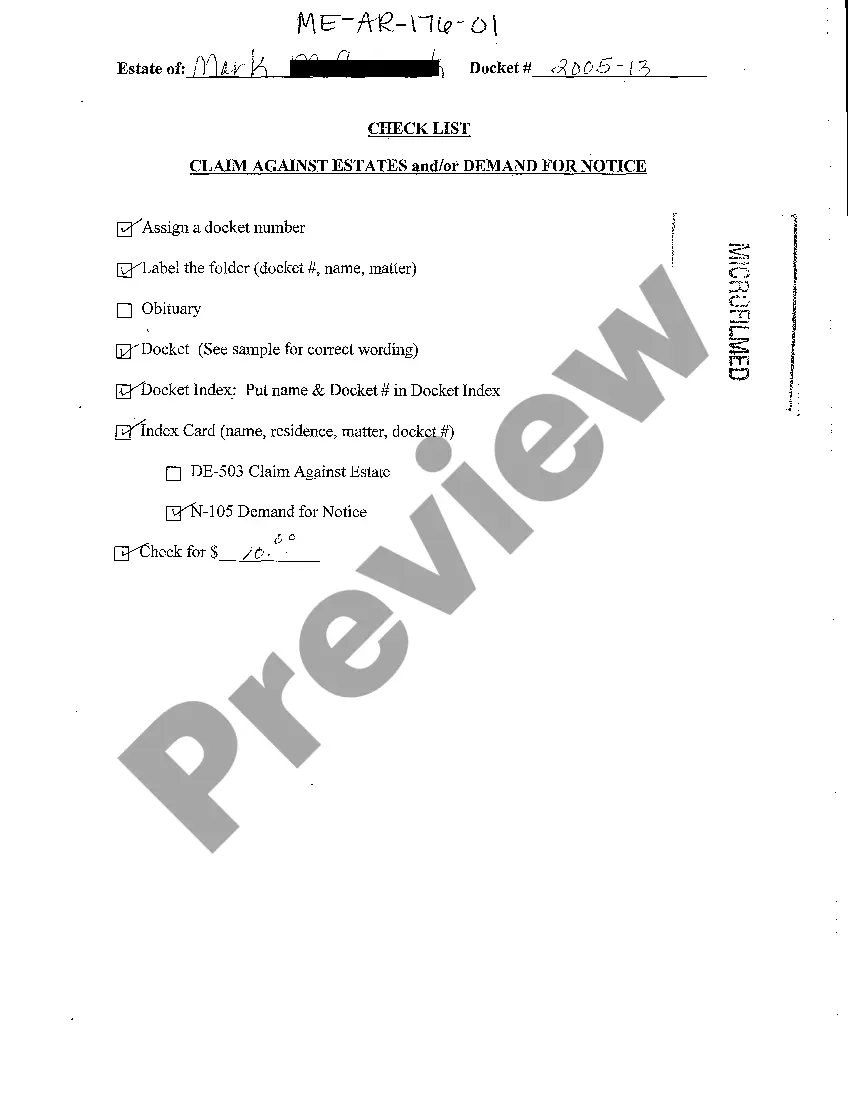

The Arizona Order for Release of Excess Proceeds of Sale is a legal document used by state courts to distribute the excess proceeds from a foreclosure sale. The Order is usually issued by the court after the sale of the foreclosed property, and it is used to determine how the money should be distributed among the various parties involved in the sale. The Arizona Order for Release of Excess Proceeds of Sale typically outlines the amount of money remaining after all the expenses associated with the sale have been paid off. It also typically specifies who is entitled to receive these excess funds, such as the holder of the mortgage, the county treasurer, or other interested parties. There are two main types of Arizona Order for Release of Excess Proceeds of Sale: (1) The Order for Release of Excess Proceeds to the Mortgagee and (2) The Order for Release of Excess Proceeds to the County Treasurer.

Arizona Order For Release Of Excess Proceeds Of Sale

Description

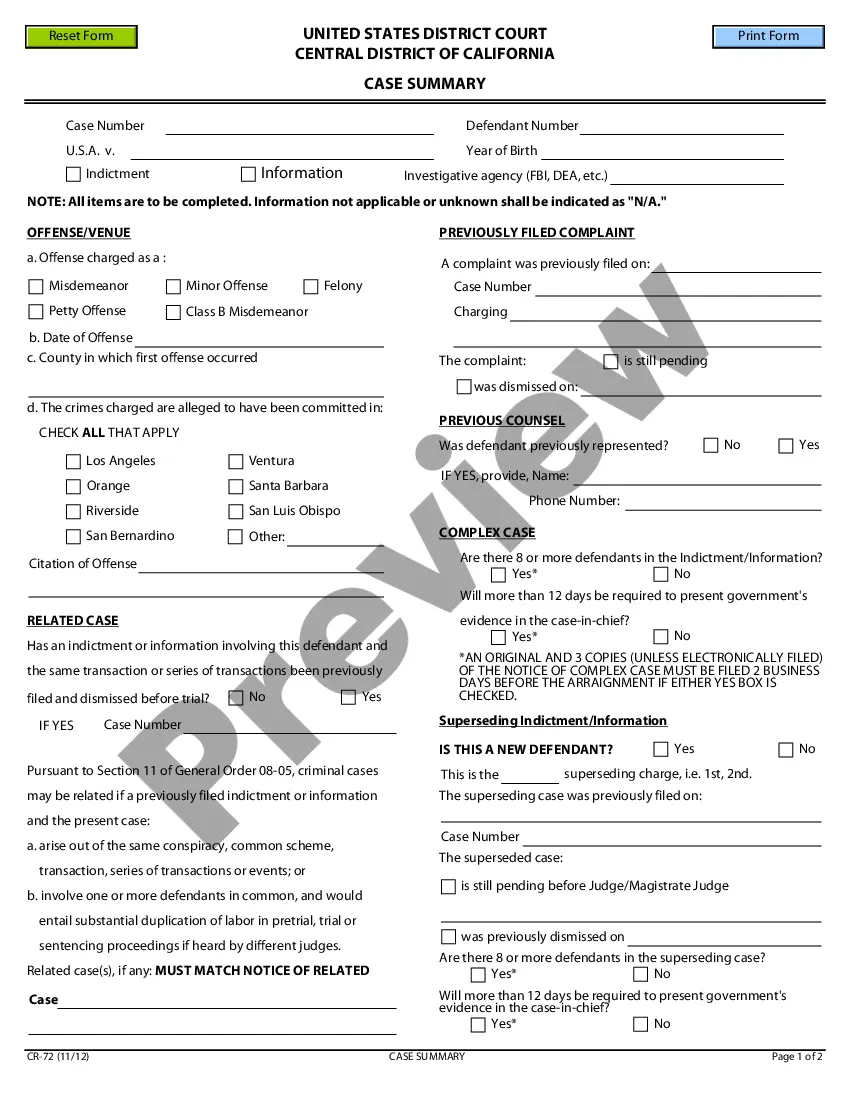

How to fill out Arizona Order For Release Of Excess Proceeds Of Sale?

Handling legal documentation necessitates diligence, precision, and utilizing thoroughly prepared templates. US Legal Forms has been assisting individuals throughout the nation in achieving this for 25 years, ensuring that when you select your Arizona Order For Release Of Excess Proceeds Of Sale template from our collection, it adheres to federal and state regulations.

Utilizing our service is simple and quick. To obtain the necessary documentation, all you need is an account with an active subscription. Here’s a concise guide for you to acquire your Arizona Order For Release Of Excess Proceeds Of Sale in just minutes.

All documents are designed for multiple uses, such as the Arizona Order For Release Of Excess Proceeds Of Sale featured on this page. If you require them again, you can fill them out without an additional payment - simply visit the My documents tab in your profile and complete your document whenever needed. Try US Legal Forms and efficiently manage your business and personal documentation while ensuring full legal compliance!

- Ensure to meticulously review the form content and its alignment with general and legal standards by previewing it or examining its description.

- Look for another official template if the one you opened previously does not meet your circumstances or state laws (the tab for this can be found in the upper page corner).

- Log In to your account and save the Arizona Order For Release Of Excess Proceeds Of Sale in your desired format. If this is your first time visiting our site, click Buy now to continue.

- Create an account, select your subscription plan, and pay using your credit card or PayPal account.

- Choose the format in which you wish to save your document and click Download. You can print the blank or incorporate it into a professional PDF editor for paperless submission.

Form popularity

FAQ

Property taxes in Maricopa County vary based on property value and location, but the average rate is typically around 0.6% to 1.3% of assessed value. Homeowners should stay informed about these rates, as they can affect overall budgeting. If you sell a property and have excess proceeds, the Arizona Order For Release Of Excess Proceeds Of Sale can help you reclaim those funds effectively. For more detailed guidance, using uslegalforms can simplify the paperwork involved in claiming your surplus.

In Arizona, you generally have up to three years to claim surplus funds from a property sale. It's important to act promptly, as these funds can significantly impact your financial situation. The Arizona Order For Release Of Excess Proceeds Of Sale provides a structured way to access those funds, allowing you to recover what is rightfully yours. Consider utilizing platforms like uslegalforms for streamlined assistance in navigating this process.

Yes, Maricopa County offers a senior property tax freeze program, which helps eligible seniors maintain the same property tax amount each year. This program is particularly beneficial for those concerned about rising property taxes, as it provides financial relief. To qualify, seniors must meet certain income and age requirements. Exploring the Arizona Order For Release Of Excess Proceeds Of Sale can also be helpful if you are managing excess funds from a property sale.

Foreclosure sales in Arizona generally occur through a public auction process conducted by the lender. This auction typically takes place on the courthouse steps after the necessary notice and waiting period. If the home sells for more than what is owed, the surplus is subject to the Arizona Order For Release Of Excess Proceeds Of Sale, allowing former homeowners to receive leftover funds. Utilizing platforms like uslegalforms can help you understand these processes better and secure your financial interests.

Arizona does not provide a redemption period after a foreclosure sale unless it involves commercial properties. Once the home is sold at auction, the right to reclaim it typically ends. However, homeowners should consult with legal professionals to navigate their options effectively. Additionally, familiarizing yourself with the Arizona Order For Release Of Excess Proceeds Of Sale may ensure you recover any excess funds from the sale.

In Arizona, you can expect to face foreclosure after missing three consecutive mortgage payments. This process begins when the lender sends a notice of default. It's crucial to be aware of the timeline, as timely actions can help you manage your situation. Understanding your rights regarding the Arizona Order For Release Of Excess Proceeds Of Sale can also aid in reclaiming any funds after the foreclosure.

A notice of foreclosure sale in Arizona is a public announcement detailing the upcoming auction of a property in foreclosure. This notice must be published and includes important information such as the sale date and location. Homeowners should review this notice carefully, as it signals the potential for excess proceeds, which can be claimed through the Arizona Order For Release Of Excess Proceeds Of Sale.

The process of a trustee sale in Arizona involves notifying the homeowner of default, conducting a public auction, and selling the property to the highest bidder. The trustee plays a crucial role in this process, ensuring transparency and adherence to the legal framework. Homeowners should be aware of the opportunity to claim any excess funds via the Arizona Order For Release Of Excess Proceeds Of Sale.

A foreclosure is a legal process initiated by lenders to recover funds owed on a defaulted mortgage. A trustee sale, however, specifically refers to the auction where the property is sold. Understanding this distinction is essential, especially for homeowners seeking to reclaim excess proceeds through the Arizona Order For Release Of Excess Proceeds Of Sale.

The trustee process entails managing the sale of a property that has entered foreclosure. A trustee acts on behalf of the lender, ensuring that all legal protocols are followed during the sale. After the auction, any excess proceeds can be claimed by the homeowner via an Arizona Order For Release Of Excess Proceeds Of Sale.