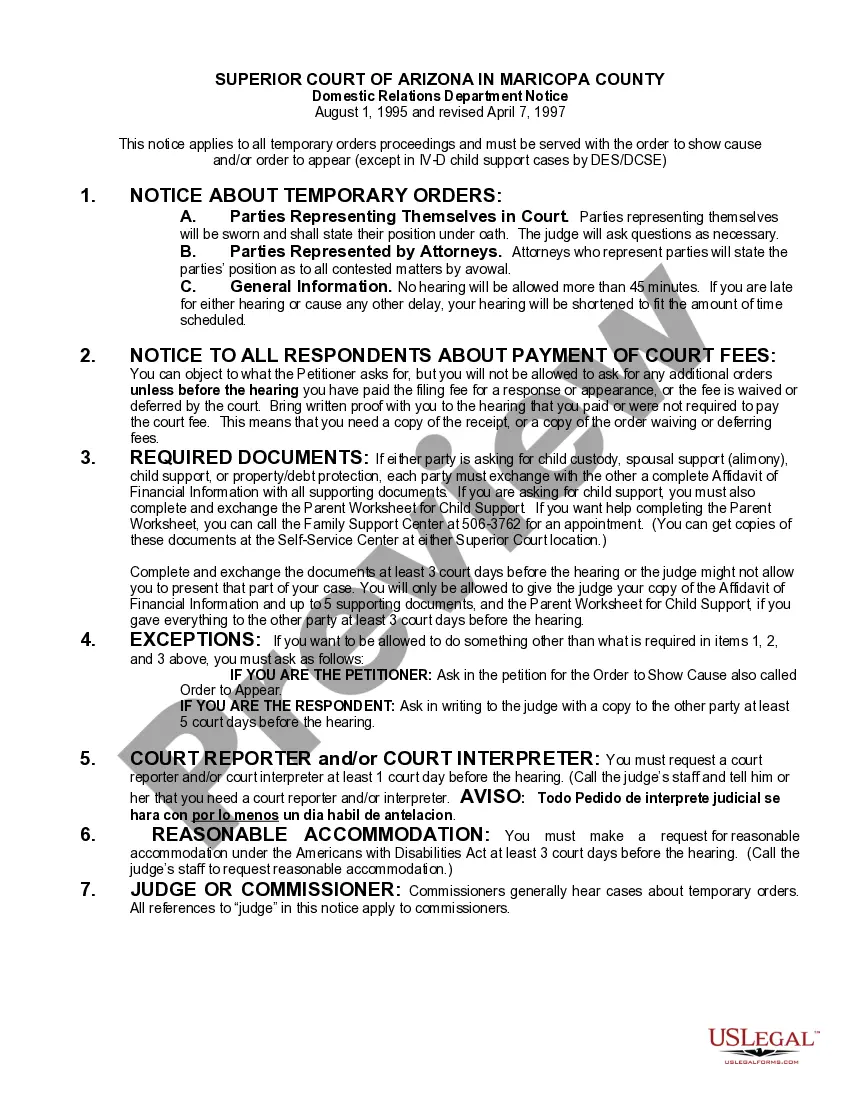

Domestic Relations Department Notice and Return Notice: This Domestic Relations Notice applies to all cases involving Temporary Order proceedings. It is to be served with both the Order to Show Cause and Order to Appear. This form is available in both Word and Rich Text formats.

Arizona DR Department Notice and Return Notice

Description

How to fill out Arizona DR Department Notice And Return Notice?

If you're seeking precise Arizona DR Department Notice and Return Notice templates, US Legal Forms is precisely what you require; obtain documents provided and verified by state-licensed legal professionals.

Utilizing US Legal Forms not only spares you from troubles related to legal documentation; additionally, you don't squander time, effort, and money! Downloading, printing, and submitting a reliable document is considerably less pricey than hiring an attorney to handle it for you.

And that's it. With a few simple steps, you have an editable Arizona DR Department Notice and Return Notice. Once your account is created, all future orders will be processed even more easily. If you possess a US Legal Forms subscription, just Log In/">Log In to your profile and click the Download button you will find on the form’s page. Then, whenever you need to use this template again, you'll always be able to access it in the My documents section. Don't waste your time and effort sifting through numerous forms on various websites. Acquire precise templates from one reliable service!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the instructions below to set up an account and acquire the Arizona DR Department Notice and Return Notice example to meet your requirements.

- Take advantage of the Preview feature or check the document details (if available) to ensure that the form is the one you want.

- Verify its validity in your state.

- Click on Buy Now to place your order.

- Choose a preferred pricing plan.

- Set up an account and pay using your credit card or PayPal.

- Select an appropriate format and save the form.

Form popularity

FAQ

Currently, Arizona does not accept tax submissions via email for security and privacy reasons. Instead, you should use the state’s online portal or mail your tax documents directly to the Arizona Department of Revenue. For more information on submitting taxes and addressing notices, refer to the detailed instructions provided in the Arizona DR Department Notice and Return Notice.

Yes, Arizona allows taxpayers to file amended returns electronically through specific tax software that supports this feature. Filing an amended return can simplify the correction process and reduce processing time. Always check the specifications for the Arizona DR Department Notice and Return Notice to ensure compliance with the latest electronic filing requirements.

Yes, usually if you have income that exceeds a certain threshold, you need to file a state tax return in Arizona. Additionally, if you had Arizona state tax withheld from your paycheck or expect to receive credits, filing is often beneficial. Review the Arizona DR Department Notice and Return Notice for specific details on requirements and any exceptions that may apply.

If you live in Arizona, your federal tax return should be sent to the address listed for your filing status in the IRS guidelines. Typically, you mail your return to the IRS at either the Ogden, UT or Austin, TX addresses, depending on whether you are expecting a refund or owe taxes. It’s important to confirm the latest mailing addresses each tax season to ensure you don't experience delays.

Submitting form 285 in Arizona requires you to fill out the form accurately and ensure you provide all necessary information. After completing the form, you can submit it electronically if you are enrolled in Arizona's e-file program or mail it directly to the Arizona Department of Revenue. Ensure you keep a copy for your records and refer to the Arizona DR Department Notice and Return Notice for additional steps.

To mail your Arizona tax return, you should send it to the appropriate address based on whether you are expecting a refund or if you owe taxes. If you are due a refund, send your return to the Arizona Department of Revenue, P.O. Box 29079, Phoenix, AZ 85038-9079. For payments, address your return to the Arizona Department of Revenue, P.O. Box 29085, Phoenix, AZ 85038-9085. Always check the latest guidelines, especially related to the Arizona DR Department Notice and Return Notice.

In Arizona, the state tax withholding rates vary based on your income level. Typically, you should withhold around 2.59% to 4.5% for Arizona state taxes, but this percentage may change depending on your specific tax situation. It is important to refer to the Arizona DR Department Notice and Return Notice guidance to understand your obligations fully. For a seamless experience, consider using uslegalforms to access the latest tax forms and helpful resources.

You can request a copy of your Arizona tax return through the Arizona Department of Revenue’s website or by contacting their office directly. They typically require basic identifying information to process your request. If you have received an Arizona DR Department Notice and Return Notice, it may include instructions on how to retrieve your tax documents efficiently. Keeping copies of your returns can also simplify future filings.

Arizona generally does not tax foreign income unless it is connected to a business or property within the state. However, if you are a resident of Arizona, you may need to report your worldwide income, including foreign sources. Keep an eye out for any correspondence, like an Arizona DR Department Notice and Return Notice, which could provide guidance on your tax responsibilities regarding foreign income. It's advisable to consult with a tax advisor for personalized guidance.

You must file an Arizona state tax return if you are a resident or if you earn income sourced from Arizona as a non-resident. This includes wages, rental income, and other earnings. If you receive an Arizona DR Department Notice and Return Notice, it may indicate a filing requirement. Knowing your obligations helps you avoid penalties and ensures compliance with state regulations.