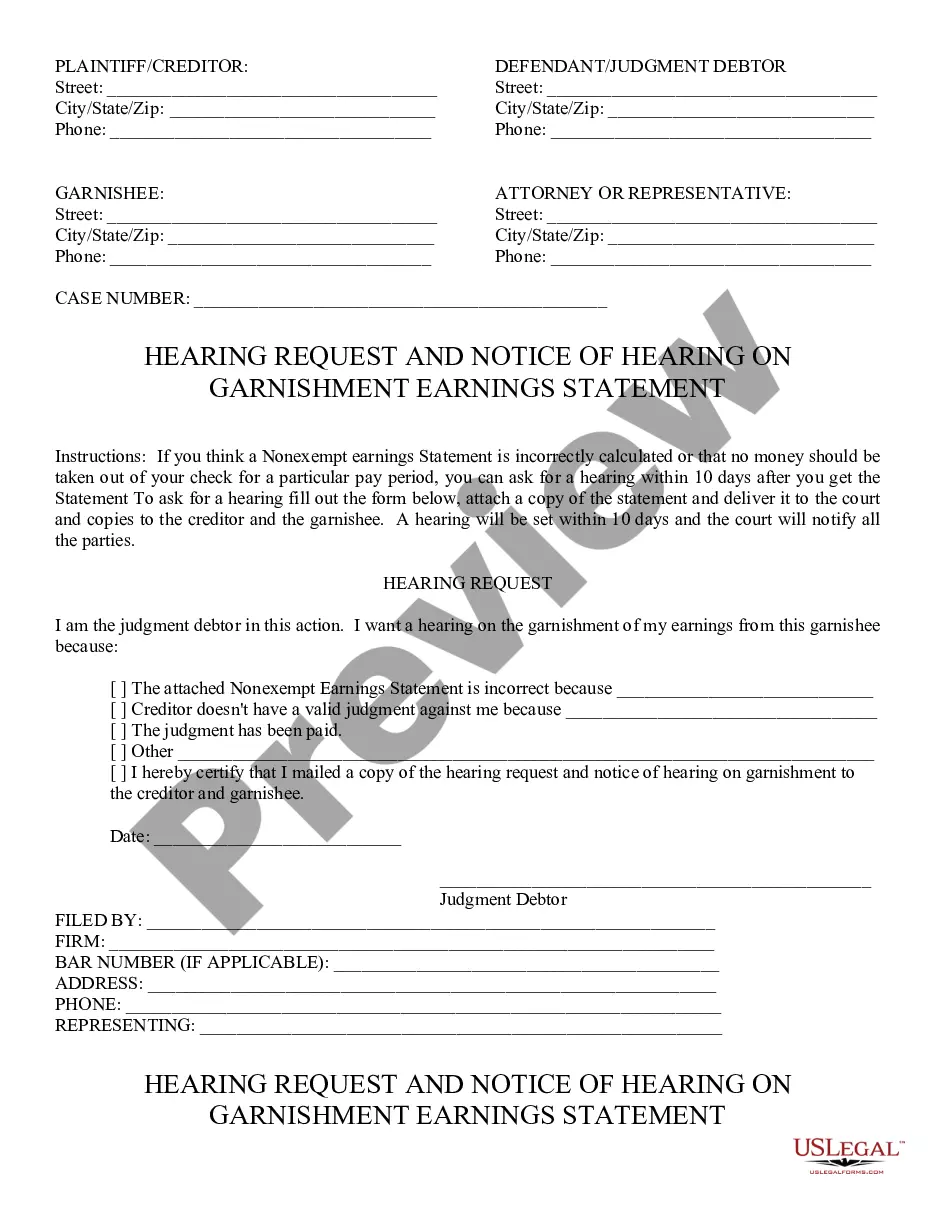

Request; Notice of Hearing on Garnishment Earnings Statement: If a debtor feels the amount garnished is incorrect, he/she files this request for a hearing on the matter. Upon filing the request for a hearing, he/she then files a notice of said hearing, including both the date and time. This form is available for download in both Word and Rich Text formats.

Arizona Request and Notice of Hearing on Garnishment Earnings Statement

Description

How to fill out Arizona Request And Notice Of Hearing On Garnishment Earnings Statement?

If you're seeking accurate Arizona Request and Notice of Hearing on Garnishment Earnings Statement templates, US Legal Forms is what you require; find documents created and validated by state-licensed legal experts.

Using US Legal Forms not only alleviates concerns about legal paperwork; additionally, you conserve time, effort, and money! Downloading, printing, and completing a professional form is significantly more cost-effective than hiring a lawyer to do it for you.

And that’s it. With just a few simple steps, you obtain an editable Arizona Request and Notice of Hearing on Garnishment Earnings Statement. Once you set up your account, all subsequent purchases will be processed even more effortlessly. If you have a US Legal Forms subscription, just Log In to your profile and click the Download button you can find on the form's webpage. Then, whenever you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time searching through countless forms on various web sources. Request accurate copies from a single reliable service!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to create an account and locate the Arizona Request and Notice of Hearing on Garnishment Earnings Statement template to address your needs.

- Utilize the Preview feature or review the document details (if accessible) to confirm that the sample is the one you need.

- Verify its relevance in the state where you reside.

- Click on Purchase Now to place your order.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select an appropriate format and download the form.

Form popularity

FAQ

The most that can be garnished from your paycheck in Arizona is typically 25% of your disposable earnings. However, if your earnings fall below a certain threshold, a lesser amount may be applicable. It is crucial to review the guidelines specified in your Arizona Request and Notice of Hearing on Garnishment Earnings Statement to ensure accurate calculations.

Recent changes to garnishment laws in Arizona aim to provide more protection to debtors while allowing creditors to collect owed amounts. Individuals should ensure they are familiar with any updates to laws that may impact how the Arizona Request and Notice of Hearing on Garnishment Earnings Statement functions, particularly regarding limits and exemptions.

The maximum amount that can be garnished from your wages in Arizona usually stands at 25% of your disposable earnings. It's vital to review your Arizona Request and Notice of Hearing on Garnishment Earnings Statement to understand how this applies to your situation specifically.

Calculating wage garnishment in Arizona involves determining your disposable income, which is your earnings after taxes and mandatory deductions. Once you have the disposable amount, you can use it to figure out the maximum allowed garnishment, typically up to 25%. Utilizing the Arizona Request and Notice of Hearing on Garnishment Earnings Statement can provide further clarification on the calculations.

To stop wage garnishment in Arizona, you should consider filing a claim of exemption or entering into a repayment agreement with your creditor. Consider seeking assistance or guidance through the Arizona Request and Notice of Hearing on Garnishment Earnings Statement process, which provides options to challenge or reduce garnishments effectively.

In Arizona, the maximum garnishment allowed is determined by federal and state laws. Generally, creditors can garnish up to 25% of your disposable earnings. Understanding the details in your Arizona Request and Notice of Hearing on Garnishment Earnings Statement will help you manage your finances better.

A writ of garnishment in Arizona remains valid for 90 days from the date it is issued. If the garnishment is not executed within this timeframe, you may need to seek a new court order. Understanding this duration is vital when dealing with an Arizona Request and Notice of Hearing on Garnishment Earnings Statement, as it can influence your immediate financial planning.

The new legislation for garnishment in Arizona is designed to offer more protection to debtors, especially regarding income thresholds and notification processes. It emphasizes the importance of the Arizona Request and Notice of Hearing on Garnishment Earnings Statement, improving clarity for individuals facing garnishment. Staying informed about these laws can empower you to take appropriate action if you find yourself in this situation.

In Arizona, the law generally allows a maximum garnishment of 25% of your disposable earnings. This will reduce if you have multiple creditors or other factors impacting your income, which you can highlight in your Arizona Request and Notice of Hearing on Garnishment Earnings Statement. Knowing what can be garnished will help you manage your budget and prepare for the potential impact on your finances.

To stop a wage garnishment in Arizona, you can file a motion to quash or set aside the garnishment with the court. You'll then need to present evidence that the garnishment causes significant financial distress. Receiving an Arizona Request and Notice of Hearing on Garnishment Earnings Statement could indicate that swift action is necessary, and using platforms like uslegalforms can guide you through that process effectively.