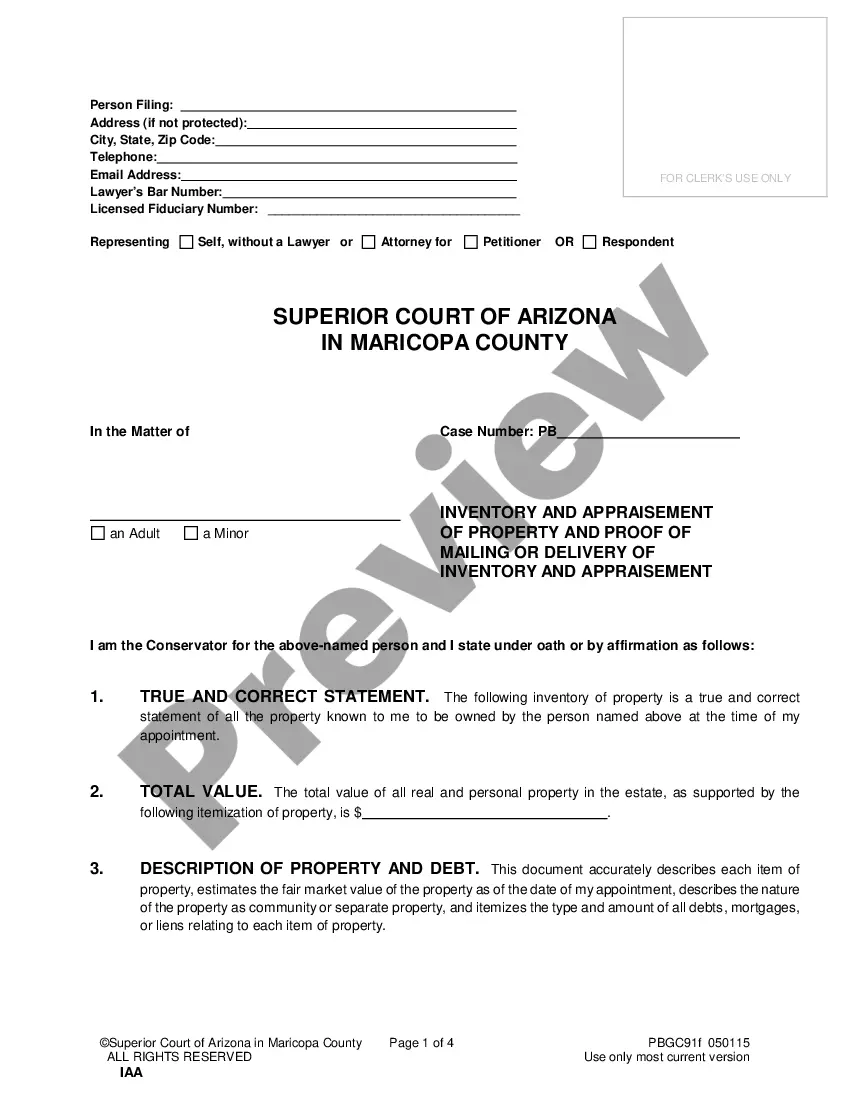

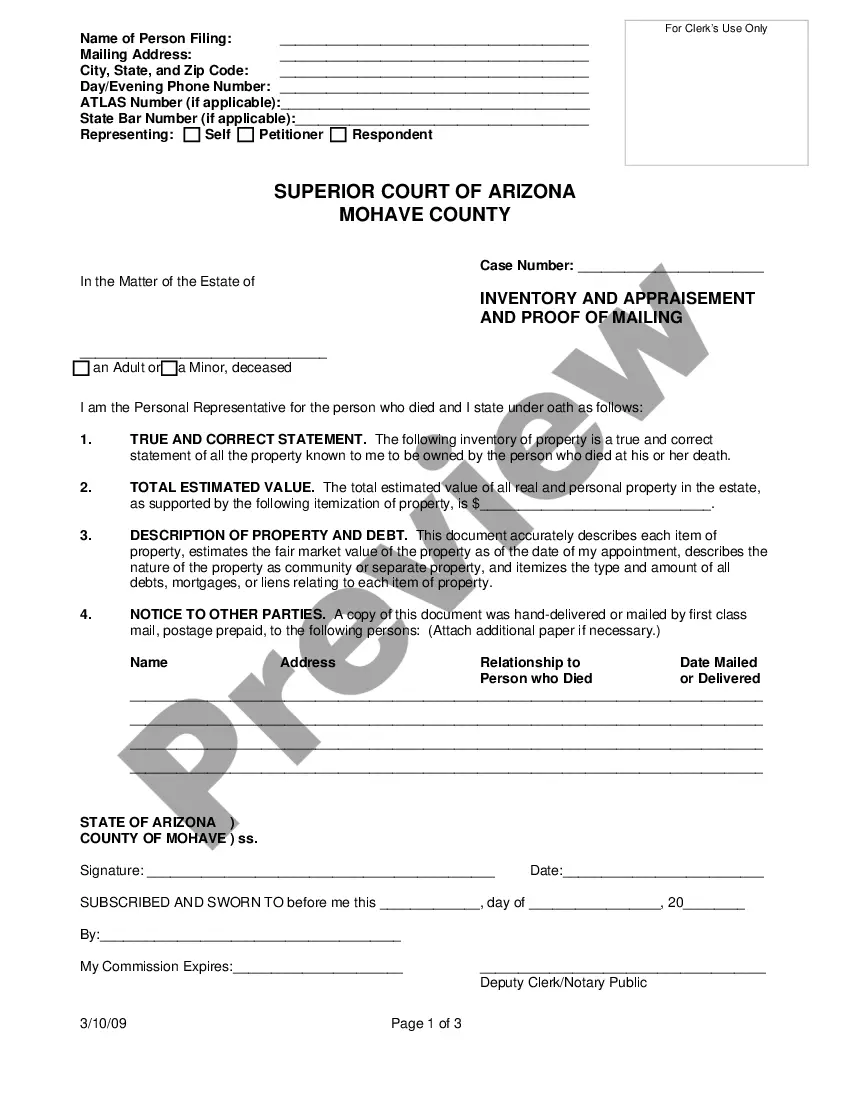

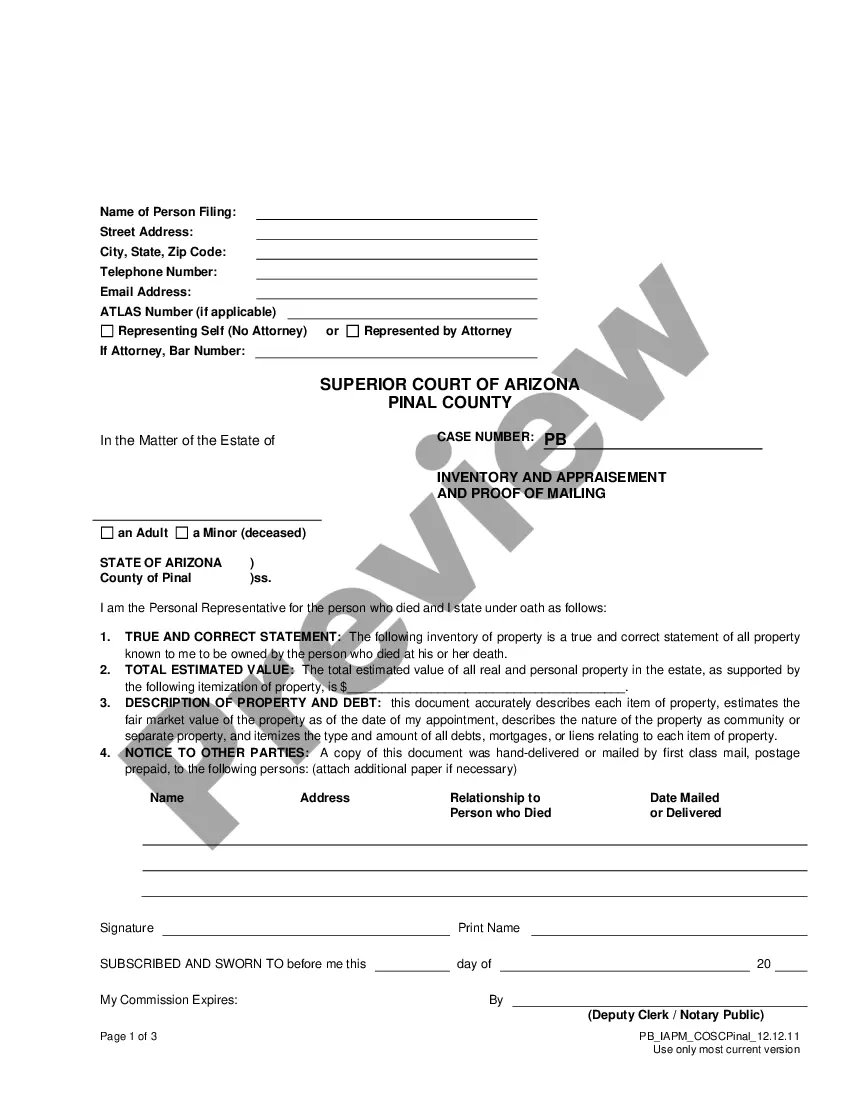

Arizona Inventory and Appeasement and Proof of Mailing is an important legal document for settling estate matters in the state of Arizona. It is used to list and appraise all estate assets and liabilities in order to calculate the estate’s net value. The Inventory anAppeasementnt and Proof of Mailing must be filed with the court after the decedent’s death in order for the estate to be properly administered. There are two types of Arizona Inventory and Appeasement and Proof of Mailing. The first type is the Personal Representative's Inventory and Appeasement, which is filed with the court by the personal representative of the estate. This document must include a detailed inventory of the estate’s assets and liabilities, as well as an appraised value of the assets. The second type is the Beneficiary's Inventory and Appeasement, which is filed with the court by the beneficiaries of the estate. This document must include a detailed inventory of the estate’s assets and liabilities and must be signed by all parties involved. The Proof of Mailing is an additional document that must be filed with the court in order to prove that the Inventory and Appeasement documents were properly mailed to all interested parties. This document must include the names and addresses of all parties to whom the documents were mailed, as well as proof that the documents were actually sent.

Arizona Inventory and Appraisement and Proof of Mailing

Description

How to fill out Arizona Inventory And Appraisement And Proof Of Mailing?

US Legal Forms is the most simple and economical method to find suitable official templates.

It is the largest online collection of business and personal legal documents created and verified by attorneys.

Here, you can access printable and fillable forms that adhere to federal and state regulations - similar to your Arizona Inventory and Appraisement and Proof of Mailing.

Review the form description or preview the document to verify you’ve found the one that meets your needs, or search for another using the search tool above.

Click Buy now when you’re confident about its alignment with all the criteria, and choose the subscription plan that suits you best.

- Acquiring your template involves just a few easy steps.

- Users with an existing account and active subscription only need to Log In to the website and download the document to their device.

- Subsequently, they can locate it in their account within the My documents section.

- For first-time users looking to obtain a correctly prepared Arizona Inventory and Appraisement and Proof of Mailing using US Legal Forms.

Form popularity

FAQ

Starting the probate process in Arizona involves several key steps. First, you need to file the will and a petition for probate with the appropriate court. Next, you’ll complete the Arizona Inventory and Appraisement and provide the Proof of Mailing to notify interested parties. Using resources like the uslegalforms platform can simplify this process by offering templates and guidance. Taking these steps carefully will help navigate the complexities of probate more effectively.

A letter of appointment is a legal document issued by the court that empowers a personal representative to administer an estate. This document outlines the representative's authority and responsibilities, including conducting the Arizona Inventory and Appraisement and the Proof of Mailing. Having a letter of appointment is crucial as it legitimizes your role during the probate process. It provides you with the necessary legal backing to act on behalf of the estate.

To obtain letters of testamentary in Arizona, you must first file a petition with the probate court. This process requires submitting important documents, including the will and a valid Arizona Inventory and Appraisement. Once approved by the court, letters of testamentary grant you the authority to act as the personal representative. This authority is essential for fulfilling your duties and ensuring proper estate management.

The priority for appointment as personal representative in Arizona is based on a hierarchy established by state law. Usually, the surviving spouse or children of the deceased are considered first, followed by other close relatives. If none of these individuals are available, creditors may be appointed. Understanding these priorities can make navigating the probate process much easier.

In Arizona, a personal representative generally has up to one year to settle an estate. This timeline allows the representative to gather assets, conduct the Arizona Inventory and Appraisement, and distribute the remaining assets to heirs. However, circumstances may arise that extend this period, particularly if complications occur during the probate process. It’s crucial for personal representatives to stay proactive to avoid unnecessary delays.

Certain assets in Arizona can be exempt from probate, including joint tenancy property, life insurance accounts, and certain trusts. These assets can pass directly to beneficiaries without going through the probate court process. However, it's critical to maintain accurate records and consider an Arizona Inventory and Appraisement for clarity on what is included.

The duration of the probate process in Arizona can vary widely, often lasting from several months to several years, depending on the estate's complexity. Factors influencing this timeline include the size of the estate, the presence of disputes, and the thoroughness of documents, including the Arizona Inventory and Appraisement. Early organization can significantly reduce this timeframe.

Probate is typically triggered in Arizona when a person passes away leaving behind significant assets, especially real estate or other titled property. If there is a will involved, it must be proven valid in the probate court. Understanding these triggers can help you prepare proper documentation, including the Arizona Inventory and Appraisement and Proof of Mailing.

A will alone does not guarantee avoidance of probate in Arizona. Even with a will in place, the probate process might still be necessary depending on asset types and values. To streamline the process, consider documenting assets through an Arizona Inventory and Appraisement, ensuring that everything is in order before moving forward.

In Arizona, there is no specific minimum value that triggers probate; however, larger estates often necessitate formal probate proceedings. If the estate includes real property or exceeds a certain value, it is more likely to enter into probate. Understanding the implications of the Arizona Inventory and Appraisement can help you assess your situation more clearly.