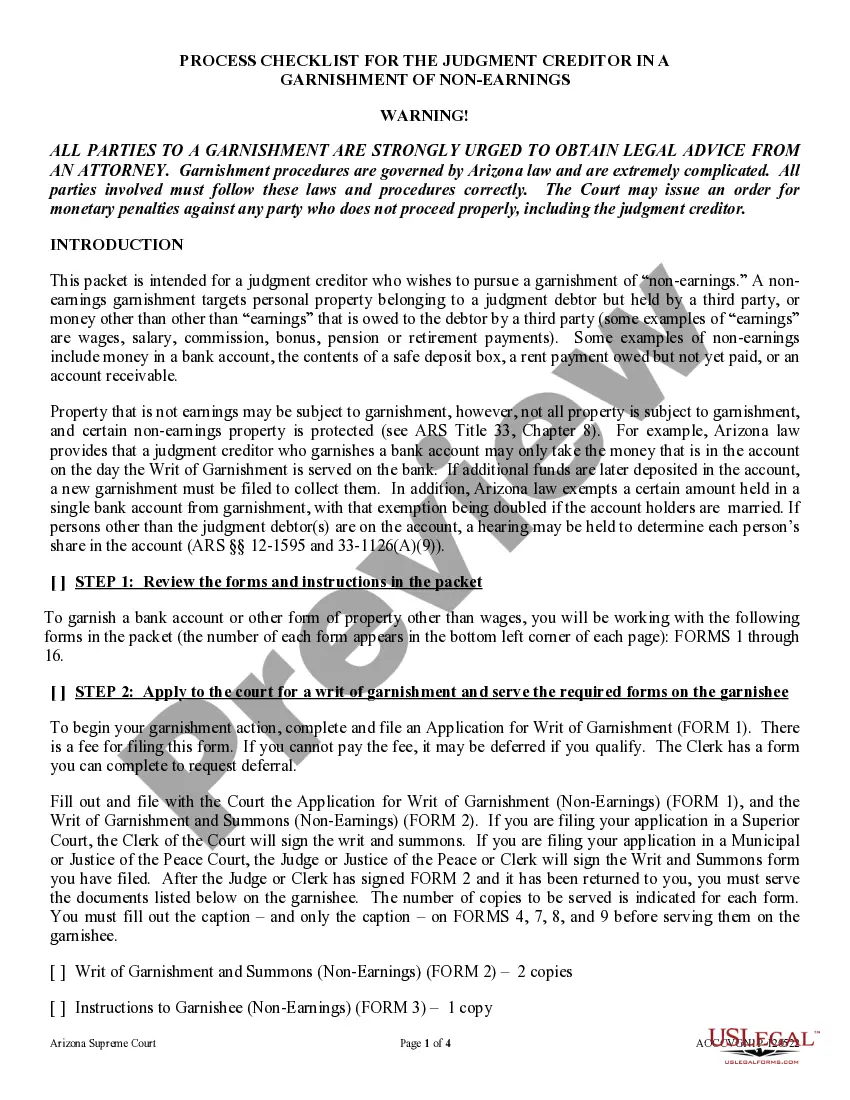

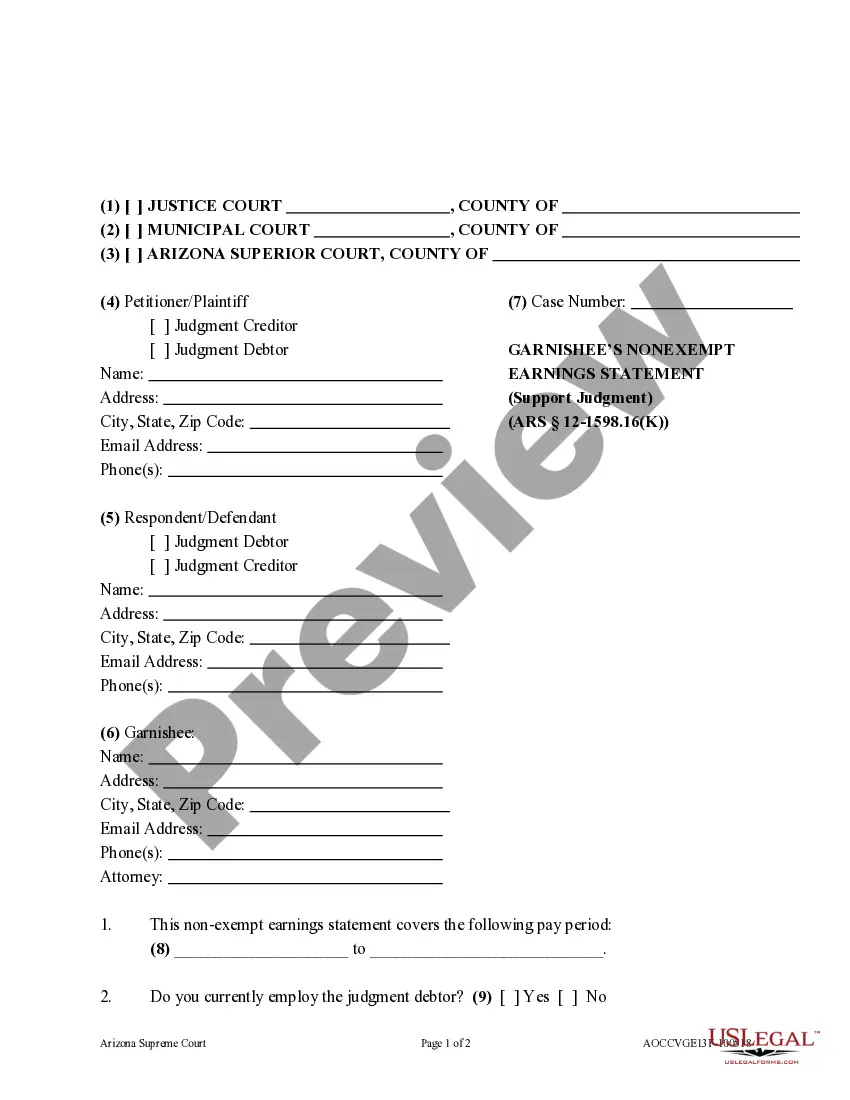

The Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings is a series of steps that must be taken in order to collect a judgment from a debtor’s wagesChecklistsst includes: 1. Drafting a Writ of Garnishment: The Judgment Creditor must first draft a Writ of Garnishment that includes the debtor’s name, social security number, and the amount to be garnished from the wages. 2. Serving the Writ of Garnishment: The Writ of Garnishment must then be served on the employer. 3. Filing the Writ of Garnishment: The Judgment Creditor must then file the Writ of Garnishment with the court. 4. Issuance of the Writ of Garnishment: Once the Writ of Garnishment is filed, the Court must issue the Writ of Garnishment. 5. Service of the Writ of Garnishment: The Writ of Garnishment must then be served on the debtor. 6. Receiving the Funds from the Garnishment: The Judgment Creditor will then receive the funds from the garnishment directly from the employer. 7. Filing a Satisfaction of Judgment: The Judgment Creditor must then file a Satisfaction of Judgment with the court, once the judgment has been fully paid. Different types of Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings may include: • Garnishment of Wages from an Employer; • Garnishment of Funds from a Bank Account; • Garnishment of Funds from a Third Party; • Garnishment of Funds from a Real Property Lien; • Garnishment of Funds from a Personal Property Lien.

Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings

Description

How to fill out Arizona Process Check List For The Judgment Creditor In A Garnishment Of Earnings?

US Legal Forms is the easiest and most lucrative way to find appropriate official templates.

It’s the largest online repository of corporate and personal legal documents drafted and verified by legal experts.

Here, you can discover printable and editable templates that adhere to federal and state regulations - just like your Arizona Process Check List for the Judgment Creditor in an Earnings Garnishment.

Review the form description or preview the document to ensure you’ve identified the one that meets your requirements, or search for another using the search tab above.

Click Buy now when you’re confident about its suitability for your needs, and select the subscription plan that you prefer most.

- Acquiring your template involves just a few straightforward steps.

- Customers with an existing account and a valid subscription only need to sign in to the online service and download the form to their device.

- Subsequently, they can locate it in their profile under the My documents section.

- And here’s how you can obtain a correctly drafted Arizona Process Check List for the Judgment Creditor in an Earnings Garnishment if you’re using US Legal Forms for the first time.

Form popularity

FAQ

Judgments in Arizona remain valid for 10 years and can be renewed for additional 10-year increments. This long duration provides creditors ample opportunity to enforce the judgment and collect the owed debt. By referring to our Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings, you can stay organized and informed about the validity and any necessary actions to extend your judgment.

In Arizona, a creditor can pursue collection on a judgment for a maximum of 10 years. After this period, the creditor must renew the judgment to continue pursuing collection efforts. Utilizing our Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings will ensure you understand renewal requirements and timelines, helping you maximize your collection efforts.

Debts in Arizona generally become uncollectible after a period of six years, similar to the statute of limitations for suing for debts. If a creditor does not act within this timeframe, they may lose their legal right to collect the debt. Our Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings provides detailed guidance on managing your collections effectively, ensuring that you stay informed about your rights and timelines.

In Arizona, creditors can pursue legal action for unpaid debts for up to six years from the date of your last payment or acknowledgment of the debt. This time frame applies to most types of debt, including personal loans and credit card debts. Understanding this timeline is essential for any creditor, which is why our Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings can help you keep track of key deadlines and actions.

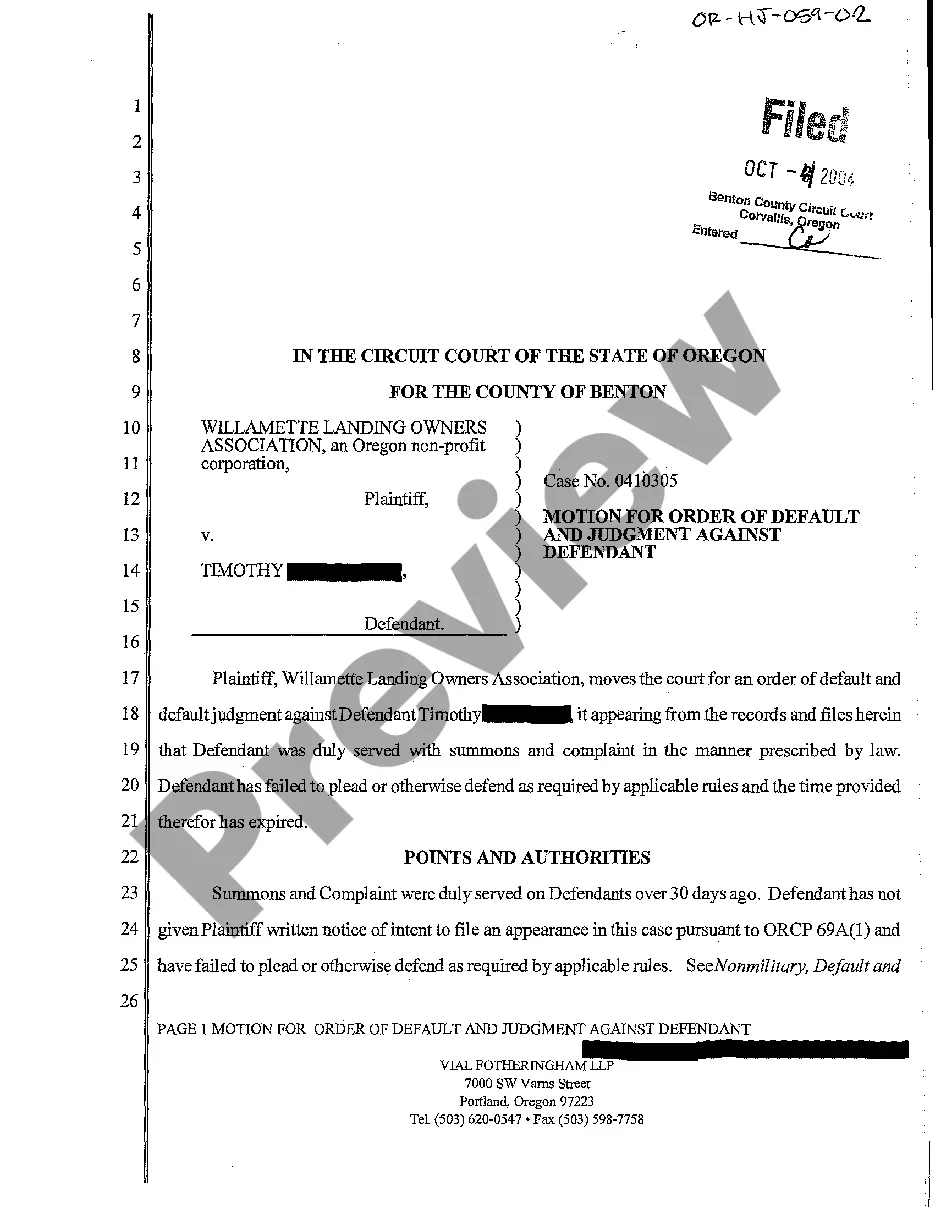

To enforce a judgment in Arizona, you must first obtain a certified copy of the judgment. Following that, the Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings will guide you through the enforcement process. It is vital to be aware of the methods available, such as wage garnishment, to collect the owed amount. Utilizing platforms like USLegalForms can provide you with the necessary documents and guidance for a seamless enforcement experience.

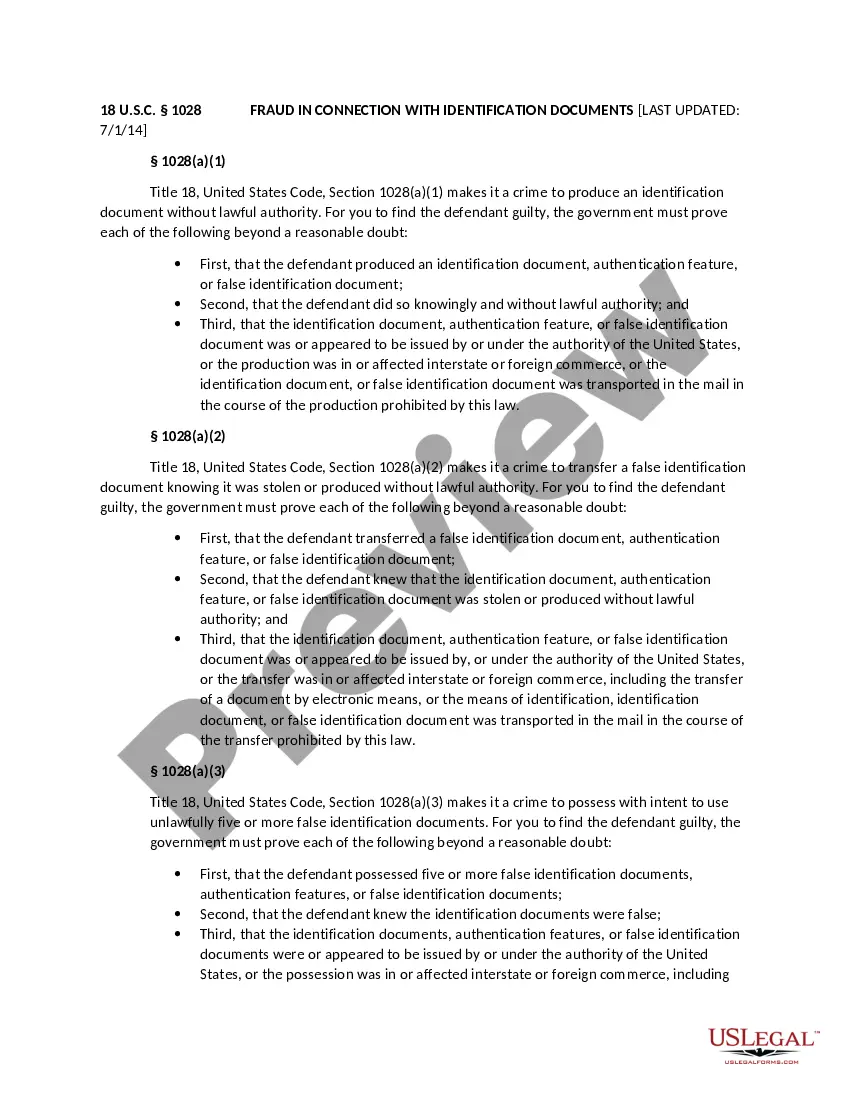

Yes, creditors can garnish wages in Arizona. However, they must follow specific legal procedures outlined in the Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings. This process ensures that the garnishment is valid and legal, providing rights and protections to both creditors and debtors. Understanding these procedures helps you navigate wage garnishment effectively.

The most that can be garnished from your paycheck in Arizona is generally set at 25% of your disposable earnings. Nonetheless, this can vary based on specific cases, such as student loans or child support. Understanding these guidelines can significantly impact your financial situation, making the Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings an important resource for both creditors and individuals.

Recent changes to garnishment laws in Arizona may affect how creditors approach wage garnishment. The new laws are designed to balance creditor rights while protecting debtors from excessive deductions. Staying updated on such changes is crucial, and referring to the Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings can help you navigate these updates effectively.

Garnishment processing involves several steps, including filing a complaint, obtaining a judgment, and serving a writ of garnishment on the employer. The employer must promptly comply with the garnishment order, which requires them to withhold a specified portion of the employee's wages. Understanding this process ensures that creditors follow legal guidelines correctly, and the Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings provides essential insights into these procedures.

The maximum amount that can be garnished from a paycheck in Arizona typically caps at 25% of your disposable income. This is a standard rule, although specific types of debts, such as child support, may have different limits. It's crucial to stay informed, and utilizing the Arizona Process Check List for the Judgment Creditor in a Garnishment of Earnings can help navigate these complicated regulations effectively.