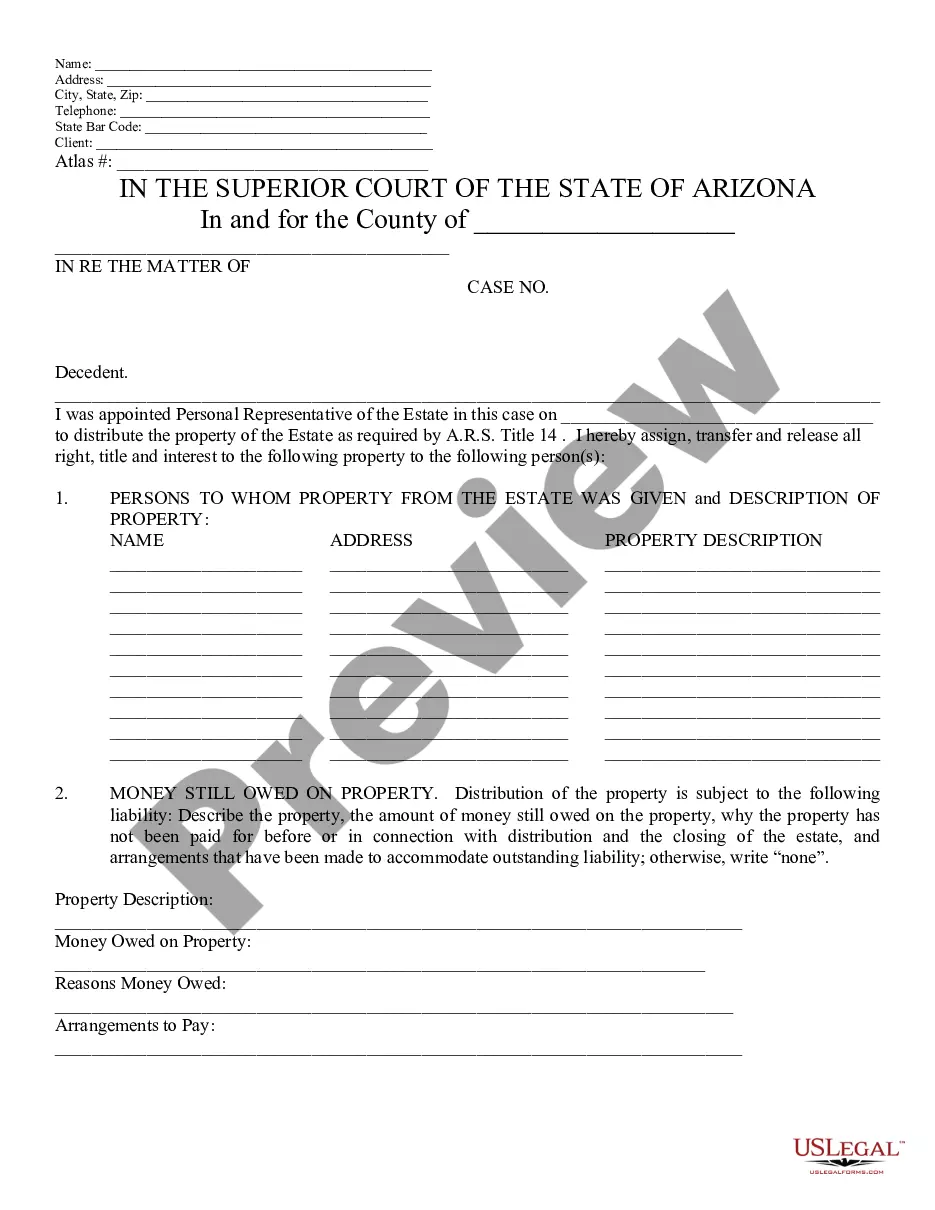

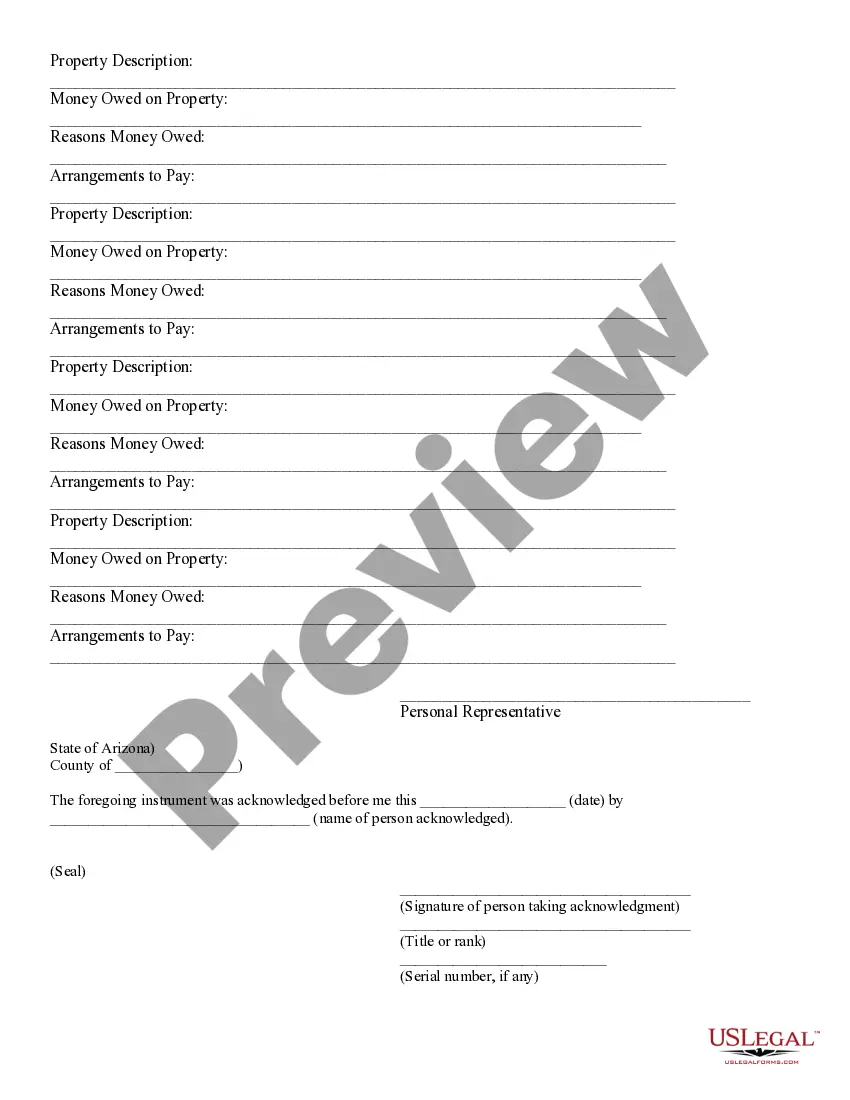

Proposed Distribution of Money and Property of Probate Estate - Schedule H - Arizona: A Proposed Distribution of Estate Property is signed by the Administrator. It fully lists all property in an estate and how he/she sugests it should be divided. It is available for download in both Word and Rich Text formats.

Arizona Proposed Distribution of Money and Property of Probate Estate - Schedule H

Description What Is Proposed Pay Distribution

How to fill out Arizona Proposed Distribution Of Money And Property Of Probate Estate - Schedule H?

If you're searching for accurate Arizona Proposed Distribution of Finances and Assets of Probate Estate - Schedule H samples, US Legal Forms is precisely what you require; obtain forms created and reviewed by state-certified attorneys.

Utilizing US Legal Forms not only saves you from troubles related to legal paperwork; additionally, you conserve time, effort, and money! Downloading, printing, and completing a professional document is significantly more affordable than hiring a lawyer to draft it for you.

And that’s all. In just a few simple clicks, you have an editable Arizona Proposed Distribution of Finances and Assets of Probate Estate - Schedule H. After creating your account, all subsequent purchases will be processed even more seamlessly. If you have a US Legal Forms subscription, just Log In to your profile and then click the Download button available on the form’s page. Then, whenever you need to access this template again, you'll always find it in the My documents section. Don't waste your time comparing countless forms across various platforms. Order professional documents from one reliable service!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the instructions listed below to set up an account and locate the Arizona Proposed Distribution of Finances and Assets of Probate Estate - Schedule H template to address your concerns.

- Use the Preview feature or review the file details (if available) to ensure that the specimen is the one you need.

- Verify its validity in your state.

- Click on Buy Now to place an order.

- Select a suggested pricing option.

- Create your account and make the payment with a credit card or PayPal.

Arizona Property Probate Form popularity

FAQ

Alabama. Alaska. Arizona. Arkansas. California. Colorado. Delaware. Florida.

The short answer is not likely. Today's market book cannot be sustained completely, but a crash as serious as the one from 15 years ago is unlikely because of a few important factors. Loose mortgage lending practices ultimately brought down some of the nation's largest banks and mortgage companies.

As long as there aren't any contests to the will or objections to the executor's actions, the executor will be allowed to settle the estate at the conclusion of the four-month waiting period. That means an executor who is on top of their responsibilities could theoretically wrap up probate in as little as four months.

No crash expected Metro Phoenix's housing market started 2020 so strong, housing analysts said it would take a catastrophe to slow it. Then when the novel coronavirus hit the U.S., housing experts forecasted home sales could slow by as much as 80% during this summer.

Eleven states have only an estate tax: Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. Washington, D.C. does, as well. Estate taxes are levied on the value of a decedent's assets after debts have been paid.

If you've inherited money or property after a loved one dies, you may be subject to an inheritance tax.The main difference between an inheritance and estate taxes is the person who pays the tax. . Unlike an inheritance tax, estate taxes are charged against the estate regardless of who inherits the deceased's assets.

The housing market is looking extremely strong for the Phoenix area in 2021. Realtor.com's most recent forecast predicts home sales in the Valley will jump 11.4% over last year's levels, which is more than the national average.

There is no inheritance tax in Arizona. If you have a loved one who lives in another state, however, you should check the local laws. Pennsylvania, for instance, as an inheritance tax that can apply to out-of-state heirs. Arizona also has no gift tax.

Here are our top five picks for real estate investments in the state. With a population of over seven million, Arizona is one of the fastest-growing states in the U.S. Its booming economy, low unemployment, warm climate, and hot tourism industry make Arizona a great place to invest.