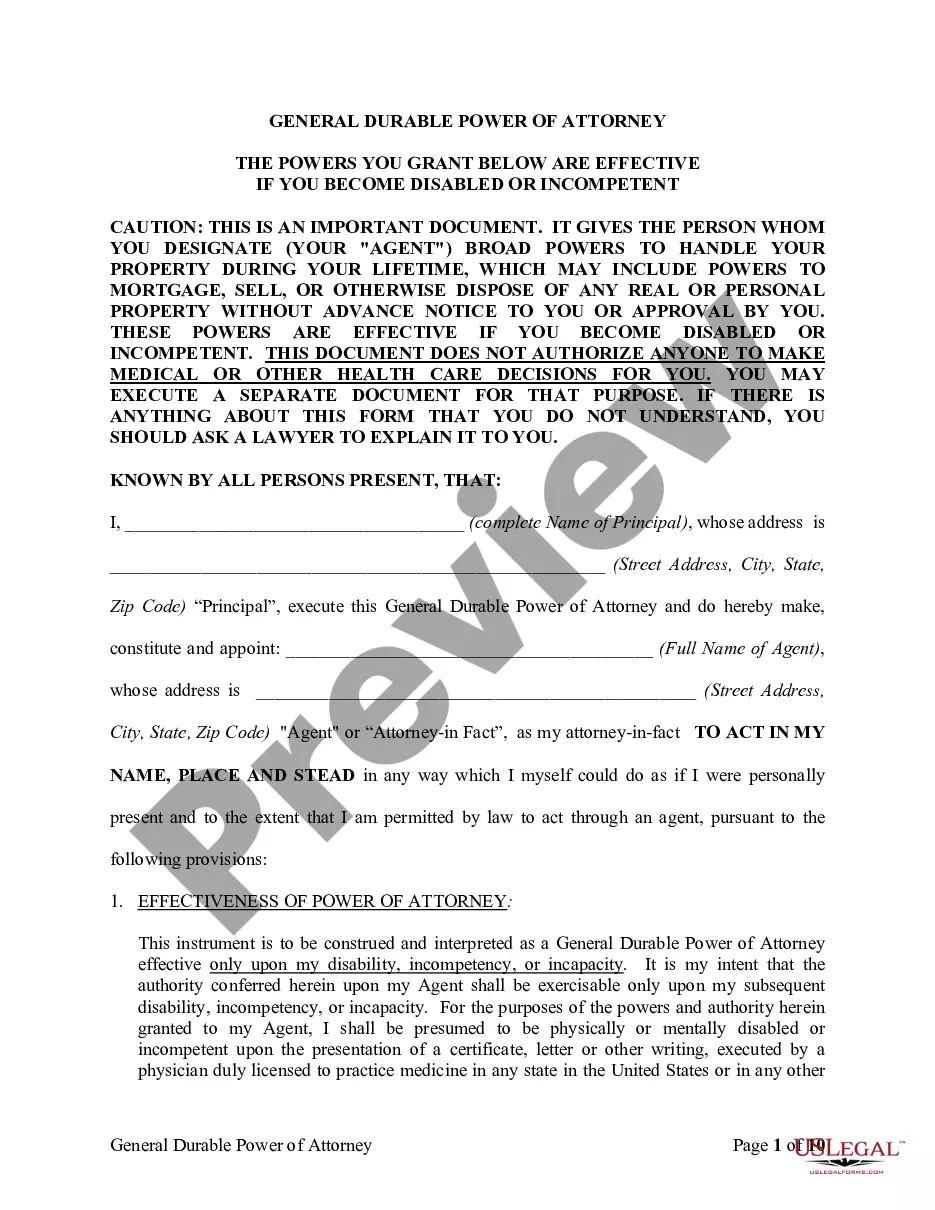

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order to Personal Representatives - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

Arizona Order to Personal Representatives and Acknowledgement and information to heirs

Description

How to fill out Arizona Order To Personal Representatives And Acknowledgement And Information To Heirs?

If you are looking for precise Arizona Order to Personal Representatives templates, US Legal Forms is exactly what you require; find documents supplied and reviewed by state-authorized legal experts.

Using US Legal Forms not only relieves you from concerns regarding legal documents; you also conserve time, energy, and money!

And that’s it. Within just a few simple clicks, you possess an editable Arizona Order to Personal Representatives. After you establish an account, all future requests will be even easier. Once you have a subscription with US Legal Forms, simply Log In/">Log Into your account and click the Download option available on the form’s page. Then, when you need to utilize this template again, you will always be able to find it under the My documents section. Don’t waste your effort sorting through numerous forms on various websites. Obtain professional documents from a single reliable source!

- Begin by completing your registration process by entering your email and setting a password.

- Follow the steps below to create your account and obtain the Arizona Order to Personal Representatives template to address your needs.

- Use the Preview option or review the document details (if accessible) to ensure that the template is the correct one you seek.

- Verify its relevance in your state.

- Click Buy Now to complete your purchase.

- Select a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

To become a personal representative in Arizona, you must file a petition with the probate court. The Arizona Order to Personal Representatives and Acknowledgement and information to heirs outlines the necessary steps and requirements. Generally, personal representatives should be 18 years or older, and they must be willing to act on behalf of the estate. Using resources like USLegalForms can simplify the process and provide the forms needed for effective representation.

In Arizona, beneficiaries typically receive information about the estate within a few weeks after the probate process begins. The personal representative is responsible for notifying all heirs, based on the Arizona Order to Personal Representatives and Acknowledgement and information to heirs. This process ensures that beneficiaries are informed about their rights and the details of the estate. Timely communication is crucial for a smooth probate experience.

In Arizona, a personal representative is typically an adult who is a resident of the state. This person might be named in the will or appointed by the court if there is no will present. It is essential that the individual effectively manage the estate to ensure a smooth process for distributing assets and fulfilling the Arizona Order to Personal Representatives and Acknowledgement and information to heirs. If you need assistance in this process, consider using the USLegalForms platform, which provides helpful resources for designating a personal representative.

To avoid probate in Arizona, consider establishing joint ownership, designating beneficiaries, or creating a trust for your assets. You can also utilize payable-on-death accounts for easier access to funds without court intervention. An Arizona Order to Personal Representatives and Acknowledgement and information to heirs can significantly assist in managing your estate efficiently. By working with professionals, you can create a solid plan that keeps your estate management straightforward.

Bank accounts may go through probate in Arizona if they lack beneficiary designations or if they are solely owned by the deceased. In this case, the account will become part of the probate estate and will be distributed according to the will or intestacy laws. It is beneficial to create strategies, such as utilizing an Arizona Order to Personal Representatives and Acknowledgement and information to heirs, to prevent unnecessary delays. Therefore, understanding the implications of account ownership is vital.

No, bank accounts designated with beneficiaries in Arizona typically do not go through probate. Instead, the funds can transfer directly to the named beneficiary upon the account holder's death. This can be effectively managed through an Arizona Order to Personal Representatives and Acknowledgement and information to heirs, ensuring a clear transfer of assets. Understanding these processes is key to maintaining financial order during challenging times.

Several assets may be exempt from probate in Arizona, providing a smoother transition for heirs. Accounts that list beneficiaries, joint property, and assets held in a trust often do not require probate. By utilizing an Arizona Order to Personal Representatives and Acknowledgement and information to heirs, you can better navigate which assets need to go through probate. Knowing these exemptions helps in effective estate planning and reduces administrative headaches.

In Arizona, accessing a deceased person's bank account without probate may be possible under certain conditions. If the account has a payable-on-death designation, the funds can be transferred directly to the beneficiary, bypassing probate. Utilizing an Arizona Order to Personal Representatives and Acknowledgement and information to heirs can simplify this process. Therefore, understanding your options is crucial to ensure proper access to these assets.

Rule 51 in Arizona pertains to the procedural requirements for probate court filings, defining how documents must be prepared and submitted. It emphasizes the need for clarity and completeness in all filings to avoid delays in the probate process. By adhering to this rule and understanding the Arizona Order to Personal Representatives and Acknowledgement and information to heirs, individuals can navigate the probate landscape more confidently.

A trustee in Arizona usually has a reasonable time frame to distribute assets, which typically is within a year, depending on the complexity of the trust and actions needed. Ensuring timely distribution requires careful management of the trust assets and compliance with legal obligations. Trustees should refer to resources like the Arizona Order to Personal Representatives and Acknowledgement and information to heirs for guidance in their responsibilities.