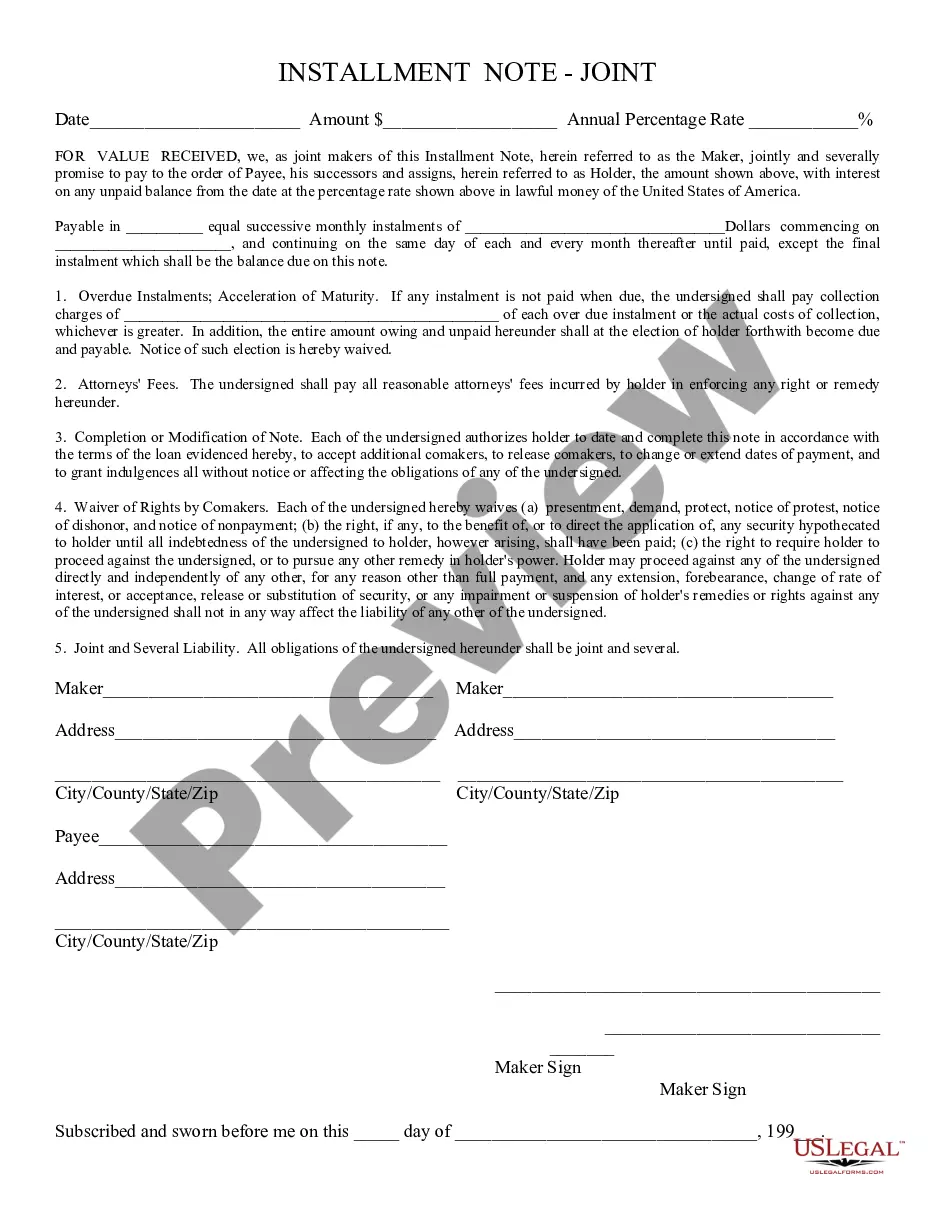

Installment Note - Joint: An Installment Note simply devises a schedule for payment on either a monthly, quartlerly, etc., basis. If at any time the Payor does not make a payment as scheduled, the Note will become immediately due in its entirety, along with any interest accrued. This form is available for download in both Word and Rich Text formats.

Arizona Installment Note, Joint

Description

How to fill out Arizona Installment Note, Joint?

If you're searching for precise Arizona Installment Note, Joint examples, US Legal Forms is what you require; locate documents created and verified by state-certified attorneys.

Using US Legal Forms not only spares you from troubles regarding legal paperwork; moreover, you save time and effort, as well as money! Downloading, printing, and submitting a professional document is far less expensive than asking a lawyer to do it for you.

And that's it. In just a few simple clicks, you have an editable Arizona Installment Note, Joint. After creating an account, all future orders will be even simpler. Once you possess a US Legal Forms subscription, just Log In to your profile and click the Download button found on the form's page. Then, when you need to use this template again, you'll effortlessly find it in the My documents section. Don't squander your time and energy searching through countless forms on various platforms. Purchase accurate copies from a single secure service!

- To start, complete your registration process by entering your email and creating a password.

- Follow the steps below to set up an account and acquire the Arizona Installment Note, Joint template to address your needs.

- Take advantage of the Preview option or review the document details (if available) to ensure that the template meets your requirements.

- Check its relevance in your state.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create your account and pay using a credit card or PayPal.

Form popularity

FAQ

Receiving mail from the Arizona Department of Revenue usually indicates they need to clarify your tax status or require additional information. This communication can relate to your tax filings, including those involving your Arizona Installment Note, Joint. It is crucial to respond promptly to avoid any penalties or complications.

Arizona Form 140NR is specifically designed for non-residents of Arizona who have earned income in the state. It provides a framework for reporting that income while allowing deductions that may be eligible. When dealing with Arizona Installment Note, Joint transactions, understanding this form can help ensure compliance and optimize your tax situation.

An Arizona joint tax application allows couples to file their taxes together, combining their incomes and deductions. This approach often results in a lower overall tax liability. When preparing your Arizona Installment Note, Joint, consider using this application for clarity and efficiency in your tax filings.

Arizona income tax operates on a graduated scale, meaning rates increase with rising income levels. Residents must file an annual return reporting their income and paying taxes owed. Familiarity with Arizona's tax structure is particularly important if your financial dealings include assets like the Arizona Installment Note, Joint.

The Arizona PTE tax is calculated based on the organization's net income. The tax rate is applied to this net income, and the entity passes the tax liability to the owners based on their share of the income. Understanding this calculation is essential, especially if the entity is part of transactions involving an Arizona Installment Note, Joint.

The Arizona PTE tax, or Pass-Through Entity tax, affects partnerships and S corporations in Arizona. These entities can elect to be taxed at the entity level, which can provide tax benefits for owners. If you manage your finances through instruments like the Arizona Installment Note, Joint, staying informed about PTE tax can optimize your tax strategy.

Form 140 is the Arizona Individual Income Tax Return. Taxpayers use this form to report their income, claim deductions, and calculate their tax liability. Completing this form accurately is vital for compliance, particularly if you are engaging with financial instruments like an Arizona Installment Note, Joint.

Arizona property tax is based on the assessed value of your property. Local governments determine this value by examining property characteristics and market trends. Property tax rates can vary depending on where you live, and knowing how these taxes apply can be crucial for managing your financial obligations, especially for those involved in an Arizona Installment Note, Joint.

No, you should not staple your W-2 to your Arizona state tax return. Instead, paperclip the W-2 and any supporting documents to your return. However, if you file electronically, your W-2 will be submitted through the software. Understanding the correct filing process can help you avoid any unnecessary complications, especially if you are dealing with an Arizona Installment Note, Joint.

Corporations operating in Arizona must file an Arizona corporation tax return, even if they do not have a tax liability. This includes C Corps and S Corps registered in the state. If you are managing an Arizona Installment Note, Joint through your corporation, fulfilling this obligation is vital for compliance.