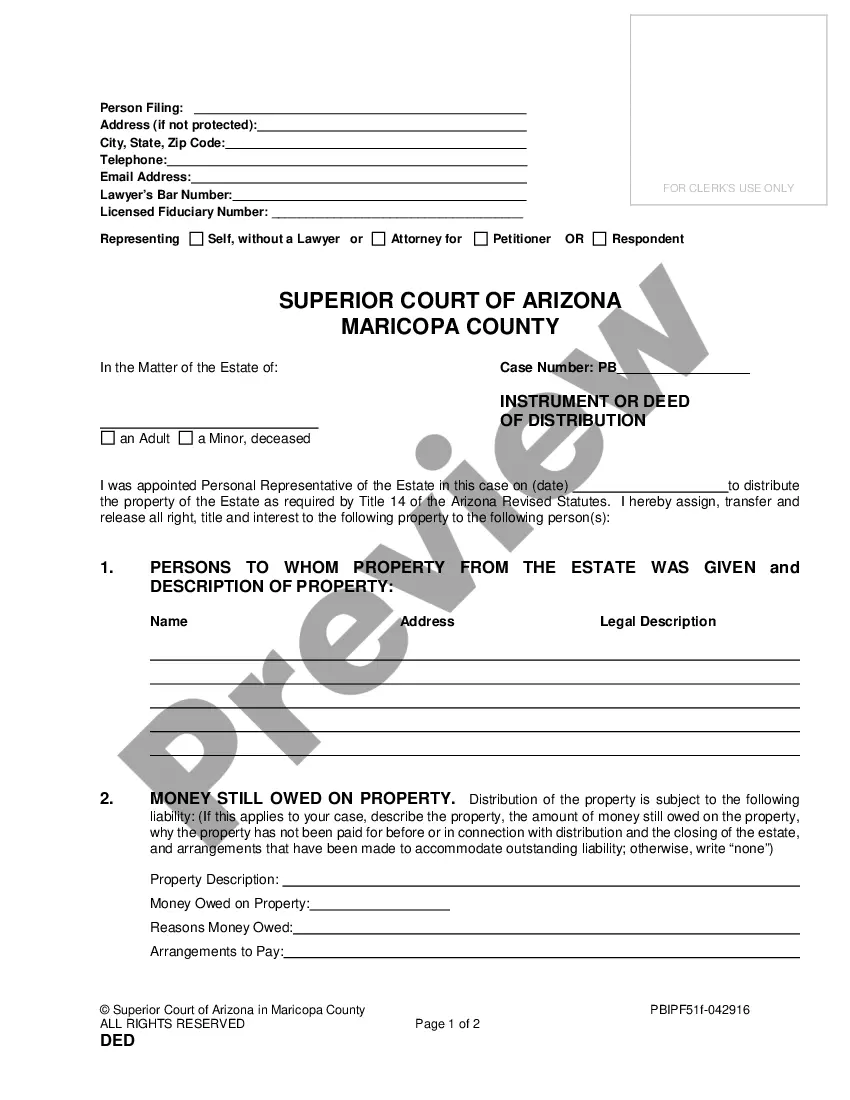

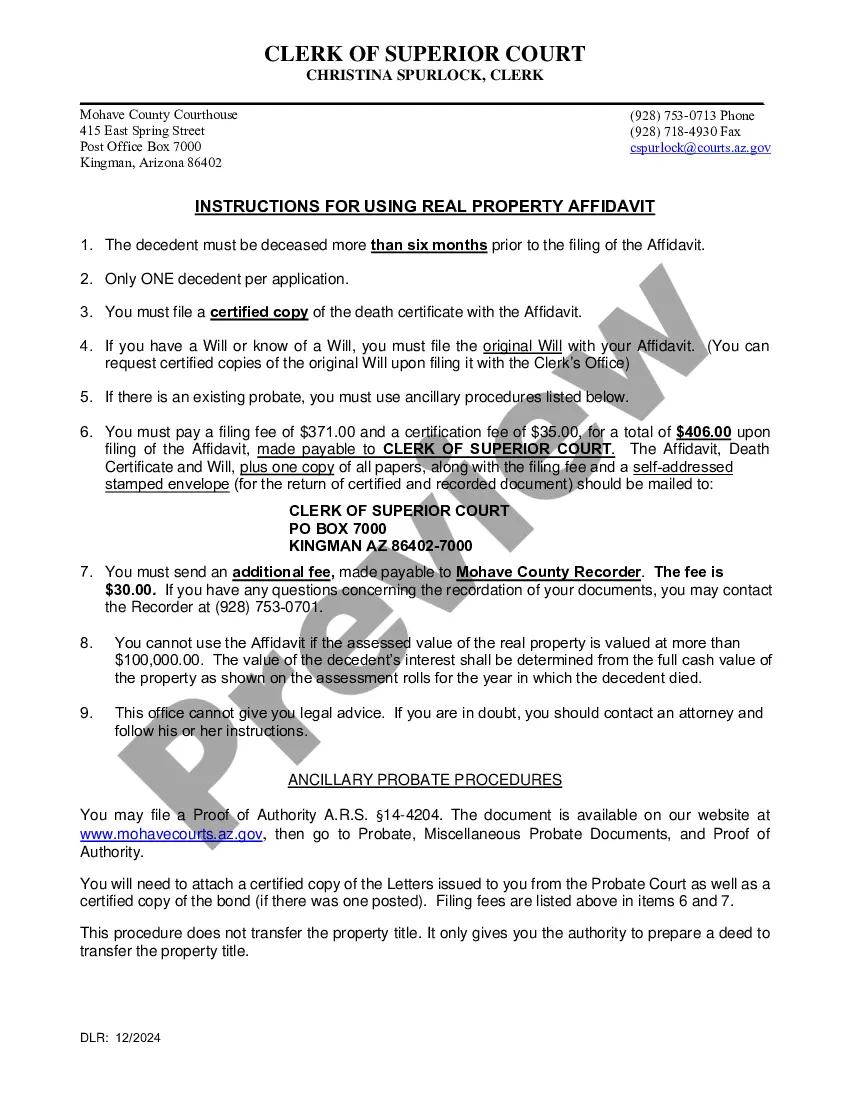

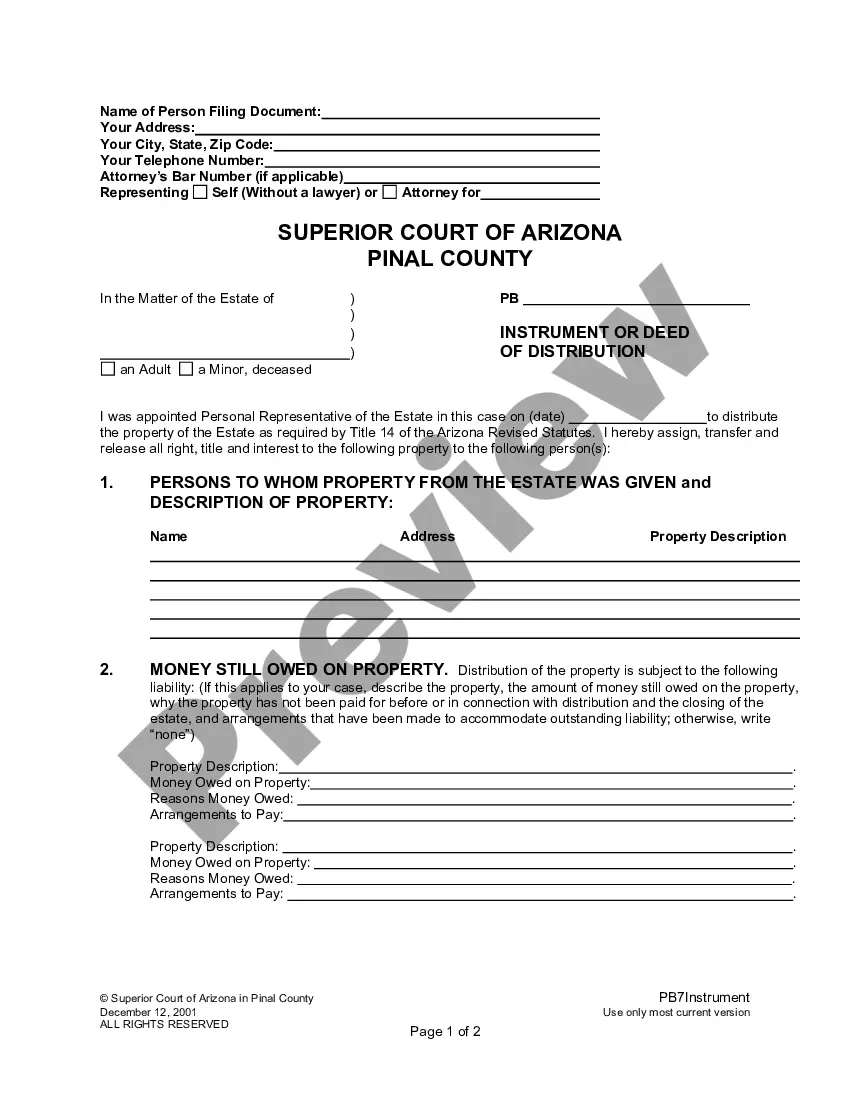

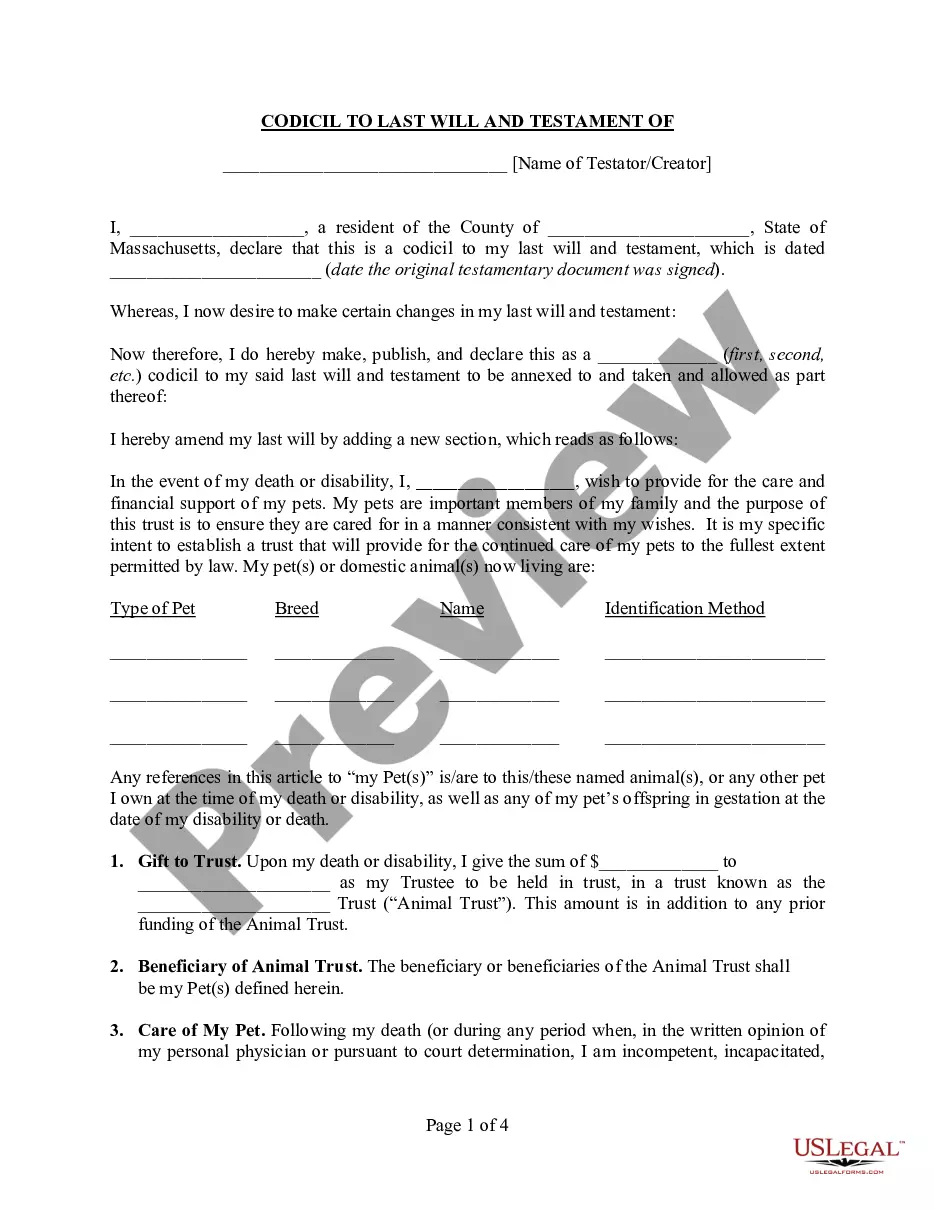

An Arizona Instrument or Deed of Distribution is a legal document used to distribute property rights in the state of Arizona. It is typically used when a deceased person leaves behind assets and those assets need to be divided among his or her heirs. The Instrument or Deed of Distribution outlines the terms of the distribution and assigns ownership of the assets to the rightful heirs. There are two common types of Arizona Instrument or Deed of Distribution: a Small Estate Affidavit and an Affidavit of Personal Representative. A Small Estate Affidavit is used when the value of the deceased’s assets is less than $75,000, and is used to transfer ownership of the assets without going through the court system. An Affidavit of Personal Representative is used when the value of the assets is more than $75,000, and requires the appointment of a Personal Representative to manage the distribution of the assets.

Arizona Instrument or Deed of Distribution

Description

How to fill out Arizona Instrument Or Deed Of Distribution?

If you’re seeking a method to suitably prepare the Arizona Instrument or Deed of Distribution without engaging a lawyer, then you’ve arrived at the right place.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and business need. Every document available on our online platform is crafted in accordance with federal and state laws, ensuring that your paperwork is properly organized.

Another excellent feature of US Legal Forms is that you never misplace the documents you purchased - you can access any of your downloaded forms in the My documents section of your profile whenever needed.

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by examining its text description or reviewing the Preview mode.

- Input the document title in the Search tab located at the top of the page and select your state from the dropdown to locate an alternative template in case of any discrepancies.

- Conduct another content verification and click Buy now when you are confident the paperwork meets all the specifications.

- Log In to your account and click Download. If you do not yet have one, register for the service and choose a subscription plan.

- Utilize your credit card or the PayPal option to process your US Legal Forms subscription payment. The blank will be available for download immediately after.

- Determine in which format you wish to save your Arizona Instrument or Deed of Distribution and download it by clicking the corresponding button.

- Import your template into an online editor to complete and sign it quickly or print it out to prepare a physical copy manually.

Form popularity

FAQ

In Arizona, the three types of deeds considered as conveyance deeds are the warranty deed, special warranty deed, and quit claim deed. A warranty deed offers the highest level of protection to the buyer by ensuring the seller has clear ownership. The special warranty deed provides some assurances but only for claims that arose during the seller's ownership. The quit claim deed transfers any interest the seller may have, without guarantees, making it useful for specific situations, such as adding a spouse to a title.

Yes, Arizona is classified as a deed state. This classification highlights that property ownership and transfers are documented through deeds rather than just titles. A deed serves as legal evidence of ownership, and certain types of deeds, such as the Arizona Instrument or Deed of Distribution, can facilitate the transfer of property after someone's passing, streamlining the process for beneficiaries.

In Arizona, there are two main types of probate: informal and formal probate. Informal probate is less complicated and can often be resolved without a court hearing, making it quicker and less expensive. Formal probate, on the other hand, involves a more structured court process and is typically used for more complex estates. The Arizona Instrument or Deed of Distribution can assist in transferring assets outside of probate in certain situations, reducing the need for formal proceedings.

In Arizona, the most common form of real property ownership is joint tenancy. This arrangement allows two or more individuals to own a property together, with the right of survivorship. When one owner passes away, their share automatically transfers to the surviving owners, simplifying the estate settlement process. Additionally, the Arizona Instrument or Deed of Distribution can facilitate transferring property in such cases.

Transferring property after a death in Arizona can be streamlined through the use of a beneficiary deed. If you prepared an Arizona Instrument or Deed of Distribution prior to death, the property will automatically pass to the designated beneficiaries without going through probate. If no such deed exists, you may need to follow the probate process, which is more time-consuming. Utilizing services like US Legal Forms can help you navigate these procedures efficiently.

If you need to file a beneficiary deed in Arizona after certain events, such as after a marriage or divorce, you can do so by completing a new Arizona Instrument or Deed of Distribution. This updated deed must reflect your current wishes and beneficiaries clearly. Once filled out and notarized, file it with the county recorder’s office to ensure your intentions are accurately recorded.

To record a deed in Arizona, you need to follow a clear procedure. Begin by preparing the deed, ensuring that it is correctly filled out and signed. Next, take the document to the appropriate county recorder’s office, along with any required fees. Recording the deed officially documents the transfer and protects the interests of the new owner in compliance with Arizona laws.

Filing a beneficiary deed in Arizona requires specific steps to ensure validity. First, you must complete the Arizona Instrument or Deed of Distribution form with accurate details, including the property description and beneficiary information. Then, sign the deed in the presence of a notary and file it with the county recorder's office where the property is located. This process secures your wishes regarding property transfer.

In Arizona, a beneficiary deed significantly impacts how property transfers upon death. If a beneficiary deed is in place, it typically takes precedence over a will regarding the designated property. This means that if you have clearly identified beneficiaries in your Arizona Instrument or Deed of Distribution, they will inherit the property directly, avoiding the probate process.

The most common type of deed used in Arizona is the warranty deed, which provides the highest level of protection for the grantee. This deed guarantees that the grantor holds clear title to the property and has the right to transfer it. For specific needs, such as transferring property between family members, the Arizona Instrument or Deed of Distribution is also frequently utilized. Choosing the right deed is essential for your real estate transactions.