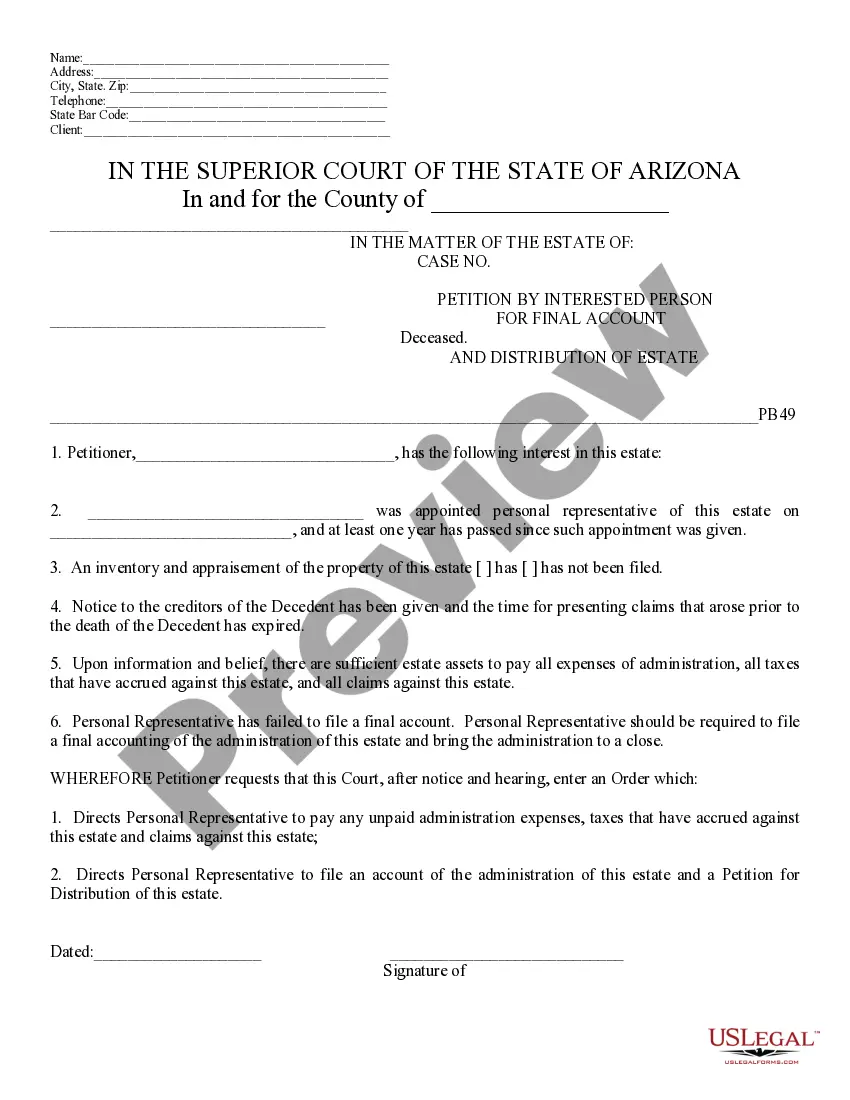

This model form, a Petition by Interested Person for Final Acct. and; Distribution of Estate - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Arizona Petition by Interested Person for Final Acct. and Distribution of Estate

Description

How to fill out Arizona Petition By Interested Person For Final Acct. And Distribution Of Estate?

If you are seeking precise Arizona Petition by Interested Person for Final Acct. and Distribution of Estate templates, US Legal Forms is precisely what you need; discover documents offered and reviewed by state-certified lawyers.

Utilizing US Legal Forms not only spares you from issues related to legal documents; it also conserves your time, effort, and money! Downloading, printing, and filling out a skilled template is far more cost-effective than hiring an attorney to draft it for you.

And that's all! In just a few simple clicks, you have an editable Arizona Petition by Interested Person for Final Acct. and Distribution of Estate. Once you create your account, all future purchases will be handled even more easily. After subscribing to US Legal Forms, simply Log In to your profile and click the Download button visible on the form’s page. Then, whenever you need to access this sample again, you will always find it in the My documents section. Don’t waste your time comparing numerous forms on multiple websites. Purchase professional templates from one reliable platform!

- Initiate your registration process by entering your email and creating a password.

- Follow the instructions below to make an account and locate the Arizona Petition by Interested Person for Final Acct. and Distribution of Estate sample to suit your requirements.

- Utilize the Preview option or read the document description (if available) to confirm that the template is what you need.

- Verify its validity in your jurisdiction.

- Click Buy Now to place an order.

- Select a suitable pricing plan.

- Create an account and pay using your credit card or PayPal.

- Choose an appropriate format and save the document.

Form popularity

FAQ

In Arizona, a trustee must typically follow the terms specified in the trust documents regarding the timing of asset distribution. Although there is no set timeframe defined in law, the trustee should act reasonably and without unnecessary delay. Swift yet careful action ensures that beneficiaries receive their rightful assets as intended. Using an Arizona Petition by Interested Person for Final Acct. and Distribution of Estate can support the trustee in this responsibility.

An executor should ideally wait until all debts, taxes, and claims against the estate have been resolved before distributing assets. This process can take several months, depending on the specifics of the estate. In balancing timeliness and compliance, the executor protects themselves from future liabilities. An Arizona Petition by Interested Person for Final Acct. and Distribution of Estate can guide this important step.

Rule 53 of the Arizona Rules of Probate Procedure addresses the requirements for final accountings and the distribution of assets in probate cases. This rule ensures that executors provide a clear and accurate account of estate assets before distribution. It protects the interests of beneficiaries by fostering transparency. Utilizing an Arizona Petition by Interested Person for Final Acct. and Distribution of Estate can facilitate compliance with this rule.

Arizona follows specific rules for determining the order of inheritance when someone passes away without a will. Generally, the deceased's spouse and children inherit first, followed by parents, siblings, and further relatives. Understanding this order is crucial for beneficiaries and executors alike. Filing an Arizona Petition by Interested Person for Final Acct. and Distribution of Estate can assist in formalizing any claims.

In Arizona, an executor typically has a period of up to one year to settle an estate. This timeframe may vary based on the complexity of the estate and any disputes that arise. It's essential for the executor to manage the estate efficiently and adhere to state laws. An Arizona Petition by Interested Person for Final Acct. and Distribution of Estate helps clarify the process.

Rule 51 in probate in Arizona pertains to the filing process for an Arizona Petition by Interested Person for Final Acct. and Distribution of Estate. This rule outlines that interested parties must file a petition with the court, allowing them to present their claims or objections. It ensures transparency and fairness in the estate distribution process. If you are navigating this rule and need assistance, uslegalforms can provide the necessary resources and templates to help you complete your petition accurately.

Yes, an executor in Arizona must provide an accounting of the estate to beneficiaries. This includes a detailed report on all assets, income, expenses, and distributions made. Transparency is crucial to building trust with beneficiaries and fulfilling the executor's duties. Ensuring compliance with the Arizona Petition by Interested Person for Final Acct. and Distribution of Estate can assist in meeting these obligations.

In Arizona, an executor is expected to complete the distribution of assets within a reasonable timeframe, typically within one year of filing probate. However, this time can vary based on the complexity of the estate and any disputes that may arise. The executor must also ensure all debts, taxes, and expenses are settled before distribution. Being proactive and organized can help expedite the process.

Initiating probate in Arizona involves filing the Arizona Petition by Interested Person for Final Acct. and Distribution of Estate with the probate court in the county where the deceased lived. You must include necessary documents like the death certificate and any existing will. After filing, the court will set a date for the hearing and notify interested parties. Following the court's guidelines will help you navigate this often-complex process more smoothly.

While you can handle probate without a lawyer in Arizona, legal expertise can greatly aid your understanding of the process. A lawyer experienced with the Arizona Petition by Interested Person for Final Acct. and Distribution of Estate can help ensure all required paperwork is correctly completed. This can help prevent delays and mistakes that could be costly in the long run. Ultimately, hiring a lawyer might provide peace of mind during a challenging time.