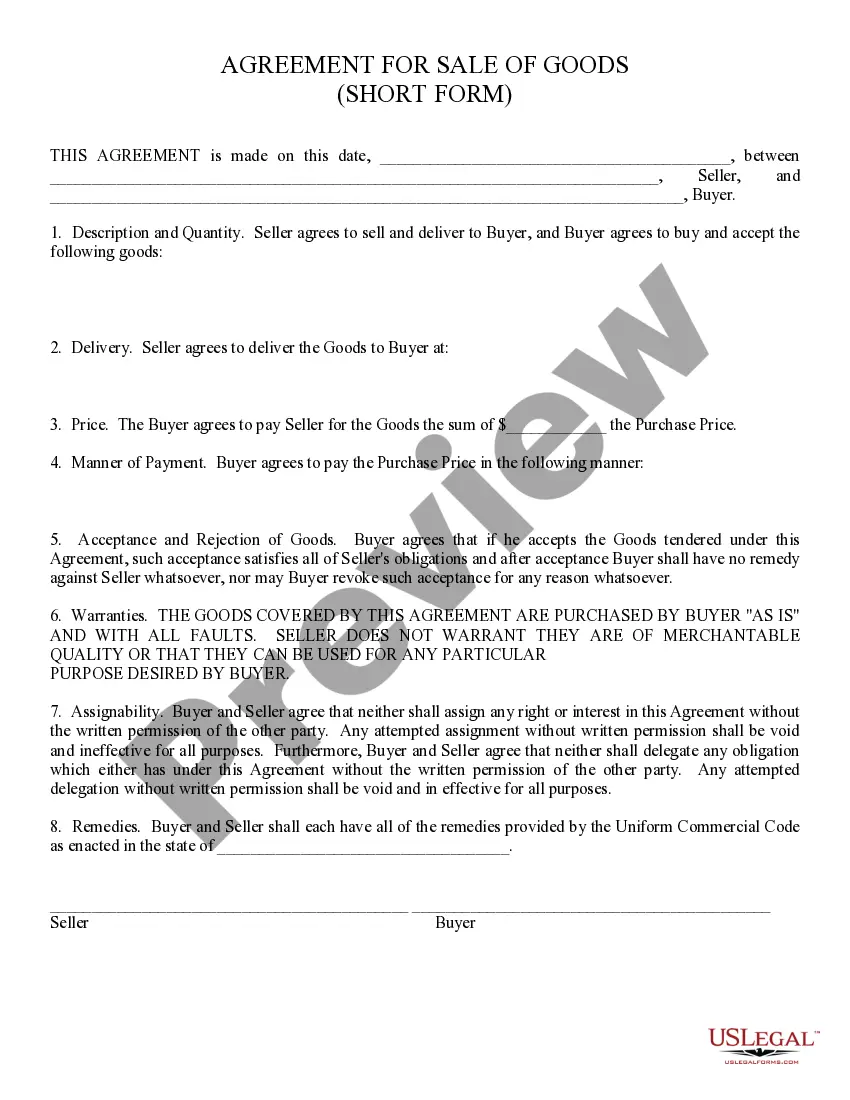

Sale of Goods, Short Form: This is a simple agreement between a Buyer and Seller for specific goods. It details what is to be sold, as well as the price. Both the Buyer and the Seller are to sign the contract. This form is available in both Word and Rich Text formats.

Arizona Sale of Goods, Short Form

Description

How to fill out Arizona Sale Of Goods, Short Form?

If you are in search of accurate Arizona Sale of Goods, Short Form examples, US Legal Forms is what you require; obtain documents created and reviewed by state-authorized legal experts.

Utilizing US Legal Forms not only alleviates concerns regarding legal documents; furthermore, you save effort, time, and money!

And that’s all. With just a few simple clicks, you receive an editable Arizona Sale of Goods, Short Form. Once you establish an account, all future purchases will be processed even more easily. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download option found on the form’s page. Then, when you need to access this template again, you'll always be able to find it in the My documents section. Don’t waste your time comparing numerous forms on different sites. Purchase accurate copies from a single secure source!

- Downloading, printing, and completing a professional template is significantly cheaper than hiring an attorney to do it on your behalf.

- To begin, complete your registration process by entering your email and setting up a password.

- Follow the instructions below to create an account and obtain the Arizona Sale of Goods, Short Form template to address your situation.

- Use the Preview option or review the file details (if available) to ensure that the sample is the one you desire.

- Verify its applicability to your location.

- Click Buy Now to place your order.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select an appropriate format and save the document.

Form popularity

FAQ

In Arizona, the frequency for filing sales tax reports depends on your TPT license classification. Businesses with higher tax liabilities may be required to file monthly, while others can file quarterly or annually. Staying proactive in filing is essential for those working on the Arizona Sale of Goods, Short Form.

The TPT filing frequency in Arizona is based on your total tax liability. Businesses may file monthly, quarterly, or annually, depending on their sales volume. Understanding this frequency is crucial for compliance, especially for those involved in the Arizona Sale of Goods, Short Form.

In Arizona, short-term capital gains tax is taxed as ordinary income. This means any profits from assets held for one year or less will be subject to the state's income tax rates. Businesses engaging in the Arizona Sale of Goods, Short Form should be mindful of these implications.

Arizona Form 140NR is the Non-Resident Personal Income Tax Return form used by individuals who earn income in Arizona without being residents. This form is significant for addressing tax obligations, especially for those engaging in business activities related to the Arizona Sale of Goods, Short Form.

The TPT rate in Arizona varies depending on the city and type of business conducted. Generally, rates range from 0.5% to 11.2%. It is vital for businesses in the Arizona Sale of Goods, Short Form to stay informed about local rates for accurate tax calculations.

A TPT license in Arizona is generally valid for an indefinite period, provided the business remains compliant with state laws. However, businesses must file renewals and remain active to keep their licenses. This is particularly important for those involved in the Arizona Sale of Goods, Short Form.

To calculate Arizona sales tax, first determine the applicable TPT rate for your business type and location. Multiply your gross sales amount by this rate to find the tax owed. This process is essential for businesses dealing in the Arizona Sale of Goods, Short Form, ensuring accurate tax reporting.

Arizona Transaction Privilege Tax (TPT) is often confused with sales tax, but they are distinct. TPT is a tax on the privilege of conducting business in Arizona, while sales tax applies to the sale of goods. Understanding this difference is crucial for compliance when engaging in the Arizona Sale of Goods, Short Form.

Business code 605 in Arizona refers to businesses engaged in retail activities related to the sales of goods. This code is crucial for categorizing your business correctly for tax purposes. Understanding your business code helps streamline your compliance with state tax regulations, particularly when dealing with the Arizona Sale of Goods, Short Form.

Your Arizona TPT number can be found in the documentation provided when you registered for a TPT license. If you are having trouble locating it, you may log into your online account with the Arizona Department of Revenue or contact them directly. Accurately managing your TPT number is essential for businesses involved in Arizona Sale of Goods, Short Form.