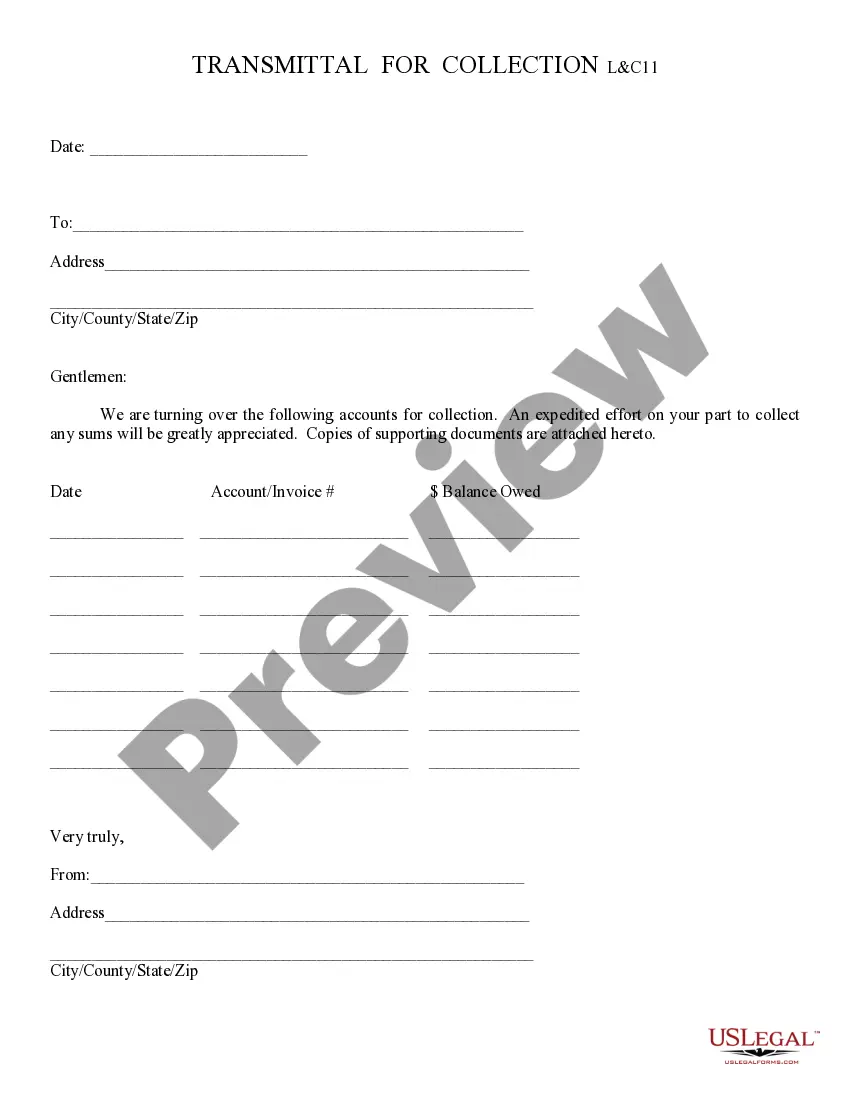

Transmittal for Collection: A Transmittal for Collection is used when a business, of any type, has not been able to collect on an account. After attempts for collection have failed, the business can enlist the help of a collections agency to follow-up with the Debtor. This form is available for download in both Word and Rich Text formats.

Arizona Transmittal for Collection

Description

How to fill out Arizona Transmittal For Collection?

If you are looking for precise Arizona Transmittal for Collection duplicates, US Legal Forms is precisely what you require; find documents created and verified by state-endorsed lawyers.

Utilizing US Legal Forms not only alleviates worries related to legal documentation; moreover, you save time, effort, and money!

And there you have it. In just a few simple steps, you now possess an editable Arizona Transmittal for Collection. Once your account is established, all future transactions will be executed even more easily. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button visible on the form's page. Then, when you need to use this document again, you can always find it in the My documents section. Don't waste your time sifting through countless forms on multiple websites. Purchase accurate templates from one secure platform!

- Downloading, printing, and completing a professional template is considerably less expensive than hiring an attorney to do it for you.

- To begin, complete your registration process by entering your email and setting up a secure password.

- Follow the instructions below to create an account and acquire the Arizona Transmittal for Collection template to meet your requirements.

- Use the Preview tool or examine the file details (if available) to confirm that the form is the one you need.

- Verify its suitability for your location.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Establish your account and pay with a credit card or PayPal.

- Choose an appropriate file format and save the document.

Form popularity

FAQ

You can find Arizona income tax forms on the Arizona Department of Revenue's official website. They offer a comprehensive collection of tax forms, making it easy for you to locate what you need. To streamline your tax submissions, use the Arizona Transmittal for Collection alongside the necessary forms to ensure a smooth process.

The Arizona Department of Revenue assigns an Employer Identification Number (EIN) to businesses for tax purposes. This number is essential for tax filings and reporting employees’ earnings. For businesses in Arizona, proper utilization of the EIN alongside the Arizona Transmittal for Collection can simplify the tax collection process.

The 'G' on a 1099 form refers to certain types of government payments, such as unemployment compensation. It indicates income you received that may require reporting. Understanding this designation can guide your tax preparation, highlighting the need to consider the Arizona Transmittal for Collection for any related documentation.

To obtain your W-2 in Arizona, contact your employer directly, as they are responsible for issuing this form. Employers usually provide W-2s electronically or by mail, which outlines your annual earnings. If you encounter difficulties, consider using the Arizona Transmittal for Collection to ensure all necessary forms are properly filed with the state.

In Arizona, you can obtain your 1099-G by visiting the Arizona Department of Economic Security website. Log into your account to download your 1099-G. If you need assistance, the Arizona Transmittal for Collection may be relevant, as it helps ensure accurate transmission of such documents.

To retrieve your 1099-G online from South Carolina, visit the South Carolina Department of Employment and Workforce website. From there, you can access your account or create a new one if you have not yet registered. This process allows you to view your tax documents, including the crucial Arizona Transmittal for Collection if applicable.

Arizona form 5011 is known as the Arizona Transmittal for Collection. This form is used to summarize and transmit supporting documents along with tax returns to the Arizona Department of Revenue. It ensures that all required documentation is filed systematically. By utilizing this form, you can make the filing process more efficient.

The collection agency law in Arizona regulates how collection agencies operate, ensuring they comply with fair practices. It requires agencies to obtain licenses and adhere to ethical standards when collecting debts. If you're seeking guidance on navigating these laws, the Arizona Transmittal for Collection can assist in organizing any necessary documents or filings.

Corporations conducting business in Arizona must file Arizona's corporate tax return. This includes both domestic and foreign corporations that generate income in the state. Utilizing the Arizona Transmittal for Collection can streamline the filing process, ensuring that your corporation meets state tax requirements.

Any individual who either resides in Arizona or has Arizona income must file an AZ tax return. This includes residents, part-year residents, and non-residents with sufficient income. Don't forget, the Arizona Transmittal for Collection is essential for ensuring your tax return is submitted properly and promptly.