Independent Contractor: This is a contract to be used by an independent contractor. The independent contractor uses this type of contract before beginning a job with either a sub-contractor and/or Owner of a parcel of land. This form is available in both Word and Rich Text formats.

Arizona Self-Employed Independent Contractor Agreement

Description

How to fill out Arizona Self-Employed Independent Contractor Agreement?

If you are looking for precise Arizona Self-Employed Independent Contractor Agreement templates, US Legal Forms is exactly what you require; access documents created and verified by state-certified attorneys.

Using US Legal Forms not only spares you from concerns regarding legal paperwork; furthermore, you conserve effort, time, and money! Downloading, printing, and completing an expert template is significantly less expensive than hiring a lawyer to handle it for you.

And that's it. In just a few simple steps, you will have an editable Arizona Self-Employed Independent Contractor Agreement. Once you create an account, all future orders will be processed even more conveniently. With a US Legal Forms subscription, simply Log In to your profile and then click the Download button you can find on the form's page. Subsequently, when you need to use this template again, it will always be accessible in the My documents section. Do not waste your time comparing numerous forms across various platforms. Obtain professional documents from a single secure source!

- First, complete your registration process by providing your email and creating a secure password.

- Follow the instructions below to establish your account and locate the Arizona Self-Employed Independent Contractor Agreement template to address your needs.

- Use the Preview option or examine the file details (if available) to ensure the template is the one you need.

- Verify its legality in your state.

- Click on Buy Now to place an order.

- Choose a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

- Select an appropriate file format and save the document.

Form popularity

FAQ

As an independent contractor, you need to fill out a few key documents to establish your working relationship. First, the Arizona Self-Employed Independent Contractor Agreement is crucial, as it outlines the terms of the project, including fees and deadlines. Additionally, you may need to provide tax forms like the W-9 to ensure proper record keeping. Overall, these documents protect both you and your client, fostering a clear understanding of the work expectations.

Yes, you can be your own contractor in Arizona, and many individuals choose to do so. By drafting an Arizona Self-Employed Independent Contractor Agreement, you can establish your own terms and conditions for the work you perform. This independence allows you to set your hours, choose your clients, and manage your work environment. Utilizing platforms like uslegalforms can simplify the process of creating agreements that protect your interests.

Becoming a contractor in Arizona typically requires completing certain steps, which can take a few weeks to several months. You need to gather necessary documentation, such as your Arizona Self-Employed Independent Contractor Agreement, and apply for any required licenses. Additionally, some contractors may need to complete training or obtain certifications, which can add to the timeline. Overall, your commitment to following through can greatly influence the speed of this process.

Yes, Arizona requires businesses to file Form 1099 for independent contractors who earn $600 or more in a calendar year. This filing helps keep accurate records of payments and ensures compliance with federal and state tax laws. By utilizing a well-crafted Arizona Self-Employed Independent Contractor Agreement, you can maintain clear documentation of your earnings, assisting both you and your clients during tax season. It's important to stay organized to avoid complications.

Yes, independent contractors in Arizona may need a business license depending on the type of work they perform and where they operate. The requirements can vary by city or county, making it essential to check local regulations. Establishing a proper Arizona Self-Employed Independent Contractor Agreement can clarify your business status and ensure you meet local compliance requirements. Having a business license can also enhance your credibility with clients.

In Arizona, 1099 employees are typically not required to carry workers' compensation insurance, as this requirement generally applies to traditional employees. However, it's wise to review the specifics of your Arizona Self-Employed Independent Contractor Agreement to clearly outline your responsibilities and protections. If you are an independent contractor working for a company, check if the company mandates coverage. Protecting yourself with appropriate insurance can provide peace of mind.

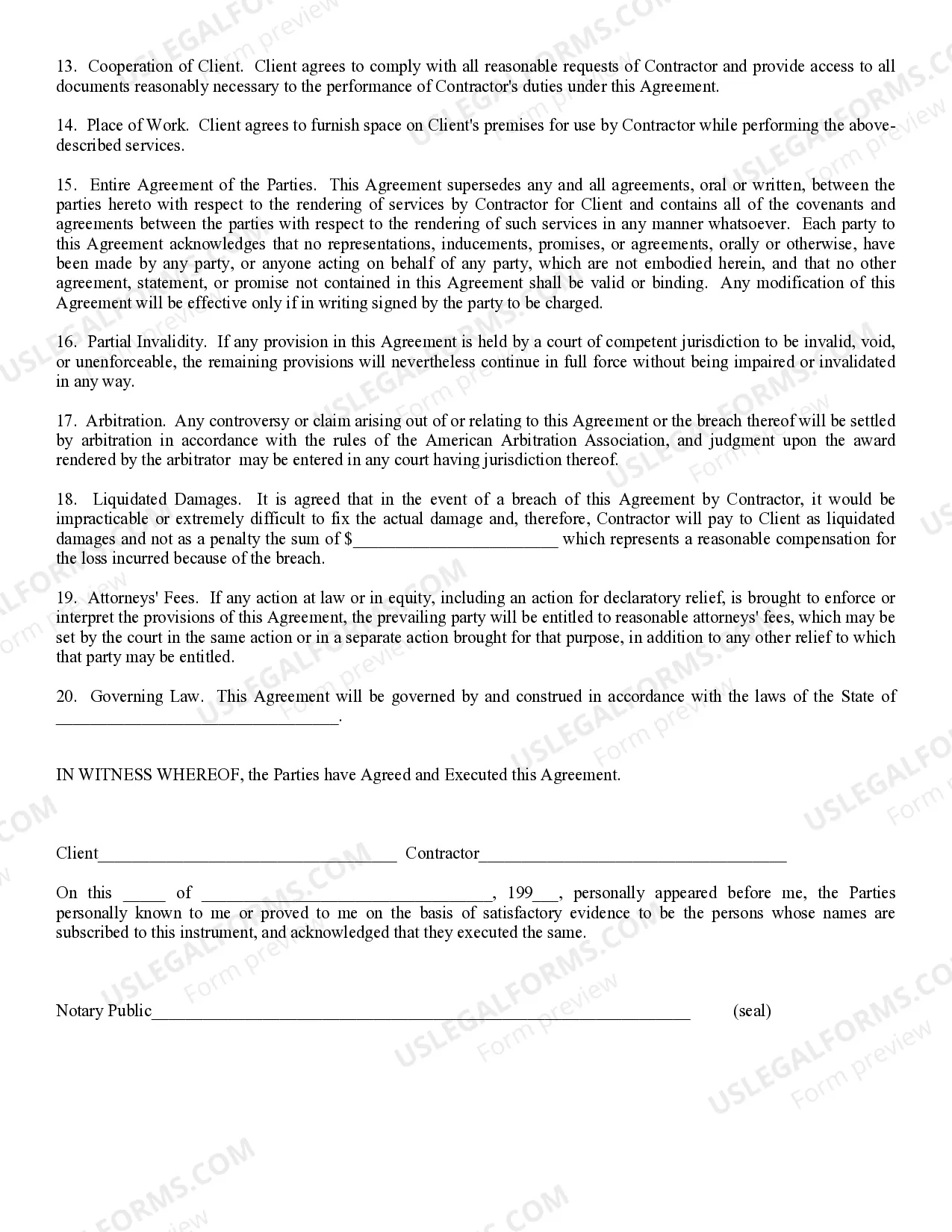

Writing an independent contractor agreement involves defining the scope of work, payment terms, and the duration of the work relationship. Be clear about each party's responsibilities and include any necessary clauses regarding confidentiality or non-compete agreements. An effective Arizona Self-Employed Independent Contractor Agreement is crucial for protecting both you and your clients. You can easily find templates online to get started.

To write a simple business agreement, outline the purpose of the agreement upfront. Include essential details such as the parties involved, specific duties, payment methods, and timelines. Ensure to cover termination terms and dispute resolution processes. Using an Arizona Self-Employed Independent Contractor Agreement can provide a solid framework for this task.

Yes, independent contractors in Arizona typically need a business license, depending on their location and type of work. This license legitimizes their operations, allowing them to work legally in their field. It’s advisable to check local regulations before starting your independent contracting business. Including such details in an Arizona Self-Employed Independent Contractor Agreement can ensure compliance.

Writing a simple contract agreement involves clearly stating the terms of the agreement. Start with the names of the parties involved, the services provided, payment terms, and the duration of the contract. Use clear, direct language to avoid confusion. An Arizona Self-Employed Independent Contractor Agreement template can simplify this process for you.