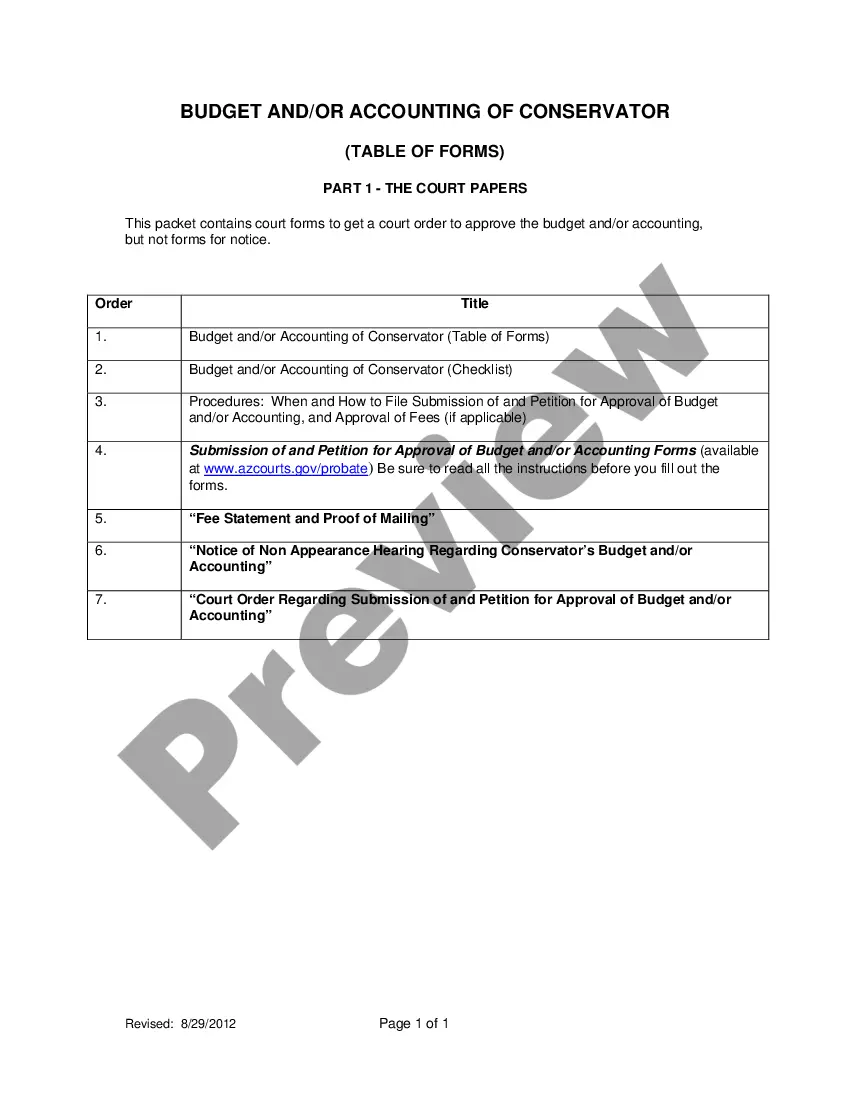

Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms) provides conservators with the necessary forms to ensure accurate financial accounting and reporting. The forms are an important part of the budget and/or accounting process, as they allow conservators to track income and expenses, report financial activity, and provide a reliable record of the estate's financial activity. The forms cover a variety of topics related to estate budgeting and accounting, such as annual budgets, disbursements, and financial statements. The forms also provide conservators with the necessary information to ensure that they are adhering to the Arizona laws and regulations pertaining to estate administration. The different types of Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms) include: 1) Conservator Annual Budget Form: This form is used to track income and expenses for the estate. It includes details such as estimated income, estimated expenses, and a record of any disbursements made. 2) Conservator Disbursement Form: This form is used to record any disbursements made from the estate. It includes details such as the amount of the disbursement, the date it was made, and the purpose of the disbursement. 3) Conservator Financial Statement Form: This form is used to provide a snapshot of the estate's financial activity. It includes details such as net income, total assets, total liabilities, and cash flow. 4) Conservator Financial Report Form: This form is used to provide a more detailed report of the estate's financial activity. It includes details such as income statements, balance sheets, and cash flow statements.

Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms)

Description

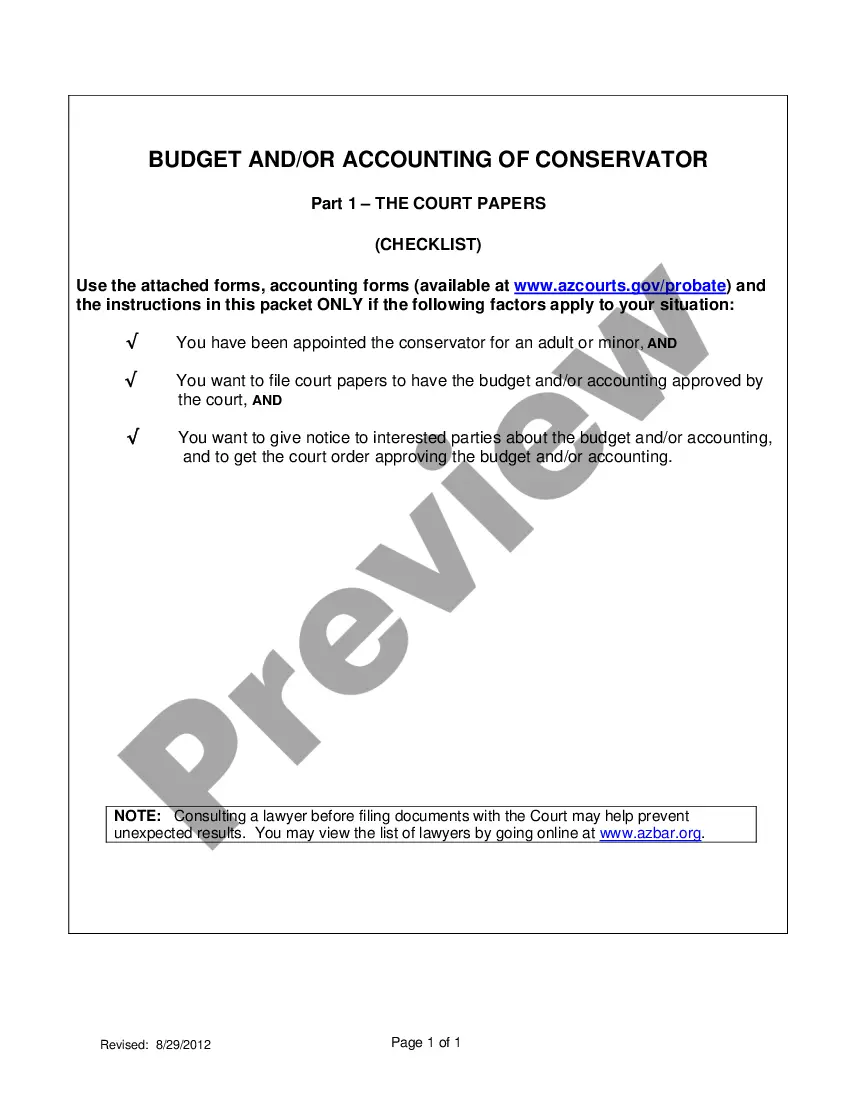

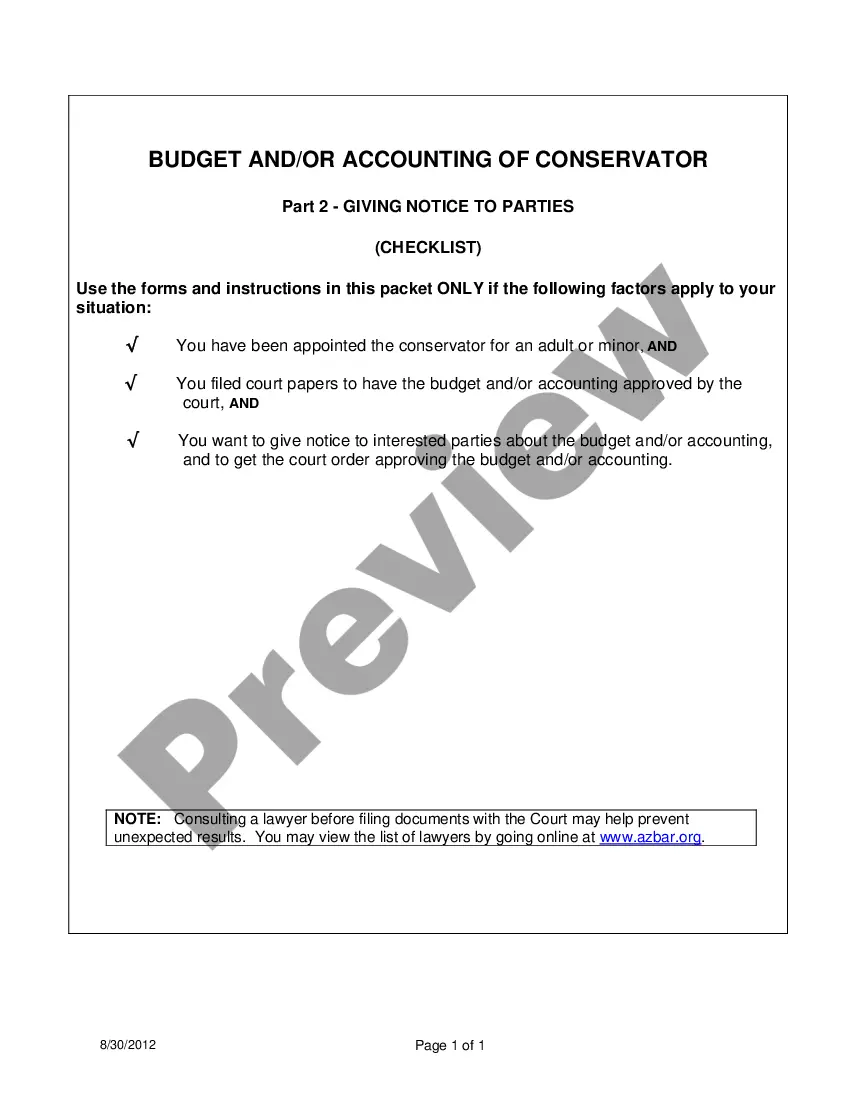

How to fill out Arizona Budget And/or Accounting Of Conservator Part 2 (Table Of Forms)?

If you’re seeking a method to suitably prepare the Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms) without employing a legal advisor, then you’re precisely in the correct place.

US Legal Forms has established itself as the most comprehensive and dependable repository of official templates for every personal and business circumstance. Each document you discover on our online platform is crafted in compliance with national and state laws, ensuring that your papers are properly arranged.

Another excellent feature of US Legal Forms is that you will never misplace the documents you have acquired - you can access any of your downloaded templates in the My documents section of your profile anytime you require them.

- Verify that the document displayed on the page aligns with your legal circumstances and state laws by reviewing its textual description or browsing the Preview mode.

- Input the document title in the Search tab at the top of the page and choose your state from the list to find an alternate template in case of any discrepancies.

- Perform the content check again and click Buy now once you are assured of the paperwork meeting all stipulations.

- Log In to your account and click Download. Create an account with the service and select a subscription plan if you do not have one yet.

- Utilize your credit card or PayPal option to purchase your US Legal Forms subscription. The template will be ready for download immediately afterward.

- Determine in which format you prefer to receive your Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms) and download it by clicking the relevant button.

- Import your template to an online editor to complete and sign it swiftly or print it to prepare your physical copy manually.

Form popularity

FAQ

To establish guardianship in California, you will need specific forms like the Petition for Appointment of Guardian and the Required Notice of Hearing. Completing these forms accurately is crucial in ensuring a smooth process in your guardianship application. Utilizing the Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms) could provide valuable templates and guidance for managing required financial documentation as part of your application.

Obtaining a conservatorship for a mentally ill person in California involves filing a petition and demonstrating that the individual cannot manage their own affairs. You will need to present medical evidence and possibly obtain evaluations from mental health professionals. To ensure you meet all legal requirements and streamline the process, consider using resources like the Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms) for organizing your financial accounting.

In California, several forms are required to initiate conservatorship proceedings, including the Petition for Appointment of Conservator and the Notice of Hearing. These forms must be completed accurately and submitted to the court. Utilizing the Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms) can assist you in organizing your financial documents, ensuring compliance with the necessary legal frameworks during these proceedings.

The new conservatorship law in California aims to provide clearer guidelines and protections for individuals under conservatorship. This law emphasizes accountability and transparency from conservators, particularly in handling finances. If you are exploring options for conservatorship and managing responsibilities, understanding the nuances of the law will be beneficial. You can also reference the Arizona Budget and/or Accounting of Conservator Part 2 (Table of Forms) for detailed financial reporting requirements.

Arizona requires probate unless the decedent's assets are all owned by a living trust or they have designated beneficiaries. Perhaps the best way to identify assets that must go through probate is to list the assets that are not subject to probate.

How to Start Probate for an Estate Open the Decedent's Last Will and Testament.Determine Who Will be the Personal Representative.Compile a List of the Estate's Interested Parties.Take an Inventory of the Decedent's Assets.Calculate the Decedent's Liabilities.Determine if Probate is Necessary.Seek a Waiver of Bond.

Assuming probate is necessary, there can be a number of consequences for not petitioning to open probate: Individually-titled assets will remain frozen in the decedent's name. The estate's assets are subject to losses. Another interested party may petition to open probate.

As conservator, your responsibilities involve managing the assets of the ward/protected person as a prudent person would. In other words, the conservator must ensure that the money and assets of the ward are used only for the benefit of the ward.

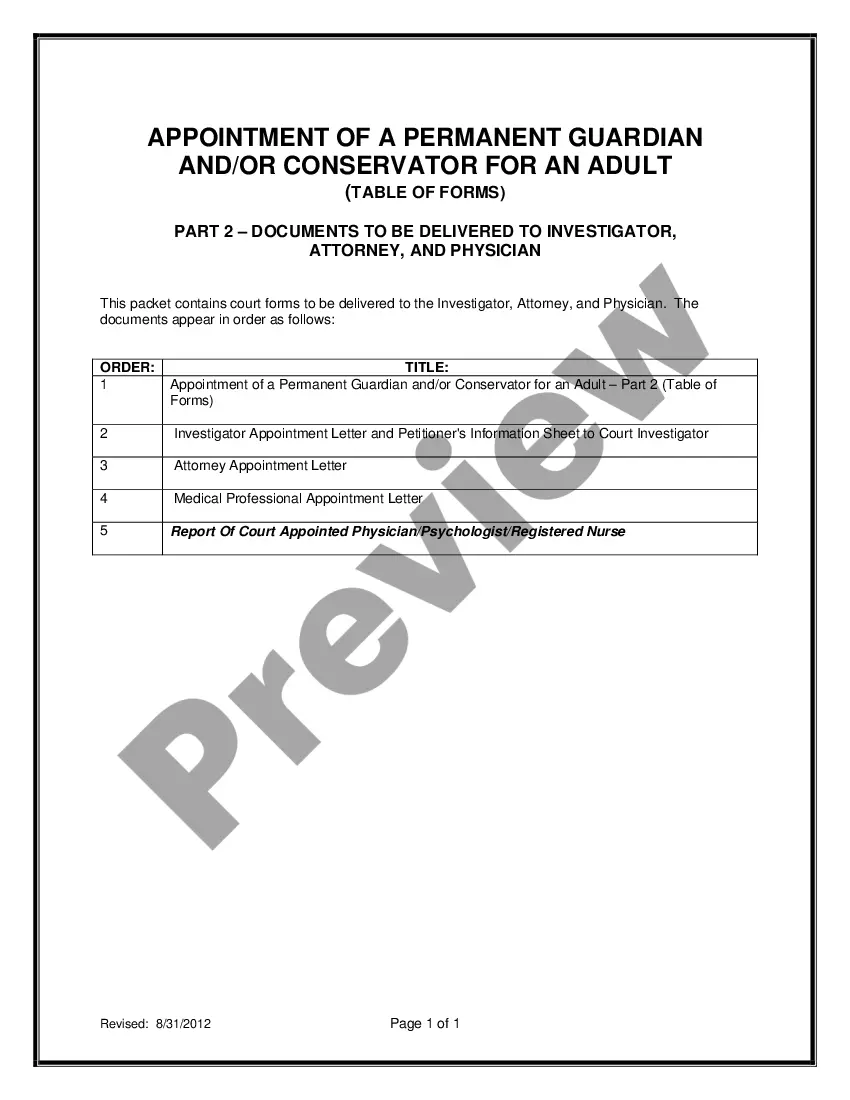

Creating a conservatorship requires filing a petition with the Superior Court Probate Division, describing the need to protect an individual and stating the assets that may be involved. In the case of an incapacitated adult, the court will appoint an attorney to represent him or her.

Ing to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.