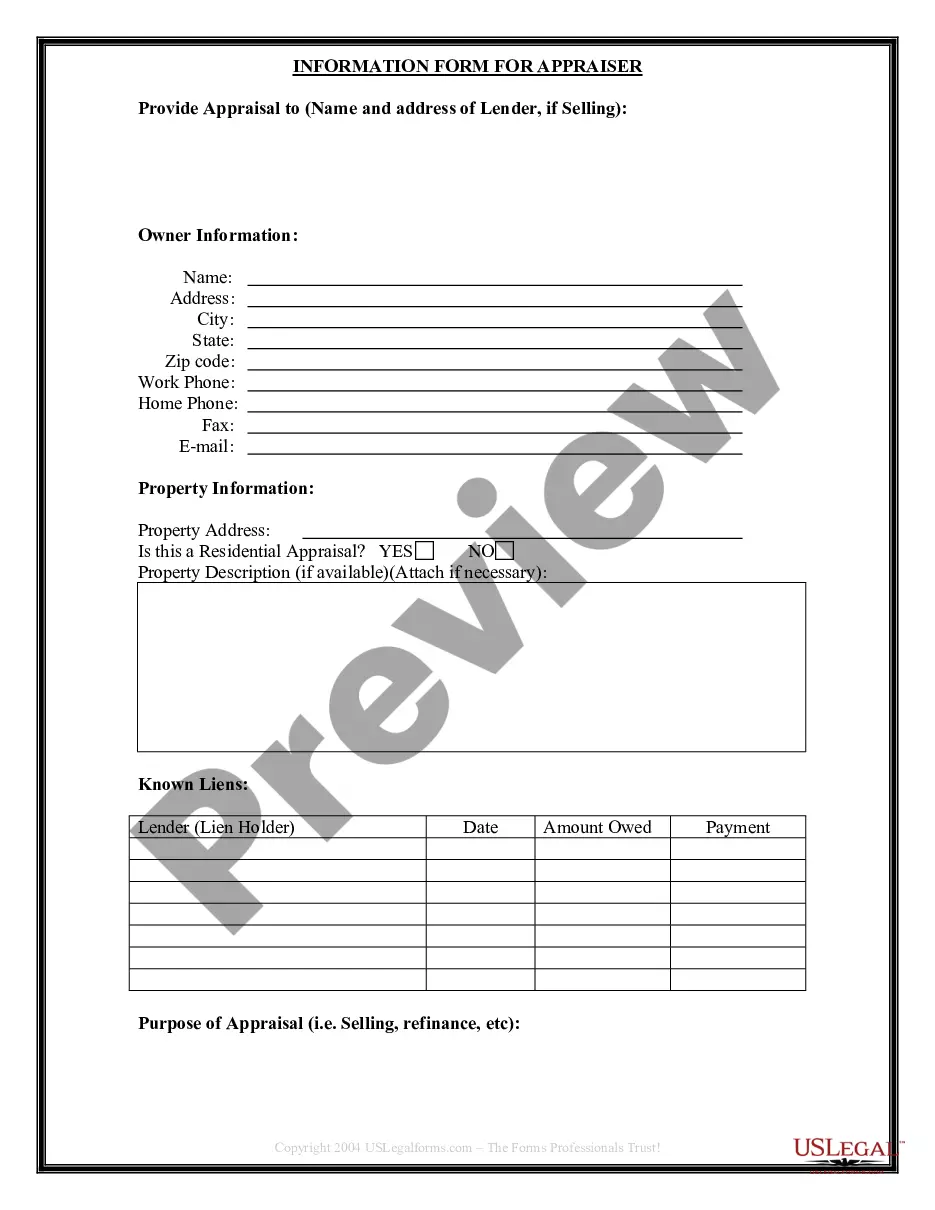

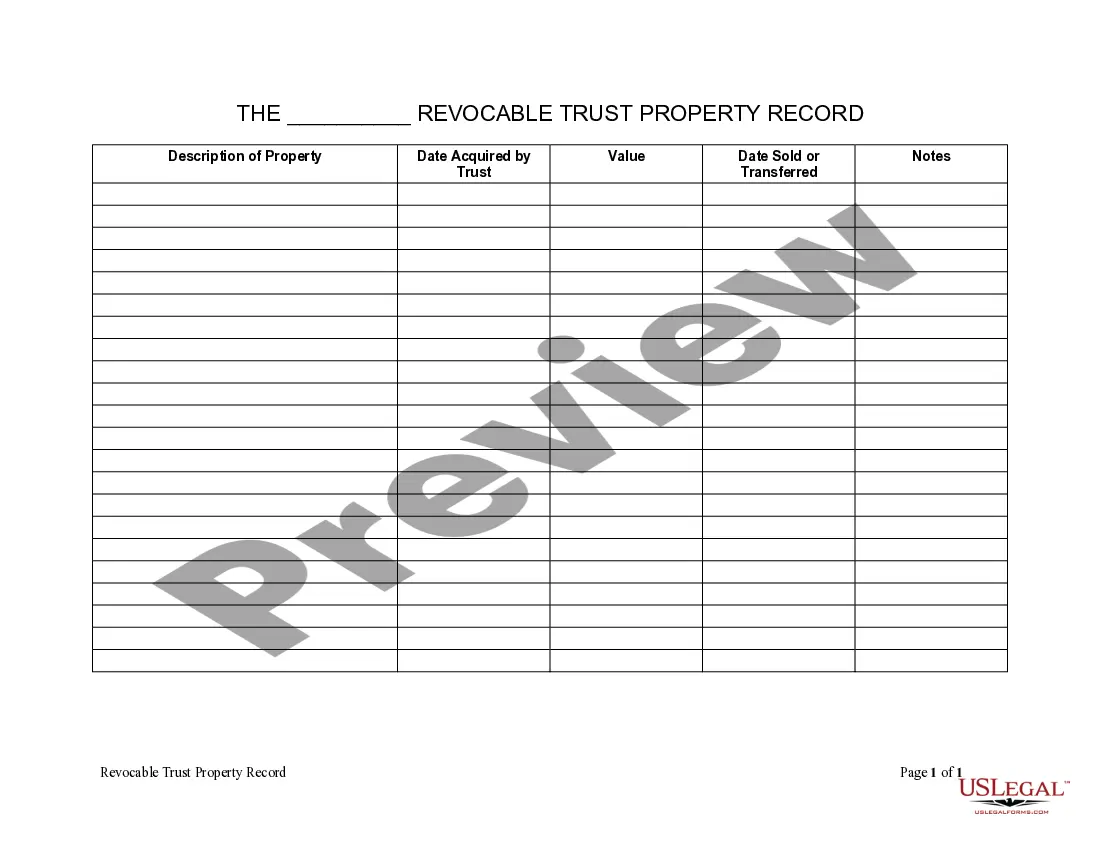

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Arizona Living Trust Property Record

Description

How to fill out Arizona Living Trust Property Record?

If you are looking for accurate copies of Arizona Living Trust Property Record documents, US Legal Forms is what you require; obtain files prepared and reviewed by state-certified legal experts.

Utilizing US Legal Forms not only shields you from issues related to legal paperwork; it also saves you time, effort, and money!

And that's it. With a few simple clicks, you have an editable Arizona Living Trust Property Record. Once you create an account, all future purchases will be processed even more easily. If you possess a US Legal Forms subscription, just Log In/">Log Into your profile and then click the Download button you see on the form's page. Then, whenever you need to use this template again, you will always be able to find it in the My documents menu. Don't waste your time sifting through countless forms on various platforms. Purchase accurate documents from one reliable service!

- Downloading, printing, and completing a professional document is considerably more affordable than hiring an attorney to handle it for you.

- To start, complete your registration by providing your email and creating a secure password.

- Follow the steps below to set up your account and obtain the Arizona Living Trust Property Record template to address your needs.

- Utilize the Preview feature or review the document details (if available) to ensure that the form is what you require.

- Verify its applicability in your jurisdiction.

- Click Buy Now to place your order.

- Select a desired pricing option.

- Create your account and pay using your credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

In Arizona, inheritances are typically considered separate property, meaning your spouse does not automatically have a claim to them. However, if you co-mingle inherited assets with marital property, they may be viewed differently. To protect your inheritance and organize your interests effectively, ensure your Arizona Living Trust Property Record is comprehensive and well-documented.

In Arizona, marital property generally includes assets acquired during the marriage, regardless of how they are titled. This can encompass real estate, bank accounts, and other belongings gained while married. Understanding what qualifies as marital property is essential, especially when dealing with your Arizona Living Trust Property Record, which could involve assets shared between spouses.

Arizona has specific rules governing trusts, primarily defined under state law. A trust must have a clear purpose, a designated trustee, and a specified benefit for beneficiaries. To navigate these requirements effectively, consider maintaining a detailed Arizona Living Trust Property Record, which can help manage trust assets and ensure compliance.

In Arizona, trusts can be treated as marital property depending on the circumstances. If a trust was created during the marriage and funded with marital assets, it may qualify as marital property. Therefore, it is crucial to keep clear records of your Arizona Living Trust Property Record to understand how it may impact your spouse's rights.

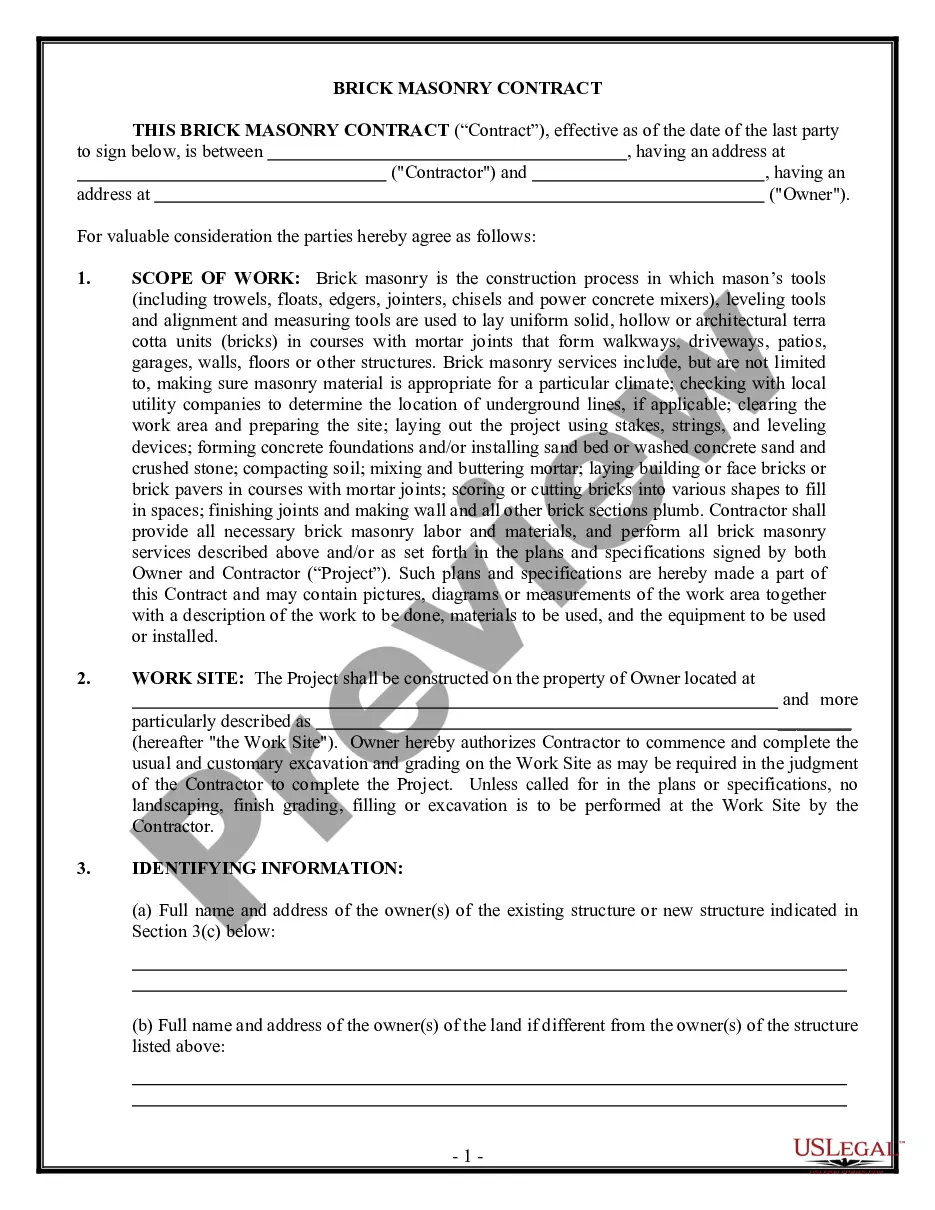

To put your house in a trust in Arizona, you will first establish the trust document, outlining the terms and beneficiaries. Next, you will need to change the title of your property to reflect the trust's name. This process is crucial for the Arizona Living Trust Property Record, ensuring that your property is properly included and protected under the trust. Consider using platforms like uslegalforms for guidance and templates to streamline this process.

The best trust for your house depends on your specific circumstances. Generally, a revocable living trust offers flexibility and control, allowing you to maintain ownership while facilitating easy transfer upon your death. Setting up this type of trust in Arizona ensures your property remains in the Arizona Living Trust Property Record, simplifying the probate process for your beneficiaries.

While it is not a legal requirement to hire an attorney to set up a trust in Arizona, it is highly recommended. Establishing a living trust can involve complex legalities, especially concerning the Arizona Living Trust Property Record. An experienced attorney can help ensure that your trust is set up correctly, meets your needs, and provides the protection you desire.

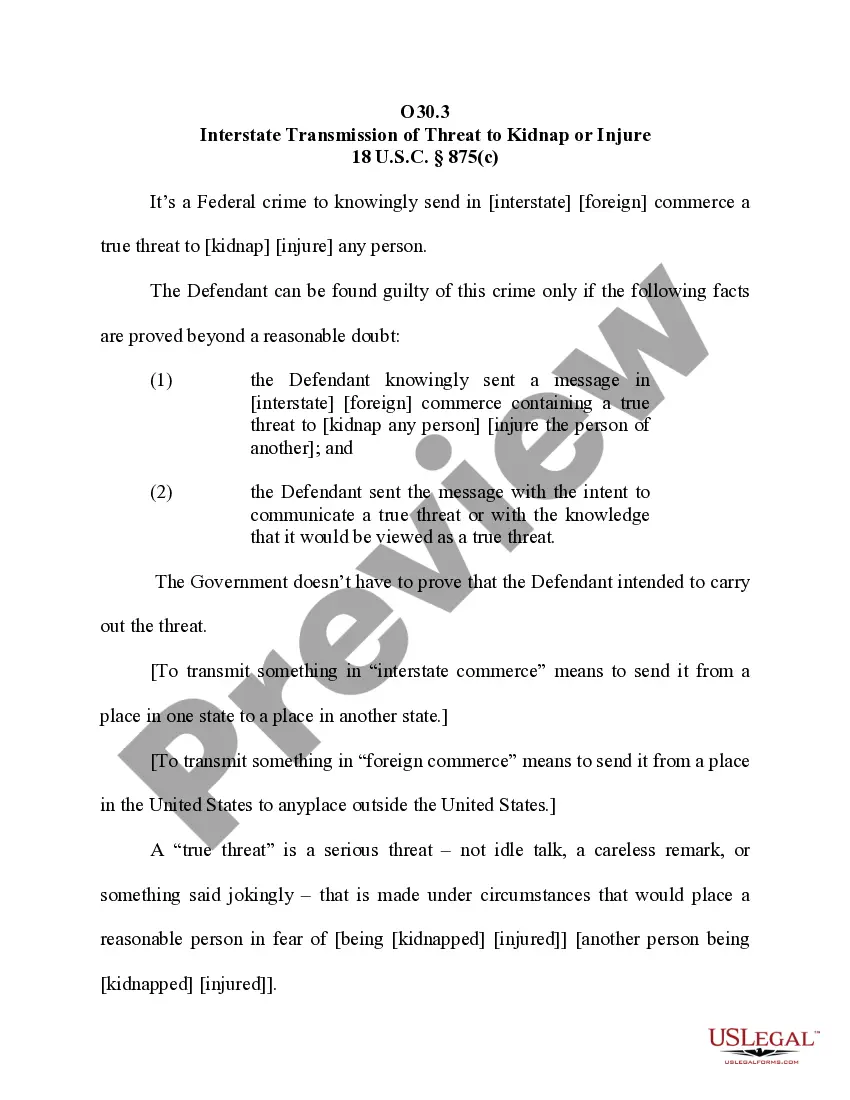

A trust in Arizona is valid if it meets specific criteria, including having a clear intent to create a trust and identifying trust property, beneficiaries, and a trustee. Additionally, the trust must comply with Arizona laws. Always ensure your Arizona Living Trust Property Record reflects these elements accurately to avoid any future disputes.

Yes, you can create your own living trust in Arizona, but it's crucial to ensure it meets state requirements. While using templates may be tempting, consider consulting with a legal expert to avoid common pitfalls. A properly drafted trust is vital for an accurate Arizona Living Trust Property Record.

You do not record the trust as a whole in Arizona, but you must record the deed that transfers the property into the trust. Make sure to file this deed with the county recorder where the property is located. Keeping an organized Arizona Living Trust Property Record can help you manage your estate efficiently.