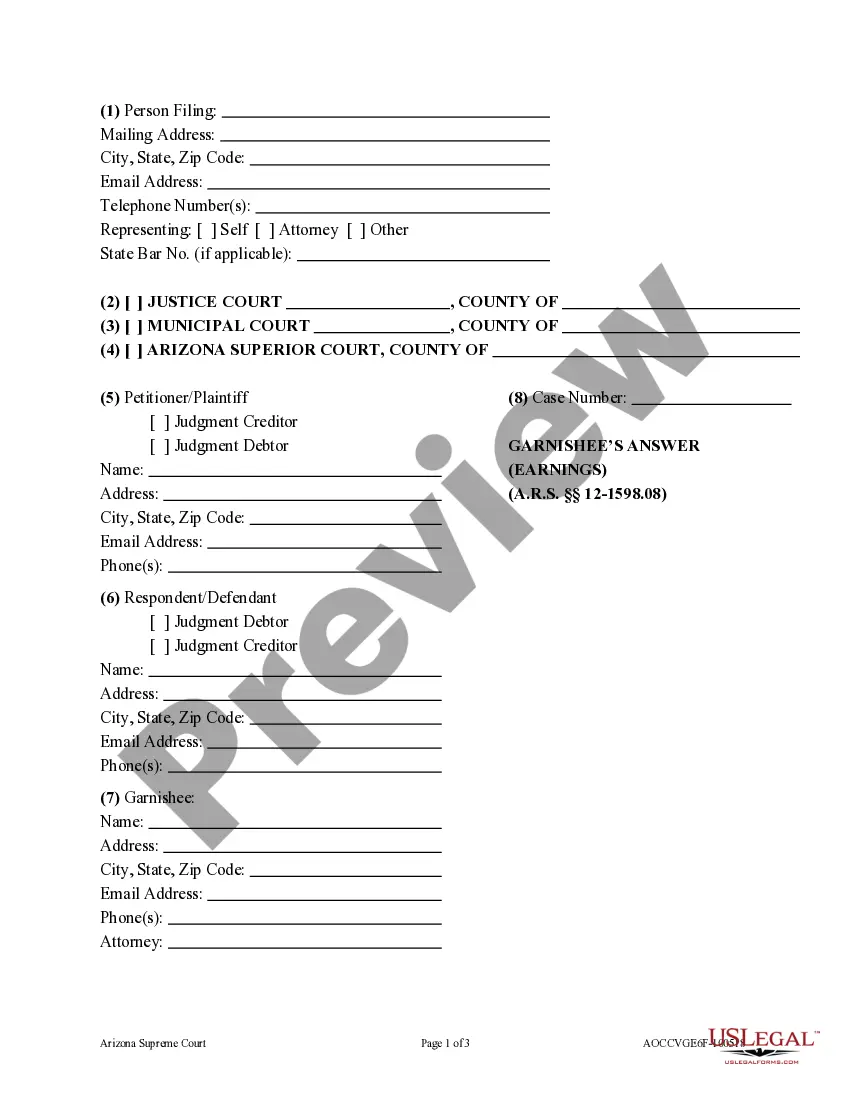

Arizona Garnishee's Answer is a form used by a creditor or debtor to answer a garnishment request from a court. It is a written response to a summons issued in a garnishment lawsuit. The answer allows the garnishee (a third-party holding the debtor's assets) to indicate whether they are holding any of the debtor's assets or income. A garnishee must provide information on any assets or income they are holding for the debtor, including bank accounts, wages, and other forms of income or property. The types of Arizona Garnishee's Answer include: 1. The General Answer: This is the most common form of answer and is used when the garnishee has no knowledge of any assets or income of the debtor. 2. The Denial Answer: This answer is used when the garnishee denies that they are holding any assets or income of the debtor. 3. The Partial Answer: This answer is used when the garnishee admits to holding some assets or income of the debtor, but not all. 4. The Full Answer: This answer is used when the garnishee admits to holding all the debtor's assets or income.

Arizona Garnishee's Answer

Description

How to fill out Arizona Garnishee's Answer?

Drafting legal documents can be quite a hassle if you lack pre-made fillable templates. With the US Legal Forms online collection of official documents, you can be assured of the accuracy of the forms you receive, as all of them comply with national and local laws and are validated by our experts.

Acquiring your Arizona Garnishee's Answer from our collection is as easy as 1-2-3. Existing users with a valid subscription simply need to Log In and click the Download button once they find the appropriate template. Later, if necessary, users can retrieve the same document from the My documents section of their account. However, if you are new to our service, registering for a valid subscription will only take a few moments. Here’s a concise guide for you.

Haven’t you utilized US Legal Forms yet? Subscribe to our service today to acquire any official document promptly and effortlessly whenever you need it, and keep your paperwork organized!

- Verification of document compliance. You should carefully examine the content of the form you intend to use and ensure it meets your requirements and adheres to your state regulations. Reviewing your document and checking its general overview will assist you in this process.

- Optional alternative search. If there are any discrepancies, explore the library using the Search tab above until you discover the suitable template, and click Buy Now when you identify the one you need.

- Account creation and form acquisition. Register for an account with US Legal Forms. After verification of your account, Log In and choose your desired subscription plan. Proceed with payment (PayPal and credit card options are available).

- Template downloading and additional use. Select the file format for your Arizona Garnishee's Answer and click Download to save it onto your device. Print it for manual completion, or utilize a multi-featured online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

If after December 5, 2022, then the new law which only allows for 10% garnishment is in place. The employer should look at the garnishment package to see when the judgment was effective as that will dictate whether 25% or 10% of the employee's non-exempt disposable earnings can be garnished.

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in ance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.

If your wages are being garnished, and you have no way to stop the garnishment, then, at a minimum, you can request that the amount garnished be reduced. You do this by submitting a request for hearing to the court, on a form that you should have received with the garnishment paperwork.

Some examples of earnings include wages, salaries, commissions, bonuses, or other compensation. Generally, only 25% of a judgment debtor's disposable earnings may be garnished. If a judgment debtor proves extreme financial hardship, a judicial officer may reduce this percentage to not less than 15% (see A.R.S.

If after December 5, 2022, then the new law which only allows for 10% garnishment is in place. The employer should look at the garnishment package to see when the judgment was effective as that will dictate whether 25% or 10% of the employee's non-exempt disposable earnings can be garnished.

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

The Writ of Garnishment and Summons is an order from the court requiring you to immediately withhold nonexempt earnings from the judgment debtor. Please make copies of this form before completing for use in future pay periods.

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in ance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.