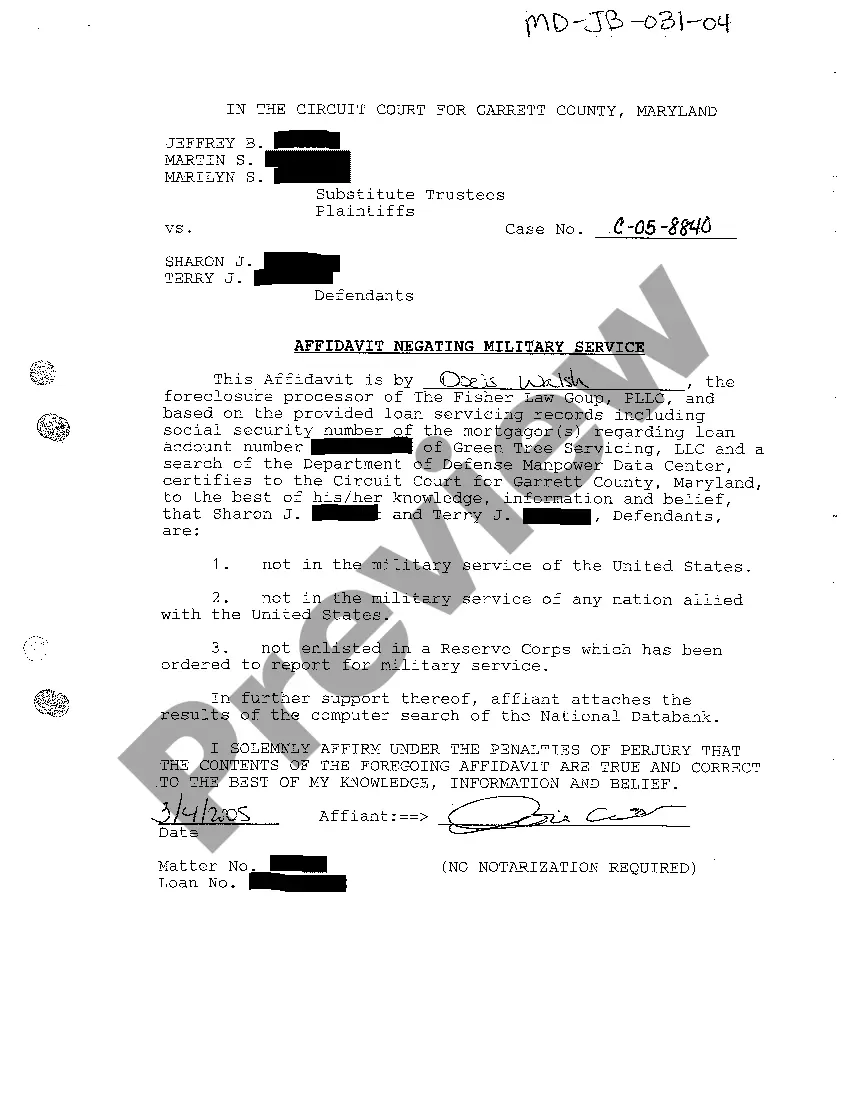

Second Notice to Judgment Debtor of Garnishment Earnings: This is a Second Notice to a Judgment Debtor that his/her wages are to be garnished until his/her debt is satisfied. Further, it states that if he/she desires a hearing on the matter, they must file a Request for Hearing within 10 days from service. This form is available in both Word and Rich Text formats.

Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings

Description

How to fill out Arizona 2nd Notice To Judgment Debtor Of Garnishment Earnings?

If you're seeking exact Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings samples, US Legal Forms is precisely what you require; access documents crafted and confirmed by licensed legal experts in your state.

Utilizing US Legal Forms not only spares you from hassles related to legal documentation; moreover, you conserve time, effort, and money! Downloading, printing, and completing a professional form is significantly more cost-effective than hiring an attorney to draft it for you.

And that's all. In just a few simple steps, you have an adaptable Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings. Once you set up an account, all future requests will be managed even more effortlessly. If you possess a US Legal Forms subscription, simply Log In to your profile and then click the Download option found on the form's page. Then, when you require this template again, you will always be able to find it in the My documents section. Do not waste your time and energy comparing different forms across various online sources. Obtain precise documents from a single reliable service!

- To get started, complete your registration process by providing your email and creating a secure password.

- Follow the steps outlined below to set up an account and locate the Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings template to address your needs.

- Utilize the Preview feature or examine the document description (if available) to ensure that the template is the one you require.

- Verify its validity in your residing state.

- Click on Buy Now to place your order.

- Choose a preferred payment plan.

- Create your account and pay using a credit card or PayPal.

- Select a suitable file format and save the documents.

Form popularity

FAQ

In Canada, certain funds are exempt from garnishment, like government benefits, retirement pensions, and some child support payments. Understanding these exemptions can help you manage your finances during a garnishment situation. For individuals facing garnishment, platforms such as uslegalforms can aid in understanding exemptions or even contesting the garnishment through the proper channels aligned with the Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings.

A creditor can garnish your wages in Arizona based on state laws that limit the amount to 25% of your disposable earnings. It is critical to respond promptly to any garnishment notice you receive to ensure your rights are protected. Understanding how creditors operate can help you manage potential garnishments, particularly with regards to the Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings.

The IRS can garnish your wages without a court order, and the maximum amount is based on your income level and filing status. Typically, the IRS may garnish up to 25% of your disposable income or more if you do not respond to their notices. Being informed about IRS guidelines is imperative, especially when receiving an Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings.

In Arizona, the most your paycheck can be garnished is tied to your disposable income. Disposable income is your earnings after taxes and other deductions. Under federal law, the maximum garnishment typically amounts to 25% of your disposable earnings or the amount by which your weekly income exceeds 30 times the federal minimum wage, whichever is less. Understanding these limits will help you in dealing with an Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings.

The maximum garnishment for an employee in Arizona is typically determined by federal guidelines as well as state law. Generally, employers may not garnish more than 25% of your disposable earnings. It's essential to know your rights and review the guidelines carefully to ensure garnishments comply with the Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings.

To stop a wage garnishment in Arizona, you may need to file a motion with the court that issued the garnishment order. It's crucial to present your financial situation and any hardships you face. Additionally, you can seek legal assistance or use platforms like uslegalforms to help navigate the process effectively. If you follow the appropriate steps, you can potentially halt or reduce the garnishment through the Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings.

Yes, debt collectors can garnish wages in Arizona, provided they have obtained a court judgment against you. Once this judgment is in place, they can initiate garnishment proceedings to recover amounts owed. The Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings explains the legal framework surrounding garnishments and what you can do to protect yourself.

In Arizona, a writ of garnishment is typically valid for up to six months. After this time, the creditor must renew the writ to continue garnishment actions. Understanding the stipulations through the Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings can offer clarity on any potential timelines and requirements you need to be aware of.

You can stop wage garnishment in Arizona by seeking the assistance of an attorney or a financial advisor knowledgeable in consumer rights. They can guide you through the necessary steps, including filing the required paperwork. Utilizing the Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings can provide vital insights on addressable options available to you.

To stop wage garnishment in Arizona, you should file a response to the creditor’s garnishment action. This includes presenting your case in court or reaching an amicable agreement with the creditor. Reference the Arizona 2nd Notice to Judgment Debtor of Garnishment Earnings for guidelines on how to navigate this process effectively and protect your financial assets.