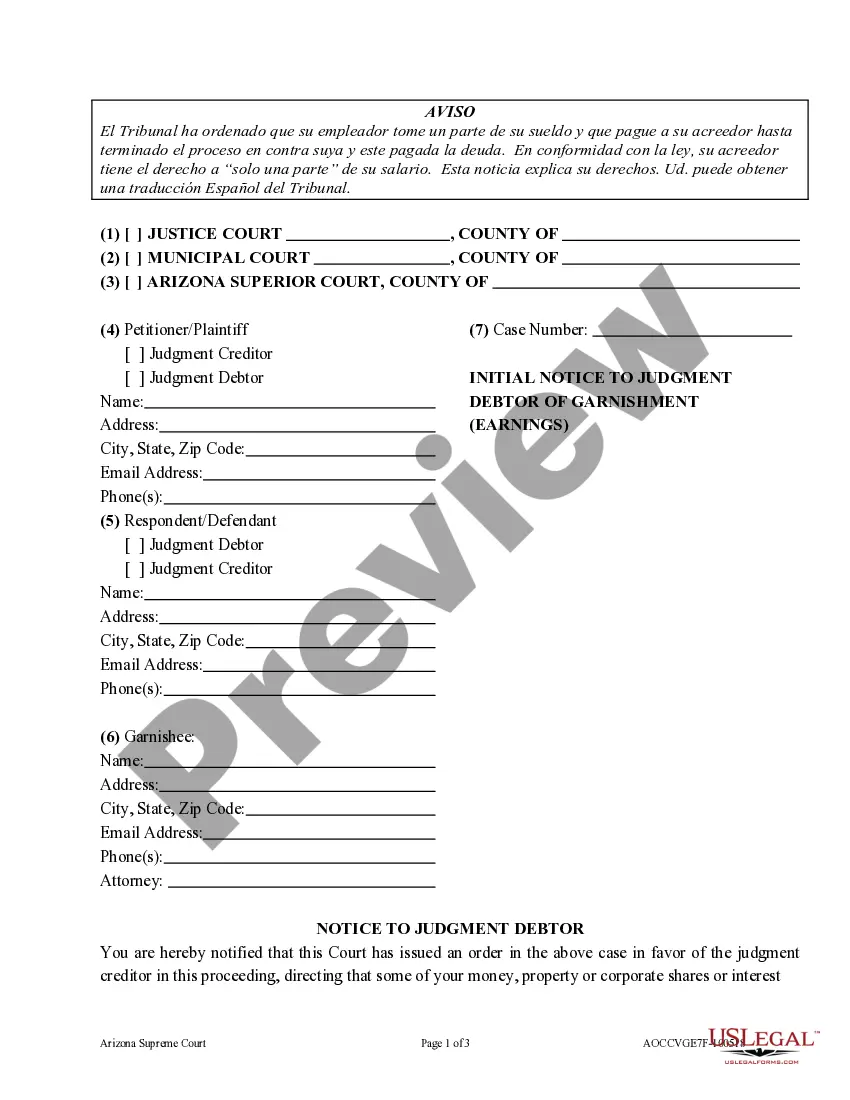

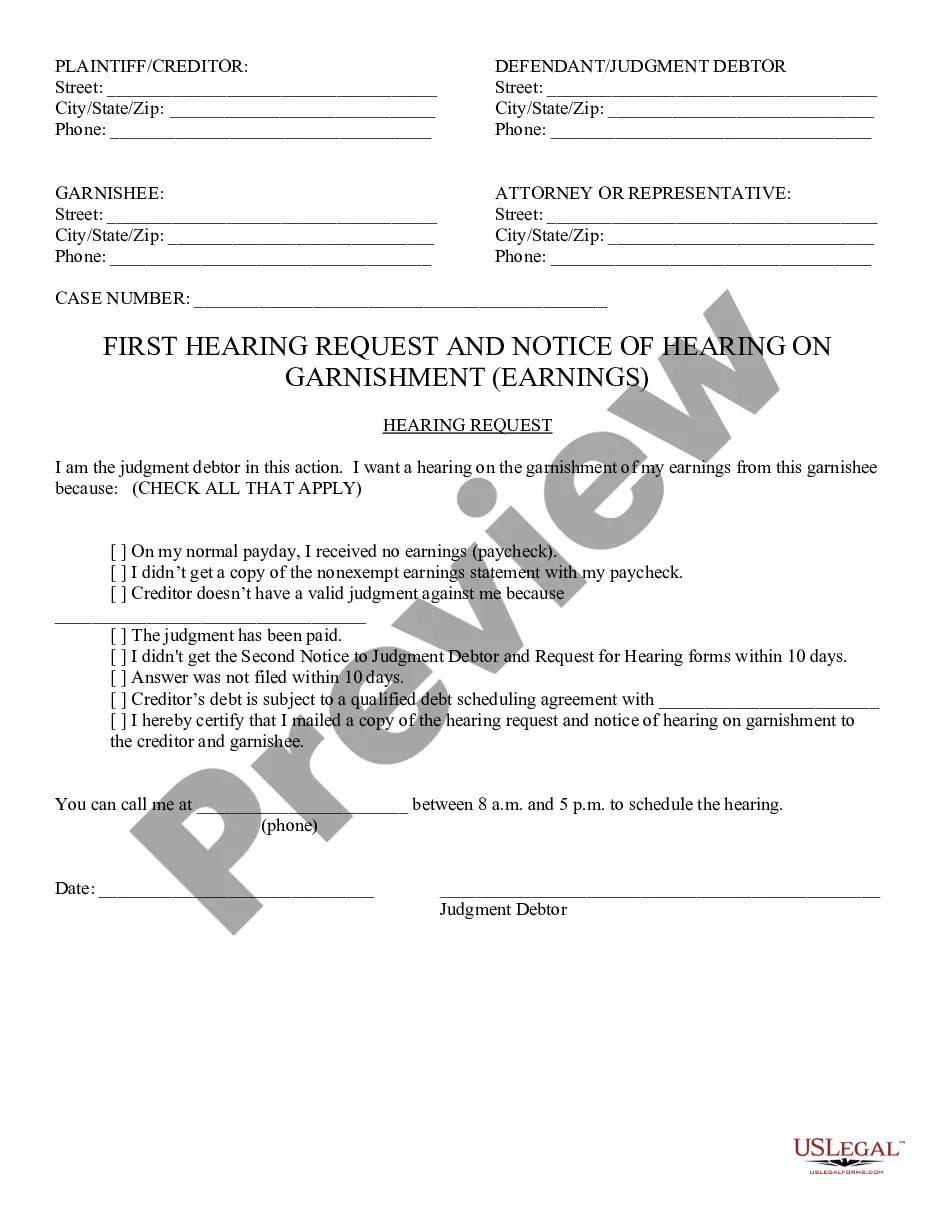

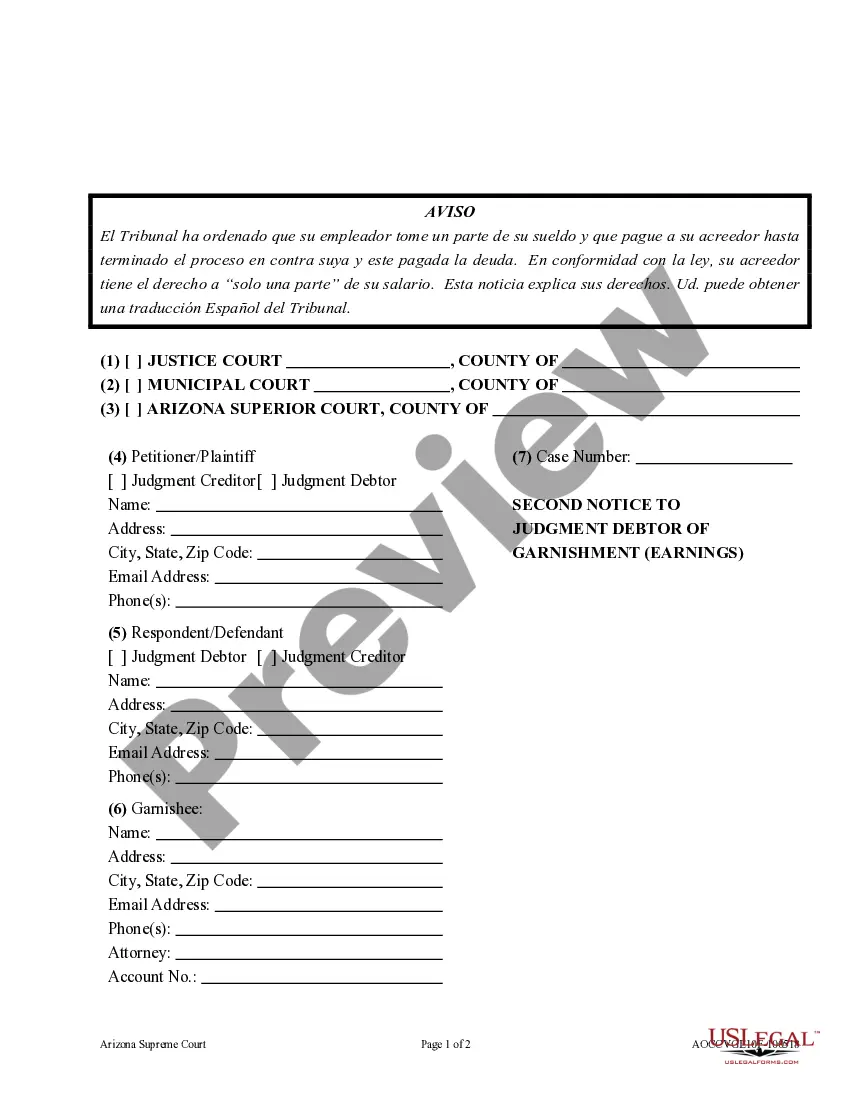

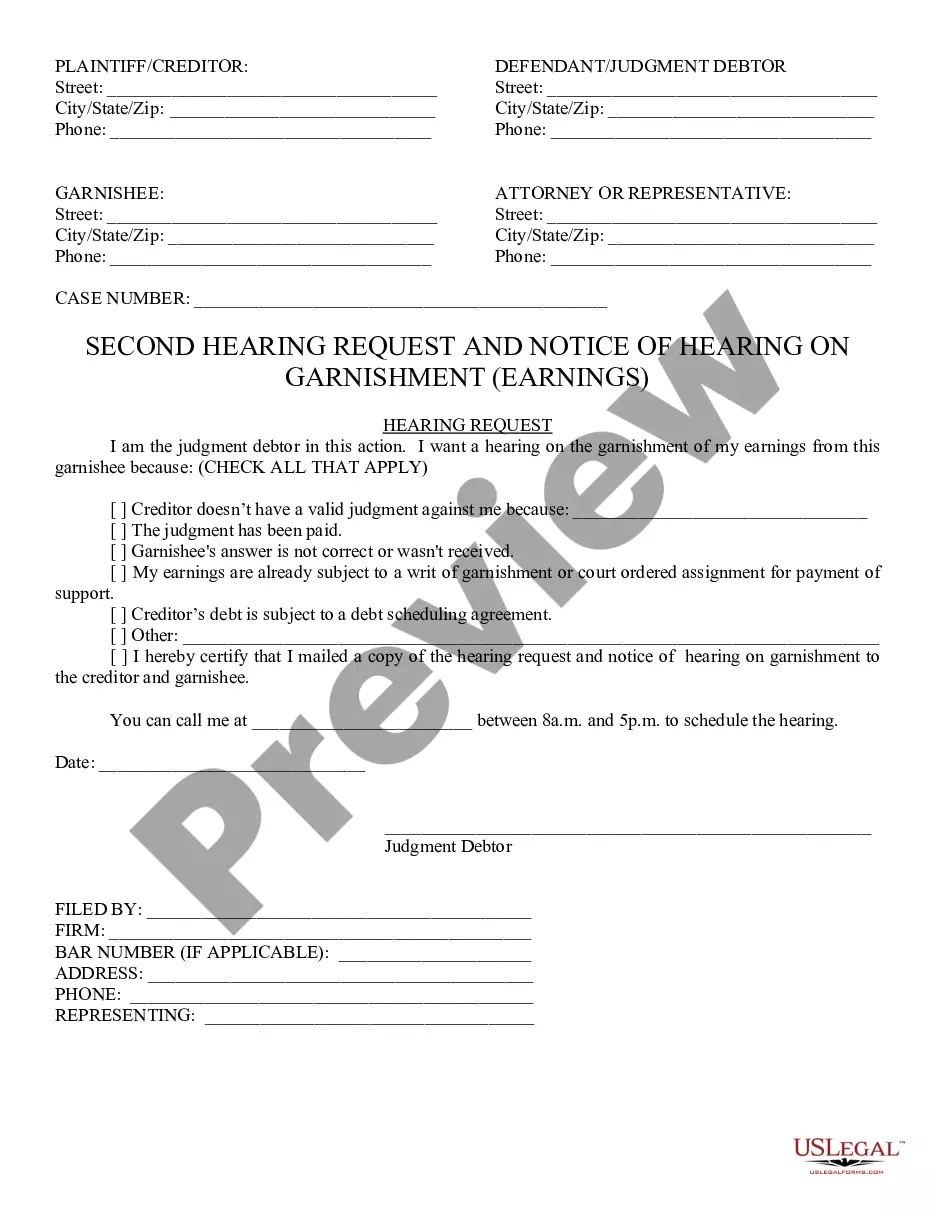

First Notice to Judgment Debtor of Garnishment Earnings: This Notice informs the Judgment Debtor that as a result of his/her non-payment, the Judgment Creditor will now be garnishing his/her wages until such judgment is satisfied. If the Judgment Debtor disagrees with the garnishment proceedings, then he/she is advised to ask for a hearing on the matter. This form is available for download in both Word and Rich Text formats.

Arizona 1st Notice to Judgment Debtor of Garnishment Earnings

Description

How to fill out Arizona 1st Notice To Judgment Debtor Of Garnishment Earnings?

If you are looking for proper Arizona 1st Notice to Judgment Debtor of Garnishment Earnings samples, US Legal Forms is exactly what you require; find documents provided and reviewed by state-licensed attorneys.

Using US Legal Forms not only saves you from concerns regarding legal documents; but also allows you to conserve time and resources, and money! Downloading, printing, and submitting a professional template is considerably more cost-effective than hiring a lawyer to do it for you.

And that's it. In just a few simple steps, you have an editable Arizona 1st Notice to Judgment Debtor of Garnishment Earnings. Once you create an account, all future orders will be processed even more easily. After you have a US Legal Forms subscription, just Log In to your account and click the Download option you see on the form’s page. Then, whenever you need to use this template again, you'll always find it in the My documents section. Don't waste your time comparing countless forms on various sites. Purchase accurate documents from a single reliable service!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up your account and obtain the Arizona 1st Notice to Judgment Debtor of Garnishment Earnings template to address your situation.

- Utilize the Preview option or review the document details (if available) to confirm that the template is the one you need.

- Verify its compliance in your state.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create your account and make payment using your credit card or PayPal.

Form popularity

FAQ

Yes, debt collectors can garnish wages in Arizona, but they must first obtain a court judgment. Upon receiving the Arizona 1st Notice to Judgment Debtor of Garnishment Earnings, you will be informed about the garnishment process. Knowing your rights during this process is crucial to defending yourself. Utilizing resources from U.S. Legal Forms can offer valuable insights and solutions.

In Arizona, a writ of garnishment remains effective for up to six months from the date it is issued. After this period, the creditor must renew it to continue garnishing your wages or bank account. Staying informed about the timeline of a writ may help you plan any necessary actions against ongoing garnishments. Handling these situations through platforms like U.S. Legal Forms can provide added guidance.

Stopping a wage garnishment in Arizona requires filing a claim of exemption with the court. This legal document argues that the garnishment is unjust or creates undue hardship. Prompt action is vital, as you typically have limited time to dispute the garnishment. Engaging with tools like U.S. Legal Forms can simplify the paperwork involved in this process.

The maximum wage garnishment allowed in Arizona is generally 25% of your disposable earnings, similar to federal law. If you earn less than 30 times the minimum wage, the garnishment amount may be further limited. Understanding these limits can help you plan your budget effectively. To protect your income more, consider seeking advice from platforms like U.S. Legal Forms.

Yes, a creditor can garnish your bank account in Arizona under certain circumstances. The creditor must first obtain a judgment against you, and then they can pursue a writ of garnishment. It’s crucial to understand your rights during this process, especially receiving an Arizona 1st Notice to Judgment Debtor of Garnishment Earnings. Consulting legal resources can provide clarity and assistance.

To stop wage garnishment in Arizona, you can file a claim of exemption with the court. This allows you to demonstrate that the garnishment is causing financial hardship. It's important to act quickly, as there are deadlines for filing this claim. Using resources like U.S. Legal Forms can help you navigate this process efficiently.

In Arizona, a creditor can garnish up to 25% of your disposable earnings, which is your income after taxes and mandatory deductions. However, if your income is below a certain threshold, different limits may apply. Understanding these limits can help you better navigate your finances and respond to the Arizona 1st Notice to Judgment Debtor of Garnishment Earnings. For personalized assistance, consider utilizing US Legal Forms to understand your options.

To stop a wage garnishment in Arizona, you can file a motion with the court that issued the garnishment. It’s important to act quickly, as there are deadlines for such actions. You may present your case by providing evidence of financial hardship or improper garnishment. Additionally, using platforms like US Legal Forms can help simplify the process, providing you with the necessary forms and guidance.

The new law for garnishment in Arizona provides additional protections for debtors, particularly concerning the information provided in the Arizona 1st Notice to Judgment Debtor of Garnishment Earnings. It requires clearer disclosures about how much can be garnished and the rights of judgment debtors. Staying informed about these changes can help you respond appropriately and protect your income.

In Arizona, the law typically limits the amount that can be garnished from your earnings to 25% of your disposable income, after taxes. This is in line with the guidelines set forth in the Arizona 1st Notice to Judgment Debtor of Garnishment Earnings. Understanding these limits is crucial; you may consult legal resources or a professional for more detailed advice tailored to your situation.