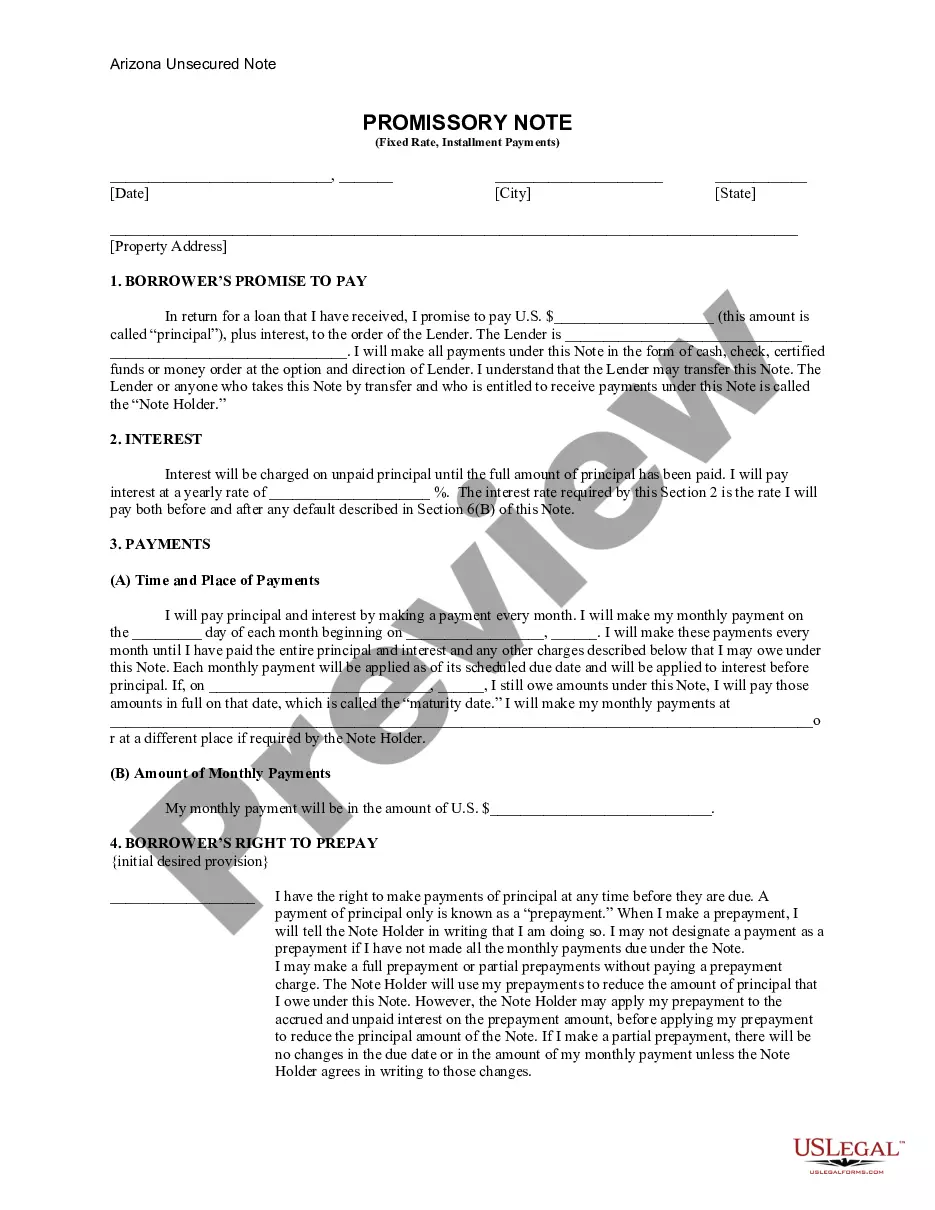

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Arizona Unsecured Installment Payment Promissory Note for Fixed Rate

Description Arizona Promissory Note Template

How to fill out Arizona Unsecured Installment Payment Promissory Note For Fixed Rate?

If you're looking for precise Arizona Unsecured Installment Payment Promissory Note for Fixed Rate document templates, US Legal Forms is what you require; access files created and reviewed by state-certified attorneys.

Utilizing US Legal Forms not only shields you from issues related to legal documents; you also conserve time, effort, and finances! Downloading, printing, and completing a professional template is indeed more economical than hiring an attorney to do it for you.

And that's it. Within just a few simple clicks, you have an editable Arizona Unsecured Installment Payment Promissory Note for Fixed Rate. Once you create your account, all future purchases will be processed even more smoothly. If you have a US Legal Forms subscription, simply Log In to your profile and then click the Download button you see on the form’s page. Then, when you need to use this template again, you will always be able to find it in the My documents section. Don’t waste your time and effort searching through multiple forms on different websites. Purchase accurate copies from a single secure platform!

- To begin, finish your registration process by providing your email and creating a password.

- Follow the steps below to establish your account and locate the Arizona Unsecured Installment Payment Promissory Note for Fixed Rate template to solve your needs.

- Use the Preview option or examine the document description (if available) to ensure that the template is the one you need.

- Verify its validity in your location.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Create an account and pay using a credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

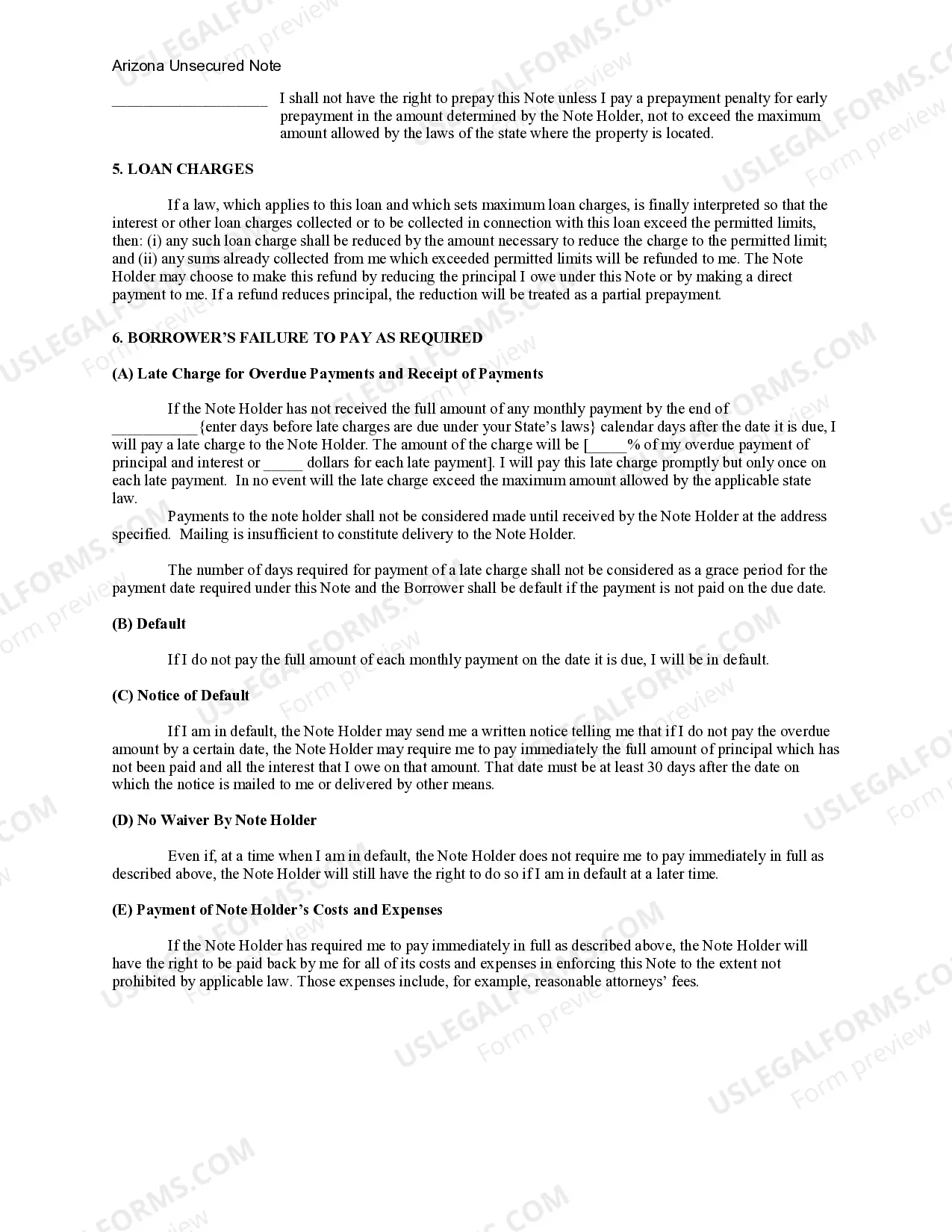

Rules for promissory notes include ensuring clarity in payment terms, providing complete information about both parties, and confirming proper signatures. These rules are essential for creating an enforceable Arizona Unsecured Installment Payment Promissory Note for Fixed Rate. Adhering to these guidelines promotes accountability and protects your interests.

The promissory note policy outlines how these notes should be used and managed within legal frameworks. For an Arizona Unsecured Installment Payment Promissory Note for Fixed Rate, this policy ensures that the terms comply with state laws and protect all parties involved. Following this policy can prevent disputes and misunderstandings.

Yes, a promissory note is a legally binding document. When executed correctly, it holds both the borrower and lender to their terms, including repayment amounts and timelines. An Arizona Unsecured Installment Payment Promissory Note for Fixed Rate solidifies this commitment, making it crucial for both parties to adhere to its stipulations.

The promissory rule refers to the legal principle that dictates how promissory notes function in accordance with the law. Specifically, in the context of an Arizona Unsecured Installment Payment Promissory Note for Fixed Rate, this rule ensures that both parties are held accountable for their commitments. Understanding this rule helps in drafting notes that are enforceable and clear.

In Arizona, the validity of a promissory note typically depends on the statute of limitations, which is six years for written agreements. After this period, the lender may lose the legal right to enforce the note. Therefore, it's essential to keep track of payment schedules and maintain communication about any outstanding amounts to ensure clarity in your Arizona Unsecured Installment Payment Promissory Note for Fixed Rate.

Filling out an Arizona Unsecured Installment Payment Promissory Note for Fixed Rate requires detailing the borrower and lender information and setting clear repayment terms. Unlike a standard promissory note, a demand note specifies that the lender can request full payment at any time. Therefore, ensure that all terms, including notification methods, are clearly outlined.

In Arizona, an unsecured installment payment promissory note for a fixed rate does not legally require witnessing or notarization to be valid. However, having it notarized can strengthen its enforceability in court. It serves as additional proof of the agreement, which may benefit both parties in case of conflicts.

The main difference lies in collateral. A secured promissory note uses an asset to protect the lender’s investment, while an unsecured note does not. The Arizona Unsecured Installment Payment Promissory Note for Fixed Rate falls into the latter category, emphasizing the borrower's commitment without tying the agreement to specific collateral. Understanding these differences helps you make informed borrowing decisions.

To obtain a promissory note, you can create one using a template or seek assistance from a legal service. Platforms like USLegalForms offer convenient resources for drafting an Arizona Unsecured Installment Payment Promissory Note for Fixed Rate, ensuring all necessary elements are included. It's important to customize the note to fit your specific terms and conditions to avoid any confusion later.

In Arizona, a promissory note does not legally require notarization to be enforceable. However, having it notarized can provide added protection for both the lender and borrower by verifying the identities and agreements of the parties involved. Using an Arizona Unsecured Installment Payment Promissory Note for Fixed Rate can facilitate this process, creating a more formal and trustworthy agreement.