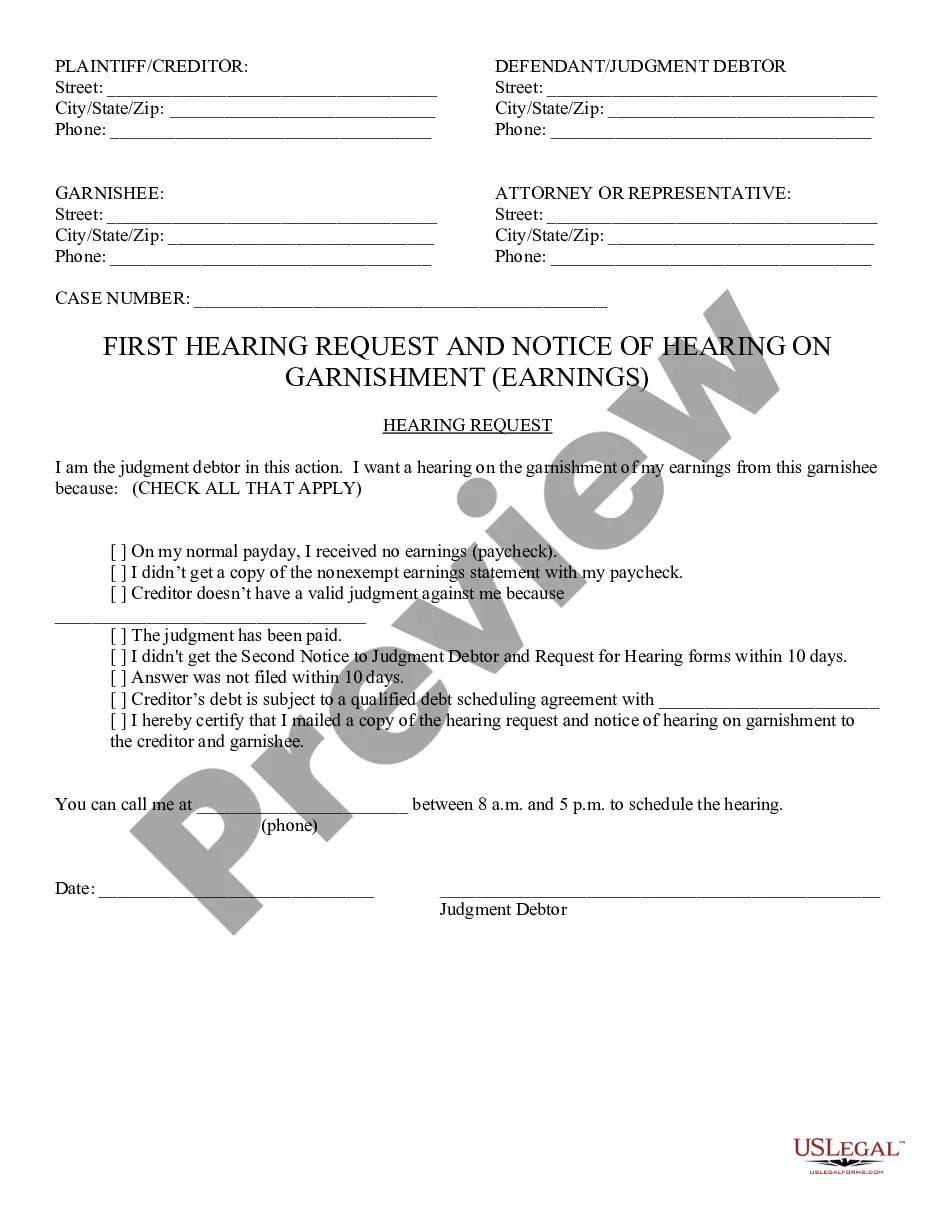

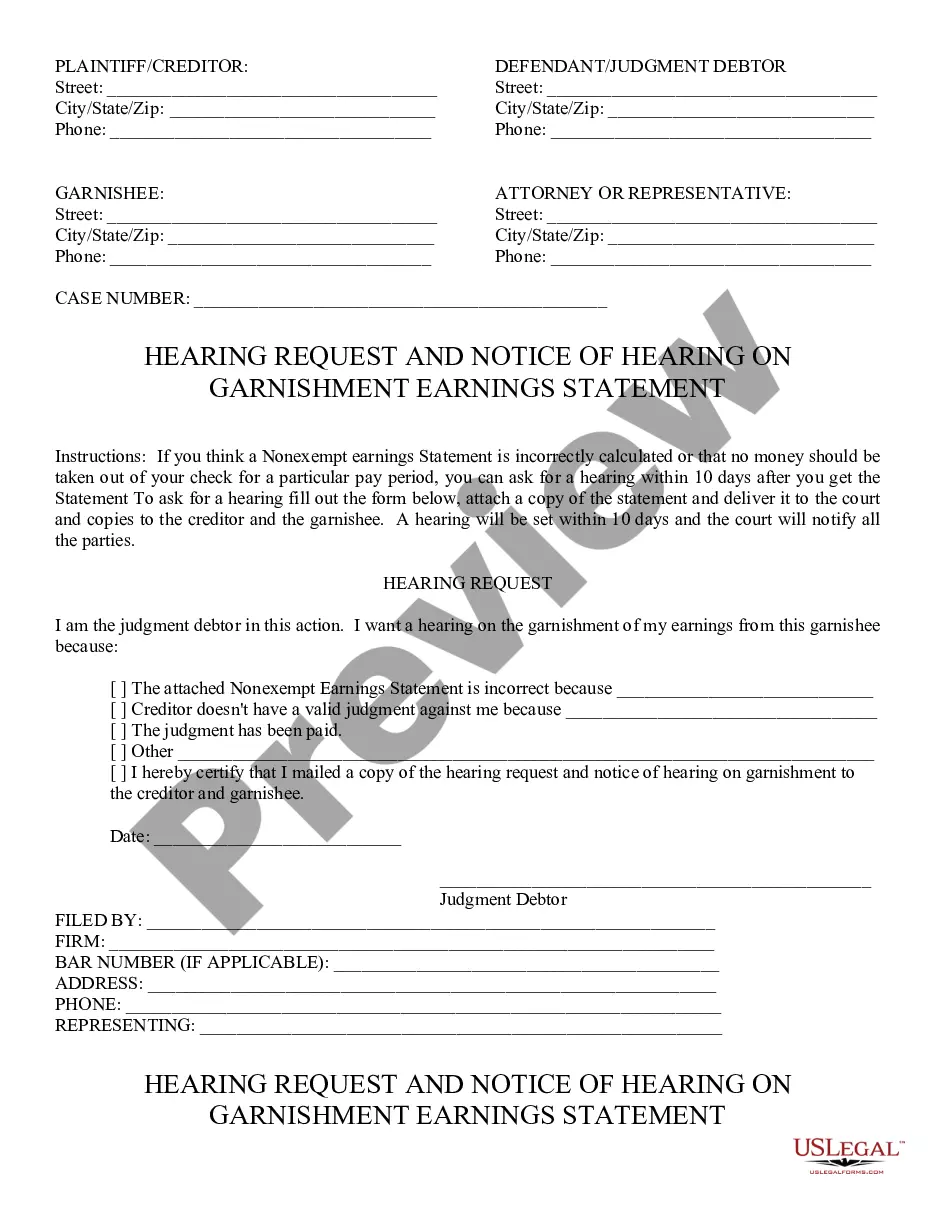

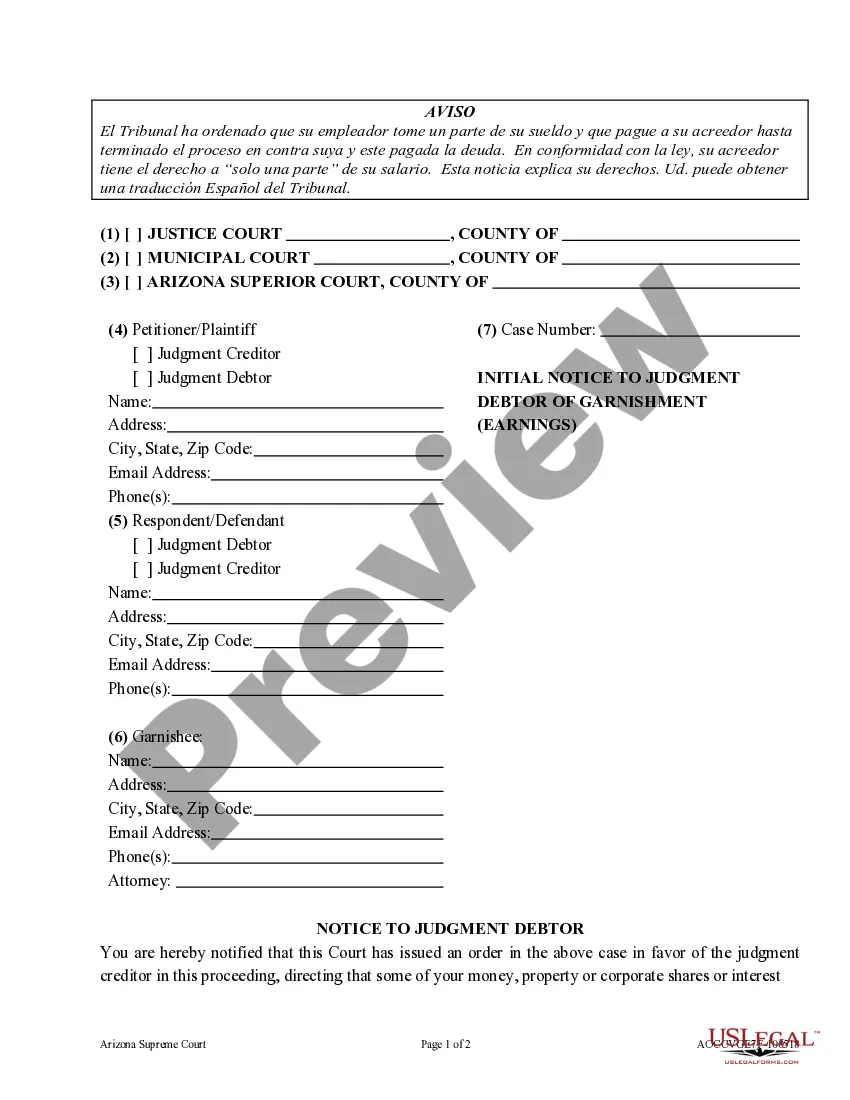

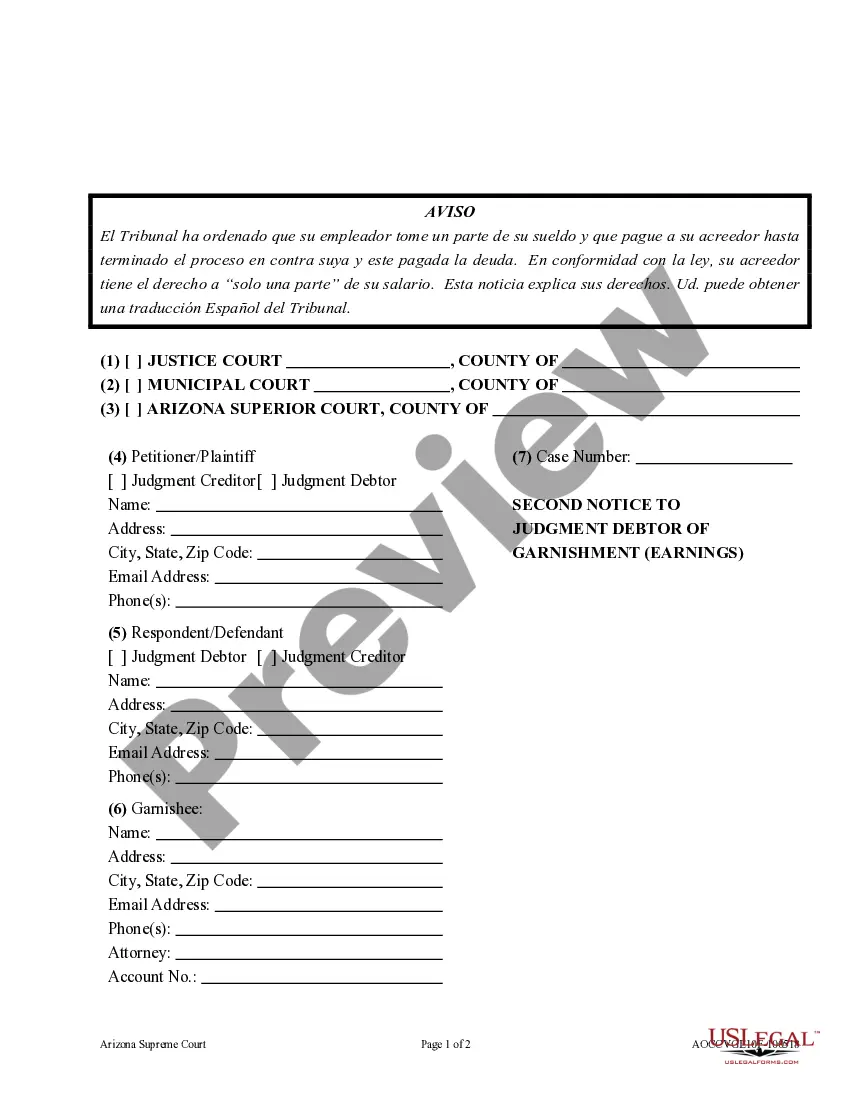

First Request and Notice of Hearing of Garnishment Earnings: This Notice informs the Judgment Debtor that as a result of his/her non-payment, the Judgment Creditor will now be garnishing his/her wages until such judgment is satisfied. If the Judgment Debtor disagrees with the garnishment proceedings, then he/she is advised to ask for a hearing on the matter. This form is available for download in both Word and Rich Text formats.

Arizona 1st Request and Notice of Hearing of Garnishment Earnings

Description

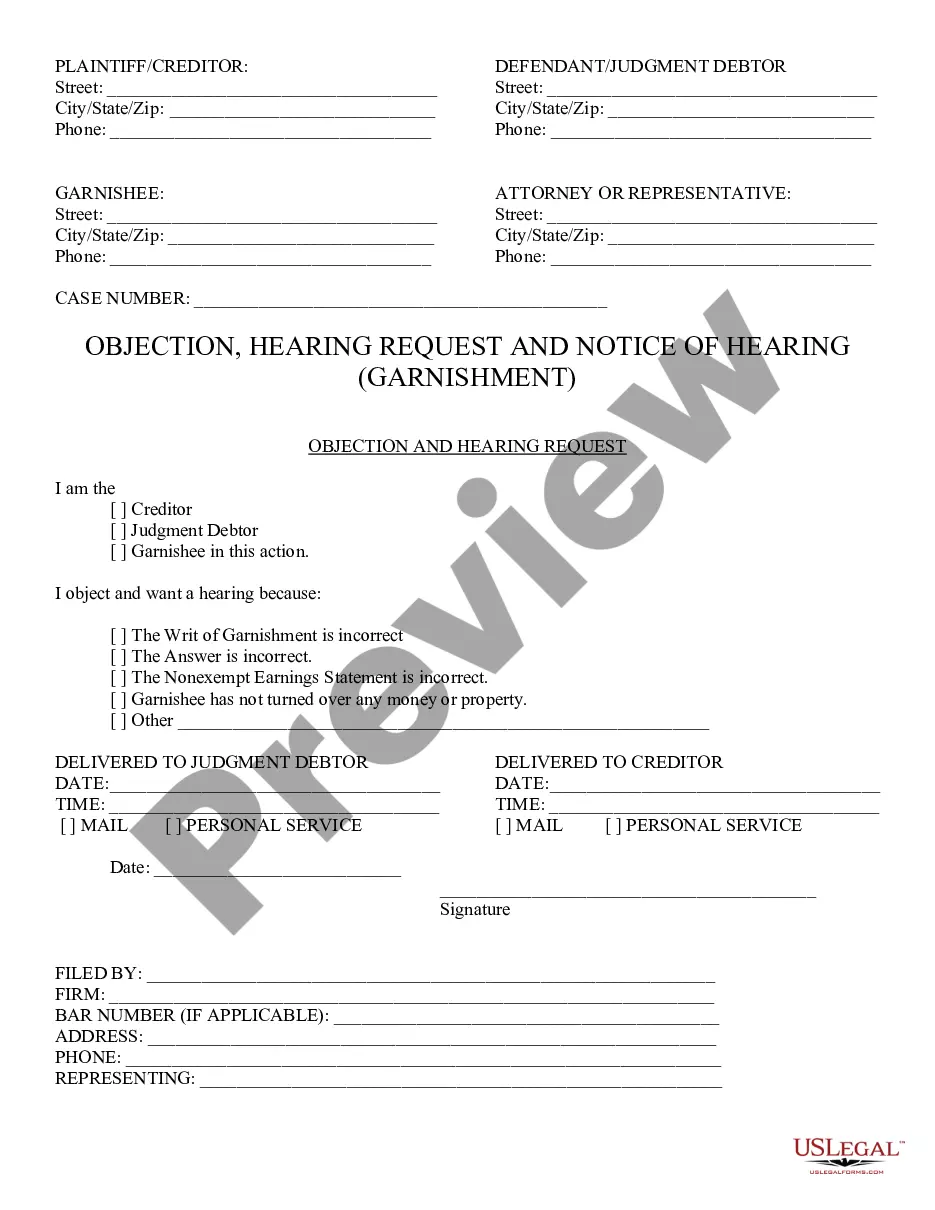

How to fill out Arizona 1st Request And Notice Of Hearing Of Garnishment Earnings?

If you're looking for accurate Arizona 1st Request and Notice of Hearing of Garnishment Earnings copies, US Legal Forms is what you need; discover documents crafted and verified by state-certified attorneys.

Utilizing US Legal Forms not only prevents you from issues related to legal documents; moreover, you conserve time, effort, and money! Downloading, printing, and completing a professional document is actually less expensive than hiring a lawyer to do it on your behalf.

And that's all. With just a few straightforward steps, you possess an editable Arizona 1st Request and Notice of Hearing of Garnishment Earnings. Once you establish an account, all subsequent orders will be processed even more effortlessly. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button visible on the form's page. Then, whenever you need to use this sample again, you'll always be able to locate it in the My documents section. Don't waste your time and energy comparing numerous forms across different websites. Purchase professional copies from a single secure platform!

- To get started, complete your registration process by providing your email and creating a private password.

- Follow the steps below to create your account and find the Arizona 1st Request and Notice of Hearing of Garnishment Earnings template to address your situation.

- Utilize the Preview feature or review the document description (if available) to confirm that the form is what you need.

- Verify its validity in the state where you reside.

- Click Buy Now to place an order.

- Select a desired pricing plan.

- Create an account and pay with a credit card or PayPal.

- Choose a suitable format and download the document.

Form popularity

FAQ

In Arizona, creditors can garnish up to 25% of your disposable earnings, depending on the situation. This limit ensures that you still have enough income to cover your basic living expenses. Knowing the provisions of the Arizona 1st Request and Notice of Hearing of Garnishment Earnings can help you understand your rights in this process.

To stop a wage garnishment in Arizona, you may petition the court for a hearing to review the garnishment. Provide evidence of financial hardship or other valid reasons for halting the process. Utilizing the Arizona 1st Request and Notice of Hearing of Garnishment Earnings helps to clarify the situation and advocate for your rights.

In Arizona, a writ of garnishment is generally valid for six months. After this period, you may need to renew the writ if the debt remains unpaid. It's essential to understand the implications of the Arizona 1st Request and Notice of Hearing of Garnishment Earnings, as it establishes the timeframe for collecting your owed amount.

Stopping a garnishment in Arizona involves filing specific legal documents with the court. You can file a motion to contest the garnishment or negotiate a payment plan with your creditor. The Arizona 1st Request and Notice of Hearing of Garnishment Earnings also provides a structure for addressing the garnishment during the hearing.

Yes, creditors can garnish your bank account in Arizona with a court order. This action typically follows the same legal process as wage garnishment, including the need for the Arizona 1st Request and Notice of Hearing of Garnishment Earnings. Once the order is obtained, funds can be withheld directly from your account to satisfy the debt.

Garnishment in Arizona allows creditors to collect debts by seizing a portion of your earnings. This process begins with a court order, specifically the Arizona 1st Request and Notice of Hearing of Garnishment Earnings. Once the order is in place, your employer must withhold the specified amount from your wages and send it directly to the creditor.

To stop a wage garnishment in Arizona, you can file a written objection or a motion with the court. This will typically require you to use an Arizona 1st Request and Notice of Hearing of Garnishment Earnings to formally engage with the process. Gathering relevant documents and possibly consulting with a legal professional can enhance your chances of success. Taking proactive steps can help you regain control over your earnings.

In Arizona, a creditor can garnish your wages up to 25% of your disposable earnings after taxes and essential deductions. This applies to various types of debts including credit card debts and personal loans. Understanding these limits can empower you to manage your finances better during challenging times. If you feel overwhelmed, consider consulting resources like USLegalForms to explore your options.

To quickly stop a wage garnishment, you can file a motion with the court to contest the garnishment or negotiate a payment plan with your creditor. This often involves using the Arizona 1st Request and Notice of Hearing of Garnishment Earnings to formally respond to the garnishment order. Consider seeking legal assistance to navigate this process efficiently, as swift action can minimize financial strain.

The new law in Arizona has updated the thresholds for wage garnishments, providing some relief to debtors. This law outlines specific exemptions and limits to protect a portion of your income from being garnished. Additionally, it emphasizes the necessity of providing a proper Arizona 1st Request and Notice of Hearing of Garnishment Earnings to initiate the process. Staying informed about these changes can help you better navigate garnishment situations.