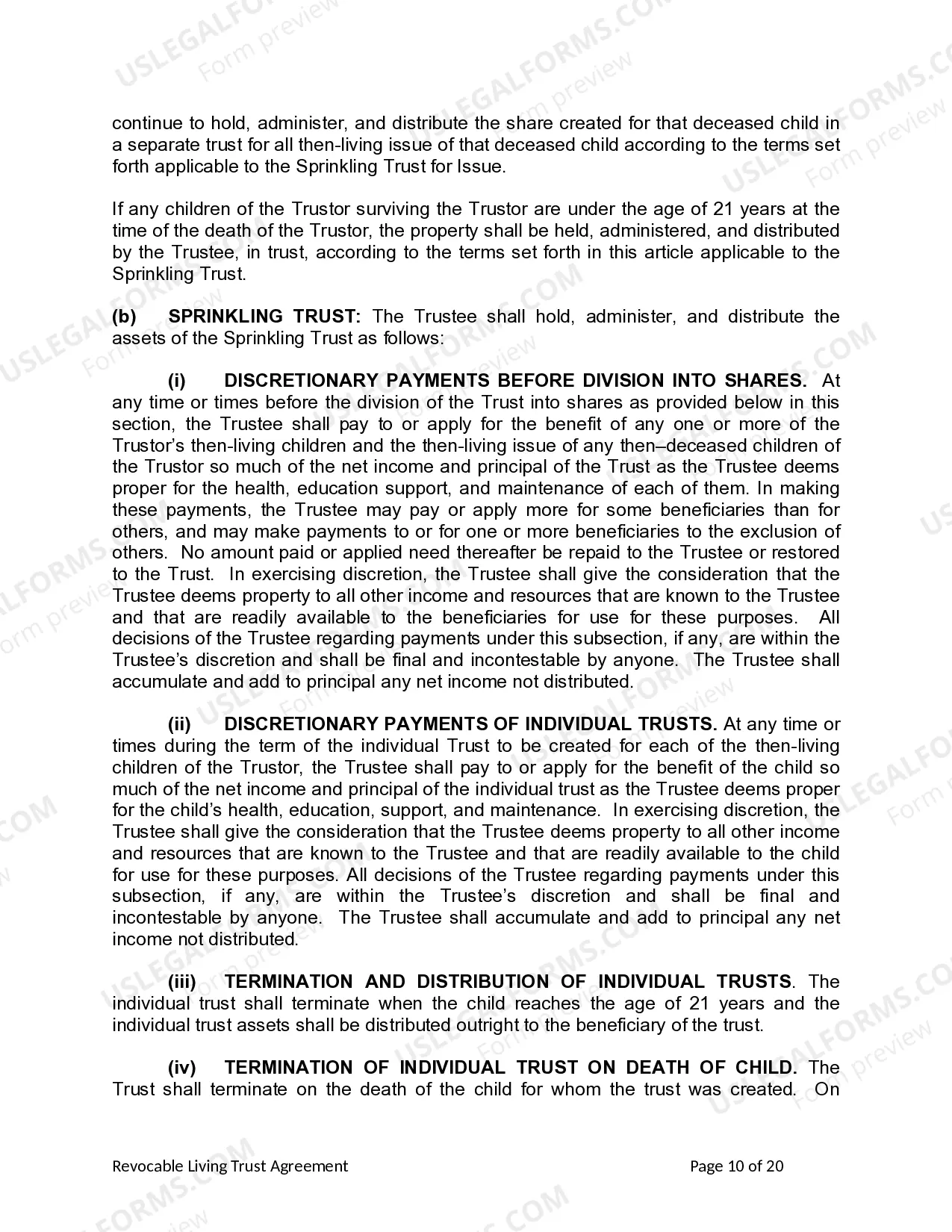

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Arizona Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Arizona Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children?

If you're seeking a precise Arizona Living Trust for an individual, whether Single, Divorced, or a Widow or Widower with Children, US Legal Forms is exactly what you require; access files that have been provided and validated by state-licensed legal professionals.

Utilizing US Legal Forms not only alleviates concerns about legal documentation; it also saves you time, energy, and money! Downloading, printing, and completing a professional template is significantly less expensive than hiring an attorney to prepare it for you.

And that's all there is to it. With just a few simple clicks, you obtain an editable Arizona Living Trust for an individual, whether Single, Divorced, or a Widow or Widower with Children. Once you create an account, all future requests will be processed even more easily. After subscribing to US Legal Forms, simply Log In/">Log Into your profile and click the Download button located on the form’s page. Then, when you need to use this template again, you'll find it in the My documents section. Don't waste your time sifting through numerous forms on various websites. Buy accurate copies from one reliable source!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the instructions provided to set up your account and obtain the Arizona Living Trust for an individual, whether Single, Divorced, or a Widow or Widower with Children template to address your needs.

- Make use of the Preview feature or review the document description (if available) to ensure that the sample is what you desire.

- Verify its legality in your jurisdiction.

- Click Buy Now to place your order.

- Choose a payment plan that suits you.

- Create an account and make payments via credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

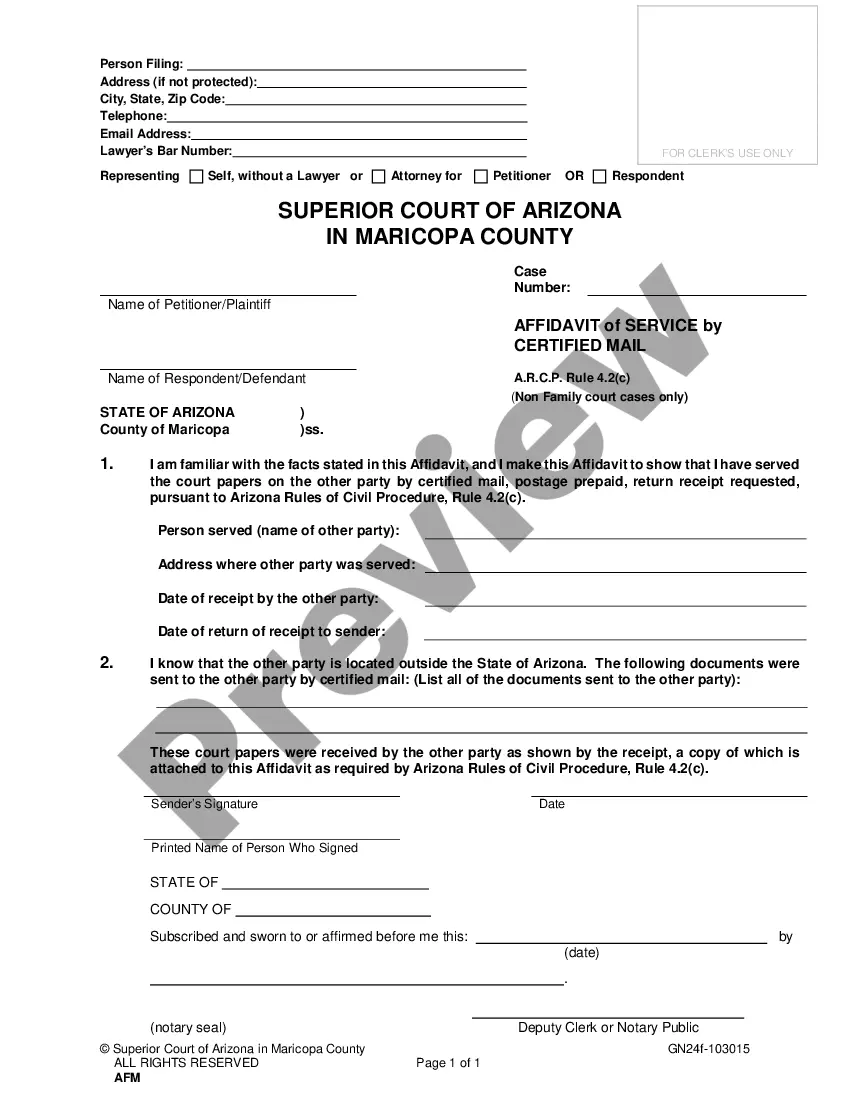

In Arizona, an Arizona Living Trust for individuals who are single, divorced, or widowed with children does not need to be recorded with the state. However, it is important to keep the trust document accessible for your beneficiaries. They must be aware of its existence and contents, particularly to access assets. A reliable platform like US Legal Forms can assist you in maintaining proper documentation, ensuring your trust is effective and your desires are met.

While you can set up an Arizona Living Trust for individuals who are single, divorced, or widowed with children without an attorney, having legal guidance is beneficial. An attorney can help ensure that the trust is legally sound and that your wishes are accurately represented. They can also navigate any complex situations, especially when it comes to legal requirements and tax implications. However, platforms like US Legal Forms can provide valuable resources if you choose to handle it independently.

Registering an Arizona Living Trust for individuals who are single, divorced, or widowed with children can be straightforward. You typically need to complete a trust document and may need to transfer ownership of assets into the trust. While you do not have to file the trust document with the state, it is wise to keep it in a safe place and inform your children about its location. Using a dedicated platform like US Legal Forms can simplify this process, offering user-friendly templates tailored for your needs.

One of the biggest mistakes parents make when establishing an Arizona Living Trust for individuals who are single, divorced, or widowed with children is not clearly outlining their wishes. This lack of clarity can lead to confusion and disputes among beneficiaries. It is crucial to specify how assets should be divided and ensure that the fund aligns with your family’s needs. Taking the time to plan thoroughly can prevent potential conflicts and provide peace of mind.

In Arizona, beneficiaries generally do have the right to see the trust document, especially after the trustor's death. This right helps ensure transparency in how assets will be distributed. If you are a beneficiary, you should expect to receive information regarding the trust and its terms. Understanding this aspect is vital for individuals who are single, divorced, or widowed while navigating an Arizona Living Trust.

Yes, you can set up a living trust without an attorney in Arizona, especially with the help of online platforms like uslegalforms. These services provide templates and guidance, allowing you to create a trust tailored to your needs as an individual, whether you're single, divorced, or widowed. However, while DIY options are available, consulting an attorney can help ensure all legal aspects are correctly addressed for your peace of mind.

To obtain a copy of a living trust in Arizona, you need to request it from the trustee, who is responsible for managing the trust. If you are a beneficiary, you typically have the right to see the trust's terms. If there's any difficulty accessing the document, consider mediation or legal advice to clarify your rights. For individuals who are single, divorced, or widowed, knowing your rights within an Arizona Living Trust is essential.

You do not need to register a living trust in Arizona. This allows individuals, particularly those who are single, divorced, or widowed, to maintain privacy regarding their assets. However, if you establish a trust for specific properties, paperwork must be completed to transfer those assets into the trust. Utilizing platforms like uslegalforms can simplify creating and managing your trust without registration concerns.

Trusts in Arizona are generally private documents and do not need to be recorded with the state. However, certain assets, like real estate, may require specific actions for ownership transfer. While there is no public record of the trust's contents, keeping a detailed inventory and document is essential for clarity among your heirs. This is especially important for those managing an Arizona Living Trust, who may be single, divorced, or widowed.

In Arizona, a living trust must be properly drafted and funded to be valid. This means you must transfer ownership of your assets into the trust, making the trust the legal owner. It's crucial to include clear instructions on how assets should be handled and distributed upon your passing. Individuals, especially those who are single, divorced, or widowed, should consult with legal professionals to ensure compliance with state laws and personal wishes.