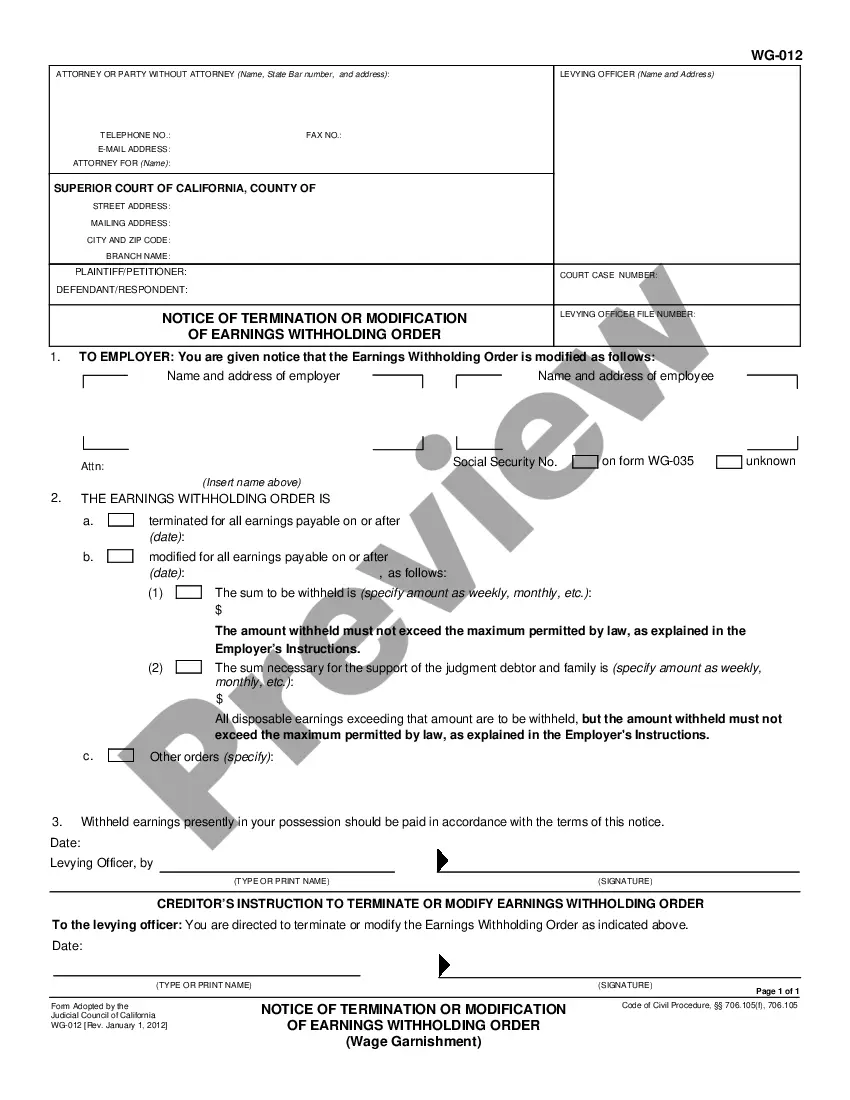

The Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign is a document used to alter an existing income withholding order issued in the state of Arizona. This agreement is used when all parties involved agree to the modification. The document must be signed and notarized by all relevant parties in order to be valid. This agreement typically outlines the original withholding order and the modifications to be made to the order. The document may also specify the proposed monthly payments, the start date of the newly modified order, and any other pertinent information. There are two types of Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign: 1. Private Agreement: This agreement is used when all parties involved agree to the modifications, and involves no court action. 2. Court-Ordered Modification: This agreement is used when all parties involved agree to the modifications, but the agreement has been approved by a court.

Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign

Description

How to fill out Arizona Agreement To Modify Income Withholding Order When All Parties Will Sign?

Managing legal paperwork necessitates focus, precision, and utilizing well-prepared templates. US Legal Forms has been assisting individuals across the country in accomplishing this for 25 years, so when you select your Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign template from our collection, you can be confident it adheres to federal and state statutes.

Engaging with our service is straightforward and swift. To obtain the necessary document, all you need is an account with an active subscription. Here’s a concise guide for you to secure your Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign in just a few minutes.

All documents are created for multiple usages, such as the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign you see on this page. If you require them again, you can complete them without additional payment - simply access the My documents section in your profile and fill out your document whenever necessary. Utilize US Legal Forms and efficiently prepare your business and personal paperwork while ensuring full legal compliance!

- Be sure to carefully review the form details and its alignment with general and legal standards by previewing it or reading its description.

- Seek an alternative official template if the one previously accessed does not fit your circumstances or state regulations (the option for that is located on the top page corner).

- Log In to your account and download the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign in your preferred format. If it’s your first time on our website, click Buy now to continue.

- Establish an account, choose your subscription package, and complete your payment with a credit card or PayPal account.

- Select the format in which you wish to save your form and click Download. Print the template or upload it to a professional PDF editor to prepare it digitally.

Form popularity

FAQ

In Arizona, child support generally ends when the child turns 18, but it may continue if the child is still in high school. You can submit an Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign to officially cease payments. Ensure both parents consent and file the necessary documents with the court. The US Legal Forms platform can provide the templates needed to make this process smoother for you.

To stop child support garnishment in Arizona, you can file an Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign. This agreement allows both parents to mutually consent to change the withholding order. You may need to provide evidence of changed circumstances, such as a job loss or a significant change in income. Utilizing a reliable legal platform, like US Legal Forms, can guide you through the process effectively.

Withholding income refers to the practice of deducting a portion of an employee's wages for mandatory payments, such as taxes or child support. This process ensures that funds are set aside to meet financial obligations promptly, reducing the burden on the employee during tax season or payment deadlines. In conjunction with the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign, withholding can be adjusted as needed to reflect changes in financial situations. Understanding this process allows both employers and employees to manage their obligations effectively and maintain financial stability.

If an employer fails to withhold child support in Pennsylvania, they could face legal repercussions, including fines or being held liable for unpaid support. It's critical for employers to understand their responsibilities regarding income withholding orders, especially under circumstances outlined in the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign. By complying with these orders, employers can avoid legal issues and ensure they are supporting the best interests of the child. Regular communication with employees about their child support obligations can prevent misunderstandings and foster a supportive work environment.

The term IWO stands for Income Withholding Order, a legal directive to deduct child support directly from an employee's wages. This order is crucial for ensuring that child support payments are made consistently and on time. By utilizing the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign, all parties involved can address any changes needed for the IWO, ensuring that it reflects current financial circumstances. This agreement promotes cooperation and helps maintain a healthy support system.

Withholding income tax at source means deducting tax from an employee's paycheck before they receive their earnings. This process ensures that tax obligations are met in a timely manner, helping to prevent any large tax bills come tax season. The Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign can also establish guidelines for additional withholdings like child support, making it easier for employers to stay compliant. By understanding this concept, both employers and employees can manage their financial responsibilities more effectively.

Income withholding release refers to the official document that stops the garnishment of wages for child support or other obligations. This process is important for ensuring that payments cease when no longer necessary. Under the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign, all parties can agree to modify the terms and halt unnecessary deductions. Utilizing this agreement helps streamline communication and maintain clear financial obligations.

To stop child support payments in Arizona, you must file a request with the court that issued the support order. Utilizing the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign can be beneficial in illustrating mutual agreement regarding the cessation of payments. Clearly state your reasons and provide any necessary documentation. For a smoother experience, you might want to check resources available on USLegalForms to assist you in navigating this process.

Terminating child support arrears in Arizona typically requires a court hearing where you present evidence. Using the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign can simplify this process by demonstrating unanimous consent from all involved parties. It’s crucial to understand the legal implications of this process, so consider consulting with a legal professional. Platforms like USLegalForms offer resources to guide you through the termination procedure effectively.

To get your child support arrears dismissed in Arizona, you must file a formal motion with the court. The court will consider whether all parties agree to the terms, which is where the Arizona Agreement to Modify Income Withholding Order when All Parties Will Sign becomes essential. Ensure you gather all necessary documentation and seek legal assistance if needed. You can also explore online platforms like USLegalForms to streamline the filing process.