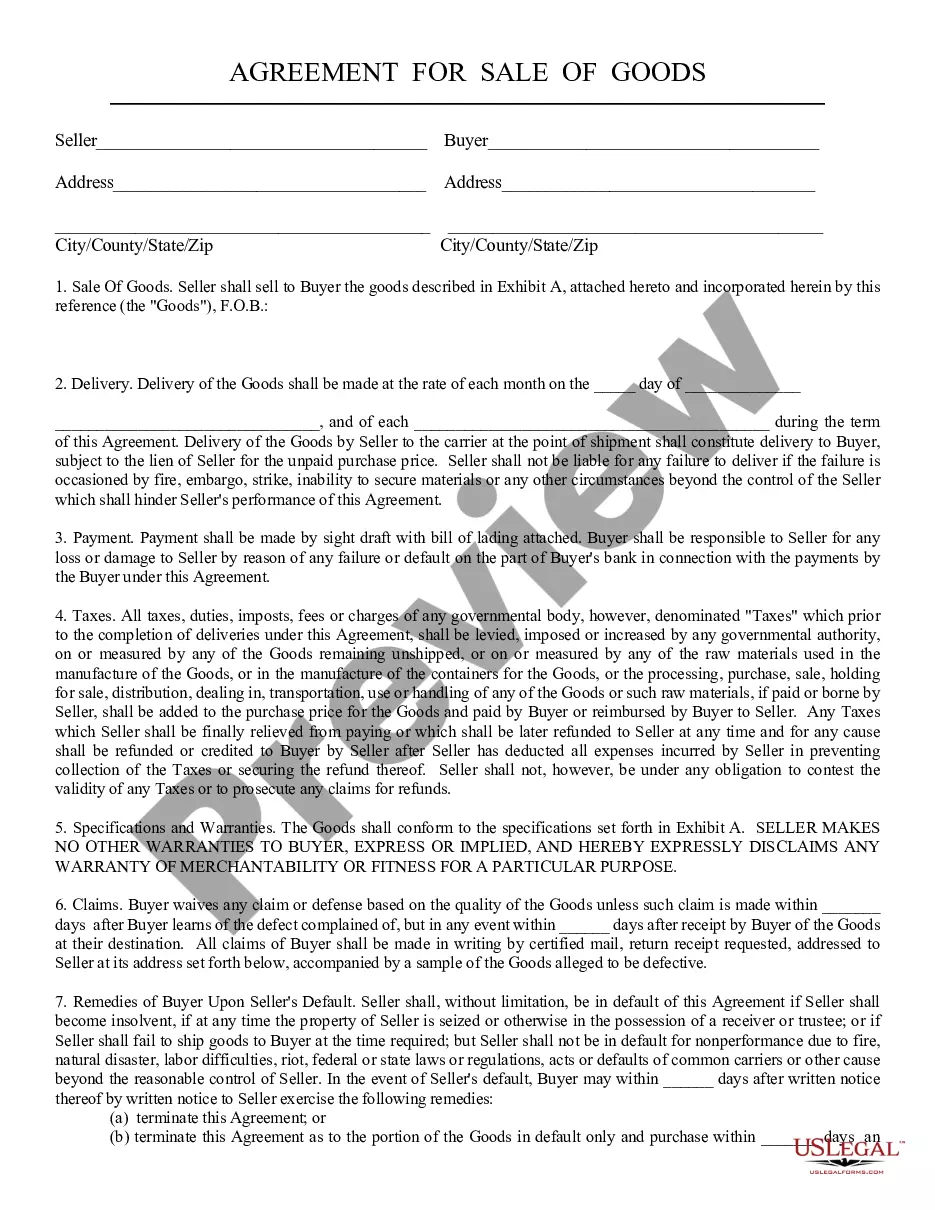

Sale of Goods - General: This Sale of Goods states the goods to be sold by the Buyer to the Seller. It further lists any conditions such as delivery and/or payment methods. This form is available in both Word and Rich Text formats.

Arizona Sale of Goods, General

Description

How to fill out Arizona Sale Of Goods, General?

If you are looking for proper Arizona Sale of Goods, General copies, US Legal Forms is what you require; obtain documents crafted and validated by state-licensed lawyers.

Using US Legal Forms not only alleviates concerns about legal documents; you also save effort, time, and finances! Downloading, printing, and completing a professional template is considerably more economical than asking an attorney to do it for you.

And there you go. In just a few simple clicks, you have an editable Arizona Sale of Goods, General. Once you establish your account, all future requests will be processed even more efficiently. If you have a US Legal Forms subscription, simply Log In/">Log In to your profile and click the Download option you see on the form's page. Then, when you need to use this template again, you will always be able to find it in the My documents section. Don't waste your time comparing various forms on multiple websites. Get accurate templates from one secure platform!

- To begin, complete your registration by entering your email and generating a secure password.

- Follow the steps outlined below to set up your account and obtain the Arizona Sale of Goods, General template to address your needs.

- Utilize the Preview option or review the file description (if available) to ensure that the sample is the one you need.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Select a recommended payment plan.

- Establish an account and pay using your credit card or PayPal.

Form popularity

FAQ

No, a TPT license and a business license are not the same in Arizona. The TPT license allows you to collect tax on the Arizona Sale of Goods, General, while a business license typically permits you to operate within a specific locality. Be sure to check local requirements, as both licenses may be necessary for compliance.

If you plan to sell goods or services in Arizona, you are required to obtain a Transaction Privilege Tax license. This requirement includes those engaged in the Arizona Sale of Goods, General. Operating without this license can lead to penalties, so it is crucial to apply before starting your business activities.

Getting a TPT license in Arizona typically takes about two to four weeks, depending on your application method. If you apply online through the Arizona Department of Revenue, it may expedite the process. Ensuring your documents are complete and accurate will help you receive your Arizona Sale of Goods, General license faster.

Arizona has a general sales tax known as the Transaction Privilege Tax (TPT). This tax applies to the sale of tangible goods, including the Arizona Sale of Goods, General. It's essential for businesses to understand the tax rate in their locality, as the state allows cities to impose additional taxes on top of the state rate.

To file your Arizona Transaction Privilege Tax (TPT) online, visit the Arizona Department of Revenue's website. You will need to create an account and gather your business details, including your Arizona Sale of Goods, General transactions. Once logged in, follow the prompts to complete your filing accurately and on time.

Getting a Transaction Privilege Tax (TPT) license in Arizona typically takes about 15 business days once you submit your application. You can expedite the process by ensuring that all required documentation is complete and accurate. For businesses involved in the Arizona Sale of Goods, General, having a TPT license is necessary for compliance with state regulations. Proper planning can help minimize delays in this process.

In Arizona, a sales tax ID is essentially the same as a Transaction Privilege Tax (TPT) license number. You can acquire it by applying online through the Arizona Department of Revenue. This process involves submitting your business information and any relevant permits. Possessing this ID is important for accurately managing taxes on your sales in line with the Arizona Sale of Goods, General.

To obtain a seller's permit in Arizona, you must apply for a Transaction Privilege Tax (TPT) license since this acts as your seller’s permit. You can complete the application online through the Arizona Department of Revenue’s website. Be prepared to provide details about your business and expected sales. Having the appropriate permits is vital for your compliance with the Arizona Sale of Goods, General.

Getting a Transaction Privilege Tax (TPT) license in Arizona requires you to complete an application through the Arizona Department of Revenue’s online platform. Make sure to gather all necessary documentation, including your business identification and any permits related to your operations. Once your application is approved, you will receive your TPT license, enabling you to operate within the guidelines of the Arizona Sale of Goods, General.

Applying for an Arizona TPT license involves filling out an application through the Arizona Department of Revenue’s website. You will need to provide various business details, including your business structure and estimated gross income. After submitting your application online, you can expect to receive a confirmation email. This license is crucial for compliance with Arizona Sale of Goods, General regulations.