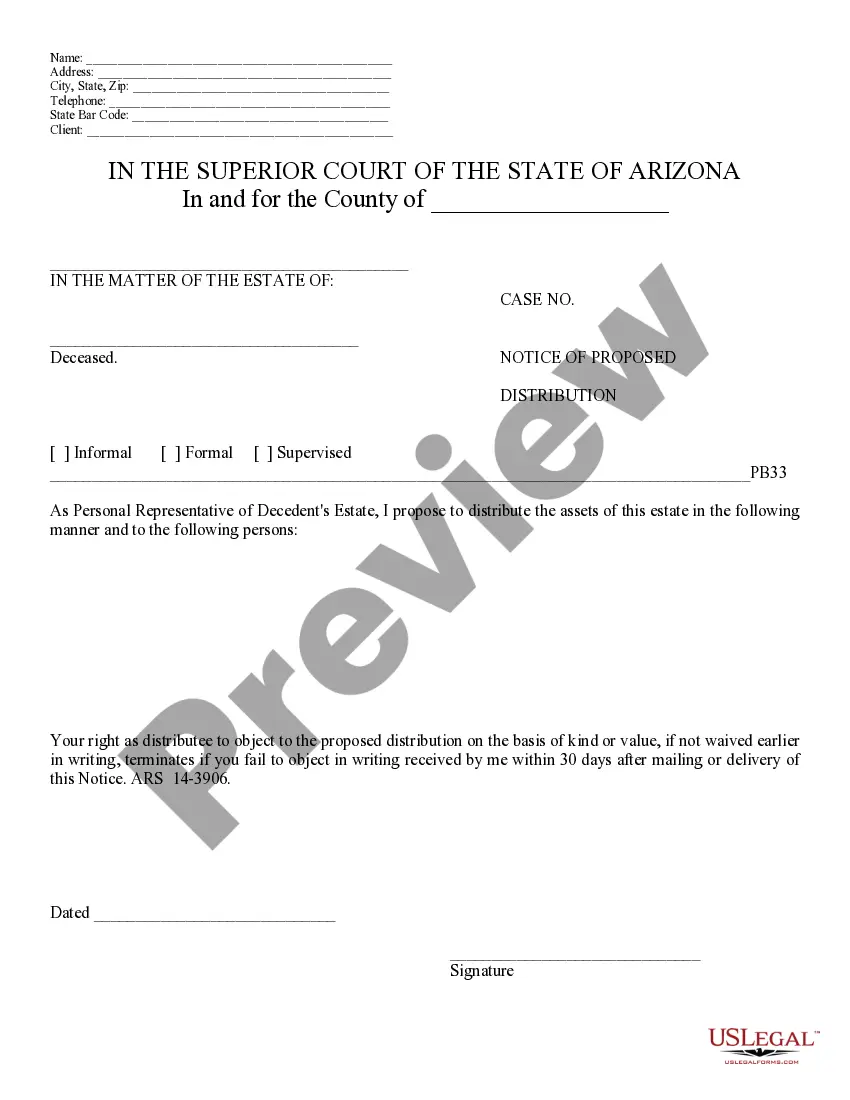

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Proposed Distribution - Arizona, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Arizona Notice of Proposed Distribution

Description

How to fill out Arizona Notice Of Proposed Distribution?

If you're searching for precise Arizona Notice of Proposed Distribution duplicates, US Legal Forms is precisely what you require; find documents generated and reviewed by state-certified lawyers.

Using US Legal Forms not only spares you from troubles regarding legal documents; moreover, you save effort, time, and money! Acquiring, printing, and completing a skilled template is considerably less costly than hiring an attorney to assist you.

And that's it. In just a few simple clicks, you obtain an editable Arizona Notice of Proposed Distribution. Once you establish an account, all subsequent purchases will be processed even more smoothly. If you have a US Legal Forms subscription, just Log In to your account and click the Download button you see on the form’s page. Then, whenever you need to utilize this template again, you'll always be able to find it in the My documents section. Don't squander your time sifting through countless forms on various web sources. Order accurate copies from a single reliable service!

- To commence, finish your registration process by providing your email and setting up a secure password.

- Follow the steps outlined below to establish your account and access the Arizona Notice of Proposed Distribution document to address your situation.

- Utilize the Preview option or review the document details (if accessible) to ensure that the template is the one you need.

- Verify its relevance in your location.

- Click Buy Now to place your order.

- Choose a preferred pricing plan.

- Create your account and make a payment using your credit card or PayPal.

- Select a convenient format and download the file.

Form popularity

FAQ

The statute of limitations for a notice of claim in Arizona generally requires that you file your claim within 180 days. This is a strict deadline and is essential for ensuring your right to pursue compensation from a public entity. It's crucial to act promptly and provide all necessary documentation to meet this statute. For assistance and clarity in submission processes, consider using services related to the Arizona Notice of Proposed Distribution.

The notice of claim statute in Arizona requires that potential claimants provide written notice to the public entity at least 180 days before initiating a lawsuit. This step is crucial for preserving your right to sue public entities for damages. Failing to follow this statutory requirement can result in the dismissal of your claim. Utilizing resources like the Arizona Notice of Proposed Distribution can clarify this process for those involved with estates or public entities.

Arizona statute 12-821 specifically pertains to claims against public entities. This statute establishes a structured process for making claims for damages against Arizona government agencies. Understanding this statute is essential for ensuring you meet all necessary requirements when filing a claim. If you're dealing with such claims, the Arizona Notice of Proposed Distribution can help facilitate understanding of how claims may affect asset distributions.

In Arizona, the time frame to file a claim depends on various circumstances but generally falls within a limited period as prescribed by law. You usually have a set period, often three years for personal injury claims and other civil cases. It's vital to adhere to these deadlines to protect your legal rights. Consulting with a legal professional can help clarify how the Arizona Notice of Proposed Distribution impacts your claim timeline.

In Arizona, a trustee must notify beneficiaries of the trust within 60 days of their appointment. This notification is essential as it allows beneficiaries to stay informed about the trust's management and any distributions. If you’re a beneficiary and haven't received your notification, it's advisable to follow up with the trustee. Additionally, the Arizona Notice of Proposed Distribution provides a structured way for trustees to communicate distribution details.

In Arizona, the statute of limitations for most debts is typically six years. This time frame is crucial because it determines how long a creditor can pursue legal action to collect a debt. If you face issues related to debt collection, understanding your rights can help you navigate recovery efforts. The Arizona Notice of Proposed Distribution can also inform you of how debts may affect a debtor's estate.

A deed of distribution in Arizona is a legal document used to transfer property from an estate to beneficiaries. This deed is often executed after the estate has gone through probate, outlining how assets will be divided. It ensures that the property is officially transferred to the rightful heirs. Understanding this process alongside the Arizona Notice of Proposed Distribution can significantly aid in estate management.

To transfer a house title after death in Arizona, you typically need to follow the probate process. This involves filing necessary documents with the court if there’s no trust established. If a trust is in place, the title transfer may be simpler and completed directly per the trust's instructions. The Arizona Notice of Proposed Distribution will inform interested parties about how the transfer will proceed.

Yes, quit claim deeds are legal in Arizona and serve as a straightforward way to transfer interest in property. However, this type of deed does not guarantee that the title is clear. It's often used between family members or in divorce settlements. If you face issues regarding property distribution, understanding the Arizona Notice of Proposed Distribution can help clarify your rights.

You can avoid probate in Arizona by using a living trust, which allows assets to pass directly to beneficiaries. Additionally, designating transfer-on-death beneficiaries for bank accounts and real estate can simplify the process. Since probate can be time-consuming and costly, exploring ways to avoid it is beneficial. Keep in mind that the Arizona Notice of Proposed Distribution might still apply if probate is necessary.