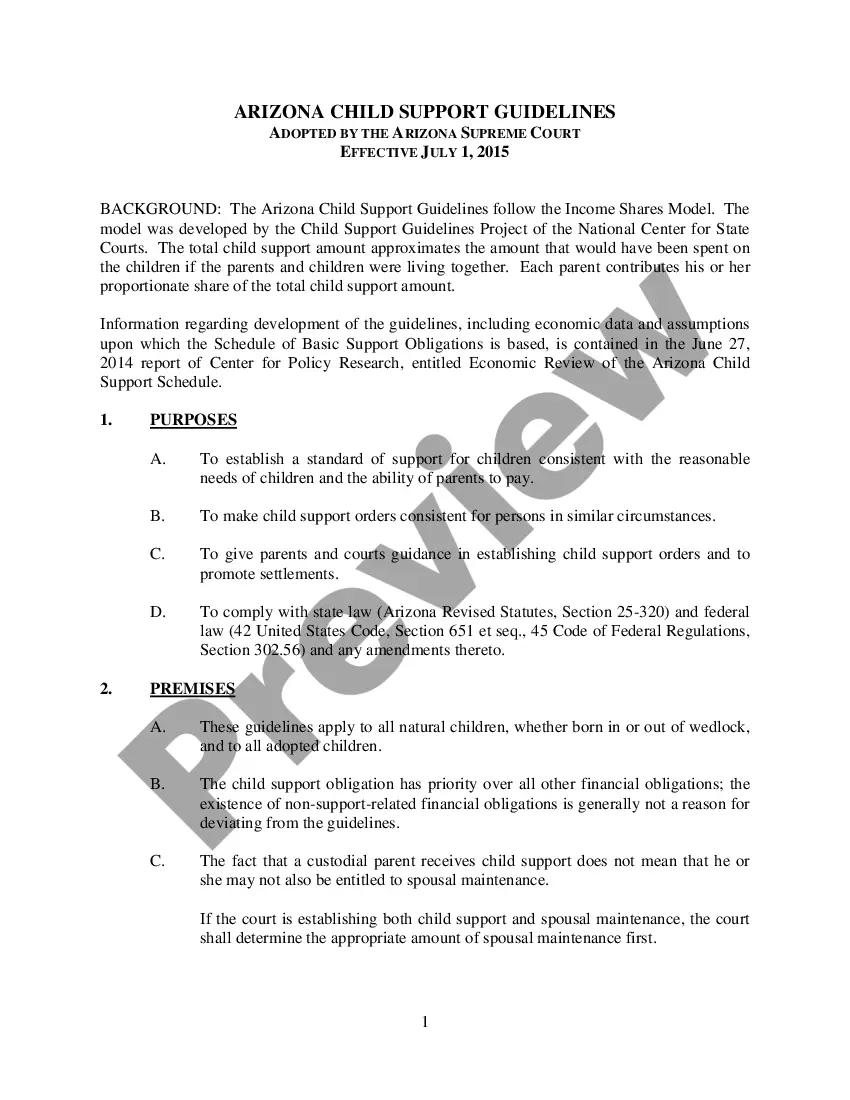

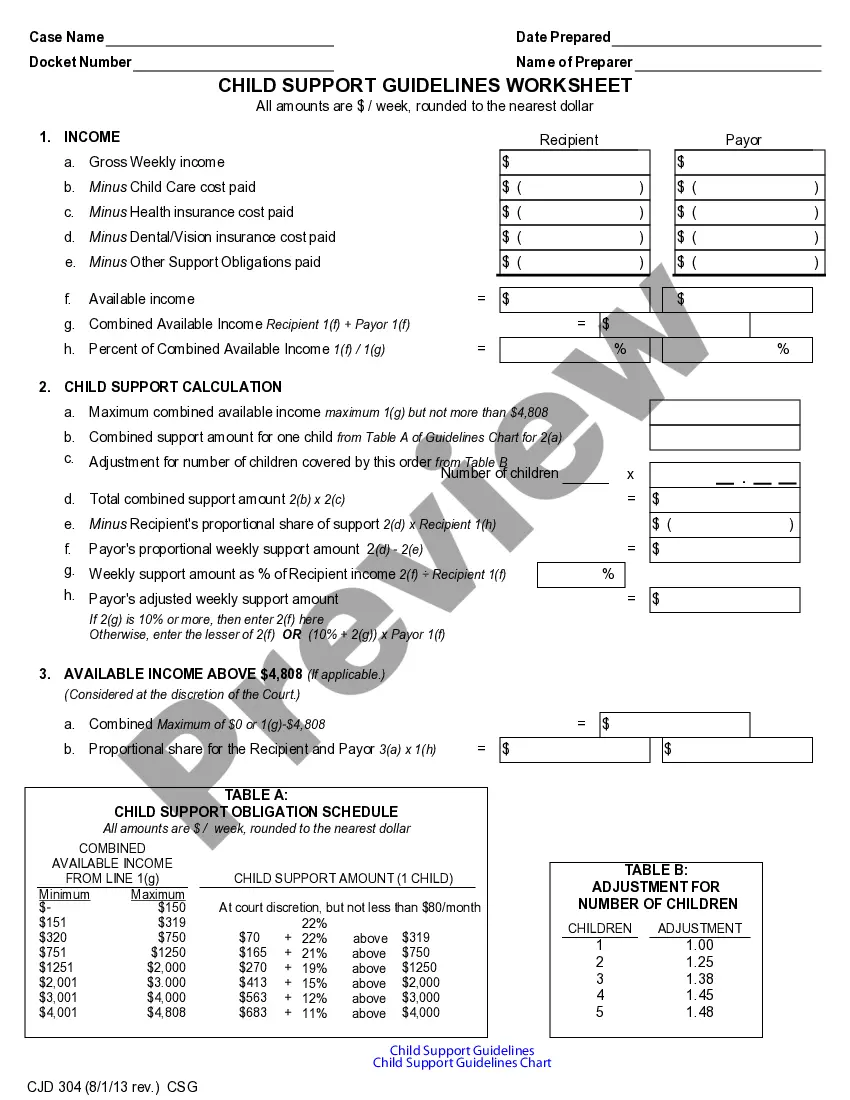

The Arizona 2011 Child Support Guidelines are a set of guidelines used to calculate child support payments in the state of Arizona. These guidelines take into consideration the income of both parents, the number of children, health insurance costs, childcare costs, and other relevant factors. The guidelines provide a standard to determine the amount of child support that should be paid and can be used by both parents to ensure that a fair amount is paid. There are two types of Arizona 2011 Child Support Guidelines: the Standard Guidelines and the Income Shares Model. The Standard Guidelines use a basic formula to calculate child support payments based on the income of the non-custodial parent and the number of children. The Income Shares Model takes into account the total income of both parents and distributes the amount of child support among both parents based on their respective incomes. The Income Shares Model is more detailed and is often used when one or both parents have high incomes.

Arizona 2011 Child Support Guidelines

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona 2011 Child Support Guidelines?

Managing official documentation necessitates focus, precision, and utilizing accurately prepared forms. US Legal Forms has been assisting individuals nationwide for 25 years; therefore, when you select your Arizona 2011 Child Support Guidelines template from our platform, you can trust it adheres to federal and state laws.

Engaging with our service is simple and efficient. To acquire the required documentation, all you need is an account with an active subscription. Here’s a quick guide to help you obtain your Arizona 2011 Child Support Guidelines in just a few minutes.

All documents are designed for multiple uses, such as the Arizona 2011 Child Support Guidelines you see on this page. If you need them again, you can fill them out without additional payment—just access the My documents tab in your profile and complete your document whenever necessary. Experience US Legal Forms and complete your business and personal paperwork swiftly and in complete legal compliance!

- Ensure to thoroughly assess the form's content and its alignment with general and legal standards by previewing it or reviewing its description.

- Seek an alternative formal document if the one you’ve accessed does not fit your needs or state regulations (the link to do so is located at the top page corner).

- Log In to your account and save the Arizona 2011 Child Support Guidelines in your preferred format. If this is your first visit to our service, click Buy now to proceed.

- Establish an account, select your subscription option, and make payment using your credit card or PayPal.

- Choose the format in which you wish to download your form and click Download. You may print the document or incorporate it into a professional PDF editor to fill it out electronically.

Form popularity

FAQ

Arizona does not specifically set a strict cap on child support payments, but the Arizona 2011 Child Support Guidelines establish recommendations based on income levels. These guidelines ensure that the child’s best interests are prioritized while considering the parents' financial capabilities. Utilizing platforms like uslegalforms can help in accurately calculating and managing child support obligations.

Currently, the state with the highest child support cap is typically thought to be New York. Each state has its unique guidelines, and while Arizona's 2011 Child Support Guidelines offer clarity, other states may require much higher support amounts. It is beneficial to understand each state's regulations to compare obligations effectively.

In Arizona, child support does not automatically stop at 18 according to the 2011 Child Support Guidelines. Support obligations may continue if the child is still in high school, up to a maximum age of 19. It is essential for parents to remain informed about their responsibilities and rights regarding child support.

Enforcing a child support order in Arizona requires filing a petition with the court to address the non-payment. You'll need to compile evidence of missed payments and demonstrate that you have attempted to resolve the issue amicably. By adhering to the Arizona 2011 Child Support Guidelines, you can effectively communicate the terms and obligations that are in place, which may increase your chances of enforcement.

To file for contempt of court regarding child support in Arizona, you must show that the other parent has willfully failed to comply with the court's support order. Fill out the appropriate forms, which can be obtained from the court, and provide evidence of non-compliance. Keep in mind the Arizona 2011 Child Support Guidelines, as they will guide you in presenting a strong case in court.

Enforcing child support in Arizona involves several steps. You can start by submitting a request to the court, along with evidence showing the non-custodial parent has failed to make payments. Additionally, utilizing the Arizona 2011 Child Support Guidelines can help clarify obligations and strengthen your case. If necessary, you may also consider legal assistance for a more effective approach.

To file for back child support in Arizona, you must first gather all relevant documentation, including any prior agreements and payment records. Next, you can complete the necessary forms, which are available on the Arizona Department of Economic Security website. Remember, it is crucial to follow the Arizona 2011 Child Support Guidelines to ensure your case is processed efficiently and fairly.

The average child support payment for one child in Arizona can vary based on several factors, including parental income and specific needs of the child. The Arizona 2011 Child Support Guidelines offer a framework for calculating payments that typically ranges from $300 to $800 per month. It is crucial to consider the individual circumstances surrounding your case when estimating the amount. For a clearer picture, reviewing the guidelines or consulting with a professional can be valuable.

To obtain a copy of your child support order in Arizona, you can contact the court that issued the order or the Arizona Department of Economic Security. You may also visit their websites for online services that provide access to case information. Having the Arizona 2011 Child Support Guidelines handy can help you understand your rights during this process. If you need official documents quickly, USLegalForms can be a helpful resource.

In Arizona, both parents can agree to waive child support, but this decision must be approved by a court. Even if both parties consent, the court reviews the agreement to ensure it serves the child's best interests. It's essential to document the agreement properly to avoid future disputes. For guidance on creating a legally sound agreement, consult the Arizona 2011 Child Support Guidelines.