by entering your email and setting up a secure password.

- Follow the instructions below to establish your account and locate the Arizona Dissolution Package to Dissolve Corporation template to resolve your issues.

- Utilize the Preview option or review the document details (if available) to ensure that the template is the one you need.

- Verify its validity in your jurisdiction.

- Click on Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and pay using a credit card or PayPal.

Az Dissolve Corporation Form popularity

Arizona Dissolve Corporation Other Form Names

Dissolution Package Corporation FAQ

Companies can dissolve through various methods, including voluntary dissolution, court-ordered dissolution, and administrative dissolution initiated by the state. The choice of method depends on the corporation's specific circumstances and requirements. It is crucial to follow the correct procedures outlined in an Arizona Dissolution Package to Dissolve Corporation, ensuring you complete the dissolution legally and efficiently.

The three types of dissolution include voluntary dissolution, involuntary dissolution, and administrative dissolution. Voluntary dissolution occurs when a corporation decides to close down, whereas involuntary dissolution is typically mandated by the state due to non-compliance with laws. Administrative dissolution happens when a corporation fails to file necessary documents. Employing an Arizona Dissolution Package to Dissolve Corporation can help you choose the right type for your situation.

A corporation generally consists of three main parts: shareholders, directors, and officers. Shareholders own the corporation and have a say in major decisions. Directors oversee the corporation's activities and set policies, while officers handle daily operations. Understanding these parts is essential when considering an Arizona Dissolution Package to Dissolve Corporation.

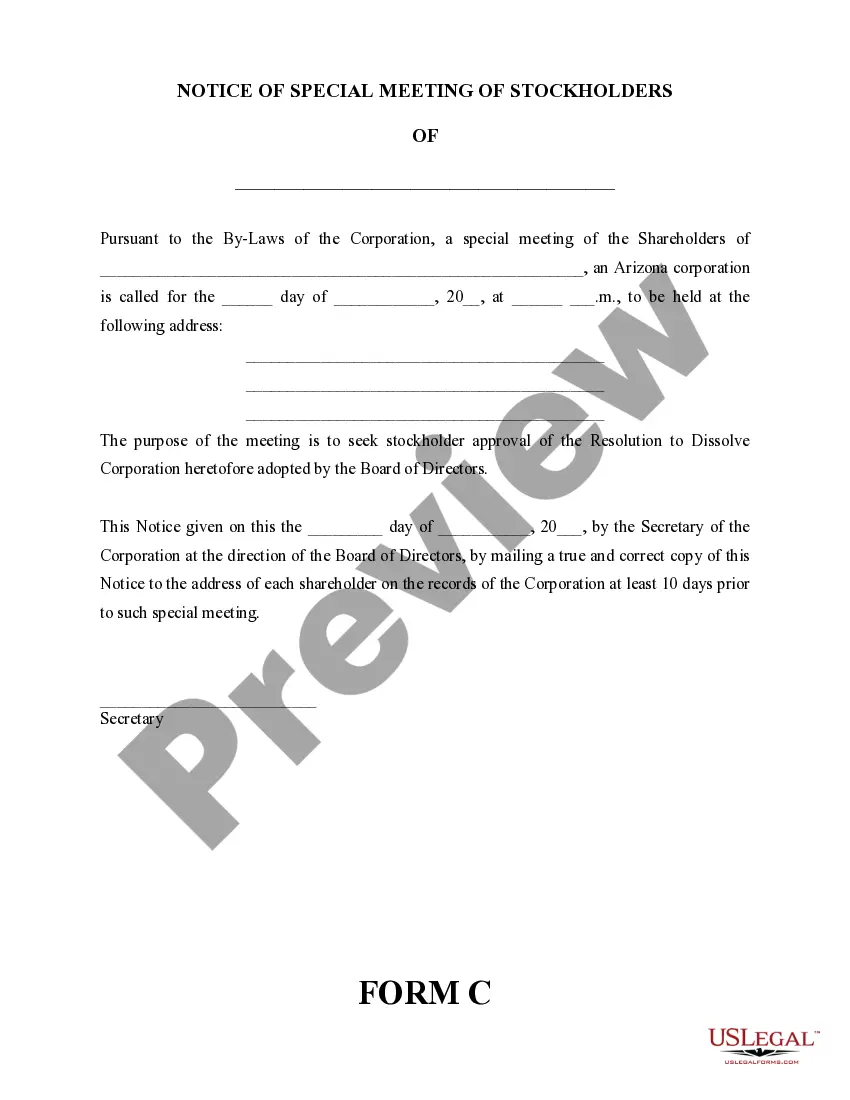

To dissolve a corporation in Arizona, you must initiate a formal process by filing Articles of Dissolution with the state. This document must include pertinent information about the corporation, including the reason for dissolution. Additionally, you should notify the IRS and settle any tax liabilities. An Arizona Dissolution Package to Dissolve Corporation can provide you with the right forms and instructions to ensure a smooth dissolution.

Dissolving a company involves several key steps. First, the corporation must obtain approval from its board of directors and shareholders. Then, you will need to file the necessary forms with Arizona's Corporation Commission, and finally, you should settle outstanding debts and obligations. Using an Arizona Dissolution Package to Dissolve Corporation can simplify this process.

Terminating an LLC in Arizona requires filing the articles of dissolution with the Arizona Corporation Commission. This action cancels the LLC's registration and stops all business operations. The Arizona Dissolution Package to Dissolve Corporation provides you with the necessary resources and tools to ensure this process is efficient and compliant with state regulations.

To officially close an LLC, you must file articles of dissolution with the Arizona Corporation Commission. It is essential to settle all debts and distribute remaining assets before submitting this document. By using the Arizona Dissolution Package to Dissolve Corporation, you will have the necessary guidance to navigate this crucial step smoothly.

Making your LLC inactive in Arizona involves submitting a dissolution form to the Arizona Corporation Commission. This form officially communicates your intent to end the business’s operations. When you use the Arizona Dissolution Package to Dissolve Corporation, you simplify the paperwork and adhere to all regulations.

To make your LLC inactive in Arizona, you should file the appropriate paperwork with the Arizona Corporation Commission. This includes submitting a statement of dissolution or application for cancellation. Utilizing the Arizona Dissolution Package to Dissolve Corporation can streamline this process, ensuring you meet all necessary requirements.

To determine if your LLC is active in Arizona, visit the Arizona Corporation Commission website. You can search for your LLC by name or registry number. The status will indicate whether your organization is active or if there are any issues requiring attention, which may help when considering using the Arizona Dissolution Package to Dissolve Corporation.