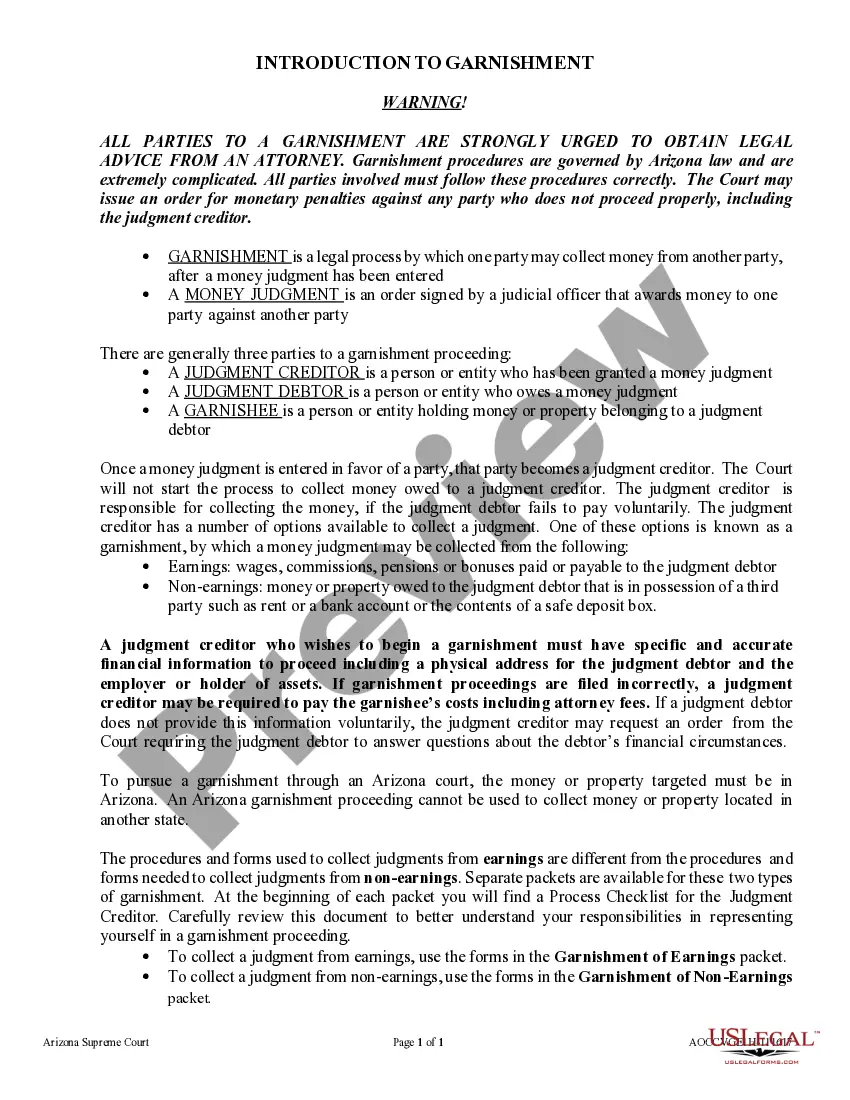

Arizona Introduction to Garnishment is a process by which creditors can collect on unpaid debts. It is a legal procedure that allows creditors to collect a portion of a debtor's wages and/or assets to satisfy a debt. In order to secure a garnishment, a creditor must first obtain a court order. Once the court order is obtained, the creditor can then send notice to the debtor's employer to withhold a certain amount of the debtor's wages. There are two types of Arizona Introduction to Garnishment: wage garnishment and bank garnishment. Wage garnishment is a process by which creditors can collect on unpaid debts by directly taking a portion of the debtor's wages. Bank garnishment is a process by which creditors can collect on unpaid debts by taking money from the debtor's bank account. In both wage and bank garnishment, the creditor must obtain a court order before proceeding. The court order is then sent to the debtor's employer or bank, and the designated funds are withheld and sent to the creditor. Both wage and bank garnishment can be a powerful tool for creditors to collect on an unpaid debt, and is a common practice in the state of Arizona.

Arizona Introduction to Garnishment

Description

How to fill out Arizona Introduction To Garnishment?

If you are searching for a method to effectively prepare the Arizona Introduction to Garnishment without employing a legal professional, then you have found the right place.

US Legal Forms has established itself as the most comprehensive and reputable repository of official templates for every personal and business circumstance. Each document you discover on our online service is crafted in accordance with federal and state statutes, ensuring your files are compliant.

Another excellent feature of US Legal Forms is that you will never lose the documents you acquired - you can access any of your downloaded files in the My documents section of your profile whenever you need them.

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its description or examining the Preview mode.

- Type the form title into the Search tab at the top of the page and select your state from the dropdown menu to find an alternative template if you note any discrepancies.

- Conduct another content review and click Buy now when you are confident in the documentation's adherence to all requirements.

- Log In to your account and select Download. Sign up for the service and select a subscription plan if you do not already possess one.

- Utilize your credit card or PayPal method to pay for your US Legal Forms subscription. The blank will be ready for download immediately after.

- Decide on the format you prefer for your Arizona Introduction to Garnishment and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

A writ of garnishment in Arizona remains valid for up to 120 days from the issuance date. After this period, if further action is needed, a new writ can be requested. Staying aware of this timeframe is essential for both creditors seeking to collect debts and debtors wishing to resolve their financial obligations. For those needing guidance, the Arizona Introduction to Garnishment offers valuable information on this topic.

In Arizona, a writ of execution is typically valid for six months from the date it is issued. If the creditor does not execute the writ within this time frame, they must reapply for a new writ. It's important to manage the timing carefully to ensure that the collection process is efficient. Understanding timelines, such as those related to an Arizona Introduction to Garnishment, can help both creditors and debtors navigate these issues more smoothly.

To stop wage garnishment in Arizona, you can file a motion for relief with the appropriate court. This motion can argue that the garnishment is unjust or that it places an undue burden on you. It is essential to provide supporting documents and evidence to strengthen your case. Utilizing platforms like US Legal Forms can help simplify this process by providing the necessary forms and guidance needed to effectively stop wage garnishment.

The statute governing garnishments in Arizona can be found in Title 12 of the Arizona Revised Statutes. This statute outlines the rules and procedures for initiating garnishments, including the limits on how much of a debtor's wages can be garnished. Understanding this law is crucial for both creditors and debtors involved in the garnishment process. The Arizona Introduction to Garnishment provides further insights into these legal guidelines.

In Arizona, you can stop a garnishment relatively quickly by filing a motion with the court. The process generally involves providing a valid reason or evidence of a legal error in the garnishment order. Once submitted, the court will review your motion and make a decision. By taking this step, you can effectively address your garnishment situation in a timely manner.

Calculating Arizona garnishment involves figuring out your disposable income and applying the state’s established percentage limits. This percentage varies depending on the type of debt owed. The Arizona Introduction to Garnishment serves as a valuable resource, providing clear guidelines that can simplify the calculation process.

In Arizona, the garnishment limit restricts the amount that can be taken from your wages to prevent undue hardship. Generally, this limit is set based on a percentage of your disposable income. Familiarizing yourself with the Arizona Introduction to Garnishment helps you understand these limits and protect yourself from excessive deductions.

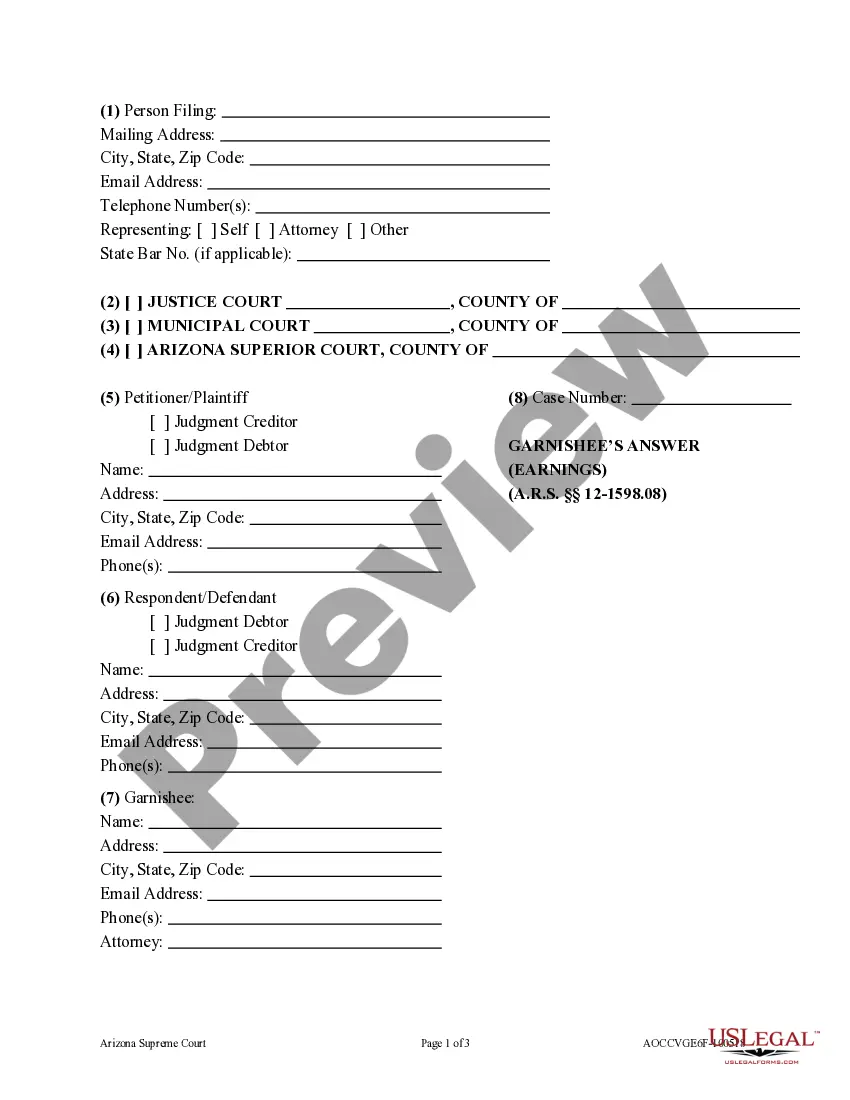

Filing a garnishee answer in Arizona involves completing specific court documents that respond to the garnishment request. You will need to disclose the amount owed and any associated details. The Arizona Introduction to Garnishment can guide you through the necessary steps, ensuring you comply with legal requirements.

To claim exemption from wage garnishment in Arizona, you must file a claim in court. This involves stating your case and providing evidence that your wages are protected under the law. The Arizona Introduction to Garnishment details the exemptions available, such as for low-income earners, allowing you to better navigate this process.

The new garnishment law in Arizona provides updated guidelines on how wages can be garnished for debts. It aims to protect borrowers by offering clearer terms on the process and limits. Importantly, understanding the Arizona Introduction to Garnishment is essential for anyone facing this situation, as it outlines your rights and responsibilities.