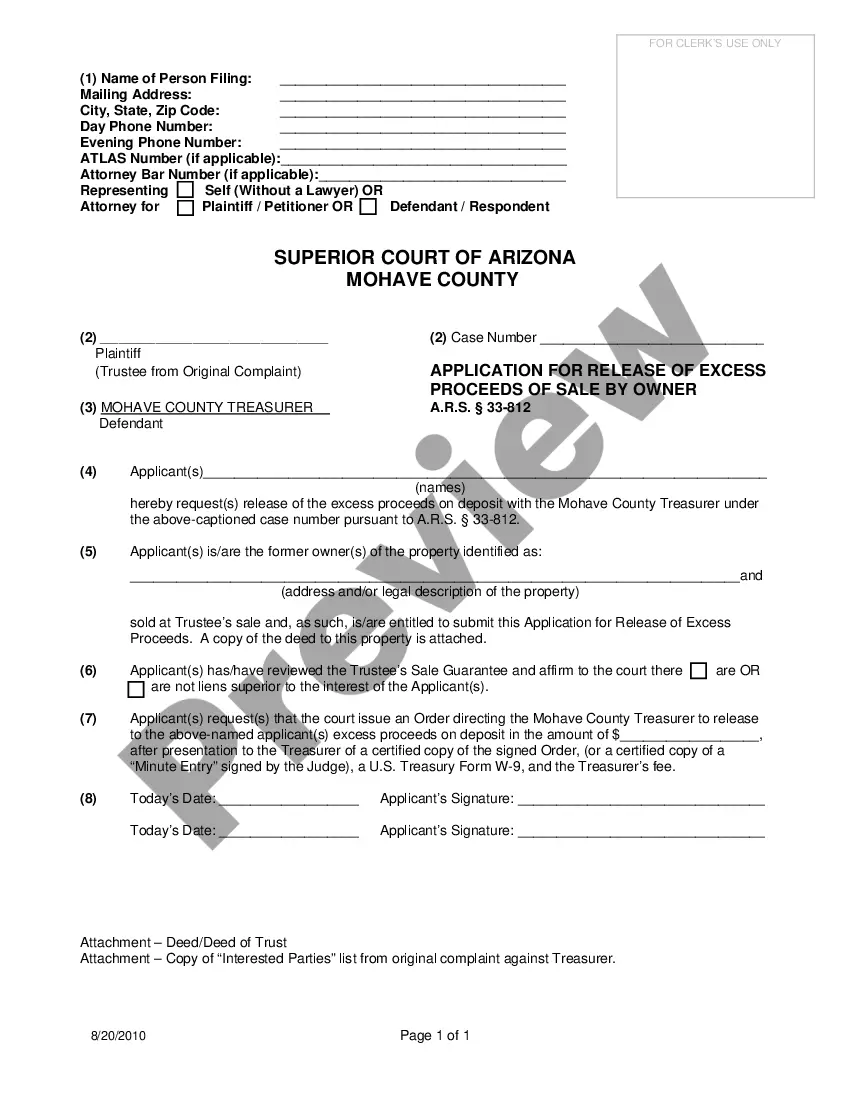

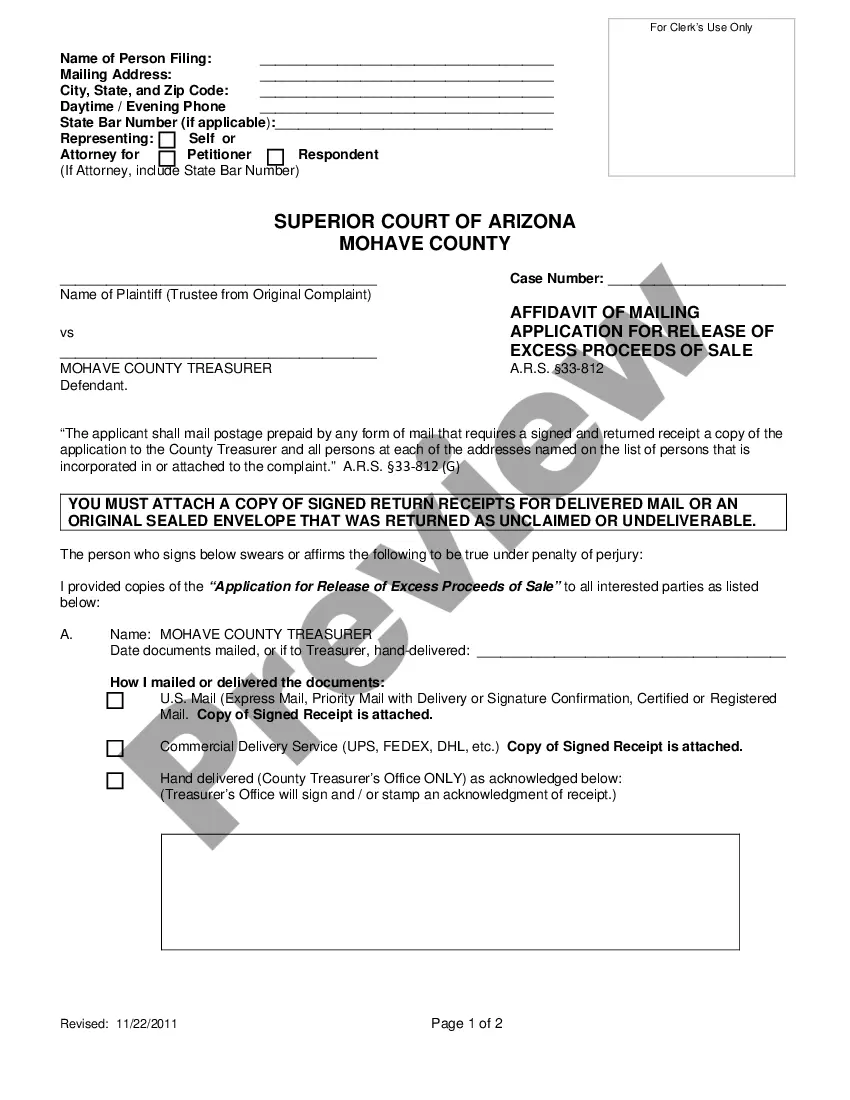

The Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale (Form #200) provides instructions for how to complete the application for release of excess proceeds of sale from the Arizona Department of Revenue. The application can be filed by the seller, the seller's attorney, or an authorized representative. The process involves providing detailed information about the sale, including the date of sale, the total purchase price, and the name and address of the buyer and seller. The application must also include the title of the property, the county parcel number, and a list of all liens against the property. The application must also include the name and address of the lien holder, the amount of each lien, and a list of all other parties involved in the sale. The application must also include a statement of the amount of the excess proceeds and a description of the property. There are two types of Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale: the Original Application and the Reinstatement Application. The Original Application is used for a sale that has been completed and the excess proceeds have already been released, while the Reinstatement Application is used for a sale that is still pending and the excess proceeds have yet to be released. The application must be completed in full, signed, and notarized before it can be submitted to the Arizona Department of Revenue. Once the application is approved, the excess proceeds will be released to the seller or their authorized representative.

Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale

Description

How to fill out Arizona Instructions: How To Fill Out The Application For Release Of Excess Proceeds Of Sale?

Drafting official documentation can be quite a hassle if you lack immediate access to fillable templates. With the US Legal Forms online collection of formal paperwork, you can trust the forms you find, as all of them align with federal and state laws and are reviewed by our experts.

So if you need to complete Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale, our service is the optimal place to obtain it.

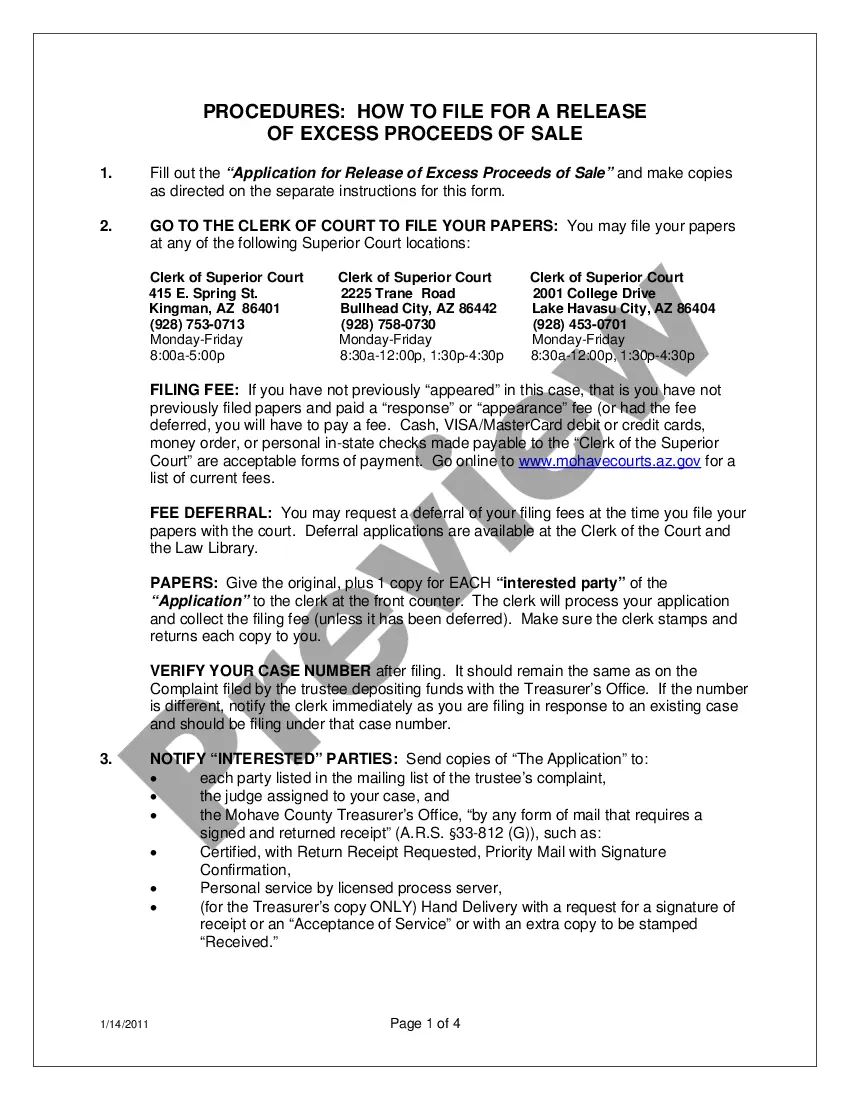

Document compliance assessment. You should thoroughly examine the contents of the form you intend to use and ensure that it aligns with your requirements and complies with your state regulations. Reviewing your document and checking its overall description will aid you in accomplishing this. Alternative search (optional). If there are any discrepancies, peruse the library via the Search tab at the top of the page until you discover an appropriate template, and click Buy Now when you identify the one you desire. Account setup and form acquisition. Register for an account with US Legal Forms. After verifying your account, Log In and select your preferred subscription plan. Make a payment to proceed (options for PayPal and credit cards are available). Template download and further utilization. Choose the file format for your Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale and click Download to save it on your device. Print it to complete your documents manually, or utilize a feature-rich online editor to create an electronic version more quickly and efficiently. Haven’t you explored US Legal Forms yet? Sign up for our service now to obtain any formal document swiftly and effortlessly whenever you need to, and maintain your paperwork efficiently!

- Acquiring your Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale from our service is as easy as pie.

- Previously registered users with an active subscription just need to Log In and click the Download button after locating the correct template.

- Furthermore, if necessary, users can retrieve the same form from the My documents section of their accounts.

- But even if you are new to our service, registering with a valid subscription will only take a few moments. Here’s a brief guide for you.

Form popularity

FAQ

After a foreclosure sale in Arizona, any excess proceeds beyond what is owed to the lender must be returned to the previous homeowner. The former owner may need to apply for these funds using the appropriate application, detailing their claim. For guidance on how to navigate this process, the Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale is an invaluable resource.

Arizona does not typically have a redemption period following a foreclosure sale, meaning homeowners usually cannot reclaim their property after it has been sold. However, specific circumstances might allow for different outcomes, so it’s important to be informed. To gain deeper insights, consider the Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale to understand your rights through this process.

In Arizona, a lender may initiate foreclosure proceedings after a homeowner misses three to six consecutive mortgage payments. The exact timing can vary based on the lender's policies and the type of mortgage. If you find yourself in this situation, consulting the Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale might help you understand your options better.

Foreclosure sales in Arizona typically occur when a homeowner defaults on their mortgage payments. The lender will auction the property at public sale, with the highest bidder purchasing the home. It's crucial to understand the process fully, especially when it comes to retrieving excess proceeds, as guided in the Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale.

In Arizona, property owners must claim surplus funds within three years after the sale of the property. This time frame is essential for ensuring you receive the funds owed to you from any excess proceeds. For a detailed process on how to go about it, explore the Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale for efficient guidance.

Yes, Maricopa County offers a senior property tax refund program that may help senior residents. This program freezes property taxes for qualified seniors, allowing you to better manage your finances. If you are looking for guidance on property tax relief options while considering surplus funds, refer to the Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale.

Property taxes in Maricopa County tend to vary based on the property's assessed value and local tax rates. As of now, the average effective property tax rate is around 0.6%. If you are navigating the process, the Arizona Instructions: How to Fill Out the Application for Release of Excess Proceeds of Sale can provide you with clarity on any excess funds that may relate to your property tax situation.