Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs

Description

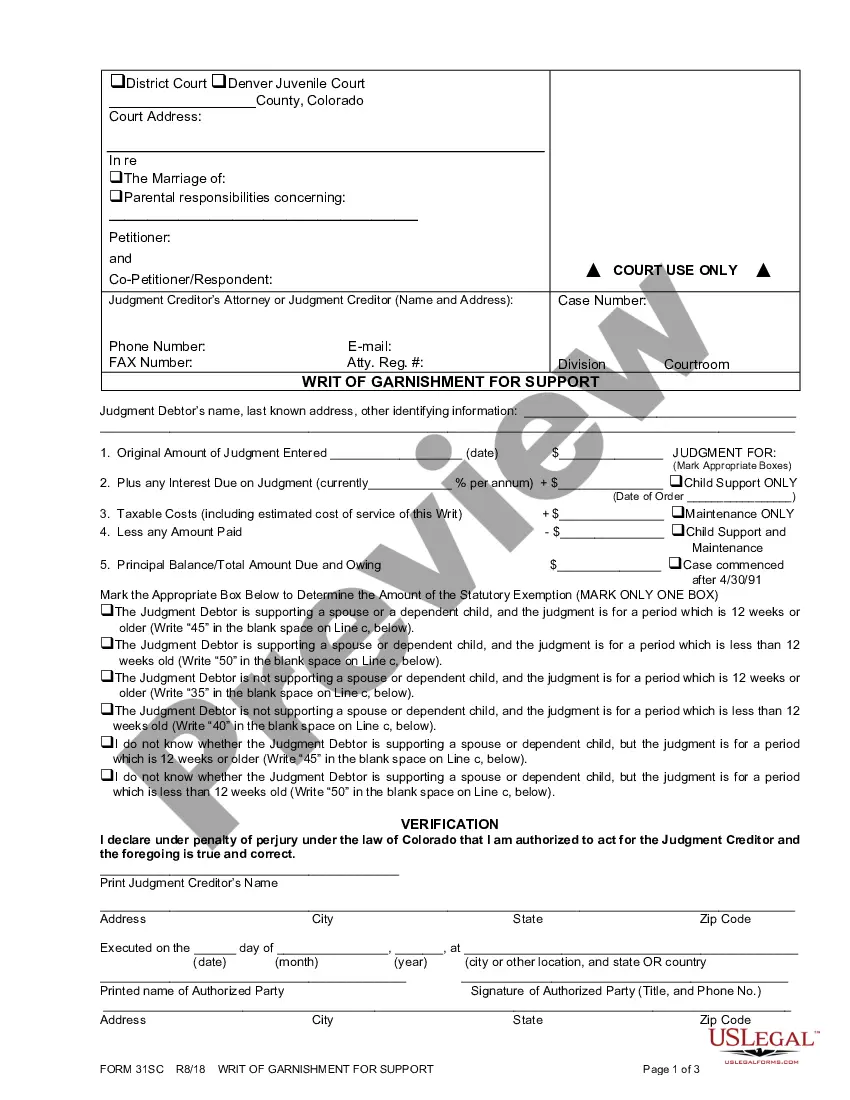

How to fill out Arizona Judgment Foreclosing The Right To Redeem A Tax Lien Or For Costs?

Completing official documentation can be quite a strain if you lack accessible fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the forms you find, as all of them adhere to federal and state regulations and are validated by our experts.

If you need to obtain Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs, our service is the optimal location to download it.

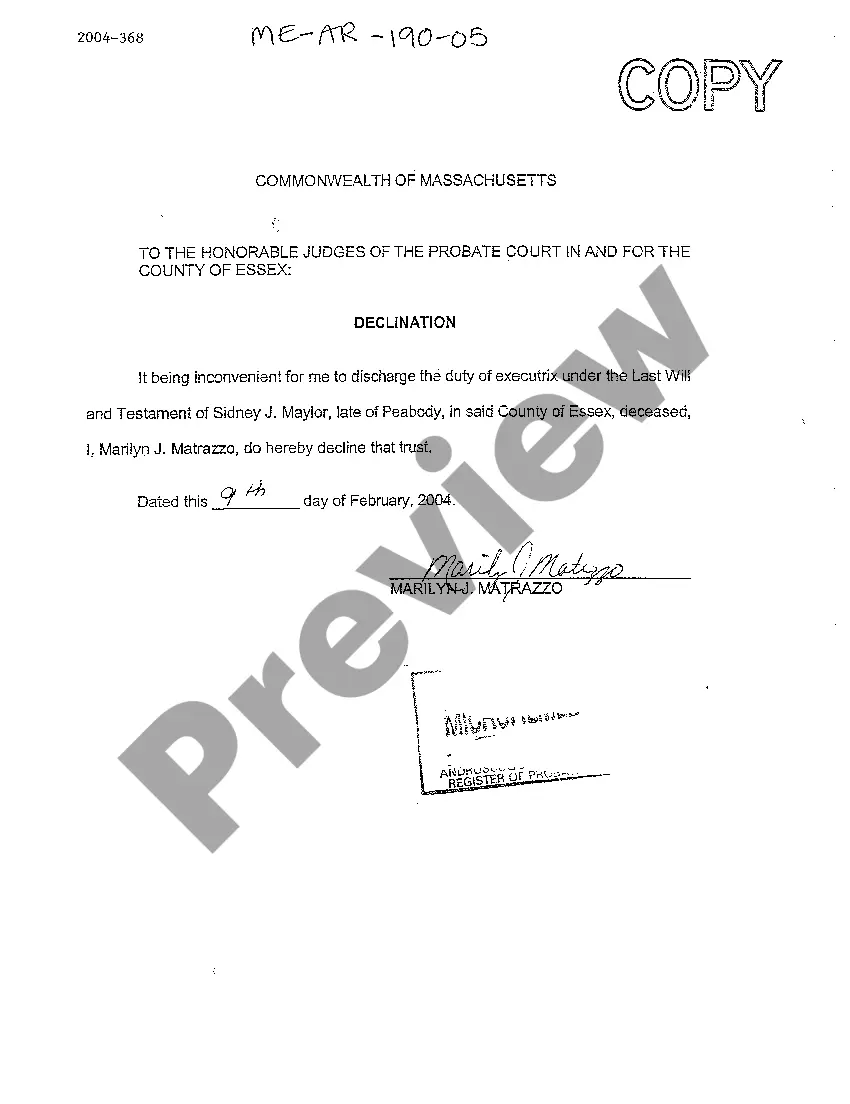

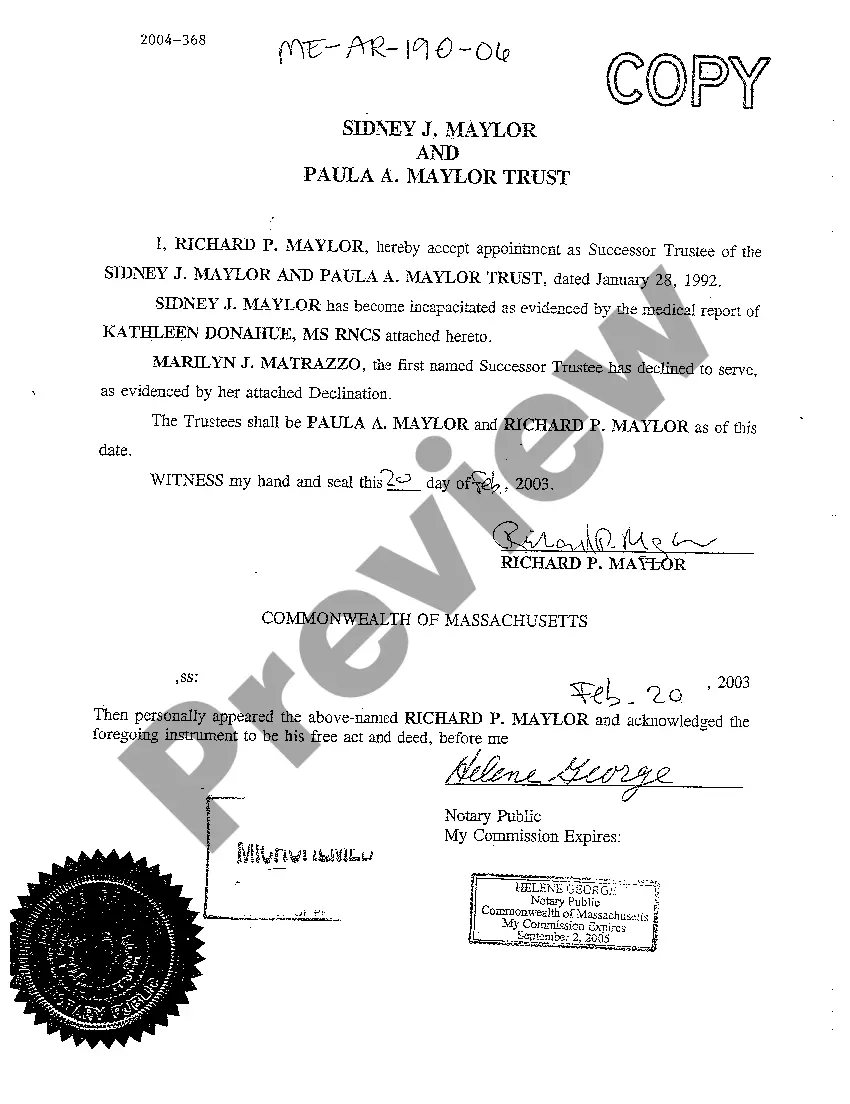

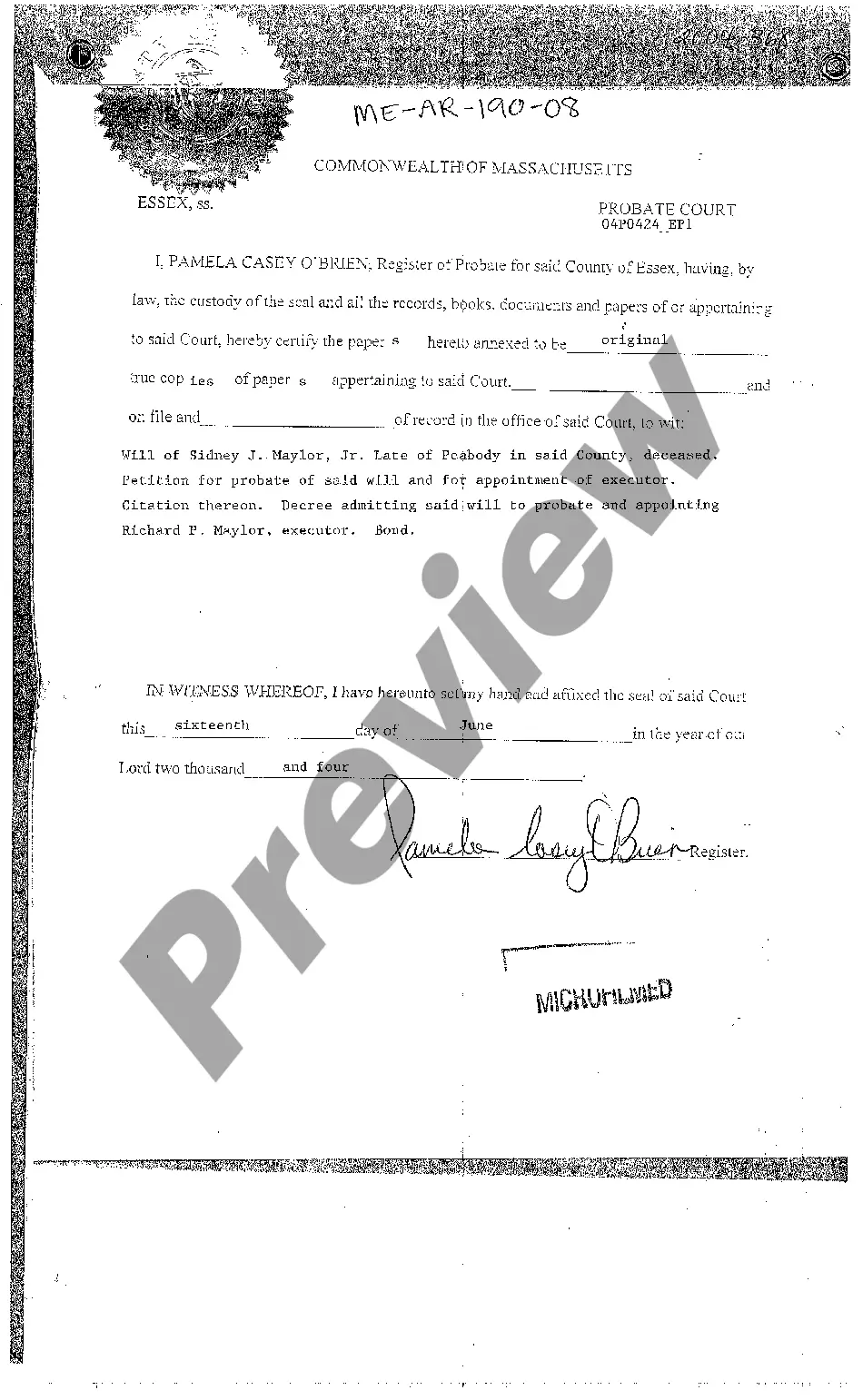

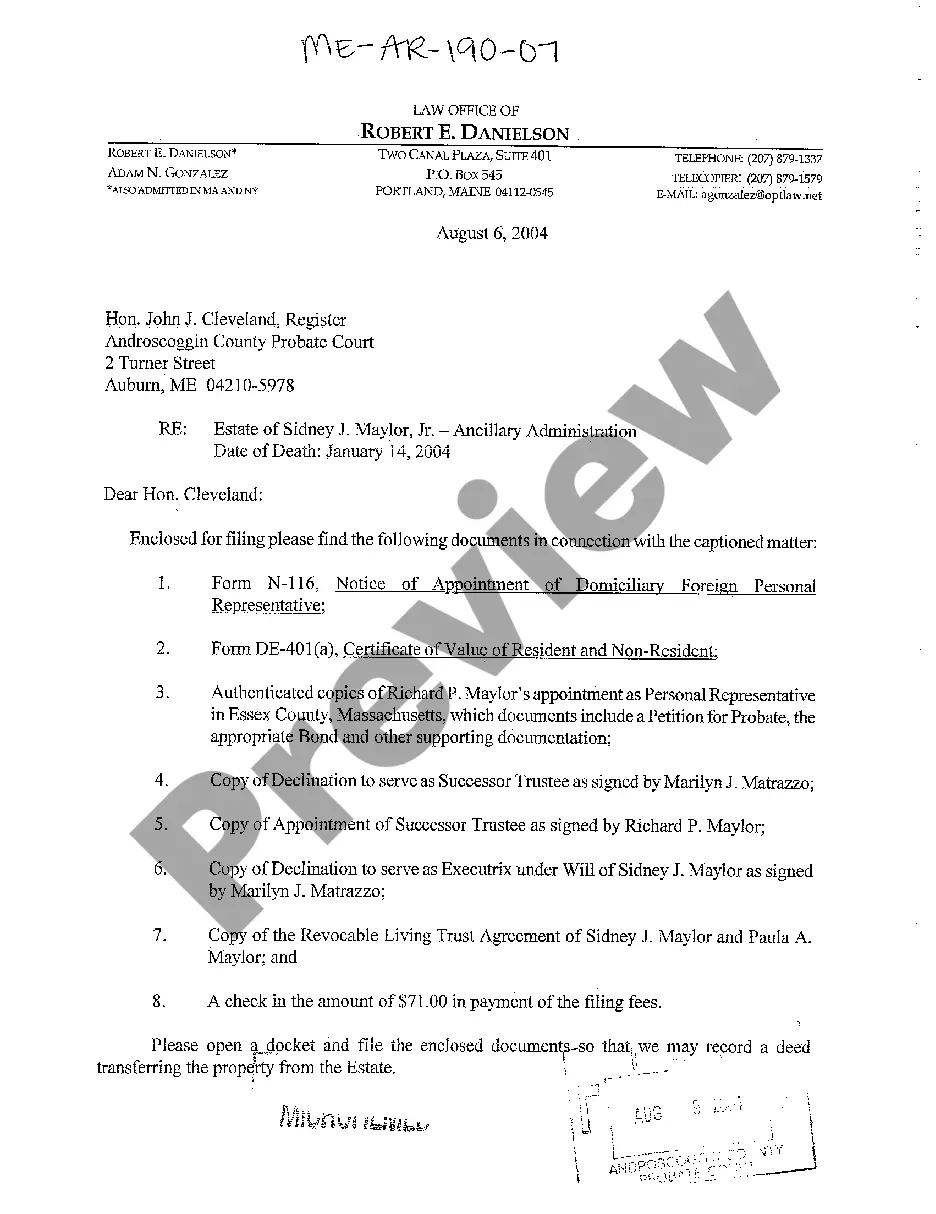

Document compliance evaluation. You should meticulously examine the content of the form you desire and confirm whether it meets your requirements and adheres to your state law regulations. Previewing your document and reviewing its general description will assist you in doing just that.

- Acquiring your Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs from our service is as easy as pie. Previously registered users with an active subscription only need to Log In and click the Download button once they locate the right template.

- Afterwards, if necessary, users can select the same document from the My documents section of their profile.

- However, even if you are not acquainted with our service, signing up with a valid subscription will only take a few minutes.

- Here’s a brief guide for you.

Form popularity

FAQ

To foreclose on a tax lien property in Arizona, you must first ensure that all legal requirements are met, including proper notification to the property owner. Once you have completed this step, you can initiate the legal process to enforce the Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs. Utilizing the services of platforms like uslegalforms can simplify this challenging process, providing you with the necessary documents and guidance.

The foreclosure process in Arizona involves several steps to ensure proper legal proceedings. Initially, a notice of the foreclosure must be filed, allowing the property owner a chance to remedy the situation. If the owner does not act, the property may be auctioned off to satisfy the Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs. Understanding this process can assist you in navigating your rights and responsibilities.

Foreclosing on a property in Arizona usually requires following a specified legal process, which involves notifying the homeowner and potentially going to court. It is crucial to understand the steps involved, including the timelines and necessary documentation. Familiarizing yourself with how an Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs plays a role in foreclosure can streamline the process for involved parties.

Property taxes in Arizona can typically go unpaid for several years before the county initiates foreclosure. The exact timeframe may vary by locality, but it usually takes about three years for action to begin on unpaid taxes. Staying on top of tax payments can prevent complications related to an Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs.

To foreclose on a tax lien in Arizona, the lien holder must first wait for a designated period specified by state law. After this period, a legal process must be followed, which may include filing a lawsuit and notifying the property owner. If you are involved in this process, knowing about an Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs can help guide your actions.

Yes, Arizona does provide a right of redemption, allowing property owners to reclaim their property after a tax lien foreclosure. However, the specifics of the redemption process can vary based on the length of time that has passed since the tax lien was placed. It is essential to be aware of this right and how an Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs can influence your situation.

In Arizona, the missed payments leading to foreclosure relate to the property tax rather than standard mortgage payments. If property taxes remain unpaid, the tax lien holder can initiate foreclosure after the redemption period concludes. Understanding how missed tax payments trigger foreclosure is key in cases involving Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs.

Tax lien auctions in Arizona are conducted by county treasurers, and typically take place annually. Investors bid on tax liens, and the right to collect the debt is awarded to the highest bidder. Each auction can vary, so understanding the process and reviewing any relevant Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs can enhance your investment approach.

The best state for purchasing tax lien certificates depends on your investment strategy, but many investors favor Arizona due to its solid interest rates and clear processes. States with strong regulations can offer better security and returns. Consider the implications of an Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs to make an informed decision.

Yes, you can buy tax liens in Arizona, and many investors find it a lucrative opportunity. Purchasing tax liens allows you to potentially earn significant interest, but you must be aware of the regulations and auction processes. Using resources like uslegalforms can help navigate the complexities of Arizona Judgment Foreclosing the Right to Redeem a Tax Lien or for Costs.