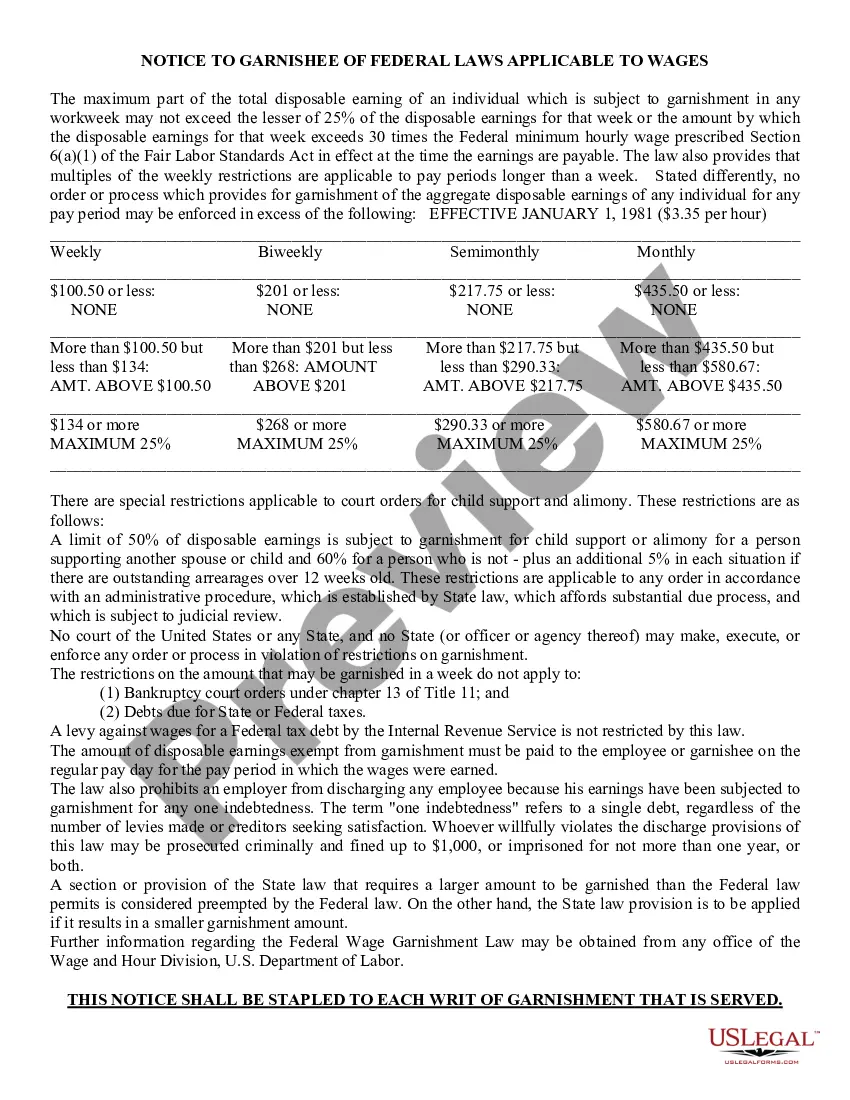

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Garnishee of Federal Law to Wages, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Arizona Notice to Garnishee of Federal Law to Wages

Description Garnishee Law Order

How to fill out Arizona Notice To Garnishee Of Federal Law To Wages?

If you're attempting to locate precise Arizona Notice to Garnishee of Federal Law to Wages samples, US Legal Forms is what you require; obtain documents supplied and verified by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from hassles related to legal paperwork; it also saves you time, effort, and money! Downloading, printing, and completing a professional template is considerably less expensive than having an attorney do it for you.

And there you have it. With just a few simple steps, you will have an editable Arizona Notice to Garnishee of Federal Law to Wages. After creating your account, all future orders will be processed even more easily. When you have a US Legal Forms subscription, simply Log In/">Log In to your account and click the Download option found on the forms webpage. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time searching through countless forms on multiple platforms. Obtain accurate templates from a single secure source!

- Initiate by completing your registration process by entering your email and creating a password.

- Follow the instructions below to establish your account and acquire the Arizona Notice to Garnishee of Federal Law to Wages template to address your issue.

- Utilize the Preview option or review the document description (if available) to confirm that the template is what you desire.

- Verify its legality in your residing state.

- Click Buy Now to place an order.

- Choose a preferred payment plan.

- Create an account and settle payment with your credit card or PayPal.

- Select an appropriate file format and store the document.

Form popularity

FAQ

The recent garnishment law in Arizona introduces changes aimed at enhancing consumer protections against excessive wage deductions. These updates emphasize the importance of adhering to the Arizona Notice to Garnishee of Federal Law to Wages. It's vital for both consumers and employers to stay informed about these changes to ensure compliance and protection. Utilizing resources from platforms like uslegalforms can provide clarity on how these laws apply to your particular situation.

The Predatory Debt Collection Act in Arizona protects residents from abusive collection practices. This act establishes clear guidelines for debt collectors, ensuring they act fairly and transparently. Under the Arizona Notice to Garnishee of Federal Law to Wages, these protections extend to prevent excessive wage garnishments from taking place. Knowing your rights under this act can help you navigate interactions with debt collectors more confidently.

Arizona has specific rules that govern wage garnishments, which include providing notice to the employee and following legally mandated procedures. The Arizona Notice to Garnishee of Federal Law to Wages outlines conditions under which garnishments may be executed. These rules aim to offer protection to workers while ensuring creditors have a fair opportunity to collect debts. Familiarizing yourself with these regulations will empower you to safeguard your rights.

In Arizona, an employer is obligated to honor a legally executed wage assignment as long as it complies with state laws. However, a wage assignment cannot exceed the limits set by the Arizona Notice to Garnishee of Federal Law to Wages. Understanding your rights and the legal requirements can assist you when dealing with wage assignments. If you're unsure, reviewing your situation with a legal expert can provide clarity.

In Arizona, the maximum amount that can be garnished from your wages is limited to 25% of your disposable earnings. This regulation is in place to protect your financial well-being. The Arizona Notice to Garnishee of Federal Law to Wages ensures that garnishments remain fair and manageable. It's important to know these limits to plan your finances effectively.

Proposition 209 in Arizona aims to regulate wage garnishments, including how and when they can occur. This legislation ensures that your earnings are protected from excessive deductions. The law specifies guidelines for organizations that seek to garnish wages through processes like the Arizona Notice to Garnishee of Federal Law to Wages. Understanding this measure helps you maintain financial stability during a garnishment.

The statute governing garnishments in Arizona sets out the legal framework and procedures creditors must follow to garnish wages or bank accounts. This includes specific guidelines on how much can be garnished and the notification process you must receive, such as the Arizona Notice to Garnishee of Federal Law to Wages. Understanding these statutes is crucial if you want to protect your rights and address any garnishment effectively.

In Arizona, a writ of garnishment remains valid for six months. If the creditor fails to act on it within that timeframe, they may need to obtain a new writ. The Arizona Notice to Garnishee of Federal Law to Wages details the limitations and implications of this timeframe. Knowing this information can empower you to respond appropriately if you face garnishment.

A writ of execution is generally valid for a period of five years in Arizona. This length can affect how long a creditor has to enforce a judgment against you. It is advisable to stay informed about the timeline mentioned in your Arizona Notice to Garnishee of Federal Law to Wages to avoid any unexpected actions. Understanding these timelines can help you plan your finances better.

You can potentially stop a garnishment quickly by filing a claim of exemption or other legal motions. This process may vary depending on the circumstances and the timing of the garnishment. An Arizona Notice to Garnishee of Federal Law to Wages can help guide you through the necessary steps to take. Consulting with a legal professional can enhance your chances of success in halting the garnishment swiftly.