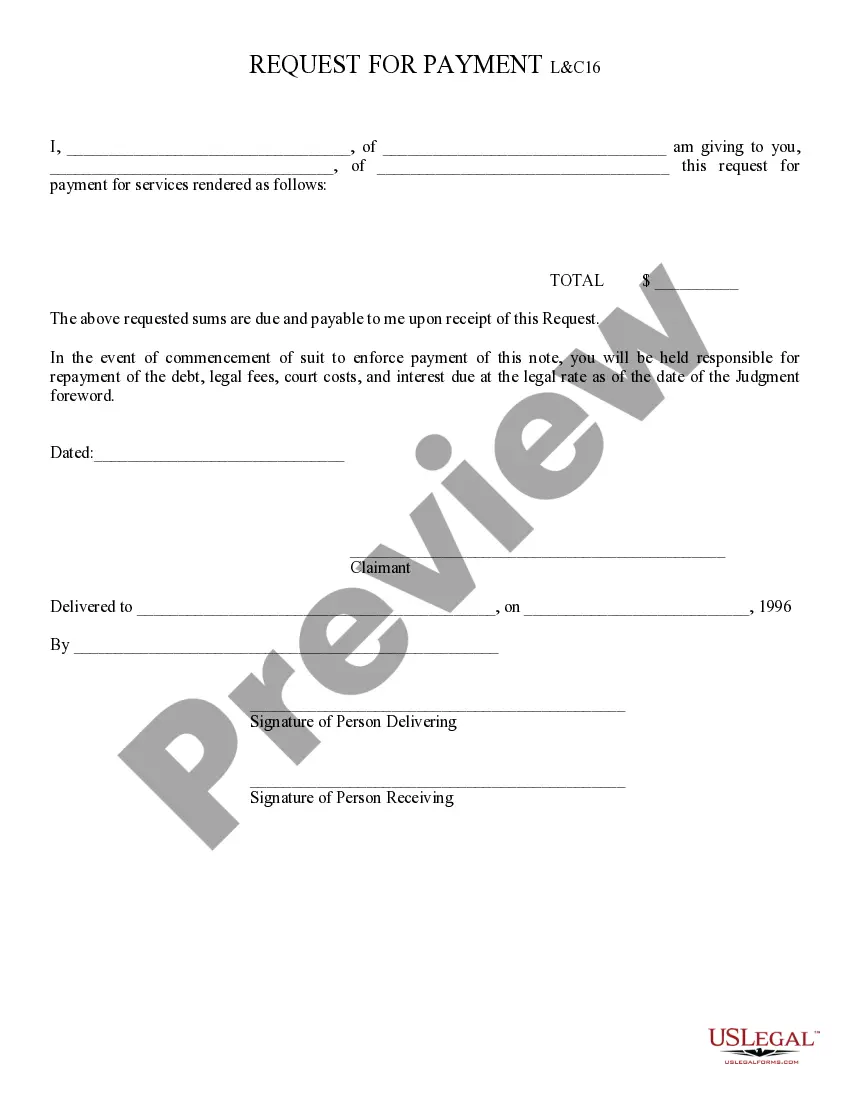

Request for Payment: A Request for Payment is sent when goods and/or services have been rendered without prior payment. Upon receipt of this request, payment is deemed due. Both the parties to the original contract must sign this form. This form is available for download in both Word and Rich Text formats.

Arizona Request for Payment

Description Azui Appeals

How to fill out Arizona Request For Payment?

If you're seeking precise Arizona Request for Payment samples, US Legal Forms is what you require; acquire documents supplied and reviewed by state-authorized legal experts.

Using US Legal Forms not only helps prevent issues regarding legal paperwork; additionally, you save time, effort, and money!

Select a suitable format and save the document. That's all there is to it. In just a few simple steps, you have an editable Arizona Request for Payment. Once you set up an account, all future requests will be processed even more easily. If you have a US Legal Forms subscription, just Log In to your account and click the Download button you see on the form’s page. Then, when you wish to utilize this template again, you'll always be able to find it in the My documents section. Don't waste your time and effort comparing numerous forms on various websites. Order exact documents from just one secure platform!

- To begin, complete your registration by entering your email and creating a secure password.

- Follow the instructions below to set up your account and locate the Arizona Request for Payment sample to meet your needs.

- Use the Preview feature or review the document description (if available) to ensure that the template is the one you need.

- Check its validity in your state.

- Click on Buy Now to place your order.

- Choose a preferred pricing option.

- Establish your account and pay with your credit card or PayPal.

Form popularity

FAQ

Arizona does not tax Social Security benefits, providing some relief for retirees. However, pensions are generally taxable, with certain exceptions based on the type of pension. It’s vital to understand how your specific pension may be taxed. For a clearer overview of these tax components, exploring guidance through uslegalforms can be advantageous.

To initiate a request for payment in Arizona, you must follow the specific guidelines set by the Arizona Department of Revenue. Generally, you need to fill out the necessary forms and provide details about your payment request. Ensure that all information is complete and accurate to avoid delays. Utilizing tools from uslegalforms can simplify this request process and help ensure compliance.

Arizona form 140 should be sent to the Arizona Department of Revenue’s designated address based on your residency status. If you are filing as a resident, direct your form to the address specified for resident taxpayers. For nonresidents, send the form to the appropriate address for nonresident filings. To streamline this process, consider using services from uslegalforms for accurate mailing instructions.

To make an Arizona Pass-Through Entity (PTE) payment, you need to use the Arizona Department of Revenue’s online payment system. This system offers a convenient and secure way to process your payments without needing to mail anything. Make sure you follow the instructions carefully to ensure your payment is correctly applied. If you require additional guidance, uslegalforms can provide you with valuable resources.

Arizona form 140ES is a form used by taxpayers to request an extension of time to file their state tax returns. This form allows you to avoid penalties for late filing while ensuring you meet your tax obligations in a timely manner. It’s crucial to submit this form before the deadline. For assistance with form completion and submission, platforms like uslegalforms can be helpful.

Nonresidents who earn income sourced from Arizona must file an Arizona nonresident return. This includes individuals who work in Arizona but reside in another state. Keep in mind that filing is necessary to report your Arizona income accurately and fulfill tax obligations. If you are unsure, consider using resources like uslegalforms to assist you in the filing process.

The Arizona PTE tax, or Pass-Through Entity tax, applies to certain business structures that pass their income directly to their owners for tax purposes. This tax offers an alternative way for businesses to manage their tax liabilities while providing some benefits to business owners. Knowing how the PTE tax works can aid in effective planning for your Arizona request for payment.

When specifying the purpose of payment, you should clearly outline the nature of the transaction, such as services rendered or products delivered. This information helps clarify the reason for the payment and ensures all parties are aligned. Being specific in your Arizona request for payment will avoid confusion and facilitate smoother processing.

A payment requisition is a document that initiates a request for funds to be disbursed. It serves as evidence of a required payment and is helpful for tracking spending within an organization. Utilizing a payment requisition can enhance the efficiency of your Arizona request for payment processes.

The TPT tax in Arizona is a transactional tax that may vary depending on local jurisdictions. This tax is typically passed on to the consumer and is applied at various rates depending on the nature of the business. Properly understanding your TPT responsibilities can streamline your Arizona request for payment processes.