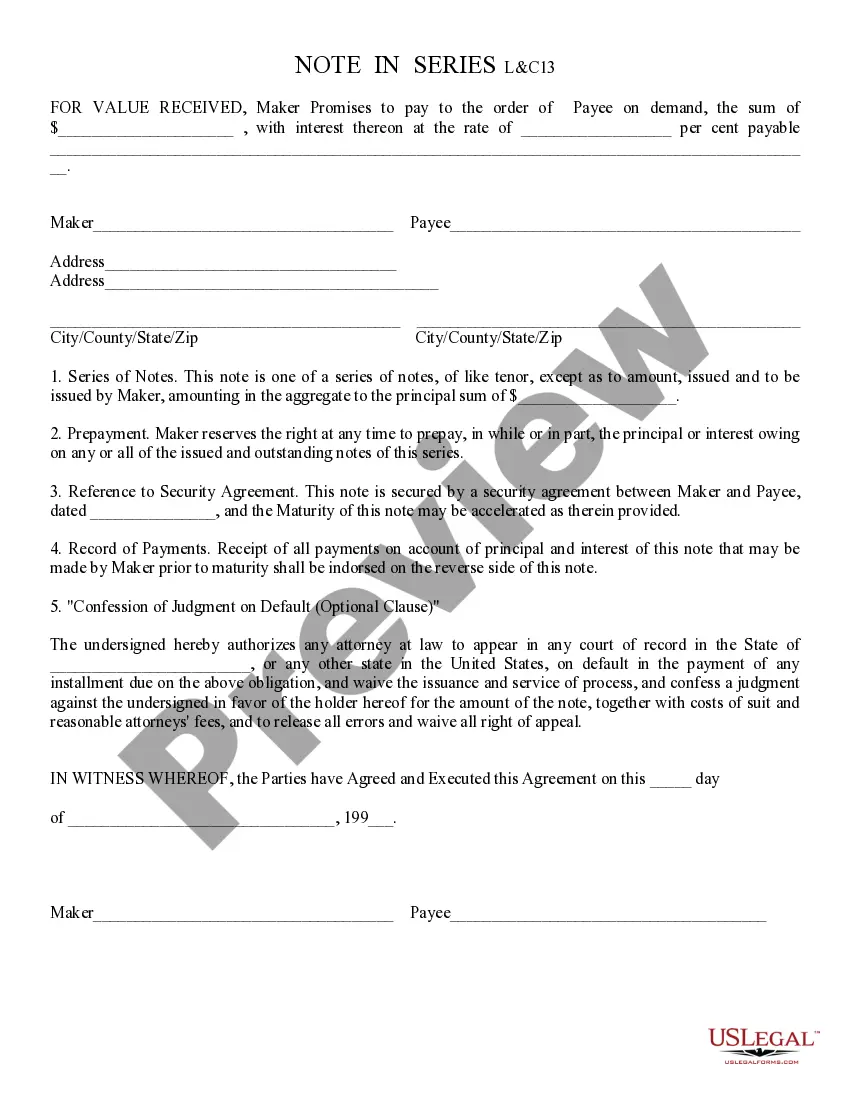

Note In Series: A Note in Series is most commonly used when the Payor and Payee are going to have a continual relationship. In other words, if the Payor and Payee are going to continue buying and selling with each other, either on a weekly or monthly basis, each Note for goods or services would be a Note in Series. This form is available for download in both Word and Rich Text formats.

Arizona Note In Series

Description Arizona Note

How to fill out Arizona Note In Series?

If you are looking for accurate Arizona Note In Series examples, US Legal Forms is precisely what you require; find documents developed and verified by state-authorized legal professionals.

Utilizing US Legal Forms not only alleviates concerns regarding legal documentation; furthermore, you conserve effort, time, and money!

And that’s it. In just a few easy clicks, you have an editable Arizona Note In Series. After creating an account, all future purchases will be processed even more smoothly. Once you have a US Legal Forms subscription, simply Log In/">Log In to your account and click the Download button available on the form's page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time searching through countless forms on different websites. Acquire professional copies from one trusted service!

- Initiate by completing your registration process by entering your email and creating a password.

- Follow the instructions below to establish an account and obtain the Arizona Note In Series template to address your needs.

- Use the Preview feature or review the document details (if available) to ensure that the example is the one you need.

- Verify its legitimacy in your area.

- Click Buy Now to proceed with your purchase.

- Select a preferred payment plan.

- Set up your account and pay with your credit card or PayPal.

- Choose a suitable file format and save the document.

Az Note File Form popularity

Az Note Sample Other Form Names

FAQ

To paper file your Arizona tax return, you can send your forms to the address specified in the tax form instructions or on the Arizona Department of Revenue website. It is crucial to use the correct address based on your filing status and type of form. For businesses involved in Arizona Note In Series transactions, accurate filing is essential for maintaining compliance and avoiding penalties.

To file Arizona tax withholding, employers must report and remit the withheld income taxes via the Arizona Department of Revenue's online portal or through paper forms. The process includes filing Form A1 and indicating the amount withheld. Ensuring accurate withholding is particularly important for entities managing Arizona Note In Series transactions, as it reflects their commitment to tax compliance.

In Arizona, the frequency of filing sales tax returns is determined by your business's revenue and tax liability. Most businesses follow a monthly schedule; however, smaller entities may qualify for quarterly or annual filings. Consistent and timely filing is essential for compliance and management of your Arizona Note In Series financial obligations.

Arizona's Transaction Privilege Tax (TPT) is often mistaken for a sales tax, but they are not identical. TPT is a tax on the privilege of doing business in the state, and it applies to businesses rather than consumers. Understanding this distinction is vital for those involved in Arizona Note In Series activities, as the tax responsibilities can differ significantly.

The filing frequency for TPT in Arizona can be monthly, quarterly, or annually, depending on your business's tax liability. Businesses with higher tax liabilities often file monthly, while smaller businesses may file quarterly or annually. Staying compliant with TPT requirements helps maintain good standing, especially when managing Arizona Note In Series transactions.

The Transaction Privilege Tax (TPT) rate in Arizona varies depending on the city and the type of business activity. Generally, the state rate is 5.6%, but local jurisdictions may impose additional taxes. Therefore, understanding the TPT implications is crucial for managing your Arizona Note In Series effectively. Always consult the Arizona Department of Revenue for the most current rates.

You can obtain Arizona tax forms from the Arizona Department of Revenue website or local tax offices. Many forms are available for download online for convenience. Additionally, exploring options available through the Arizona Note In Series can guide you on where to find specific forms for your tax needs.

Taxes in Arizona are calculated using a combination of state and local tax rules. Generally, you add up your taxable income and apply the appropriate tax rates based on brackets. By utilizing the Arizona Note In Series, you can simplify the tax calculation process and ensure compliance with state regulations.

Sales tax nexus in Arizona refers to the connection between a business and the state that requires tax collection. If a business has a physical presence in Arizona or engages in specific activities, it may need to collect and remit sales tax. The Arizona Note In Series is a valuable tool to understand how nexus rules impact different business operations.

The base sales tax rate in Arizona is 5.6%, but local taxes may increase this percentage. Thus, total sales tax rates can vary depending on the city or county. Understanding these rates is crucial, and resources like Arizona Note In Series can assist you in navigating local tax variations.